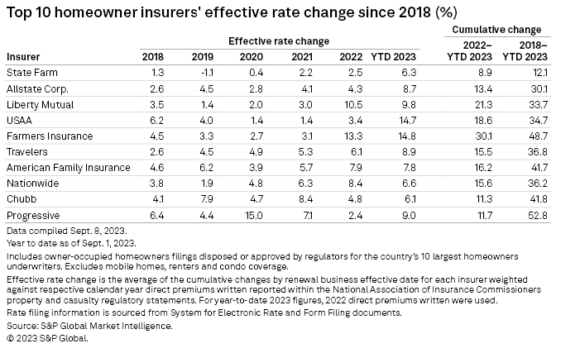

Farmers Insurance coverage Group of Cos. and United Companies Vehicle Affiliation (USAA) have elevated owners insurance coverage charges by practically 15% every to guide all different insurers.

In response to S&P International Market Intelligence‘s RateWatch utility, Farmers’ year-to-date calculated efficient price change on home-owner insurance policies via Sept. 1, 2023 was up 14.8% – only a tick greater than USAA’s 14.7% price hikes to this point in 2023.

“Macroeconomic situations proceed to plague US private lines-focused insurers because the previous two years have seen a higher-than-average rise in owners’ insurance coverage charges,” S&P mentioned. “Between 2018 and 2021, the countrywide yearly common change was within the 3% vary however jumped to about 6% in 2022. Via roughly the primary eight months of 2023, the nationwide common rise in owners’ premium charges was 8.8%.”

Farmers has obtained approval to extend charges throughout 43 states, with a mean hike of greater than 10% in 28 states. S&P mentioned the insurer’s three largest efficient price will increase had been in Illinois, Texas and Tennessee, at 25.3%, 25.1%, and 23.8%, respectively.

In the meantime, USAA has raised charges in 44 states via Sept. 1, highlighted by a 36.6% efficient price change in Arizona, which noticed insurers improve charges probably the most of another state – a weighted common of 18.4%, S&P mentioned. Texas was second-highest, with a 16.4% improve.

USAA additionally elevated charges by greater than 30% in two different states — Colorado and Tennessee.

Progressive Corp. has the most important year-to-date efficient price change in any state among the many nation’s largest home-owner writers with an uptick of about 57% in North Carolina that went into impact June 19 for renewals. Progressive was additionally accepted to hike charges by a weighted common of 25% in California.

The states with the bottom weighted common improve by insurers thus far in 2023 are Hawaii, Vermont and New Jersey at 1.8%, 2.5% and a couple of.8%, respectively.

Subjects

Agribusiness

Owners

Involved in Agribusiness?

Get automated alerts for this subject.