Alan Blinder thinks American households and staff have by no means had it so good. However as a result of they’re trusting their mendacity eyes as an alternative of specialists like him, they’re disgruntled concerning the economic system. Why don’t the hoi polloi recognize that “unemployment is close to file lows, web jobs are nonetheless being created at a breakneck tempo, and inflation has fallen notably?”

There’s one thing essentially baffling about this attitude. Thousands and thousands of Individuals insist they confront vital materials hardship, but the commentariat — particularly those that are allies of, or a minimum of sympathetic to, the technocratic left — stubbornly doubles down on abstractions. Sure, it’s good that the unemployment charge isn’t increased than it’s, and it’s good that inflation has fallen. However it’s absurd and conceited to insist that distant observers have a clearer image of wellbeing than the individuals who say they’re hurting.

Blinder concludes that individuals are not glad with mere disinflation. “Quite, they appear to need costs for objects similar to gasoline and groceries to fall again to the place they was.” He predicts (accurately, I believe) that costs aren’t coming again down. Moreover, creating deflation by engineering an mixture demand shortfall would trigger pointless ache. (This isn’t true of all deflation, nevertheless. Extra on this beneath.) Amazingly, Blinder by no means discusses the apparent downside: The costs of products and providers have risen sooner than wages for years.

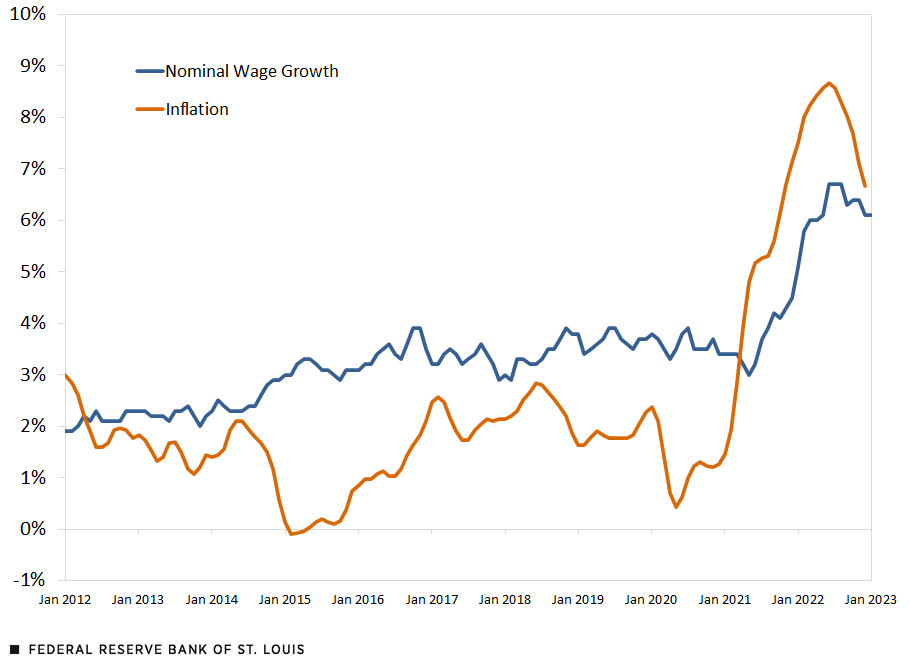

Search Blinder’s article for phrases similar to “wage,” “wage,” and “compensation.” You gained’t discover them. That is an astounding oversight for an economist. The issue isn’t that issues have gotten dearer; It’s that worth hikes for issues we eat have outpaced our incomes. Writing for the Federal Reserve Financial institution of St. Louis, Victoria Gregory and Elisabeth Harding seize the issue in a revealing chart:

Contra Blinder, there’s actually no puzzle right here. Wages went up, however different costs went up way more. Even when each development strains return to their pre-pandemic progress paths, staff are completely poorer due to the actual wage cuts that endured from January 2021 till very lately.

There’s one other downside with Blinder’s evaluation: he thinks deflation at all times and in all places causes financial hurt. “It takes a really sick economic system to trigger deflation,” he warns. However he’s fallacious. Demand-side deflation is harmful. Provide-side deflation, brought on by enhancements in know-how and productive capability, isn’t.

We’ve got many historic examples of benign deflation, together with the US expertise for a lot of the late nineteenth century. The availability of products and providers grew sooner than the provision of cash, inflicting costs to fall. Benign deflation doesn’t scale back output and employment. Quite the opposite, the rise in cash’s buying energy is an important sign about normal productive circumstances, which helps markets create as a lot wealth as they sustainably can.

Blinder’s evaluation, in essence, is garden-variety demand-side fundamentalism. He thinks that fiscal and financial coverage can steer the economic system whichever manner he needs it to go, as if there aren’t any basic useful resource constraints to restrict how mixture demand progress interprets into actual earnings progress and inflation. The previous three years reveal how totally falsified this paradigm is.

Blinder and his ilk can insist till they’re blue within the face that the economic system is ok. Staff, households, and companies aren’t shopping for it. If issues had been truly good, the technocratic left wouldn’t must attempt so laborious to persuade us.