When you’ve bought a brand new automotive or leased one, you may need come throughout the time period “hole insurance coverage.” It’s typically talked about throughout mortgage or lease paperwork, and you’ll have been suggested to get it from the dealership. Nevertheless, the reason won’t have been clear.

At Vargas & Vargas Insurance coverage, we’re right here to make clear hole insurance coverage—what it covers, its prices, and the selection between dealership buy and including it to your Massachusetts auto insurance coverage coverage. (Sure, you heard that proper—we’d counsel another supply!)

Whereas hole insurance coverage is sort of inexpensive when included in your auto insurance coverage, it tends to be pricier if purchased on the dealership. However there are distinctions between the 2 choices. Let’s discover the small print!

What’s GAP insurance coverage?

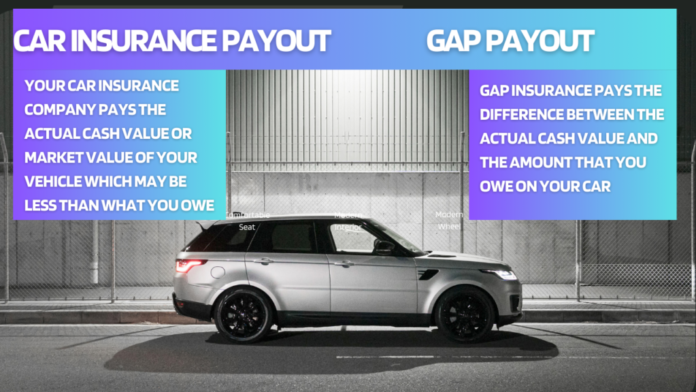

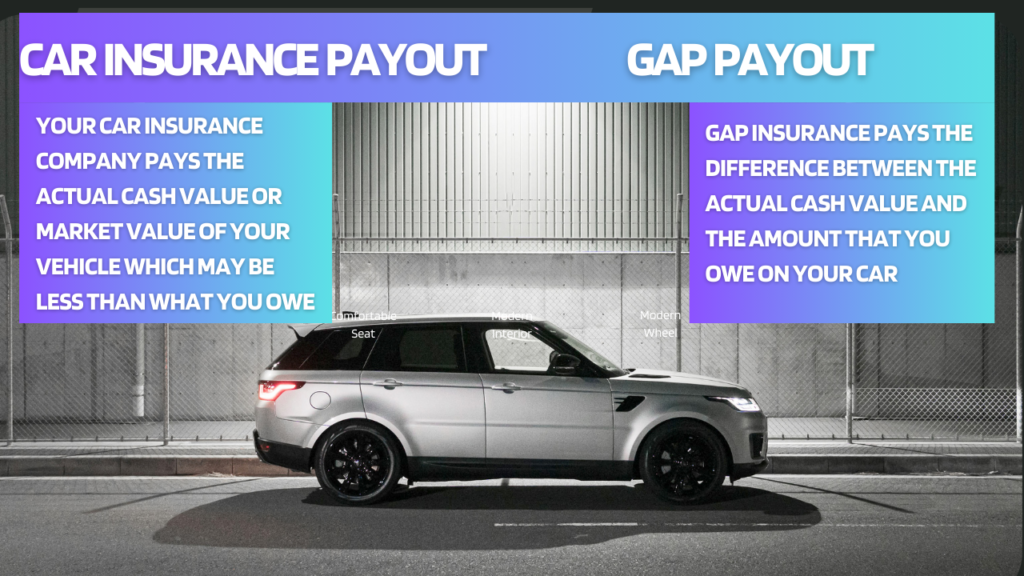

When your automotive is in an auto accident, your Massachusetts auto insurance coverage coverage covers the automobile’s “precise money worth.” Have in mind it doesn’t substitute the automotive itself. This distinction is essential.

From the second you drive your new automotive away from the dealership, its worth depreciates. Within the unlucky occasion of a complete loss or theft, your insurance coverage will reimburse the automotive’s precise money worth at the moment. If this quantity falls in need of your mortgage or lease, you would nonetheless owe cash. That is the place GAP (Assured Asset Safety) insurance coverage comes into play – it bridges this hole, overlaying the distinction.

Who Can Buy GAP Insurance coverage?

GAP insurance coverage might be added to an auto insurance coverage coverage inside 30 days of buy of auto. Nevertheless it’s necessary to notice that you probably have an accident earlier than that 30 days is up, and also you haven’t added the protection but, you won’t be able so as to add it after the accident.

You additionally will need to have purchased the automobile utilizing a mortgage or lease, and the automobile have to be 5 years or newer to be eligible.

Is GAP Insurance coverage Necessary?

Whereas not mandated by the state of Massachusetts, GAP insurance coverage will not be a requirement for all drivers. Nevertheless, for those who’re leasing a automobile, the leasing firm would possibly insist on this protection. Checking your lease settlement will present readability on whether or not it’s crucial. To grasp the affect of leasing in your auto insurance coverage, be happy to achieve out for extra data.

How lengthy do I have to pay for GAP insurance coverage?

The period of your GAP insurance coverage protection is dependent upon your particular person circumstances. Typically, it’s advisable to have GAP insurance coverage all through your complete period of your auto mortgage or lease. This fashion, you’re protected in case of a complete loss or theft. Nevertheless, you possibly can think about cancelling the protection as soon as the hole between your mortgage/lease stability and the automobile’s worth decreases considerably. To make an knowledgeable choice, focus on your scenario along with your insurance coverage supplier.

What Does GAP Insurance coverage Value?

By together with GAP insurance coverage in your Massachusetts auto insurance coverage coverage, you’ll doubtless see a rise of round $25 to $50 in your annual premium.

Nevertheless, for those who go for dealership or finance firm protection, the associated fee will fluctuate primarily based on components equivalent to MSRP, mortgage period, financed quantity, and APR. Typically, this feature would possibly vary between $500 and $750.

Remember that some sellers and finance corporations would possibly mechanically bundle GAP insurance coverage into your month-to-month cost. To keep away from surprises, make certain to inquire about this earlier than finalizing your paperwork.

Your Native Impartial Insurance coverage Dealer

Vargas & Vargas Insurance coverage has assisted people, households, and companies for over 4 a long time. We’re right here to handle your questions and discover the most effective protection on the best charges. Attain out to us at 617-298-0655.