In August and September, auto producers historically start promoting the subsequent 12 months’s fashions. The apply began in 1936 when Franklin Delano Roosevelt requested auto producers to regulate their annual manufacturing unit retooling schedule to maintain auto staff working in the course of the vacation seasons. It was meant as an financial stimulus.

In most mannequin years, you don’t see many adjustments. We see the automotive tweaks with just a few angles and some new types — large adjustments are few and much between. Inside touchscreens are getting bigger. Sensible machine choices are rising. Information gathering can be rising.

For automobiles, the large change in 2024 will likely be that many extra fashions will likely be electrical or hybrid, with some very well-known nameplates starting to supply electrical variations. Volkswagen is quickly to come back out with a brand new electrical Vanagon within the US. A Corvette hybrid is on the horizon, utilizing electrical energy for sooner acceleration. Cadillac is including to its EV lineup with the Celestiq. Whereas electrical autos aren’t anticipated to take over the market very quickly, it’s clear that many vehicle producers are shifting gears.

It’s a brand new mannequin 12 months for insurance coverage, too. Insurers are within the midst of an incredible shift that may require not solely retooling techniques however mindsets as properly. It’s a needed reconfiguring for insurers that want to retain and develop market share.

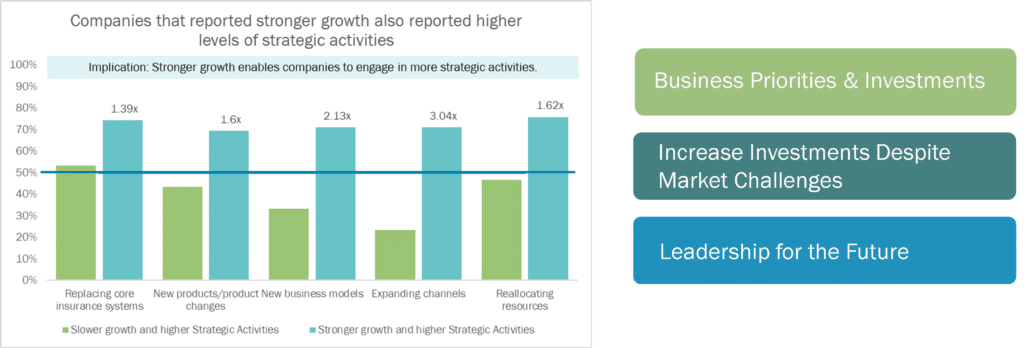

Majesco’s Strategic Priorities analysis discovered that as insurers thought-about and launched into a enterprise transformation and targeted on key strategic areas equivalent to core substitute, new product growth, exploring modern enterprise fashions, reimagining enterprise processes, and diversifying distribution channels, they skilled larger progress, as illustrated in Determine 1 beneath.

Determine 1: Alignment between progress and strategic actions

Equally essential is the reallocation of sources, making certain the continuation of present enterprise operations whereas investing sooner or later. This strategy underscores the importance of setting priorities, making strategic investments, and exhibiting sturdy management.

In a current Majesco/Capgemini L&AH Roundtable dialogue, L&AH enterprise leaders shared their views on this transformation. They outlined the steps their firms are taking to create the operational and cultural surroundings wanted to maintain tempo and lead the business. You’ll be able to learn the total Majesco/Capgemini report by downloading, Don’t Pull Again…Put the Pedal to the Metallic for L&AH Transformation. You’ll discover a few of these insurer insights within the quotes beneath.

Customary Gear #1: An funding technique for retooling and progress

Prioritizing operational and distribution investments as a technique for progress might appear to be a no brainer. The fact is that it’s robust to do.Many insurers are grappling with the query of whether or not they can undertake the enterprise transformation and funding alone. It entails vital capital investments in an already capital-intensive enterprise. Thus, it prompts the consideration of potential alternatives that align with a dedication to funding and a chance to set a distinct trajectory. Essentially, insurers should obtain operational effectivity at scale, which could be completed by way of acquisitions, natural progress, and efficient utilization of investments.

“Once I envision our firm ten years from now, I anticipate a major transformation in our tradition and operations. With a steady inflow of recent associates, we’re dedicated to vary, evolution, and elevated agility. Over the subsequent 5 to 10 years, many staff, who might have been extra resistant to vary, will retire. We have now exerted further effort to convey them alongside on this journey.”

Roundtable Participant

As firms embark on these substantial investments, it’s essential to query whether or not they’re defensive or offensive. Are they making these investments to outlive or to attain scalability? The success of those investments depends on attaining operational effectivity and reaching progress throughout all enterprise strains. Due to this fact, progress turns into crucial.

Are insurers rising and subsequently making investments or are they making investments to facilitate progress? These facets warrant cautious consideration in setting enterprise priorities – for each the present and future enterprise.

Customary Gear #2: Preparations that may permit for alliances, partnerships, mergers, and acquisitions.

A quick-changing insurance coverage business can be grappling with the challenges and alternatives that could be discovered by way of mergers and acquisitions. On the one hand, a merger would possibly assist a standard insurer set up a route for change and modernization. Alternatively, an insurer would possibly achieve the higher hand in partnerships and mergers by establishing a know-how framework that’s so aggressive as to be unassailable. The fitting preparations will place insurers to be discerning, swift, and engaging as they strategy new relationships of any variety.

Roundtable individuals mentioned the likelihood that the market will witness intriguing partnerships and M&A actions that transcend non-public fairness companies buying annuity firms solely for his or her capital. As an alternative, we might even see companies searching for alliances with firms which can be already making substantial investments, recognizing that becoming a member of forces can collectively foster progress and serve the most effective pursuits of policyholders. It will convey a contemporary strategy to technique, priorities, and funding within the enterprise that’s critically wanted.

These preparations would require actual innovation as a result of main insurers must show that they:

- Perceive the hyperlink between utilizing cutting-edge applied sciences, like generative AI and machine studying, and reaching new markets.

- Grasp the timing crucial — that insurers are within the midst of a crucial shift in how they do enterprise that have to be met with new enterprise fashions.

- Pursue options and companions that align with their concentrate on prospects and stakeholders.

Customary Gear #3: A renewed have a look at what creates differentiation in insurance coverage.

One other essential facet that deserves consideration is the position of individuals, tradition, and management on this course of. Managing these adjustments could be extraordinarily difficult, and maybe much more complicated than its technical facets. Many organizations are grappling with change when their long-standing mindset was to construct merchandise that final for many years with out change. Shifting this mentality is essential for achievement with right this moment’s altering market and buyer wants.

“Certainly, I strongly consider that change administration surrounding the implementation of recent technical platforms requires extra effort than the know-how itself. It’s very important to convey individuals alongside on the journey, making certain that they share a transparent imaginative and prescient and perceive the strategic goals. It’s important to acknowledge that people have various ranges of consolation with change and that not everybody will embrace it enthusiastically. Contemplating the generational range inside our group, we’ve got staff with vital tenure who might not view change as a optimistic factor or readily embrace it. Millennials, alternatively, could be relieved to depart behind the period of inexperienced screens. Getting Gen Xers or child boomers on board may pose extra challenges. Therefore, we can’t overlook the human facet of transformation. The individuals aspect is of utmost significance.”

Roundtable Participant

Previously, insurers believed that the key sauce lay in how they dealt with coverage issuance and repair. They thought that customizing the software program or constructing their techniques, preserved their distinctive strengths. That sort of uniqueness is now a burden that’s holding insurers again from progressing. The intensive customization made it pricey and difficult to improve the software program or transfer to the cloud. They can not shortly take improvements from upgrades.

Does management perceive the total scope of alternative obtainable to insurers proper now? Does the enterprise acknowledge it would have extra “uniqueness” because it features capabilities that aren’t custom-built?

The roundtable agreed that insurers should rethink their technique and embrace the strategy of taking as a lot as doable out of the field. Not solely will this strategy speed up pace to implementation, however it would lower total whole price of possession and allow faster pace to market upgrades, new merchandise, and extra. The flexibility to simply improve when new releases can be found is essential to maintain the corporate at the vanguard by making the most of the R&D in software program and fast shift in applied sciences – like Cloud, AI/ML, and now, generative AI.

“You made an ideal level about differentiation being attributed to our individuals and our merchandise. I totally agree with that. The problem we’ve set for ourselves is to depend on out-of-the-box options for 95% or extra of our wants. In any other case, we’d simply be ingesting the identical wine from a elaborate new bottle. Change administration is essential right here. We have to be prepared to vary, leveraging know-how with out intensive customization. This enables us to keep away from the prices related to customization and concentrate on deploying our individuals to serve our prospects, whereas letting our merchandise shine on their very own. It’s about cultivating a mindset inside the group that embraces change and is prepared to let go of previous practices. Our foremost focus needs to be on serving our prospects and delivering worth. Every little thing can change, and that’s okay.”

Roundtable Participant

Customary Gear #4: Subsequent-gen know-how, from point-of-purchase to clever core.

Insurers should speed up their digital enterprise transformation as a result of know-how and new working fashions present a basis to adapt, innovate, and ship at pace as markets shift. This insurance coverage mannequin 12 months is inaugurating ground-breaking potentialities to insurers which can be open to swapping out their “engines” with extra economical, quick, and AI-powered alternate options.

The rising significance and adoption of platform applied sciences, Cloud, APIs, new/non-traditional knowledge sources, and superior analytics capabilities are actually essential to progress, profitability, buyer engagement, new merchandise, channel attain, and workforce adjustments.

Proper now, selections are being made that may decide which firms will emerge as winners within the subsequent three to 5 years. These winners will likely be wanted as companions and employers as a result of their means to attain scalability, agility, and their pivotal position in leveraging know-how. These leaders will likely be ready for the subsequent main disruption, leaping ahead from the competitors.

L&AH firms are actually in a position to make strides that weren’t doable even twelve months in the past, because of the launch of Majesco’s L&AH Clever Core, Majesco World IQX Gross sales & Underwriting Workbench, Digital Enroll360 for L&AH, and ClaimVantage Connect360 for L&AH. Majesco options kind the benchmark for the way Particular person, Group, and Voluntary enterprise will likely be accomplished now and into the longer term.

As we speak’s leaders are nimble, inventive — and daring. As they deal with the robust problems with legacy debt and an elevated want for organized knowledge and analytics, forward-looking L&AH insurers will likely be fixing supplemental points that had been silently driving down profitability whereas they steadily climb the ladder of progress.

Daring strikes that embrace the longer term are defining the subsequent technology of leaders within the insurance coverage business. Every firm must rethink the way it prioritizes and allocates sources – individuals and capital. Will you retain issues comparatively the identical, allocate the identical quantity to every enterprise unit to maintain it operational, and concentrate on some enhancements for enterprise processes and merchandise? Or will you reallocate a few of these sources to make daring adjustments for the longer term?

As we speak’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Samantha Chow, World Head, Insurance coverage, Annuities, and Advantages Chief, Capgemini Monetary Providers