With lower than two weeks remaining till Argentina’s presidential election, Javier Milei, the unconventional “anarcho-capitalist” candidate, maintains his lead within the polls towards 4 different contenders. His stunning victory within the August primaries could be largely credited to his dedication to dollarize the Argentine financial system, a transfer perceived as the ultimate resolution to the nation’s financial turmoil.

Argentina’s dollarization would signify a profound transformation, involving the abandonment of the peso and the dissolution of the Argentinian central financial institution. This potential transfer, together with Milei’s anti-China rhetoric, raises a big but usually ignored problem regarding the continuation of the foreign money swap line established between the Central Financial institution of Argentina (BCRA) and the Individuals’s Financial institution of China (PBOC), which has been not too long ago used to keep away from a default on Argentina’s repayments to the Worldwide Financial Fund (IMF).

In 2014, an iterated model of the Sino-Argentina bilateral swap line (BSL) was shaped as a part of a complete strategic partnership between the 2 nations. Over time, it has turn out to be an important supply of monetary assist for Argentina when it faces money shortages.

The not too long ago launched IMF Employees Nation Report highlighted the truth that the BSL accounts for a good portion of the BCRA’s worldwide reserves and performs an important position in providing short-term liquidity assist to assist Argentina service its exterior debt obligations and finance imports. The PBOC not too long ago agreed to the BCRA’s request for one more three-year time period and doubled the accessible portion of the swap to almost $10 billion, signifying a strengthened bilateral partnership.

Nevertheless, if Milei have been to emerge because the winner within the October 22 election, there can be appreciable uncertainty surrounding the continuation of the swap line with China and Argentina’s potential to repay the IMF within the occasion of dollarization. This radical shift doubtlessly indicators a reorientation of Argentina’s financial methods, which might reverberate via its commerce dynamics and diplomatic relations with China.

The Evolution of the Argentina-China BSL: An Uneven “Tango”

Bilateral foreign money swap strains, established by two financial authorities, supply mutual insurance coverage during times of monetary instability by enabling the alternate of currencies at predetermined rates of interest and alternate charges. Starting in 2008, China launched into constructing its personal international community of central financial institution swap strains, quickly gaining momentum attributable to its sturdy dedication to internationalization of the renminbi (RMB) and the rising curiosity of rising markets in in search of various sources of financing. As of Might 2023, China has entered into bilateral foreign money swap agreements with over 40 nations and areas, with a complete worth exceeding 4 trillion RMB ($582.3 billion).

Amongst China’s numerous swap agreements with completely different nations, its association with Argentina stands out attributable to its longevity and in depth utilization. The BCRA was among the many early adopters of swap agreements with China, and it stays one of many few establishments which have extensively accessed the PBOC swap line to handle liquidity stresses.

A short historical past offers context. The primary Argentina-China BSL, valued at 70 billion RMB (roughly $11 billion), was signed in 2009 for a three-year time period. Though it was the biggest monetary settlement between China and any Latin American nation on the time, the unique association was by no means activated till it was amended in 2014 by a renewed cope with vital enhancements in flexibility, performance, and affordability. The 2015 supplementary settlement additional expanded its capabilities by permitting the BCRA to transform as much as 20 billion RMB from the swap line into U.S. {dollars}. This transformation elevated it from primarily serving as a neighborhood foreign money commerce settlement mechanism into the lender of final resort to finance fiscal debt.

Though each events have an equal choice to activate the swap line as wanted, the dynamic within the Sino-Argentina BSL is characterised by uneven dependence. Whereas the USA usually acts because the lender in such agreements, China’s substantial overseas reserves and robust financial fundamentals additionally empower it to tackle the lender’s position, giving it the authority to approve or reject the BCRA’s request for a swap draw. When the necessity for liquidity arises, the BCRA can provoke a request, and upon approval from the PBOC, RMB is deposited into the BCRA’s account on the PBOC. In return, the PBOC receives an equal quantity of peso as collateral. On the finish of the reimbursement interval, normally round one yr, the BCRA pays again the RMB at a predetermined rate of interest, reported to be between 600 and 700 foundation factors.

Since its activation in 2014 to counter extreme foreign money depreciation, Argentina has persistently turned to the PBOC swap line, and its dependence has steadily elevated. In response to analysis by Vincient Arnold, the BCRA has maintained excellent balances underneath the swap association starting from $2.6 billion to $20.5 billion between 2014 and 2021. Throughout this timeframe, the ratio of swap obligations to overseas reserve obligations elevated from 8.2 % to 51.6 %.

Over time, this pattern has intensified as Argentina’s financial system has descended additional into turmoil. In the course of the tenure of then-President Mauricio Macri’s right-wing administration in 2018, there was an try to scale back reliance on the PBOC swap line by in search of funding from the IMF. Nevertheless, the file $57 billion bailout from the IMF didn’t resolve Argentina’s financial troubles.

By 2022, Argentina’s deteriorating financial state of affairs had pushed it to the brink of default with the IMF. Despite the fact that a last-minute deal on debt restructuring was reached in 2022, Argentina continued to battle to satisfy its common fee obligations. Beginning this yr, Argentina, for the very first time, turned to the PBOC swap line to repay the IMF. In response to the IMF’s Employees Nation Report as of mid-August, Argentina had drawn $2.7 billion from the PBOC swap line (together with a bridge mortgage) twice within the span of 30 days to avert default with the IMF. Past debt financing, a further $2.7 billion in swap attracts was allotted for financing imports ($1.8 billion) after the peso suffered a selloff and servicing debt obligations to bondholders ($900 million).

The Way forward for the Argentina-China BSL: Tango Tangles?

The latest repayments by Buenos Aires to finance its IMF debt spotlight Argentina’s rising dependence on the PBOC swap line. Nonetheless, the potential alternative of the China-friendly incumbent, Alberto Fernández, by the Trump-like Javier Milei introduces uncertainties concerning whether or not Argentina will proceed making funds to the IMF sooner or later and whether or not it can have the necessity – and the flexibility – to make the most of the swap line as soon as extra.

The swap line with China is believed to at the moment maintain the important thing to avoiding Argentina’s IMF default, in keeping with Matthew Mingey, a senior analyst with Rhodium Group. Nevertheless, Milei’s proposal to abolish the central financial institution presents a definite problem to it. It is because the swap line was established via bilateral agreements involving central banks and the currencies of each nations, as talked about earlier. On this association, the BCRA is the only real eligible celebration on Argentina’s aspect to handle its bilateral swap line with its Chinese language counterpart. If the BCRA and the peso have been to be abolished, the swap line would turn out to be primarily meaningless.

Therefore, a number of essential questions come to the forefront: Who would step into the BCRA’s sneakers in relation to managing the unwinding of the swap line with China? Dollarization gained’t happen in a single day. Would China proceed to supply entry to swap strains for Argentina, contemplating that the PBOC swap line would possibly stay in place for a transitional interval?

Milei’s chief dollarization strategist has put ahead a suggestion to ascertain a devoted fund in an OECD jurisdiction as a way to take over the duties of the BCRA in managing the nation’s reserves and coping with short-term peso debt. Nevertheless, there hasn’t been a transparent plan laid out but for managing the bilateral monetary agreements that the present administration has entered into, together with the swap settlement with China. Whereas the first focus of this specialised fund is to repay the $26 billion price of debt devices held by industrial banks, there hasn’t been any dialogue about the way to handle the debt ensuing from the foreign money swap association with China.

Concerning the second problem, empirical proof signifies that these agreements usually have an asymmetrical nature, giving China a big higher hand in relation to deciding when and the way to activate, prolong, or broaden swap strains. This benefit has led some students to argue that China strategically makes use of this leverage to both reward or penalize associate nations primarily based on their alignment with China’s political positions. Nevertheless, it’s vital to notice that being a creditor additionally exposes China to exchange-rate dangers associated to the borrowed foreign money. Within the case of the swap line with Argentina, China offers liquidity and, consequently, assumes the credit score danger related to Argentina’s borrowing. If Argentina encounters difficulties in repaying the swap, China might doubtlessly incur losses attributable to alternate price danger.

In a much less optimistic state of affairs, some Chinese language students surveyed are suggesting that China might must take a more durable stance if Milei adopts a extra assertive posture towards China by aligning carefully with the USA. A Chinese language scholar related to a state-run assume tank acknowledged, “China ought to insist that the brand new authorities both tones down its anti-China rhetoric, or else, we should always withdraw our funding.”

Whereas a direct termination of the swap deal will not be imminent, China might decide to not supply additional entry to the swap line. In such a state of affairs, the first concern on the Chinese language aspect revolves across the administration of the activated portion of the swap line, which stood at $6.5 billion as of mid-August. Any mishandling of this example would undoubtedly set off home backlash, notably amid financial downturns.

Contemplating China’s previous dealings with pro-U.S. administrations like these of Mauricio Macri and Brazil’s Jair Bolsonaro, it’s doubtless that Beijing would undertake a extra pragmatic and cautious strategy to settle the swap line with Argentina. In 2018, when Argentina confronted financial challenges just like these it faces at this time, Macri selected to not activate the PBOC swap line however as a substitute turned to the U.S.-backed IMF, securing a record-breaking $50 billion bailout program.

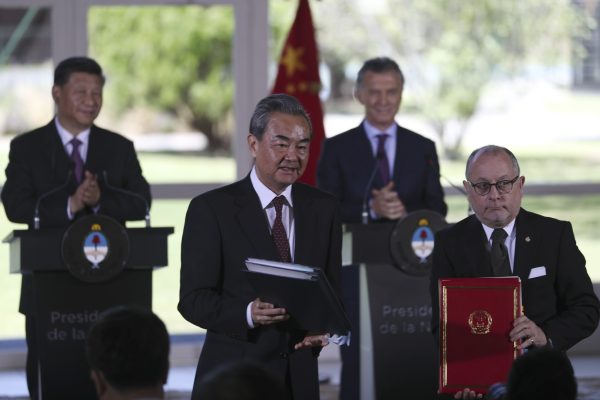

Surprisingly, China didn’t reply by freezing the swap line. As an alternative, China used it as leverage to distance Argentina from its alignment with the USA. Throughout Chinese language President Xi Jinping’s go to to Buenos Aires in December 2018, an further 60 billion RMB was added to the unique swap line as a part of a bundle of 30 commerce and funding bilateral offers. These strikes successfully softened Macri’s pro-Washington agenda. Equally, Bolsonaro’s initially robust stance towards China noticed a big shift as Beijing elevated its funding commitments to assist increase Brazil’s sluggish financial system.

It’s evident that when politicians in favor of nearer ties with Washington prioritize enterprise pursuits and keep away from inflicting political discomfort, Beijing has proven openness to take care of cooperation. This precept is also relevant to Javier Milei, if he’s certainly victorious within the presidential election. One key problem related together with his dollarization plan is the implementation part. The central financial institution should alternate all of its liabilities in

home foreign money for U.S. {dollars}. If Milei can not safe ample monetary sources from multilateral establishments, he might reevaluate the potential for accessing a swap line with China or discover various avenues for securing financing from China.

Milei’s proposal for dollarization is estimated to price the already cash-strapped financial system $40 billion. He and his group at the moment are exploring numerous choices to lift these funds however have but to supply a convincing plan. Attainable options embrace sourcing funds from repatriating property held overseas or reintegrating unreported money into the monetary system. Moreover, the special-purpose fund talked about earlier would function collateral for potential borrowing. This fund would encompass treasury bonds, debt from the general public pension fund, and shares within the state oil firm.

Nevertheless, skeptics argue that Argentina has been excluded from the worldwide bond market since its default in 2020, with few traders prepared to have interaction in any transactions involving Argentine bonds. Consequently, Argentina has few present exterior financing choices apart from China and Qatar, the opposite bilateral lender serving to Argentina repay the IMF.

Milei’s incapacity to safe such a considerable quantity of funding via market channels would restrict his ambition to dollarize the nation’s financial system and immediate him to think about a path just like his predecessors by in search of funding from China. If Milei moderates his China coverage, China might doubtlessly proceed financing a dollarized Argentina, no matter whether or not a swap line is in place. On this context, there are parallels with China’s efforts to domesticate sturdy ties, each in finance and commerce phrases, with dollarized economies like Ecuador and El Salvador.

The shortage of a swap line doesn’t essentially discourage China from lending cash to Ecuador. In whole, Ecuador took on about $18 billion in loans from China, primarily through the presidency of Rafael Correa, an anti-U.S. leftist. These funds have been obtained via Chinese language state-owned banks for numerous infrastructure initiatives or via prepayment agreements, through which Chinese language oil corporations supplied upfront money in alternate for future oil gross sales. When pro-American conservative Guillermo Lasso assumed workplace, regardless of his prior criticisms of Chinese language loans, China prolonged oil-backed loans and agreed to restructure $4.4 billion of Ecuador’s debt, ensuing within the nation saving $1 billion from 2022 to 2025. 2025.

Within the case of El Salvador, its vice chairman, Félix Ulloa, mentioned that China had provided to amass the nation’s $21 billion in overseas debt. Nonetheless, the spokesperson for the Chinese language International Ministry declined to supply any official response to this declare.

China seems undeterred in strengthening commerce ties with dollarized economies both. Earlier this yr, Ecuador’s President Lasso efficiently negotiated a free commerce settlement with China, anticipated to broaden export alternatives by almost $1 billion. In response to the United Nations COMTRADE database, Ecuador’s commerce knowledge with China signifies that its exports steadily elevated from round $500 million in 2013 to $4.07 billion in 2021, regardless of the dearth of native foreign money settlement facilitation.

In distinction, Argentina’s exports to China have fluctuated between 2014 and 2022, and it maintains a commerce deficit with China, regardless of its swap line doubling since its initiation. Furthermore, analysis has prompt that the commerce results on foreign money swap settlement associate nations not taking part within the Belt and Highway Initiative are much less pronounced.

After we evaluate Ecuador and Argentina, it turns into clear that the commerce relations between China and Argentina maintain larger significance by way of each amount and geopolitical impression. For Argentina, its exports to China, which is its second-largest purchaser, represent an important supply of constant income. This earnings is significant for replenishing the nation’s depleted reserves and attaining the monetary targets established with the IMF.

Moreover, sustaining steady commerce relations with Argentina aligns with China’s strategic goals, notably in securing important sources like lithium and soybeans from nations that aren’t carefully aligned with the USA. Disrupting these commerce ties wouldn’t be in the perfect curiosity of both celebration. On this context, it seems that discontinuing the swap line between China and Argentina would have restricted repercussions on their total bilateral commerce relations.

Conclusion

“It takes two to tango,” because the saying goes. As a possible dollarization unfolds, the future of the bilateral swap line is entangled with the broader financial and coverage dynamics between China and Argentina. Milei’s challenges in addressing Argentina’s multifaceted issues, coupled with China’s pursuits in sustaining a steady bilateral relationship, recommend that pragmatic concerns might in the end chart the course forward.

If elected, Milei will shortly discover himself grappling with mounting challenges each inside and past Argentina’s borders. The nation teeters on the precipice of an ever-deeper recession, as inflation skyrockets far above 100% and worldwide reserves dwindle. The IMF faces mounting stress to undertake a more durable stance on Argentina, guaranteeing its dedication to financial targets and debt obligations. It’s a frightening process to ascertain how Milei will navigate these financial and monetary hurdles whereas concurrently attracting ample funding for his dollarization technique.

This difficult state of affairs might in the end immediate Milei to reevaluate Argentina’s entry to the swap line with China as he pursues the trail of dollarization. In the meantime, a disruptive bilateral relationship with Argentina isn’t in China’s finest curiosity. China ought to be capable to discover a pragmatic decision with Argentina to handle the problems surrounding the bilateral swap line. This doesn’t essentially rule out the potential of Argentina persevering with to entry the swap line for a sure interval. On this intricate financial diplomacy, practicality is prone to information the steps of each nations as they navigate these complicated challenges.