Minimal wage regulation prevents employers from paying workers under a certain quantity per hour. There’s a federal minimal wage, however many states and localities set a better wage for employers to comply with. To make sure your enterprise is compliant with labor legal guidelines, learn on to be taught what’s minimal wage.

What’s minimal wage?

The minimal wage is the lowest quantity you’ll be able to legally pay an worker per hour of labor. You may pay greater than the minimal wage if you happen to’d like, however you can not pay lower than the minimal wage.

Minimal wage legal guidelines don’t apply to impartial contractors, so it’s essential to just remember to classify your workers appropriately.

Who units the minimal wage?

The federal authorities units a regular minimal wage that applies to all workers in america. Nonetheless, states and localities can set minimal wage charges, too.

So, which price do you could comply with? Federal, state, or native?

Federal minimal wage vs. state vs. native

What occurs if a state’s minimal wage is decrease than the federal minimal wage? What about if the native minimal wage is decrease than the federal?

If the state or native minimal wage is decrease than the federal minimal wage, it’s essential to pay your workers no less than the federal minimal wage price.

What about if the state or native minimal wage is increased? If the state or native minimal wage is increased than the federal price, pay your workers the state or native price (whichever is increased).

Professional tip: When selecting between federal, state, and native minimal wage legal guidelines, at all times pay your workers the very best price.

What’s the federal minimal wage?

The federal minimal wage is ready by the Truthful Labor Requirements Act (FLSA) and enforced by the U.S. Division of Labor (DOL).

Though the federal minimal wage price is topic to alter, it has not elevated since 2009.

So, what’s the nationwide minimal wage? The present federal minimal wage is $7.25 per hour. Nonetheless, the federal minimal wage may probably enhance in upcoming years.

Minimal wage by state

Every state can set its personal minimal wage. If a state’s minimal wage is larger than the federal minimal, pay workers no less than the state’s minimal wage.

For instance, the minimal price in Ohio is $10.45 per hour for 2024. When you have workers in Ohio, it’s essential to pay them no less than the state’s minimal since it’s higher than the federal minimal wage of $7.25.

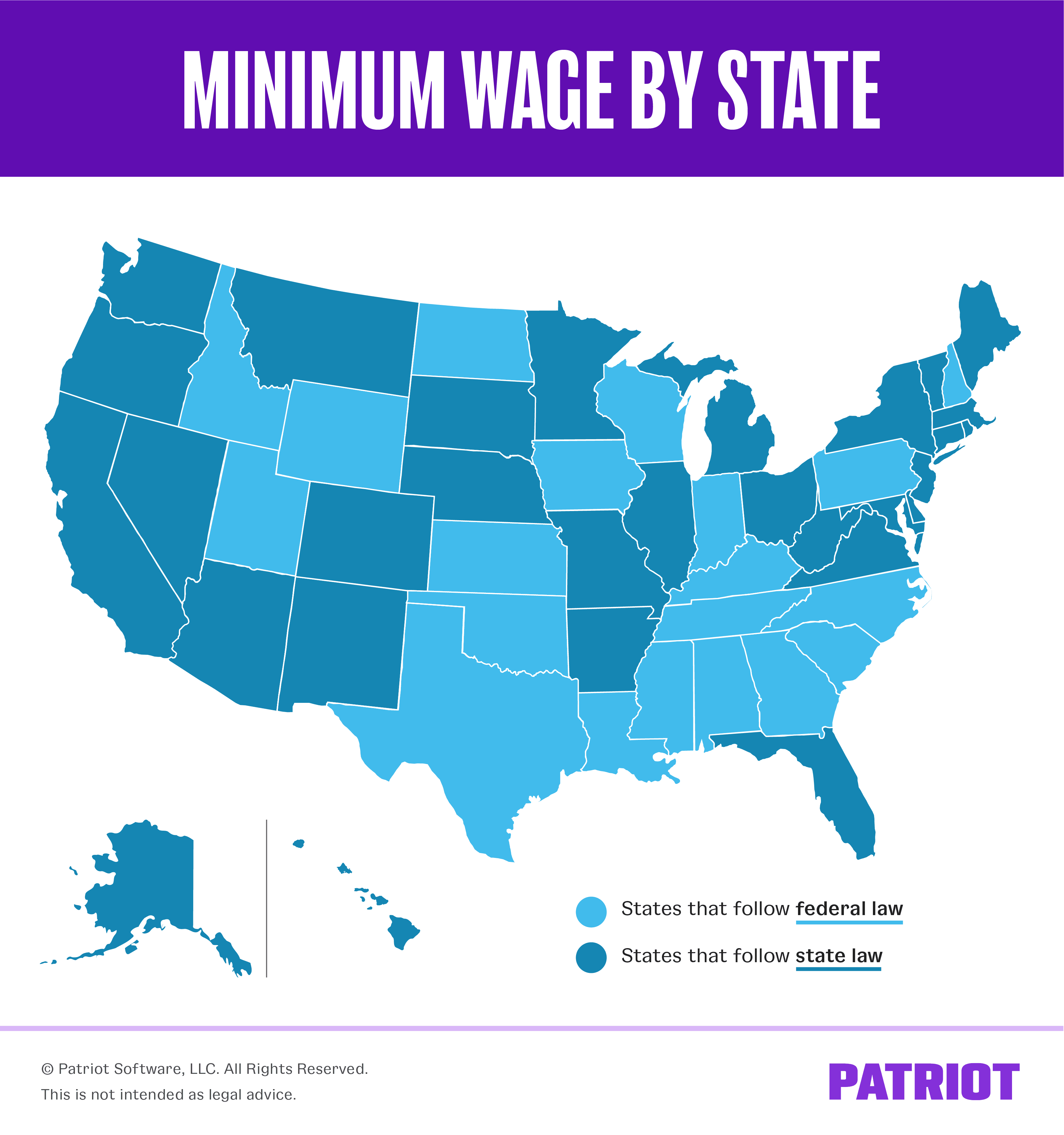

Use the map under to see which states comply with the federal minimal wage price and which set their very own minimal.

You could be questioning how a lot minimal wage is in your state. Take a look at our state-by-state minimal wage price chart under to search out out. Remember the fact that the states with $7.25 comply with the federal minimal wage base.

[State minimum wages as of January 1, 2024]

*These states don’t have a state-mandated minimal wage. As an alternative, most employers should pay the federal minimal wage.

**These states have a minimal wage of $5.15 for any employers who should not lined by the Truthful Labor Requirements Act. Most employers are lined by the FLSA and should pay the federal minimal wage of $7.25.

Heads up! State minimal wage legal guidelines are ever-changing. Keep up-to-date together with your state’s minimal wage necessities by periodically checking your state’s web site.

Native minimal wage

Some cities and counties create an area minimal wage that differs from state or federal charges. Native wages are most typical in greater cities. Employers should pay the increased of the 2 charges if the native minimal wage is totally different from the state minimal wage.

For instance, the minimal wage in San Francisco is $18.07 per hour (as of July 1, 2023). Employers in San Francisco should pay workers no less than the native base wage as a result of it’s higher than each the state and federal minimums.

One other instance is New York. Employers in many of the state should pay an hourly minimal wage of $15.00 per hour. Nonetheless, the minimal wage in Lengthy Island, Westchester, and NYC is $16.00 per hour.

Like state minimal wage charges, native charges are topic to alter. Verify together with your native authorities for extra data.

Exceptions to minimal wage

There are some exceptions to paying your workers minimal wage. Minimal wage varies for:

Minimal wage for tipped workers

The FLSA at present permits a tip credit score, which reduces the federal minimal wage for tipped workers. Tipped workers can have a decrease base wage as a result of their ideas ought to make up the remainder of their wages.

The federal tipped minimal wage is at present $2.13. This is applicable to workers who earn greater than $30 in ideas monthly.

Particular person states can even have minimal wage legal guidelines for tipped workers. Verify your state’s tipped minimal wage legal guidelines to be taught extra.

Youth minimal wage

The FLSA additionally permits a particular youth minimal wage. You may pay workers below age 20 a wage of $4.25 for the primary 90 days of employment. After 90 consecutive days of employment or the worker reaches 20 years of age (whichever comes first), the worker should obtain the minimal wage.

Some states have a youth minimal that’s higher than the federal youth minimal wage. For extra data, take a look at the U.S. Division of Labor’s web site.

Residing wage vs. minimal wage

When trying via state and native minimal wage legal guidelines, you may even see the time period “dwelling wage.” So, what’s a dwelling wage?

A dwelling wage is a state or native wage that’s increased than the minimal wage. Just like value of dwelling, the dwelling wage is the quantity an employer would wish to pay an worker to keep away from poverty. The objective of a dwelling wage is to lower poverty via elevated earnings.

This text has been up to date from its unique publication date of March 22, 2012.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.