A reader asks:

I recognize Ben’s long-term view of inventory market corrections however what if this time is completely different? What are the stats when the Fed is actively offloading trillions of property AND elevating charges? What if this cycle is an anomaly and ought to be handled as such?

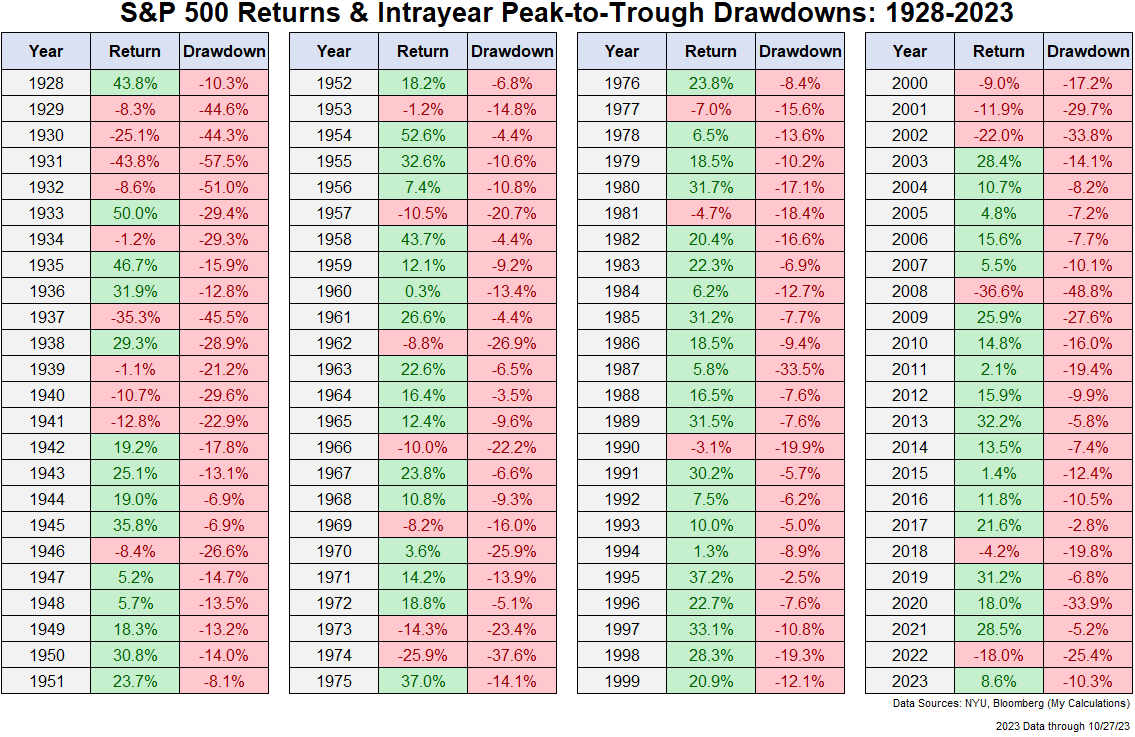

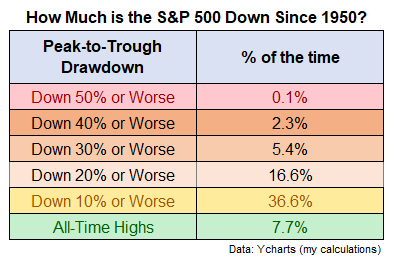

This query was written in response to a latest submit the place I used the next desk to point out the historic distribution of losses over the previous 70+ years in U.S. shares:

By my calculation, the S&P 500 was down 10.3% for the reason that finish of July as of the shut final Friday.

That’s a run-of-the-mill correction however it doesn’t really feel like a run-of-the-mill correction to many buyers.

What in regards to the trillions in authorities debt?!

What about rising rates of interest?!

What in regards to the potential for a recession?!

What about greater for longer?!

What in regards to the geopolitical pressure throughout the globe?!

I do know the world feels fragile proper now. The geopolitical scenario looks like a powder keg able to burst. The financial system is in unchartered territory with charges going from 0% to five% in a rush. Uncertainty appears to be at an all-time excessive.

I don’t imply to sound insincere about something happening proper now, however the future is all the time unsure. The one individuals who assume the world has by no means been in a worse place are those that have by no means opened a historical past ebook.

Within the twentieth century, we endured a pandemic, the Nice Despair, two world wars, the Vietnam Struggle, the Korean Struggle, the Chilly Struggle, the Gulf Struggle, 19 recessions, excessive inflation, low inflation, deflation, excessive charges, low charges, Black Monday, a handful of inventory market crashes and dozens of corrections alongside the way in which.

Within the twenty first century, we’ve endured 9/11, the Iraq conflict, the conflict in Afghanistan, an riot on the Capitol, the pandemic, the Nice Monetary Disaster, the best inflation in 40 years, damaging oil costs, a misplaced decade within the inventory market bookended by separate 50% crashes and a handful of recessions.

The listing of dangerous stuff I missed right here is almost limitless. Historical past is plagued by unspeakable tragedies and but we as a species someway forge forward. We create. We innovate. We develop. Life goes on. Issues finally get higher.

Regardless of all of that nasty stuff that occurred the inventory market was up 10% per 12 months.

Can I assure it will proceed?

After all not.

Does that imply you need to abandon the inventory market?

I’m not going to.

You may make the case the inventory market is without doubt one of the final remaining sane establishments on this nation.

One of many onerous components about investing within the inventory market is each historic dip on a long-term chart seems like an exquisite shopping for alternative. Everybody can take a look at a backtest and confidently say they might have stepped as much as purchase when shares had been down.

It’s a lot more durable to take action when shares are within the midst of a downturn as a result of nobody is aware of how dangerous issues will get or how low costs will go.

It sounds clever to say this time is completely different for the inventory market however each time is completely different. Every market and financial cycle is exclusive. If there have been a playbook for these things investing can be a complete lot simpler.

Right here’s what I do know in regards to the historical past of corrections within the inventory market:

Since 1928 the U.S. inventory market has averaged a ten% correction in roughly two-thirds of all years, a bear market as soon as each 4 years and a crash of 40% or worse as soon as each 13 years.

The common peak-to-trough drawdown in a given 12 months going again to 1928 has been a bit greater than 16%. In 6 out of the previous 10 years alone, the S&P 500 has skilled a double-digit correction.1

The inventory market goes up more often than not however typically it goes down.

The inventory market normally falls for good cause as nicely.

It is smart the inventory market is in correction territory proper now. We’ve not solely gone by means of a painful financial regime shift however the bull market of the 2010s was a powerful one. Imply reversion was sure to make an look sooner or later.

I don’t know what’s going to occur to inventory costs from right here.

I don’t understand how lengthy this correction will final.

And I can not assure the inventory market will produce the identical returns sooner or later that it has previously.

However I do know that each correction looks like it should by no means finish when you are in it after which all the time seems like a shopping for alternative with the good thing about hindsight.

Nobody ever stated investing was simple. That’s why the inventory market affords you a danger premium — it’s by no means simple.

I’m not saying that is some generational shopping for alternative. It’s not. However I’m not able to abandon the inventory market simply because there are some scary headlines.

Historical past is filled with scary headlines and the inventory market has finished simply fantastic.

Corrections within the inventory market are utterly regular. It’s the price of doing enterprise. Future corrections will all the time really feel completely different as a result of markets and buyers are always altering and evolving. That doesn’t imply you abandon danger property as a result of they make you’re feeling uncomfortable.

You’re by no means going to outlive within the inventory market in case you deal with each downturn prefer it’s the tip of the world.

We mentioned this query on the newest version of Ask the Compound:

Josh Brown joined me once more at the moment to reply questions on when to promote huge gainers in your inventory portfolio, the distinction between now and the dot-com bubble for tech shares, de-risking your portfolio as you strategy retirement and learn how to deal with allowance on your kids.

Additional Studying:

No One Is aware of What Will Occur

12015 (-12.4%), 2016 (-10.5%), 2018 (-19.8%), 2020 (-33.9%), 2022 (-25.4%) and now 2023 (-10.3%).