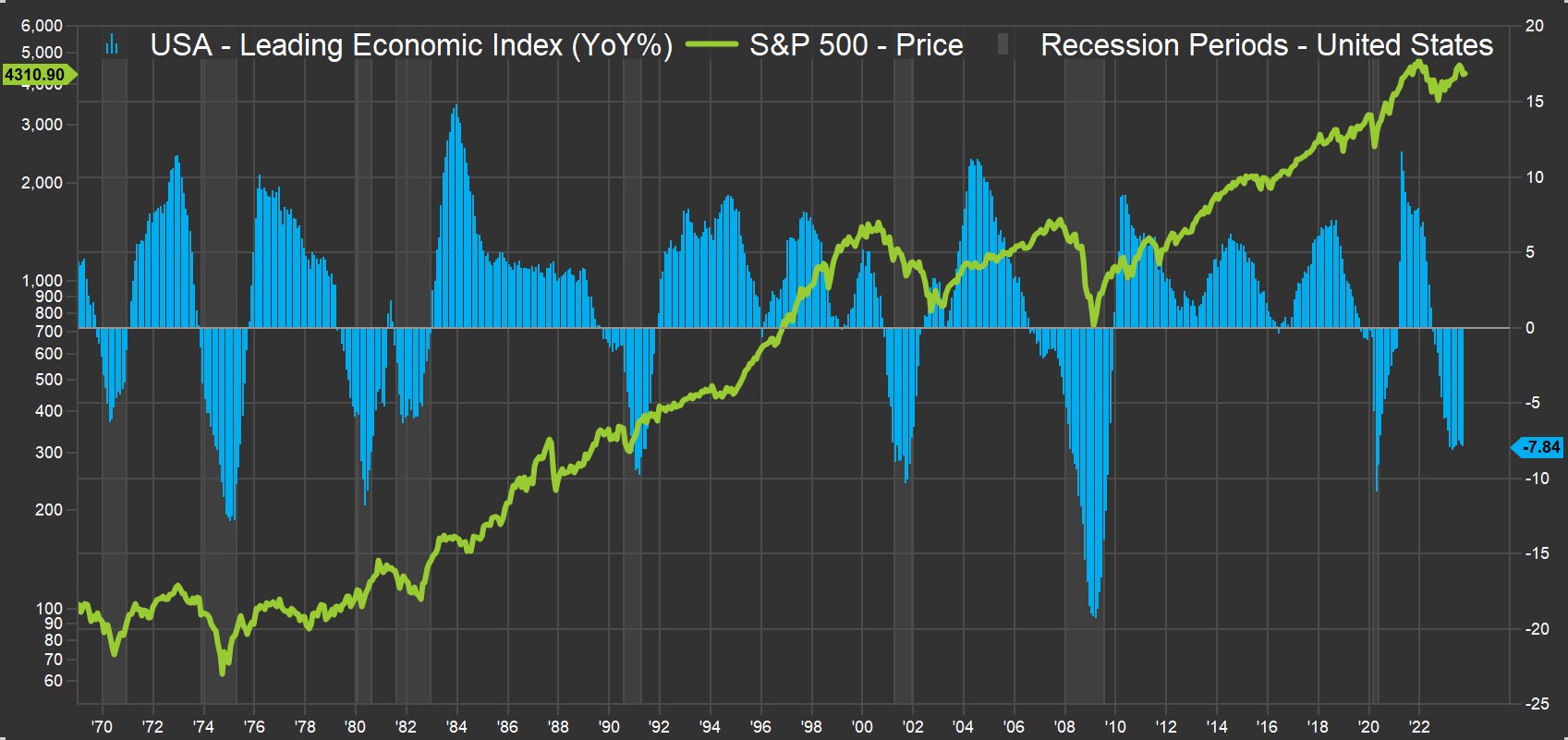

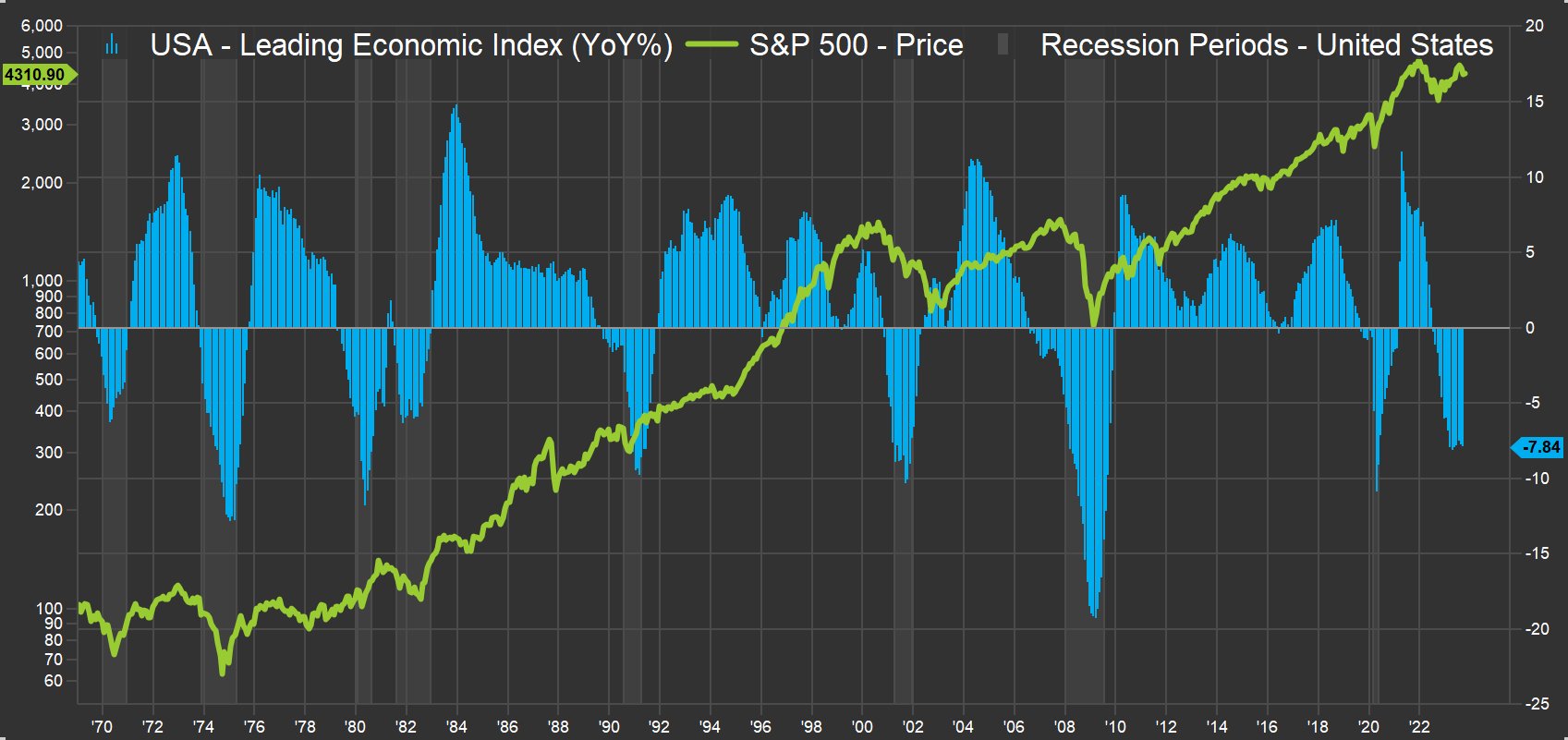

Main Financial Indicators have been warning us of a recession for a very long time. They’ve been adverse on a year-over-year foundation for 15 straight months, which is the second-longest streak of adverse readings.

Regardless of all of the warnings and regardless of the Fed attempting to gradual the financial system, it continues to march on:

- The unemployment fee has been under 4% for twenty straight months.

- We’ve added 2.4 million jobs in 2023.

- S&P 500 Q3 earnings present a 2.7% y/o/y change, which might be the primary constructive studying since Q3 2022. Combination earnings usually are not too far under a document excessive.

I don’t know if the LEI will not be precisely capturing the present financial system or if it’s simply taking a very long time for fee hikes to filter by the financial system. Each may very well be true, however maybe a greater place to search for clues concerning the financial system’s trajectory is in promoting spending.

Promoting is among the best levers firms can pull if they’re getting ready to hunker down. Typically talking, an organization will decelerate its promoting spend earlier than deciding to put off workers. And promoting spending will be dialed down a lot faster than investments, particularly ones which are already underway. Primarily based on latest earnings experiences, there is no such thing as a signal that firms are getting ready to hunker down.

Meta’s promoting, which represents 98.5% of their general income, hit an all-time excessive in Q3, rising at a blistering 23.5% y/o/y, and 6.8% q/o/q. Google’s promoting grew 9.4% y/o/y and a pair of.6% q/o/q. Even Snap, which has had a troublesome time rising its advert income, grew 5% y/o/y.

Companies are nonetheless spending and customers are too. On Visa’s most up-to-date earnings name, the CEO mentioned: “All year long, we now have seen resilient client spending.”

Mastercard’s CEO mentioned one thing comparable: “In your query round how we see This fall shaping up, it’s really very a lot in keeping with what I shared which is our base case state of affairs continues to be one in all the place the buyer stays resilient.”

There are many areas within the financial system that aren’t simply signaling a recession is perhaps coming. They’re already in it. The housing marketplace for instance is in a full-on recession. Some areas of the posh market are additionally seeing a slowdown. I’m not saying the financial system is booming, though GDP would say it’s, but it surely’s positively not as unhealthy as some folks really feel it’s.