The insurance coverage business has skilled a surge in telematics-based insurance coverage insurance policies during the last decade. These insurance policies utilise telematics know-how to trace and monitor driver behaviour, with the purpose of offering personalised premiums primarily based on particular person driving habits. Particularly widespread amongst younger drivers, telematics has performed a vital function in curbing inflation within the underneath 25s market.

Telematics has confirmed efficient in selling safer roads and rewarding good driving behaviour. Nevertheless, the reluctance of customers to share their knowledge has restricted its adoption past the youngest age group.

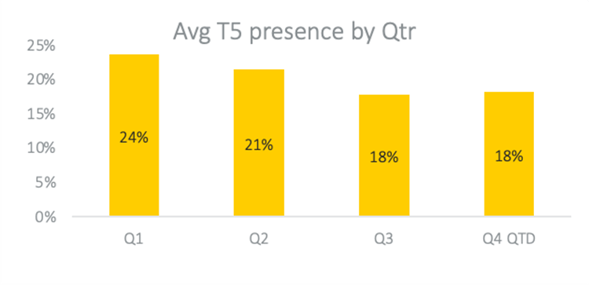

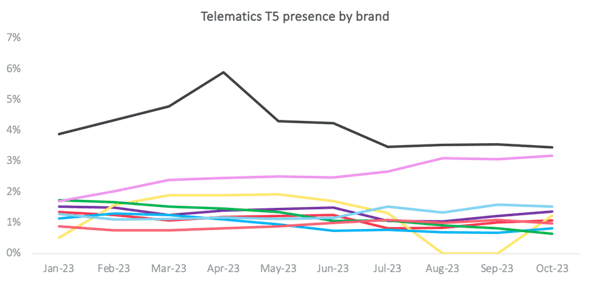

Though telematics manufacturers have managed to stay aggressive throughout all age teams for a while, their presence available in the market is now declining. Within the first 10 months of 2023, the proportion of telematics manufacturers showing within the prime 5 outcomes throughout main worth comparability web sites fell by 6 share factors. The main telematics model skilled the biggest drop in competitiveness. However, a handful of telematics manufacturers have defied this pattern by preserving their premiums steady whereas the general market sees inflation.

Contemplating that the aggressive presence for telematics manufacturers has remained robust for underneath 25s, this market stage decline would possibly point out a strategic resolution by some gamers to focus their efforts the place they obtain the perfect conversion charges.

Nevertheless, different elements could also be at play. Over the previous two years there was a surge in tiered product choices. This has come significantly within the type of “necessities” merchandise, which provide decrease costs for decreased protection. These newcomers are primarily aggressive for drivers aged 30 and over. It’s potential that elevated competitors from these choices has compelled some telematics manufacturers to retreat from the older age teams.

Trying forward, it’s important to contemplate the potential longevity of telematics as an insurance coverage product. As know-how evolves, telematics capabilities are more likely to turn into normal options in automobiles, eliminating the necessity for standalone telematics gadgets. This poses each a risk and a possibility for current telematics insurers. Whereas integration into automobiles might lower demand for conventional telematics insurance policies, it additionally presents a brand new avenue for collaboration with automobile producers. Partnering with producers might present new market entry alternatives and doubtlessly attain untapped demographics. Convincing policyholders of the advantages will stay the important thing problem.