Six months after the implementation of the FCA’s new Shopper Obligation, the stress on insurers to place prospects first continues to accentuate. Nevertheless, this stress isn’t solely coming from the heavy hand of regulation – it’s additionally coming from customers themselves.

If you consider it, the Shopper Obligation couldn’t have arrived at a extra acceptable time. Over the past 12 months, we’ve seen document breaking premium hikes, customers financially squeezed by the deepening value of dwelling disaster and complaints hit a 5 yr excessive. It is a good storm that places customers at higher danger of economic detriment.

Because of this concoction of things, what prospects count on from their insurers is altering. And solely people who search to know tips on how to meet these altering expectations will achieve a Shopper Obligation world.

However the place to begin? By understanding your prospects, in fact…

Rising expectations

Over the past yr, we’ve seen unprecedented premium inflation. Within the twelve months to November, motor insurance coverage premiums rose a median of 67%. House insurance coverage additionally went up virtually 40%.

Analysis carried out in July 2023 revealed that 69% of customers have felt the influence of the cost-of-living disaster, and 66% are fearful about with the ability to afford their payments.

This mix of things is pushing extra folks to buy round for insurance coverage at renewal. Nevertheless, with the world of twin pricing and widespread new enterprise reductions a forgotten reminiscence, and plenty of are left unable to discover a higher deal.

When left on this predicament by way of no fault of their very own, customers are going to count on extra for his or her cash. And these expectations are going to proceed to extend alongside rising premiums.

What do prospects need?

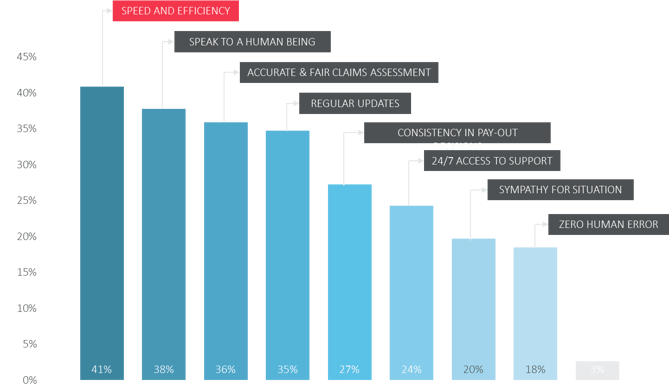

To reply this query, we surveyed over 1000 insurance coverage prospects to seek out out what they count on from the expertise of submitting an insurance coverage declare. 41% mentioned cited velocity and effectivity in processing a declare prime on the prime of their checklist of desires – unsurprising given the hike in house and motor complaints pushed by delays in payouts reported by the Monetary Ombudsman Service earlier this yr.

Nevertheless, extra apparently 40% chosen a further possibility – ‘the entire above’. 4 in 10 prospects count on an ideal buyer expertise. And who can blame them. We stay in a world the place corporations like Amazon and Uber exist, the place immediate gratification looks as if a proper, not only a privilege. These are prospects that need extra and count on extra, and so they aren’t going away any time quickly.

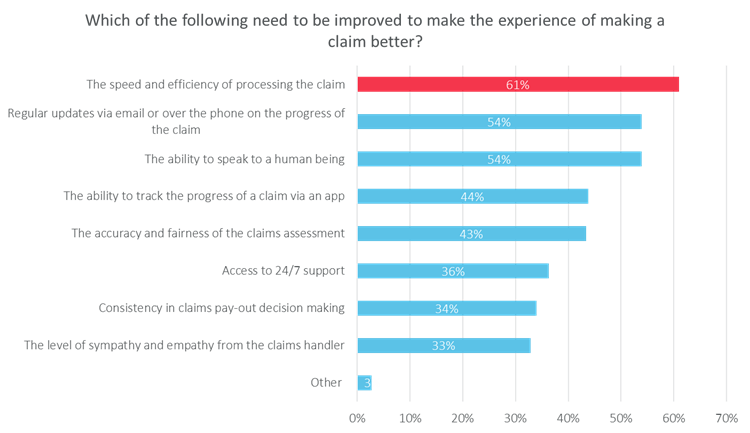

We went on to ask respondents that had beforehand made a declare, ‘Which of the next must be improved to make the expertise of creating a declare higher?’, the highest reply got here in at 61% saying the ‘Velocity and effectivity of processing the declare’. So, not solely do prospects count on velocity and effectivity, claimants are recognising that that is additionally the business’s greatest space for enchancment the place expectations usually are not presently being met.

What does this all imply for Shopper Obligation?

It’s insights like these that show the necessity for such regulation.

Some may see the rules as extra of a nuisance than a profit, nonetheless they current a possibility for corporations to suppose and act in a different way and to do what’s proper for the shopper. It’s permission to interrupt time-old processes and the ‘that’s how we’ve at all times achieved it’ rhetoric. It’s an opportunity to create a legacy.

Buyer expectations are presently not being met, and if the right storm continues to play out with out motion from the business, this expectation hole will solely widen.

Shopper Obligation signifies that it’s now crucial that the corporations accountable for delivering items and companies are delivering good shopper outcomes.

To make sure buyer retention and satisfaction, it is advisable to prioritise your efforts by really understanding the important thing drawback areas. Now we have developed a Shopper Outcomes Benchmarking service that helps you measure buying expertise, help expertise, efficiency in assembly shopper communication preferences and repair expectations, and far more.