“It’s like we’re virtually in a melt-up,” David Kudla, founding father of Mainstay Capital Administration, mentioned on Bloomberg Radio.

“You’ve obtained skilled cash managers on the market which might be lagging their benchmarks — they’re taking part in catch-up and making an attempt to reap the benefits of this rally to try this. Retail cash is coming off the sidelines as a result of money-market funds have been paying such excessive yields, however now the market is doing so effectively so we’re seeing that cash come into the market,” Kudla mentioned.

Although fairness funds have seen an total infusion of $349 billion this yr — barely shy of 2022’s $398 billion haul — 4 S&P 500 ETFs have been the recipients of greater than a 3rd of the flows, the most important share ever, in accordance with Athanasios Psarofagis, Bloomberg Intelligence ETF analyst.

It’s been to the detriment of funds monitoring particular sectors like power and utilities. Sector ETFs have seen outflows of $12 billion, their worst yr on report.

These withdrawals proved prescient. Simply 31% of “active-like” ETFs — together with thematic funds, ESG merchandise, elements and actively managed automobiles — managed to outperform the benchmark index this yr, on tempo for the bottom beat-rate in information going again to 2014, in accordance with Bloomberg Intelligence. Not one of the classes tracked by BI had a beat charge of greater than 50%.

The success of broad-market indexes masked a tough yr for a lot of forms of tactical investments, notably these premised on security. Choices-linked ETFs promising further yield, which entered the yr as dealer darlings, racked up billions of {dollars} in inflows however delivered tepid outcomes.

Essentially the most well-known, JPMorgan’s Fairness Premium Earnings ETF (ticker JEPI), gained about 9% on a total-return foundation, trailing the S&P by about 17 proportion factors.

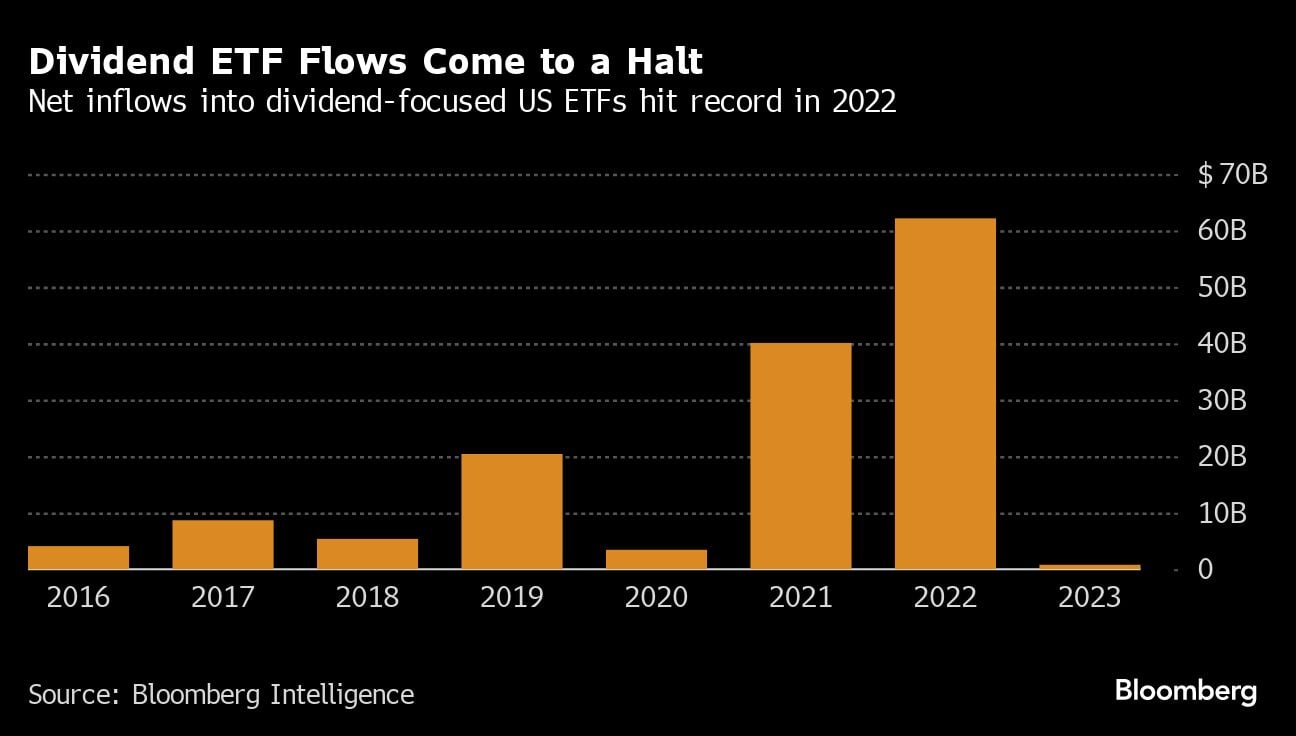

It was an analogous story for ETFs centered on dividend methods, which raked in additional than $60 billion from defensive-leaning buyers in 2022. Dividend-focused ETFs took in simply $1.5 billion this yr, one of many lowest hauls on report after most funds missed out on the tech-led rally and underperformed the S&P 500.

One of many worst performers is the $18.8 billion iShares Choose Dividend ETF (ticker DVY), which returned simply 0.8% after all-in bets on utilities and monetary shares fizzled.

“You look again on this yr and say, ‘Why did I even hassle to have issue investing or sector-specific investing when had I been within the S&P 500, I’d have performed a lot better?’” B. Riley’s Hogan mentioned. “There’s loads of that reckoning that’s occurring.”

Credit score: Adobe Inventory