Why Excessive Sports activities Matter for Life Insurance coverage

Life insurance coverage and excessive sports activities have an fascinating relationship. Although a person is perhaps completely wholesome and don’t have any pre-existing well being circumstances, indulging in excessive sports activities means a excessive threat of an accident. Attributable to that, insurance coverage corporations look carefully at every state of affairs.

Examples of maximum sports activities embrace however will not be restricted to:

- Alpine snowboarding

- Sky diving/parachuting

- Scuba diving

- Mountain climbing

- Bungee leaping

- Flying small (mild and extremely mild) planes

This text focuses on sky diving, its related dangers and what it means for all times insurance coverage corporations and individuals who seek for life insurance coverage (together with time period life insurance coverage, complete life insurance coverage, and different life insurance coverage varieties) whereas participating within the sport of sky diving.

Sky Diving and Related Dangers

Although sky diving/parachute sports activities are thought of an excessive sport, its security requirements and high quality of drugs have constantly improved over the a long time. However, there are some dangers related to sky diving – and insurance coverage corporations take good word of these dangers. The dangers embrace touchdown issues (late deployment, malfunctioning gear, potential collisions with different sky divers or objects, and so on.).

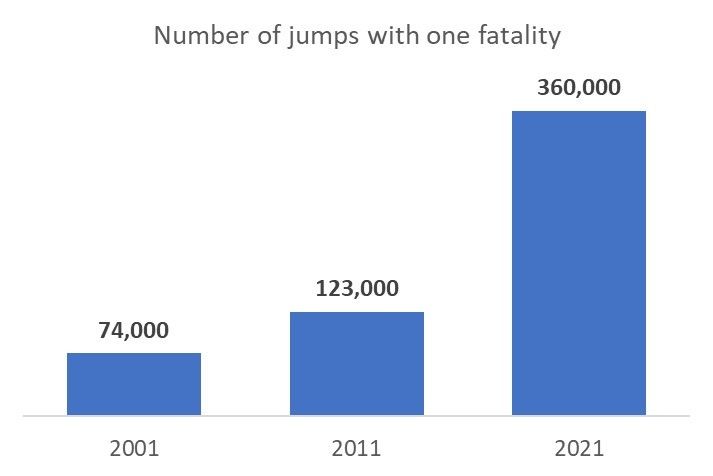

In response to the United States Parachute Affiliation, there have been 10 skydiving fatalities within the U.S. in 2021 (per 3.57 mil jumps), which means a fatalities price of 0.28 per 100,000 jumps. That interprets into 1 fatality per ~360,000 jumps. That may be a 3-time enchancment from 2011, which noticed 1 fatality per ~123,000 jumps, and an nearly 5 time enchancment from 2001 with 1 fatality per ~74,000 jumps. (Supply:)

Canadian numbers will not be dissimilar. In 2014, the Canadian Sport Parachuting Affiliation reported 1 fatality per 148,000 jumps.

You will need to point out that the chance varies in case you are leaping solo or in a tandem with an skilled diver. Within the latter case, threat decreases even additional.

Can You Get Life Insurance coverage if You Skydive?

The fast reply is, it relies upon. There are a number of elements that impression your means to get life insurance coverage, equivalent to:

- One-time or recurring exercise

- Stage of threat (tough solo soar vs safer tandem soar)

- Affiliation with a parachute/sky diving membership

For instance, one of many life insurance coverage corporations we work with would cost commonplace charges in your life insurance coverage coverage so long as it’s one soar and you haven’t any intention to repeat it or turn out to be an avid sky diver.

Additionally, affiliation with a parachute or sky diving membership ends in commonplace charges as you’ll possible be uncovered to excessive security requirements and surrounded by skilled divers.

There are some elevated threat eventualities (e.g., intention to do repeated jumps) when a life insurance coverage firm will cost you an elevated price. For instance, with one in all our insurance coverage offers, you’d pay $2.5 per thousand of protection. That signifies that a $100,000 coverage would price you $250/yearly or roughly $21/month. Must you determine to get a $500,000 coverage, it might price you $1,250/yearly or round $104/month.

Must you have interaction often in high-risk jumps, your life insurance coverage utility could be very prone to be declined.

In some circumstances, an insurer will problem a life insurance coverage coverage however will exclude your sky diving exercise from potential claims. On this case, the coverage pays out if a coverage holder passes away from another motive than sky diving.

In any case, must you reply a sky diving query positively, you have to to finish an extra sub-questionnaire explaining precisely your ski diving intentions.

Does Skydiving Have an effect on Life Insurance coverage?

Sure, sky diving does have an effect on life insurance coverage and you want to disclose it to an insurer when finishing a life insurance coverage utility. In any other case, any potential accident may not be coated.

Relying in your skydiving intentions, an insurance coverage firm will do one of many following:

- Give you a coverage overlaying sky diving accidents at a normal price

- Give you a coverage however cost a better premium

- Give you a coverage however exclude skydiving accidents from it

- Decline your utility

In lots of circumstances, whether it is only a low threat, one time soar (e.g., to attempt it out, in a tandem soar with an teacher), you’ve gotten an ideal probability of getting a normal rated life insurance coverage coverage.

However, you need to verify with the insurance coverage firm to see if this threat is roofed, whereas absolutely disclosing your intentions.

Does Life Insurance coverage Cowl Skydiving Accidents?

In case you are thinking about figuring out “does life insurance coverage pay when you die skydiving?” the reply is “it relies upon”. To start with, you want to perceive if you have already got an current life insurance coverage coverage, or you’re planning to get one earlier than the soar.

If you have already got a life insurance coverage coverage in place, you need to verify the positive print. Evaluate the total insurance coverage booklet to know if excessive sports activities and skydiving are coated. If an insurance coverage dealer helped you with the coverage up to now, he/she will help you with this query. In case your coverage doesn’t cowl skydiving, you need to focus on this together with your insurance coverage dealer/insurance coverage firm to seek out your potential choices.

When you shouldn’t have a life insurance coverage coverage and plan to use for all times insurance coverage whereas doing skydiving, you want to work with an insurance coverage firm that explicitly covers skydiving dangers. You’ll need to finish a skydiving/parachute questionnaire and, if it’s a low threat, one time soar, the possibilities are good that it is going to be coated. Be certain that to verify this by way of an insurance coverage coverage doc or, if not obtainable (i.e., skydiving just isn’t explicitly included within the coverage textual content) get a written assertion out of your insurance coverage firm/dealer.

What Life Insurance coverage Sorts Can You Get if You Skydive?

There are a selection of life insurance coverage insurance policies you may get when skydiving.

| Insurance coverage Sort | Medical Examination | Detailed Medical Questionnaire |

Quick Questionnaire | Protection Limits | Necessary to Know |

| 1. Conventional, Medically Underwritten Life Insurance coverage with STANDARD RATES | Sure | Sure | No | $5,000,000+ | Sure, for one soar and no intention to repeat. |

| 2. Conventional, Medically Underwritten Life Insurance coverage WITHOUT A MEDICAL EXAM | No | Sure | No | $5,000,000+ | Sure, for one soar and no intention to repeat. You possibly can keep away from a medical examination when you fall into explicit age segments and have good well being with out critical health-preconditions. |

| 3. Conventional, Medically Underwritten RATED Life Insurance coverage | Sure | Sure | No | $5,000,000+ | Sure, in case of repeated jumps or some sky diving elements growing the chance of your jumps. |

| 4. Simplified Difficulty Life Insurance coverage | No | No | Sure | $1,000,000+ | Sure, can usually qualify for this insurance coverage. Questionnaires range throughout suppliers. Most questionnaires is not going to ask you about excessive sports activities, however some could. |

| 5. Assured Issued Life Insurance coverage | No | No | No | $25,000+ | Sure, you may at all times qualify for this one. |

What’s Greatest Life Insurance coverage for Sky Diving/Parachute Sports activities?

Just about each life insurance coverage firm presents life insurance coverage for individuals who take pleasure in excessive sports activities, together with Manulife, SSQ Life Insurance coverage, Empire Life, Canada Life, Assumption Life and extra. Remedy of maximum sports activities can range from firm to firm.

We advocate working with an skilled life insurance coverage dealer who has entry to most life insurance coverage insurance policies available on the market and might evaluate utility standards for excessive sports activities and, skydiving/parachuting specifically, throughout all kinds of insurance coverage corporations to get you the perfect price and protection.

Our skilled life insurance coverage brokers are blissful to help you on this journey – merely full the quote request on the best aspect of your display.