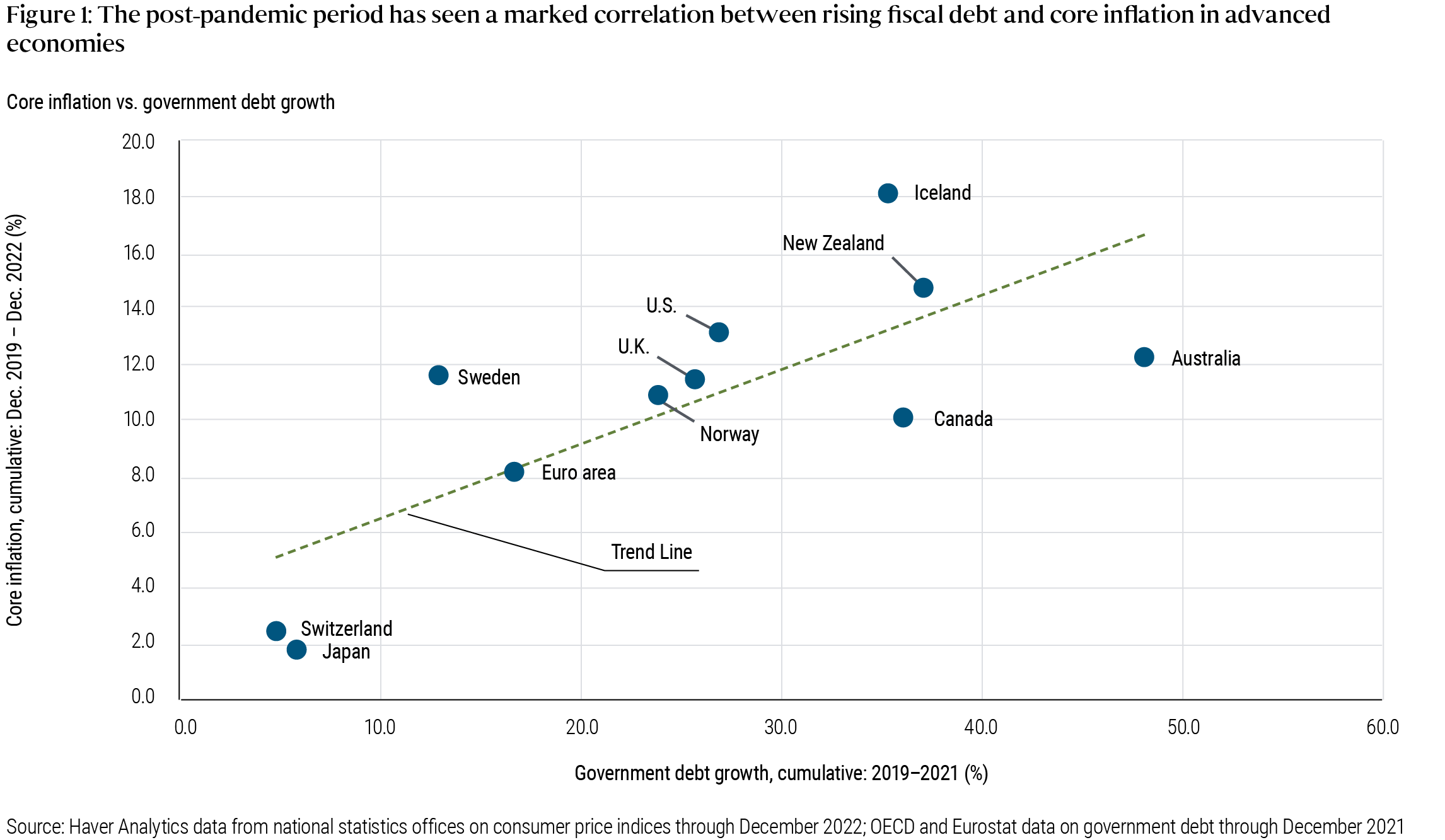

Peder Beck-Friis and Richard Clarida at Pimco have a pleasant weblog publish on the current inflation, together with the above graph. I’ve questioned, and been requested, if the variations throughout nations in inflation traces up with the dimensions of the covid fiscal enlargement. Apparently sure.

It is a easy reality, and it is harmful to crow too loudly when issues go your means. Fiscal concept says that inflation comes when debt or deficits exceed expectations of a rustic’s means or will to repay. The latter can differ quite a bit. So, it doesn’t predict a easy relationship between debt or deficits and inflation. Nonetheless, it is good when issues come out that means, and extra enjoyable to jot down {qualifications} than to give you excuses for a opposite outcome!

I’ve seen different proof that does not look so good (will publish when it is public). One instance is throughout eurozone nations. However that is a great reminder the place to anticipate success and the place to not anticipate success. Inflation as described by most macro fashions, together with fiscal concept, monetarism, and so forth., is the part widespread to all costs and wages. It’s in essence the autumn within the worth of foreign money. In any historic expertise we see a number of relative worth modifications on high of that, particularly costs over wages. Certainly inflation is barely measured with costs, and a central concept is to measure the “price of residing,” not the worth of the foreign money. Throughout the eurozone there is just one foreign money and thus just one underlying inflation. The big variation in measured inflations are relative costs, actual alternate charges between nations, and might’t go on perpetually. That we can not hope to elucidate inflation variation throughout nations within the eurozone with a easy concept that describes the worth of foreign money provides you some sense of the error bars on this train as properly.

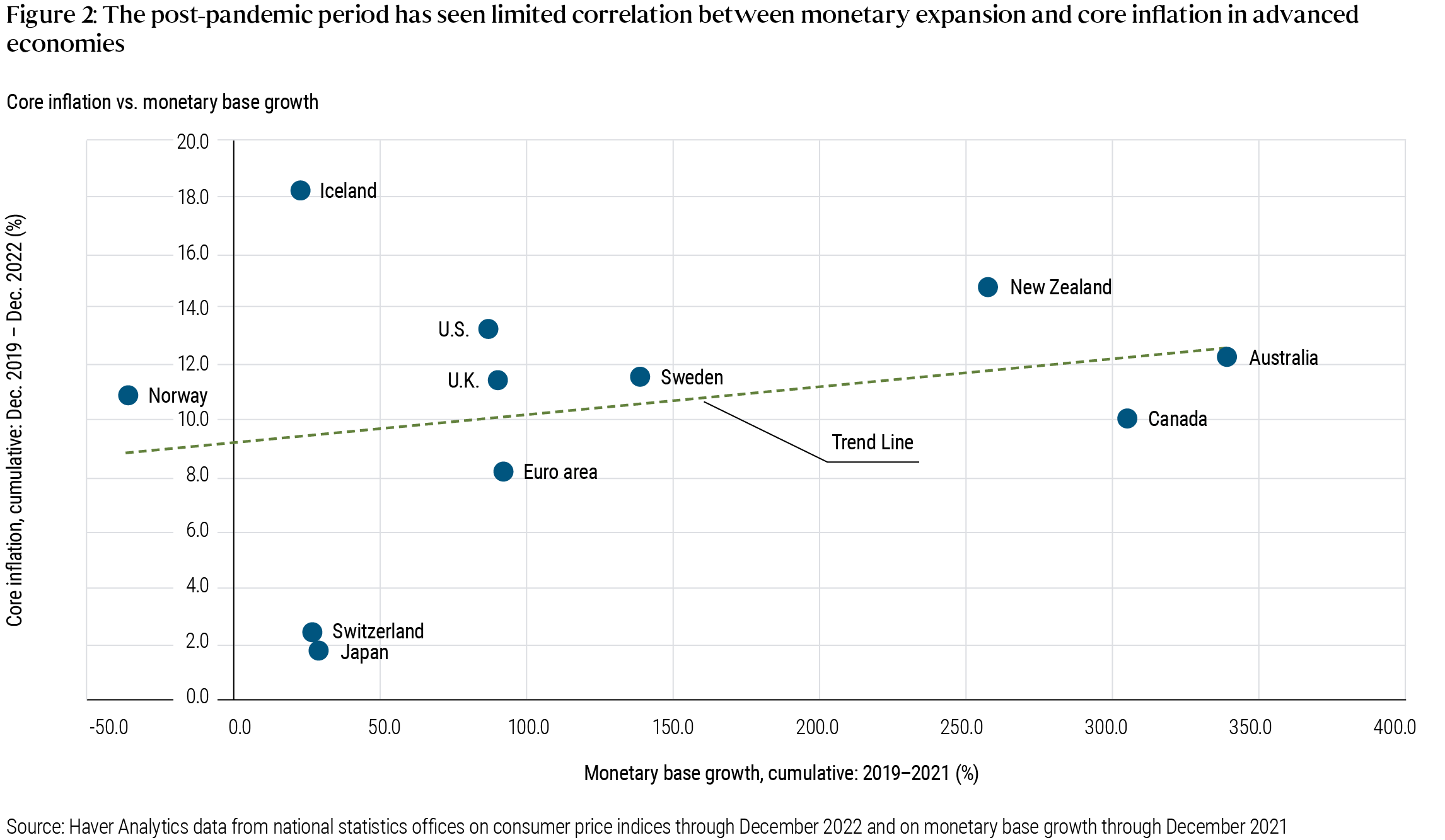

Beck-Friis and Clarida additionally take a look at cash progress, above. There was a giant enlargement in M2 earlier than the US inflation. Monetarists took a victory lap. M2 has since fallen quite a bit. There may be not a lot correlation between financial enlargement and inflation throughout nations nonetheless. The slope of the regression additionally clearly relies on one or two factors.

Cash or debt, which is it? When governments print cash to finance deficits (or interest-bearing reserves), fiscal concept and financial concept agree, there may be inflation. Printing cash (helicopters) is maybe significantly highly effective, as debt carries a popularity and custom of compensation, which cash could not carry. A core situation separating financial and monetary concept is whether or not a giant financial enlargement with out deficits or different fiscal information would have any results. Would a $5 trillion QE (purchase bonds, situation cash) with no deficit have had the identical inflationary affect? Monetarists, sure; fiscalists, no.

Beck-Friis and Clarida opine that fiscal stimulus is over and central banks now have all of the levers they should management inflation. I am not so positive. The US continues to be working a trillion or so deficit regardless of a 3.6% unemployment charge, and right here come entitlements. And, as weblog readers will know, I’m much less assured of the Fed’s lever. We will see.

Replace:

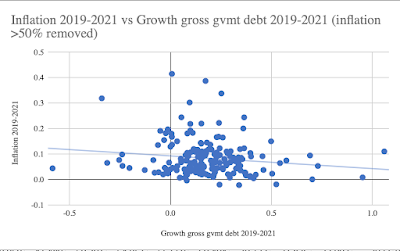

Mark Dijkstra makes the next graph (see feedback for hyperlink), based mostly on IMF knowledge for all nations. Hmm, would not look so good.

Nevertheless, if you take a look at a number of small nations, bizarre issues occur. The far proper knowledge level is Estonia, with 100% improve in debt and 14% cumulative inflation. Estonia began with 8.2% debt/GDP, nonetheless, so its rise to 18.4% is a 100% rise in debt to GDP ratio. So, Estonia spent 10% of GDP on covid and now navy, in comparison with 30% of GDP for the US. Once more, fiscal concept is just not debt or deficit = inflation, however debt vs. means and can to repay. One can argue that this improve in debt is extra repayable. Argentina has -8% progress in debt/GDP and 100% inflation. Inflation is inflating away debt/GDP quicker than the federal government can print the debt. The excessive inflation nations on this graph are Uzbekistan, Ghana, Guinea, Sierra Leone, Turkmenistan, Nigeria, Zambia, and Haiti. They’re all plausibly fiscal inflation, from preexisting fiscal issues, not steady nations that immediately borrowed/printed 30% of GDP with no plans to pay it again, the slightly particular case of the US, EU, UK. OK, I am making excuses and I am glad I began with the cautionary paragraph. Fiscal concept is just not really easy as debt = inflation! However we do must confront the numbers, and I hope this spurs some extra critical evaluation.