Each three years the Federal Reserve places out a report that summarizes the modifications to household funds in the US.

I do know averages, aggregates, medians and such by no means inform your entire story however directionally these things could be useful when it comes to understanding the place issues stand.

Let’s dig in.

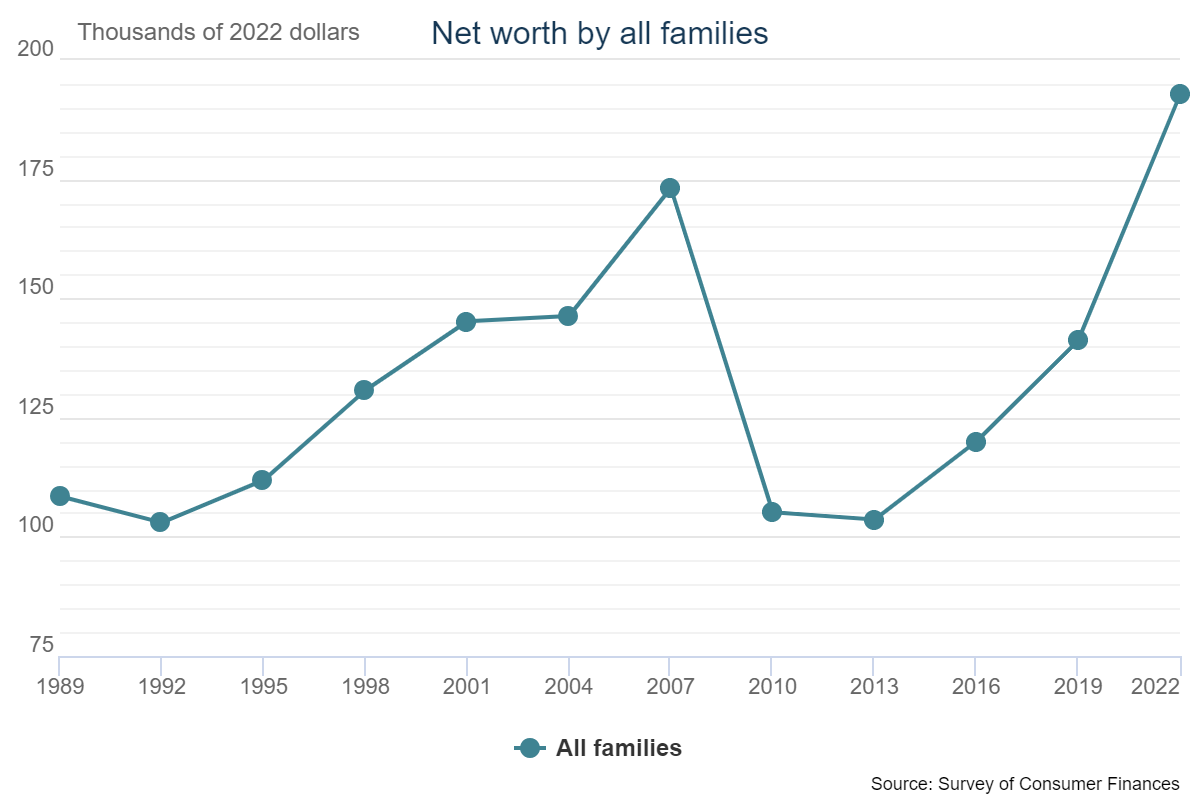

Actual median internet price for U.S. households was up a surprising 37% from 2019-2022.

That is only a huge enhance in wealth contemplating the truth that 2022 was one of many worst years ever for a diversified portfolio of shares and bonds.

However Ben what about inflation?!

To be clear, these numbers are inflation-adjusted.

And whereas internet price grew 37%, whole family debt grew lower than 4% from 2019-2022. Signal me up for that each three years, please.

That is what the change in internet price appears like each three years going again to 1989:

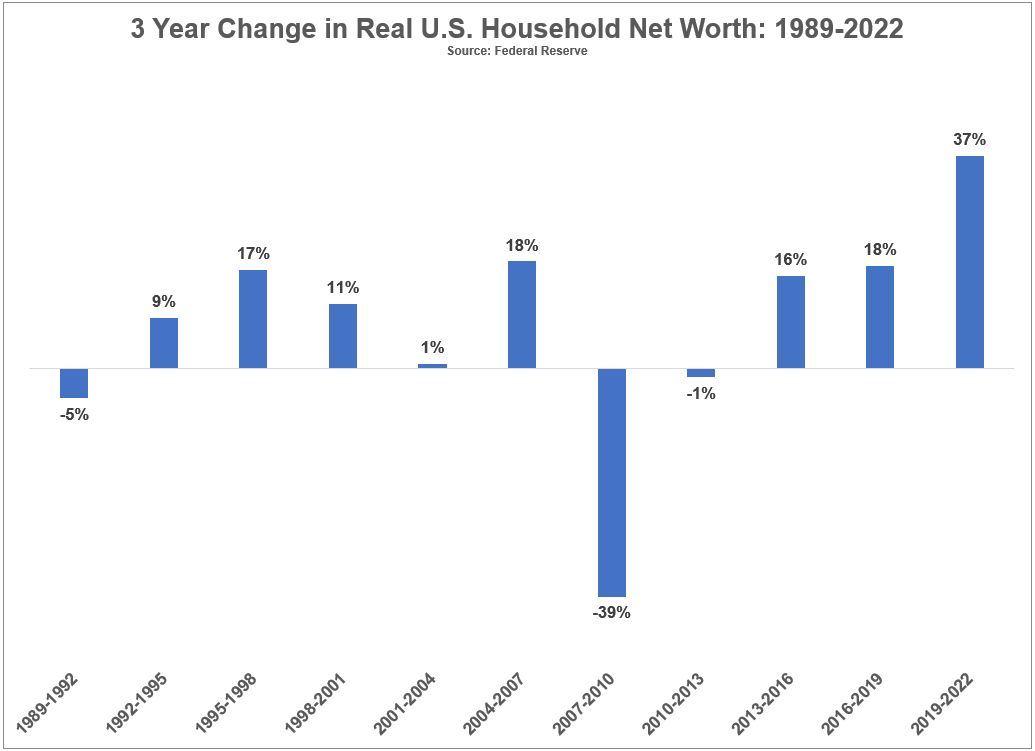

Now have a look at the relative change each three years to place the newest transfer into perspective:

You may see that is by far the largest enhance and there isn’t a detailed second.

The 2019-2022 enhance is off-the-charts good and this was after we already had a powerful snapback in 2013-2016 and 2016-2019 from the 2008 monetary disaster.

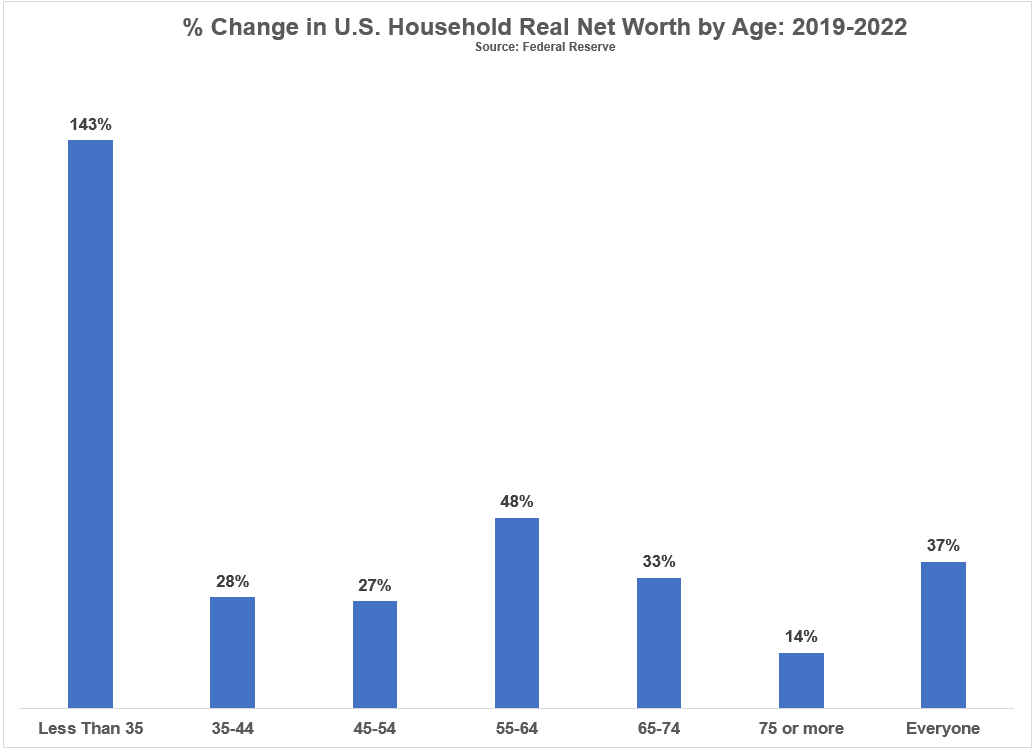

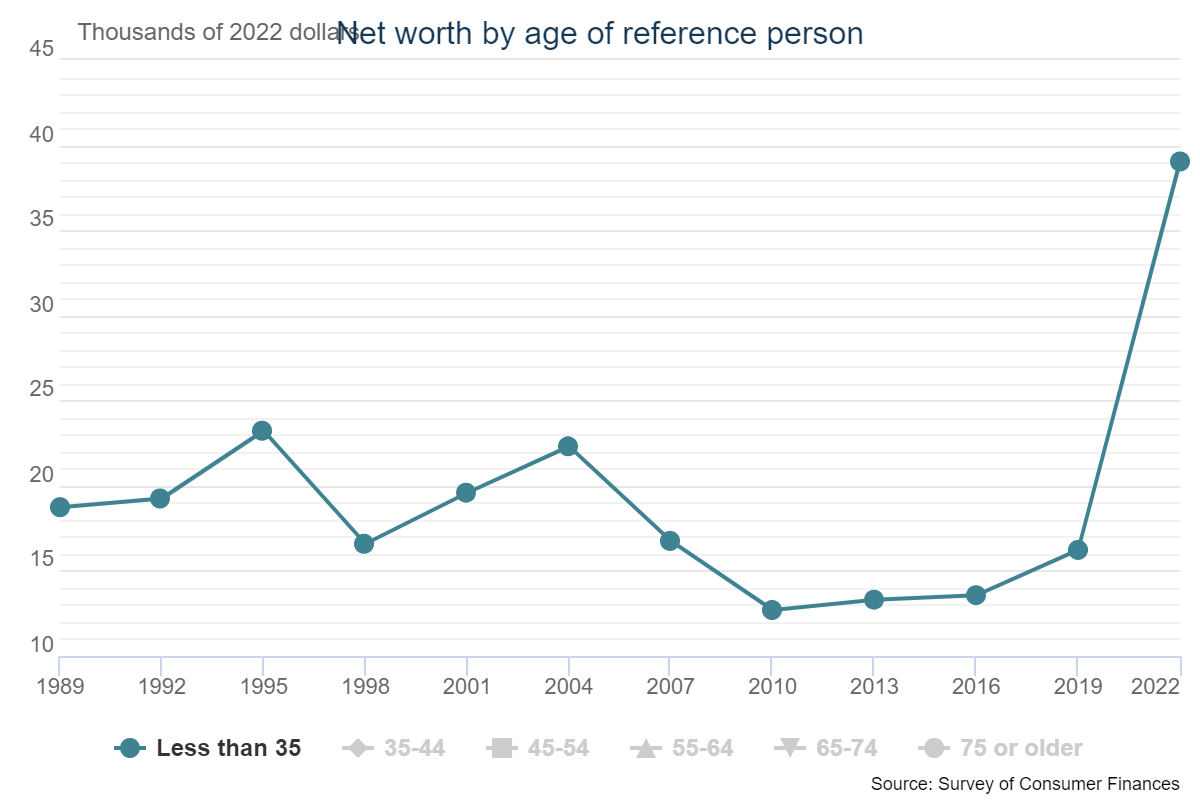

Now let’s have a look at the relative modifications by age bracket:

Have a look at the rise in wealth by the underneath 35 cohort.

It’s one other off-the-charts enhance:

Younger individuals as a complete are in a significantly better place now than they have been just some brief years in the past.

In fact, this huge enhance in wealth needed to be all housing-related, proper?

The rise in housing costs actually performed a task right here. Nationwide, housing costs have been up 40% from 2019-2022.

However renters really skilled a good larger enhance of their actual internet price than householders. The beneficial properties have been 43% and 34%, respectively.1

There are at all times going to be winners and losers on this system, however the monetary place of American households improved considerably throughout the board.

So why does it look like everyone seems to be depressing? Why is sentiment in regards to the financial system so dire?

Folks hate inflation and financial volatility. Individuals like to borrow cash so increased charges are doubtless hurting morale. The housing market is damaged in the mean time in order that’s not serving to both.

There are additionally psychological causes everybody appears to hate the financial system.

The pandemic performed head video games with us.

It was a loopy time frame for everybody however financially individuals have been in a bizarre place.

There was far more money available as a result of individuals weren’t spending as a lot and the federal government was handing out cash. Costs have been really taking place for a short while whereas incomes have been rising.

Going from that state of affairs to one in all quickly rising costs and charges has certainly tousled our equilibriums.

Plus, there’s the media component.

The media has at all times liked dangerous information nevertheless it looks like we’re hooked on it now.

If it bleeds it leads. The upper the VIX the upper the clicks.

This can be a actual phenomenon.

The media spent the previous 18-24 months bashing us over the pinnacle with recession predictions and speaking about how dangerous inflation is. They don’t present counterprogramming when inflation falls or the financial system improves.

There are at all times headlines about layoffs. We hardly ever hear when corporations go on hiring sprees.

We merely can not take pleasure in good financial information anymore.

Don’t imagine me?

Simply have a look at this headline:

And this one:

And one other:

Pay attention I get it.

That is all finance mind stuff the place excellent news is definitely dangerous information as a result of it means the Fed must preserve mountain climbing or preserve charges excessive to sluggish the financial system.

I’m a glass-is-half-full man however I’m not naive to the truth that issues aren’t excellent within the financial system.

There are many issues to fret about. A recession remains to be an actual risk. Excessive inflation has made issues tougher for a lot of households.

But it surely’s additionally price mentioning how a lot progress we’ve made this cycle.

It could not really feel prefer it however the funds of U.S. households have improved significantly in a brief time frame.

That’s price celebrating even when it may’t final ceaselessly.

Additional Studying:

How Wealthy Are American Households?

1To be truthful, absolutely the stage of wealth for householders nonetheless dwarfs the extent of wealth for renters by an element of roughly 38x. It’s nonetheless spectacular. Renters noticed increased development over the earlier 3 yr interval from 2016-2019 as properly.