How do you handle the dangers you are conscious of whereas additionally figuring out rising dangers and getting ready for the unknown? Apply the identical rules you employ along with your shoppers in monetary planning: Search for new dangers, each threats and alternatives; examine these dangers to know their affect; and develop a plan to handle them.

What You Do not Know Can Damage You

Think about you are on trip. You obtain a video message from a pal in a canoe paddling down what was your avenue. They’re checking to see if your house has flooded like the remainder of the world.

This may occasionally sound like a scene out of a film, however sadly, it was a actuality for my household when torrential rain and flash flooding devastated areas of New England. Residing in a mountain city, I by no means thought of flooding—it was one thing that occurred to different individuals in different elements of the nation. Boy, was I incorrect.

What if a flood, hurricane, or twister destroyed your workplace? How wouldn’t it have an effect on your small business? How lengthy wouldn’t it take you to get again up and working? How would you service your shoppers throughout this time?

Figuring out rising dangers like these ought to be an integral a part of any enterprise technique and resilience planning.

What Is an Rising Threat?

Based on the Worldwide Threat Governance Council, an rising danger is “a danger that’s new, or a well-known danger in a brand new or unfamiliar context or underneath new context situations (re-emerging).”

Rising dangers are situations, conditions, or tendencies which will have an effect on a person or a wider group. They’re typically complicated, might evolve or change quickly, and may be powerful to establish and assess as a result of their excessive degree of uncertainty.

In some instances, they continue to be unknown as a result of the character of the chance and its potential affect are additionally unknown. There could also be insufficient details about the chance, and the group may have extra time to evaluate it completely.

Going again to my earlier flooding instance, whereas climate forecasts have come a great distance, meteorologists nonetheless cannot precisely predict the exact location or complete affect of a climate occasion. Does that imply we must always ignore extreme climate alerts? Completely not. We will use these instruments to establish the chance of maximum climate.

Methods and Instruments for Figuring out Rising Dangers

One strategy to establish new dangers is thru “horizon scanning.” This course of entails inspecting exterior info to uncover potential alternatives and threats. You should utilize this info to help strategic decision-making and enterprise preparedness.

At Commonwealth, we mix horizon scanning with the next instruments to assist us collect the knowledge we want:

Simulation workouts are one other device Commonwealth makes use of to assist us establish the what-if situations that might affect our enterprise.

There is no such thing as a one-size-fits-all strategy. You may select the very best strategies for figuring out and assessing rising dangers based mostly on the dimensions of your group.

Rising Dangers Particular to the Monetary Companies Trade

We have mentioned the hazard of maximum climate, however advisors also needs to be vigilant about different dangers. InsuranceNewsNet just lately reported on a number of dangers that might have an effect on your small business.

These dangers embrace recession; know-how; environmental, social, and governance (ESG) funding methods; and regulatory compliance and fiduciary duty:

Managing shopper expectations may be difficult within the face of a recession. Some shoppers have excessive expectations for rates of interest and funding returns. And that is very true for individuals who depend on their investments for earnings. No enterprise is totally proof against a recession, so it is essential to stay aware of the likelihood, whether or not it happens quickly or within the coming years.

Growing Your Threat Response Technique

As soon as you’ve got recognized the rising dangers that might have an effect on your small business, it’s time to develop a danger response technique. Be sure you take into account the chance to your small business earlier than controls are in place (inherent danger) and the chance after controls are in place (residual danger).

You also needs to take into account the severity of the chance by way of enterprise context and related enterprise goals as you resolve which of those actions to take:

-

Settle for it. Analyze the chance and resolve there is no such thing as a motion wanted.

-

Switch it. Cross danger possession to a 3rd get together (e.g., insurance coverage, efficiency bonds, warranties, or ensures).

-

Mitigate it. Apply actions (controls) that search to scale back the affect and probability of a danger to an appropriate tolerance (e.g., having a dialog along with your shopper to verify that the request is legitimate).

-

Keep away from it. Use an alternate strategy that eliminates the chance driver or affect (e.g., ceasing a product line, declining to increase to a brand new geographical market, or promoting a division).

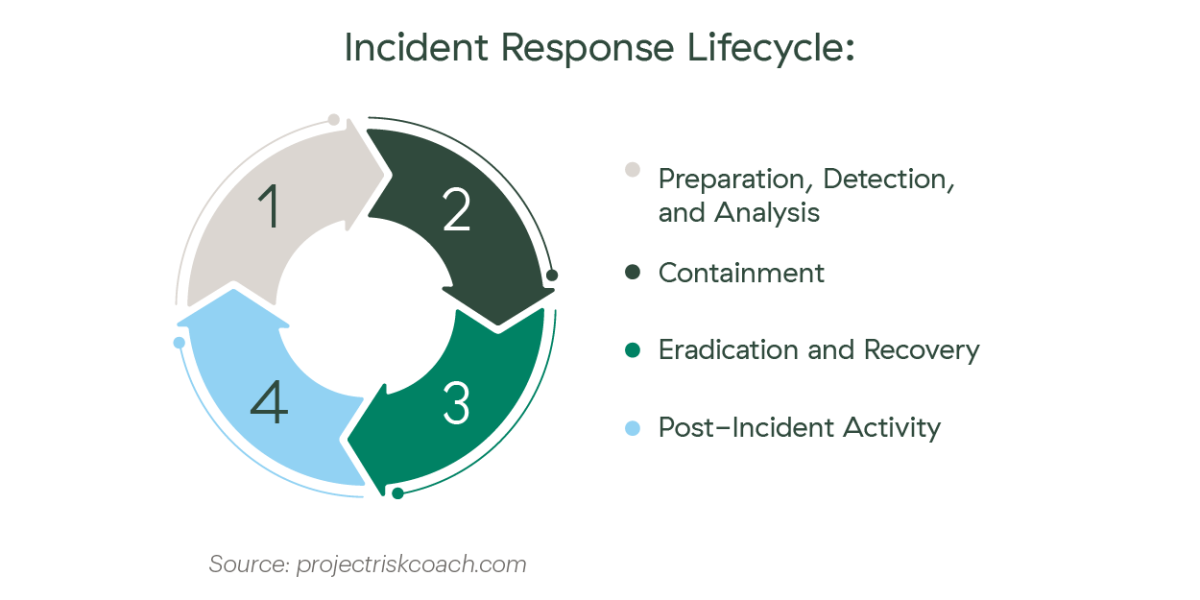

When a danger turns into an incident. You might wish to take into account creating an incident response plan (IRP). It is a device that may show you how to with restoration when a danger turns into an incident. Whereas many IRP examples are particular to info safety, you should utilize them to create a template extra particular to your small business. An IRP sometimes contains communication plans, group and particular person tasks, reporting and documentation necessities, controls, and particular actions to assist resolve or defend towards the problem.

There are sometimes 4 phases to an incident response lifecycle:

The emergence of AI know-how might enhance the probability of a cyber incident. Having an IRP will enable your small business to rapidly reply to and get better from an incident.

Future-Proof Your Advisory Agency

By their nature, rising dangers are different, tough to quantify, and infrequently much more tough to establish. Due to their potential detrimental affect on enterprise operations, it is vital to look previous at this time’s dangers and completely analyze the rising tendencies of tomorrow to assist your agency put together for what the longer term might convey.

Obtain our white paper for assist figuring out the subsequent steps.

FREE DOWNLOAD

7 Key Dangers to Keep away from in Your

Monetary Advisory Observe

Actionable ideas that will help you consider your agency’s potential legal responsibility.

Editor’s Word: This submit was initially revealed in October 2018, however we’ve up to date it to convey you extra related and well timed info.