What You Have to Know

- Three calls — promote U.S. shares, purchase U.S. Treasury payments and buy Chinese language shares — shaped the consensus view.

All throughout Wall Avenue, on equities desks and bond desks, at large corporations and area of interest outfits, the temper was glum. It was the tip of 2022 and everybody, it appeared, was game-planning for the recession they had been satisfied was coming.

Over at Morgan Stanley, Mike Wilson, the bearish inventory strategist who was quickly turning into a market darling, was predicting the S&P 50O Index was about to tumble.

Just a few blocks away at Financial institution of America, Meghan Swiber and her colleagues had been telling purchasers to arrange for a plunge in Treasury bond yields. And at Goldman Sachs, strategists together with Kamakshya Trivedi had been speaking up Chinese language property because the economic system there lastly roared again from Covid lockdowns.

Blended collectively, these three calls — promote U.S. shares, purchase Treasuries, purchase Chinese language shares — shaped the consensus view on Wall Avenue.

And, as soon as once more, the consensus was lifeless improper.

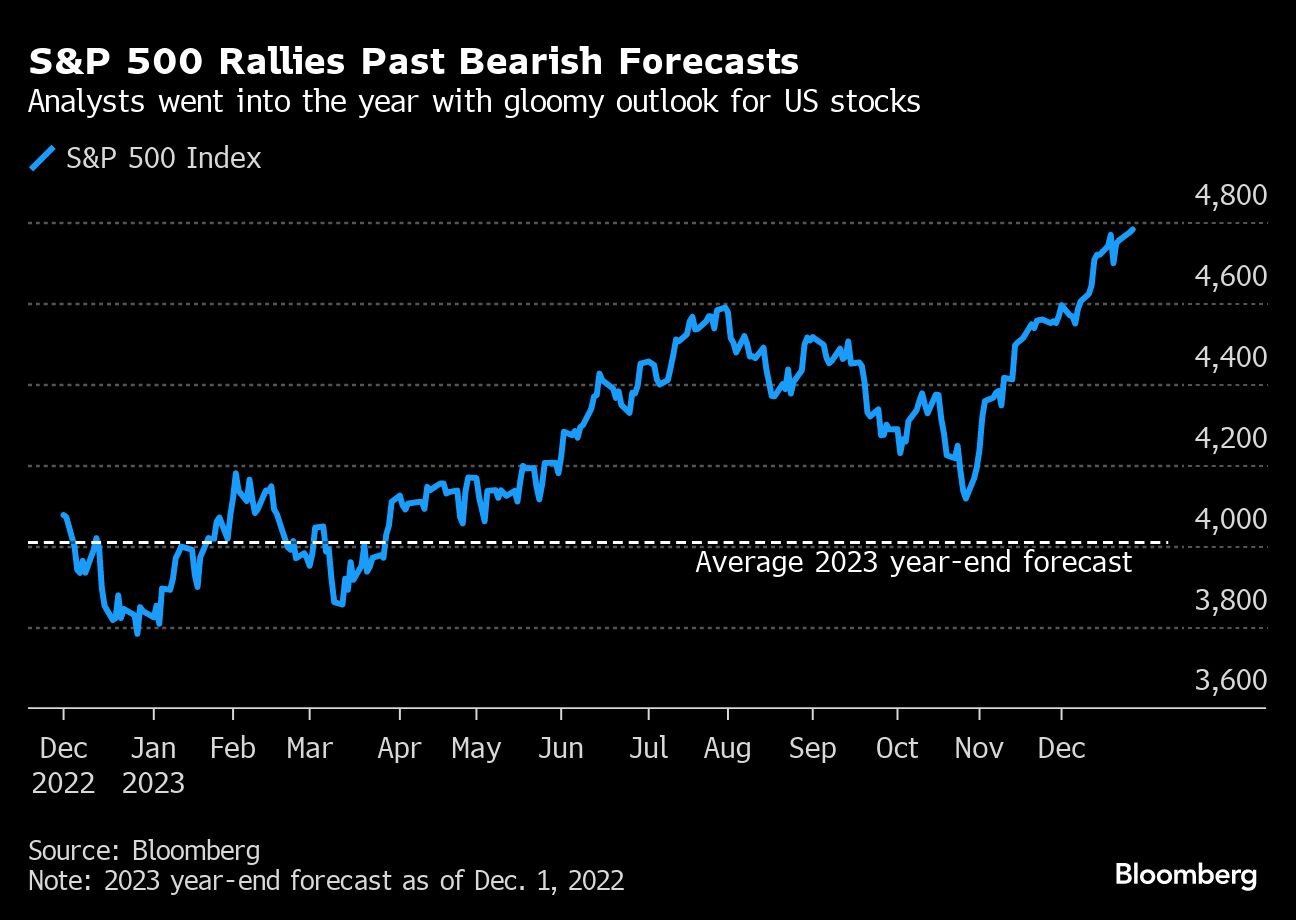

What was speculated to go up went down, or listed sideways, and what was speculated to go down went up — and up and up. The S&P 500 climbed greater than 20% and the Nasdaq 100 soared over 50%, the most important annual achieve because the go-go days of the dot-com increase.

It’s a testomony largely to the way in which the financial forces unleashed within the pandemic — primarily, booming client demand that fueled each development and inflation — proceed to bewilder the most effective and brightest in finance and, for that matter, in coverage making circles in Washington and overseas.

And it places the promote facet — because the high-profile analysts are recognized to all on Wall Avenue — in a really uncomfortable place with buyers the world over who pay for his or her opinions and recommendation.

“I’ve by no means seen the consensus as improper because it was in 2023,” stated Andrew Pease, the chief funding strategist at Russell Investments, which oversees round $290 billion in property. “Once I have a look at the promote facet, everybody obtained burned.”

Cash managers at outlets like Russell got here out trying alright this yr, producing returns in shares and bonds which can be barely greater on common than the positive factors in benchmark indexes.

However Pease, to be clear, didn’t fare a lot better together with his forecasts than the celebrities on the promote facet. The foundation of his mistake was the identical as theirs: a nagging sense that the U.S. — and far of the remainder of the world — had been about to sink right into a recession.

This was logical sufficient. The Federal Reserve was within the midst of its most aggressive interest-rate-hiking marketing campaign in many years and spending by customers and corporations appeared certain to buckle.

There have been few indicators of that to date, although. Actually, development truly quickened this yr as inflation receded. Throw into the combination a pair of breakthroughs in synthetic intelligence — the recent new factor on the planet of tech — and also you had the right cocktail for a bull marketplace for shares.

S&P 500 & Wilson’s Predictions

The yr began with a bang. The S&P 500 jumped 6% in January alone. By mid-year, it was up 16%, after which, when the inflation slowdown fueled rampant hypothesis the Fed would quickly begin reversing its charge hikes, the rally quickened anew in November, propelling the S&P 500 to inside spitting distance of a document excessive.

Via all of it, Wilson, Morgan Stanley’s chief U.S. fairness strategist, was unmoved. He had accurately predicted the 2022 stock-market rout that few others noticed coming — a name that helped make him the top-ranked portfolio strategist for 2 straight years in Institutional Investor surveys — and he was sticking to that pessimistic view.

In early 2023, he stated, shares would fall so sharply that, even with a second-half rebound, they’d find yourself principally unchanged.

He instantly had loads of firm, too.

Final yr’s selloff, sparked by the speed hikes, spooked strategists. By early that December, they had been predicting that fairness costs would drop once more within the yr forward, in accordance with the typical estimate of these surveyed by Bloomberg. That type of bearish consensus hadn’t been seen in a minimum of 23 years.

Even Marko Kolanovic, the JPMorgan Chase strategist who had insisted by means of a lot of 2022 that shares had been on the cusp of a rebound, had capitulated. (That dour sentiment has prolonged into subsequent yr, with the typical forecast calling for nearly no positive factors within the S&P 500.)

It was Wilson, although, who grew to become the general public face of the bears, satisfied that a 2008-type crash in company earnings was on the horizon. Whereas merchants had been betting that cooling inflation can be good for shares, Wilson warned of the alternative — saying it will erode corporations’ revenue margins simply because the economic system slowed.

In January, he stated even the downbeat Wall Avenue consensus was too sanguine and predicted the S&P may drop greater than 20% earlier than lastly snapping again.

A month later, he warned purchasers the market’s risk-reward dynamic “is as poor because it’s been at any time throughout this bear market.”

And in Might, with the S&P up almost 10% on the yr, he urged buyers to not be duped: “That is what bear markets do: they’re designed to idiot you, confuse you, make you do belongings you don’t need to do.”