I grew up in Wichita, KS and Tulsa, OK. Smack dab in the course of Twister Alley. After I was a child, each Friday at midday, each cities would run assessments on their twister alarms. Which have been simply repurposed Chilly Warfare nuclear bomb sirens.

Should you have been from out of city, it was somewhat disconcerting. However should you have been a neighborhood and it was sunny or December, you went about your day. Though the very fact it was winter was not a assure that tornadic exercise wouldn’t materialize. Surprisingly sufficient, in all my time in Kansas, Oklahoma, and now Texas, I’ve NEVER seen a twister. That is akin to somebody who grew up in Colorado having by no means skilled snow. Go determine.

So, welcome to Monument Metropolis. That is kinda-sorta our Friday early warning system testing. As a reader, to not panic, however to easily acknowledge that we’re monitoring traits within the capital market climate system. However as an alternative of Superior Doppler and air raid sirens, we’re utilizing Relative Rotation Graphs® (RRG®s) and a Friday weblog as a part of our radar array.

For the uninitiated, please learn our RRG® primer submit right here. Briefly, these visuals may give us a chicken’s eye view of relative energy in and among the many capital markets, highlighting factors of energy and weak point.

Let’s first do a mid-month verify on stock-to-bond relative energy, a variation of which is a big part of our Versatile Asset Allocation (FAA) mannequin. On a weekly scale, shares have turned over compared to the mixture bond market, as measured by the $AGG ETF. Not an ideal “comp” for our FAA mannequin, however directionally it really works for us.

On a smaller timeframe (day by day), the connection has really began to enhance and is heading additional into the main quadrant. Given the disproportionate share of U.S. equities within the building of the $ACWI ETF, 3Q23 earnings season – along side ongoing geopolitical occasions within the Center East –are going to go a great distance in figuring out the near-term course of this chart. Bear in mind, this isn’t a rendering of absolute efficiency, only a relative efficiency comparability. The $ACWI line could flip up as a consequence of energy in shares and/or weak point in bonds.

Subsequent, let’s revisit the eleven S&P 500 sectors, that are most related for our Core ETF mannequin, the place we run a relative energy sector rotation sleeve. Briefly, there isn’t a ton to like right here now, with three attainable exceptions (Utilities $XLU, Know-how $XLK and Communications $XLC). The trajectory of practically each sector has turned over, with these notable exceptions.

And after a brutal stretch, probably a perform of the race increased in rates of interest, Utilities appears to be working off deeply “oversold” situations as quantified by the short-term RSI (backside panel of the chart beneath). The RSI merely quantifies up days versus down days…on this case, over the previous 14 days (which is customary). Numbers above 70 are usually related to “overbought” situations and 30 with “oversold.”

This final bit is much more evident on the day by day RRG® rendering, as $XLU’s relative energy momentum has bottomed, with the trajectory headed within the course of the blue Enhancing quadrant. In different phrases: longer-term I’ve no clue the course of the Utilities sector, however it’s not stunning to see it “bounce” proper right here.

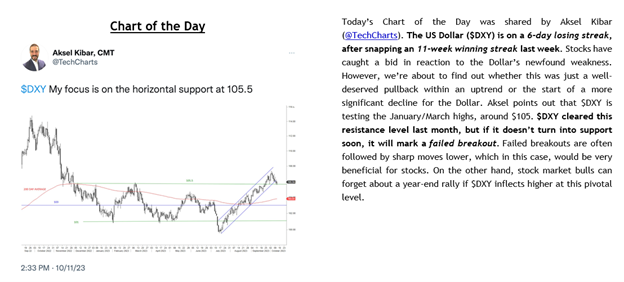

One closing remark to make concerning the U.S. Greenback and seasonality. Not too long ago, a powerful USD has been an enormous hindrance to shares, however it seems that the DXY is on the verge of a “failed breakout,” one thing which might probably add a tailwind to some favorable seasonality traits. In different phrases, don’t be shocked to see shares drift increased from right here regardless of the horrific scenes taking part in out abroad. Particularly given the truth that the S&P 500 has bounced off an important assist stage, it’s 200-day shifting common.

Have an excellent weekend,

-Erin