Do your shoppers dictate what sort of enterprise you’ve got, or does what you are promoting dictate the forms of shoppers you serve?

Early in your profession as an advisor, you might have had comparatively few standards for accepting new shoppers. The extra belongings you possibly can collect, the higher! However as your agency and repair providing have matured, you and your workforce might need assistance managing the e-book you’ve got constructed. Have you ever ever gone again to evaluate whom you are working with and the assets and time they require of you?

One technique that might provide help to redirect your vitality towards the best folks and actions—and create extra room for development—is constructing a shopper segmentation and repair mannequin. This is how.

What is the Make-up of Your Ebook?

Step one in constructing a shopper segmentation and repair mannequin is to know the folks in your present shopper base. Assume by way of each quantitative standards (e.g., belongings beneath administration and income generated) and qualitative elements (e.g., stage of belief, coachability, and referral historical past).

Additionally, think about what you do for them. Does everybody at the moment obtain the identical companies, equivalent to a monetary plan, an annual evaluation assembly, common outreach, and invites to shopper occasions? (Trace: If the reply is sure, put together for a change!)

Separating your shoppers into segments primarily based on clearly outlined standards and figuring out the companies you will ship to every one can assist enhance capability and construct scale.

A Technique for Consumer Segmentation

After you have a greater understanding of your present shoppers, it is time to begin categorizing them. There are numerous methods advisors can strategy shopper segmentation. The hot button is to search out the one which works greatest for you and what you are promoting, which implies having a imaginative and prescient to your agency and the perfect shoppers you wish to work with.

You could be conversant in the segmentation strategy that locations shoppers into classes labeled “A,” “B,” “C,” or “D” primarily based on both income or AUM. Whereas this quantitative strategy helps to establish your most worthwhile shoppers, likelihood is you already know these shoppers properly. So, what about the remainder of your e-book?

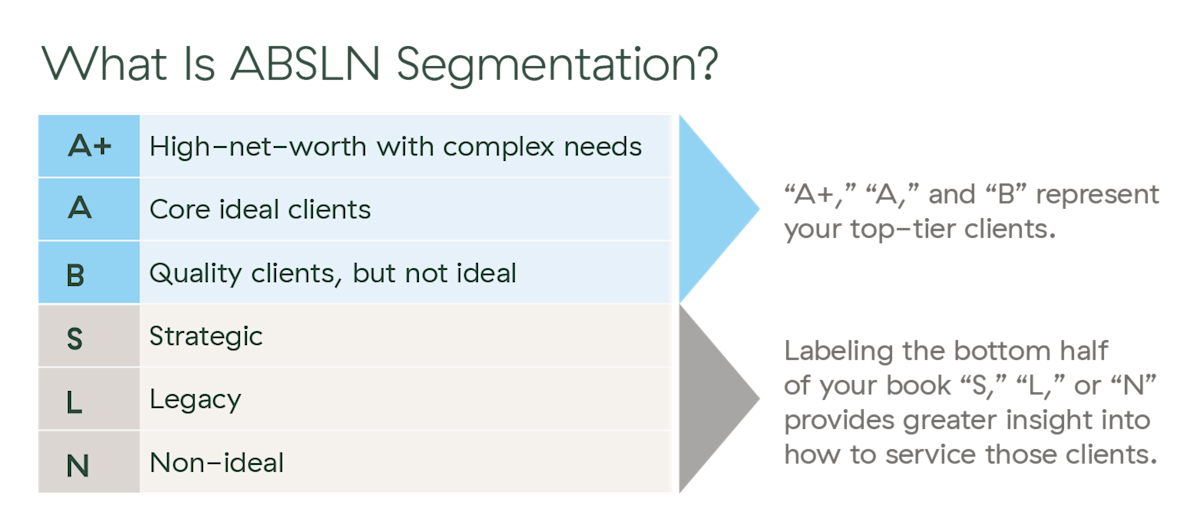

Commonwealth’s Enterprise Consulting workforce typically recommends our advisors use a extra holistic segmentation technique referred to as the “ABSLN” technique.

With the ABSLN segmentation technique, you continue to establish your high shoppers as “A+,” “A,” or “B” primarily based on the income they generate to your agency. For the underside tiers, although, you will use qualitative standards to put shoppers into segments labeled “S,” “L,” or “N.”

-

S/Strategic: People on this tier have the potential to turn out to be excellent shoppers. Take into account younger, excessive earners with robust financial savings, enterprise house owners with illiquid wealth, or HENRYs (excessive earners, not wealthy but).

-

L/Legacy: These shoppers might have a legacy relationship that justifies offering continued service—for instance, “A” shoppers’ youngsters, widows, or private buddies.

-

N/Non-ideal: These shoppers don’t match into some other segments. For them, you possibly can proceed providing service, switch them to a junior advisor, or discontinue your relationship.

This strategy gives deeper perception into the sorts of shoppers at the moment in your e-book, which you’ll be able to then use to establish the forms of companies you will ship to them.

From technique to motion. Just lately, I labored with a Commonwealth-affiliated advisor on some capability points. They have been questioning whether or not to rent a service advisor to handle the underside half of their e-book. Collectively, we used the ABSLN technique to section their shoppers and analyze how a lot income every tier introduced it. It rapidly grew to become clear that hiring a brand new advisor would price them way over the belongings being managed. So, the advisor determined it would not make monetary sense to rent assist in that space.

Through the use of this evaluation, although, the advisor realized that lots of their present shoppers fell into the “non-ideal” class. They determined to cut back the companies they supplied to that group and have been capable of unencumber a while, which was their unique aim.

Pairing Segmentation with Companies

As soon as you’ve got completed the shopper segmentation train, you may transfer on to constructing your shopper service mannequin, the place you will establish which companies you will ship to every section—and the way typically.

If you happen to’re like many advisors I work with, you might have your companies mapped out in your head. However belief me, it is price documenting them. Like with different processes, clear documentation will assist be certain that you constantly provide high-quality service.

To assist with selections about service choices, mirror on these questions:

Your outcomes may begin wanting one thing just like the under grids, with all companies—together with funding administration, monetary planning, advertising and marketing initiatives, and shopper occasions—on the left and the tiers which may be eligible for every service on the proper.

If the overall variety of hours you will spend to ship service throughout every shopper class does not align with the common income earned from that class, you could want to regulate.

In fact, there’s no magic quantity for what number of shopper conferences to carry every year, and the variety of choices will differ by advisor. Resolve what you may present your shoppers whereas additionally being conscious of your capability.

Now What? From Technique to Motion

You’ve got segmented your shoppers and created a service mannequin. Now, it is time to implement your technique in your follow. This implies systematically evaluating each side of what you are promoting to determine the place to make changes.

Listed here are some questions to think about:

By aligning every space of the enterprise along with your new service mannequin, you will be higher positioned to draw extra excellent shoppers and scale what you are promoting.

Prepared for a Change?

When you do not have a deliberate shopper segmentation and repair mannequin, your shoppers can find yourself dictating how what you are promoting runs. Why not strive a distinct strategy? In spite of everything, providing your shoppers an ideal service expertise should not come on the expense of your personal enterprise’s development.

Taking time to finish these workouts permits you to focus your vitality the place you want it most. The profit is extra time to handle extra relationships—primarily with excellent shoppers. Plus, you’ll have the ability to help elevated income with fewer assets, which implies extra earnings heading on to your agency’s backside line. And that is a win-win.