James Waterproof coat, who has all the time been adamantly skeptical of ESG/SRI/inexperienced investing (although much less loudly against anti-woke/purple investing, maybe as a result of it’s so marginal), supplied a pleasant evaluation (“Inexperienced Traders Had been Crushed. Now It’s Time to Make Cash,” WSJ.com, 12/5/2023) of the declining reputation of ESG investing in 2023 and the challenges dealing with sure inexperienced power corporations.

“Make investments in keeping with your political opinions,” he begins, “and also you’re unlikely to earn cash.”

“[T]he actual world is harder than advocates of ESG—environmental, social and governance—investing claimed,” he huffed.

It’s “The Huge Inexperienced Distress Machine,” they warn.

(sigh)

One may level out that ESG investing isn’t merely a political gesture. The “G” in ESG, measuring efficient company governance, particularly, is predictive of company efficiency, however he’s by no means been serious about nuance.

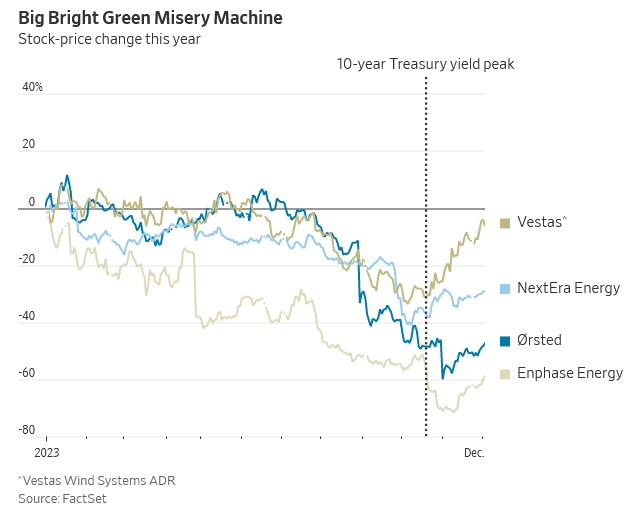

His case highlights the inventory value declines of 4 small “inexperienced power” corporations:

One may level out that “inexperienced power corporations” are not the core of an ESG-screened portfolio, although they may certainly be included in it. The biggest holdings within the ESG-screened model of the S&P 500: Microsoft, Apple, Amazon, Invidia, Alphabet, Tesla, UnitedHealth Group, JPMorgan Chase, and Eli Lily.

Listed below are two extra necessary issues to level out.

2024 will probably be higher for ESG funds than was 2023

The purpose that makes me much less irked with him is “traders who purchased inexperienced shares most likely didn’t suppose they had been making a leveraged wager on Treasuries, however that’s what they ended up with.” He argues that rising rates of interest affect renewable power shares (for which he makes use of the synonym “inexperienced shares”) in two methods. First, renewable power tasks are 80% debt-funded, and debt is more and more costly and exhausting to amass. Second, customers making private investments in “inexperienced” merchandise – warmth pumps, photo voltaic, electrical vehicles – additionally use debt, whether or not bank cards, HELOCs, or second mortgages, to finance them. Increased borrowing prices led to decrease demand for these merchandise.

Excessive prices shift individuals’s consideration from the long-term – the necessity for renewables and world heating – to the brief time period – the necessity to cowl the invoice.

He additionally argues that a lot, although not all, of the “greenium” has been squeezed out of the market. Valuations on renewables are manner down if not deeply discounted. That makes them extra economically rational purchases now than they had been two years in the past.

As well as, rates of interest are likelier to fall than to rise in 2024. These expert at analyzing the Fed’s entrails anticipate three fee cuts of some magnitude, probably beginning round mid-year. That’s complemented by a probably game-changing Treasury Division ruling: worthwhile inexperienced corporations can now promote tax credit that they’ve obtained to different companies to boost cash. The primary such sale was simply closed by First Photo voltaic:

In what either side are calling the primary important credit score switch of its variety within the photo voltaic manufacturing trade, First Photo voltaic introduced that it entered into two separate Tax Credit score Switch Agreements (TCTAs) in late December to promote $500 million and as much as $200 million, respectively, of 2023 Inflation Discount Act (IRA) Superior Manufacturing Manufacturing tax credit to Fiserv, a monetary providers firm.

The Treasury proposed laws desiring to incentivize the manufacturing of eligible parts inside the USA. Qualifying supplies embody photo voltaic and wind power parts, inverters, some battery components, and relevant crucial minerals.

“That is the IRA delivering on its intent, which is to incentivize high-value home manufacturing by offering producers with the liquidity they should reinvest in development and innovation,” stated Mark Widmar, CEO of First Photo voltaic. “This settlement establishes an necessary precedent for the photo voltaic trade, confirming the marketability and worth of Superior Manufacturing Manufacturing tax credit.” (Renewable Vitality World, 1/5/2024)

The brief model is that these credit give the producers of photo voltaic, wind, inverters, batteries, and important supplies entry to a brand new supply of capital that’s unbiased of conventional credit score markets and never constrained by prevailing rates of interest.

ESG-screened funds did higher in 2023 than their non-ESG counterparts.

Whereas traders (and a number of other Pink state governments) fled, ESG variations of the S&P 500 and the equal-weight S&P 500 continued their dominance over the non-screened siblings.

| 2023 (by way of 12/26) | Three 12 months | 5 12 months | |

| Xtrackers S&P 500 ESG | 27.39% | 11.84 | n/a |

| S&P 500 | 25.68 | 10.41 | 16.31 |

| ESG S&P 500 Equal Weight | 13.39 | n/a | n/a |

| S&P 500 Equal Weight | 13.13 | 9.39 | 14.80 |

S&P International themselves printed this efficiency comparability, for the interval ending 11/30/2023:

| One 12 months | Three-year | 5-year | 10 years | |

| S&P 500 ESG | 15.56 | 11.26 | 14.15 | 12.56 |

| S&P 500 | 13.84 | 9.76 | 12.51 | 11.82 |

And it’s not simply the S&P500. MFO Premium tracks 722 ESG kinds of funds and ETFs. In 2023, 370 of them outperformed their peer teams. Greater than half of ESG funds outperformed their friends even when situations turned in opposition to them.

Thirty-six ESG funds and ETFs posted returns of 30% or extra in 2023, together with the 2 Shariah-screened ETF index funds.

Let’s be clear right here: within the worst of instances, ESG investing makes funding sense. ESG funds make severe cash.

Backside line

If Mr. Waterproof coat is correct, the longer term for ESG investing is way brighter than its current previous. Nicely-managed ESG funds that use screens intelligently, as a device for eliminating monetary disasters and never only for advertising functions, are worthwhile additions to any portfolio.

That doesn’t free particular person traders from the duty of researching their funds rigorously. Three years in the past each damned marketer within the trade began operating round with stickers studying “inexperienced” and “accountable” on each failed fund within the firm. Because it seems, rotten funds with inexperienced stickers stay rotten funds and are dying off. On the similar time, there are funds with severe, considerate methods which have a long-term observe report of utilizing ESG screens to boost efficiency (and, simply possibly, doing a tiny bit of excellent within the course of).

My sole inexperienced holding, which I’ve mentioned in every of my annual portfolio disclosures, is Brown Advisory Sustainable Progress. It gained 38.8% in 2023 and has eked out 16% APR since I first purchased it. Actually, that doesn’t really feel like a “distress machine.” Which is to say, I’m unsure that Mr. Waterproof coat’s evaluation of ESG investing is kind of so clear and profound as could be warranted by inclusion on the earth’s premier enterprise paper.