The rise of electrical autos within the UK is gaining momentum, with a brand new electrical car (EV) now being registered each 60 seconds, in keeping with the SMMT. Within the twelve months to July 2023, new battery electrical car gross sales rose by 88%, and by 2024, it’s anticipated that ZEVs (zero-emission autos) will account for about 22% of recent automobile gross sales and 10% of van gross sales, indicating a major transformation within the automotive business. That is in accordance with the federal government’s newly confirmed ZEV mandate.

With vital quantity flooding into the market, it may appear the EV insurance coverage market is the place to be – and that’s actually the place Aviva Zero has firmly established itself. Shopper Intelligence knowledge reveals that within the three months to July 2023, Aviva Zero elevated its quotability throughout all 4 PCWs, returning a quote in place 1-5 c.30% of the time, making it probably the most aggressive product out there. In June, Aviva Zero modified their carbon offsetting coverage, now solely offsetting carbon emissions for 1000 miles of driving, which has allowed them to broaden their quoting footprint within the increased mileage segments.

Aviva isn’t the one model trying to get a bit of the EV pie – Admiral and AXA have just lately emerged as new rivals within the EV market, and in July 2023 Go Skippy launched its new EV product throughout two of the PCWs. With all the pieces on the up for EVs, it could possibly be straightforward to imagine we’ll quickly see extra insurance coverage manufacturers scrambling to affix the social gathering.

Nevertheless, regardless of the rising recognition of electrical autos, some vital obstacles stay for each insurers and customers. Firstly, electrical automobile claims value 25.5% greater than their inner combustion engine (ICE) equivalents and take 14% longer to restore in keeping with Thatcham Analysis.

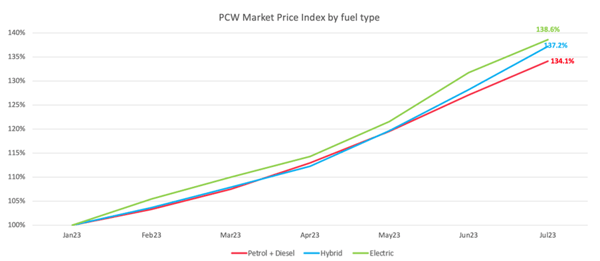

Secondly, insurance coverage is inflating sooner for EVs – most probably pushed by claims prices. Shopper Intelligence knowledge reveals premiums for EVs have inflated by 39% between January and July 2023, in comparison with 34% for ICE autos.

SOURCE: MARKETVIEW, PETROL + DIESEL = 24,220 RISKS, HYBRID = 693 RISKS, ELECTRIC = 280 RISKS.

One other impediment is the sooner depreciation of EV values in comparison with conventional automobiles, which can discourage some customers from buying them. Moreover, the set up of public charging factors stays painfully sluggish, making lengthy distance journey near-impossible and public charging costlier for drivers if this trajectory is to proceed.

Because of the challenges that exist on this market, quite a lot of manufacturers have determined to exit. In October 2023, it was reported by Life Insurance coverage Worldwide that John Lewis have briefly stopped providing insurance coverage to EV drivers on account of issues over repairs prices. Moreover, Shopper Intelligence knowledge reveals that specialist EV insurance coverage supplier Growth has both left the market or taken a hiatus. This hesitancy to supply EV cowl from the market may make sourcing insurance coverage harder for customers and probably inflate costs even additional.

Nevertheless, these obstacles gained’t exist perpetually. The know-how and manufacturing of EVs will evolve and the repairs market and charging infrastructure will catch up – it’s solely a matter of time. Meaning the insurance coverage business will need to be able to pivot when the time is correct. The query is when.