Final Up to date on December 10, 2022 at 9:45 pm

We’re comfortable to launch a brand new market timing software with which you’ll be able to convert each day value information to month-to-month information and compute shifting averages for fairness (indices, shares and mutual funds), gold and gilt (utilizing bond yield). It is a observe as much as backtest carried out on fairness, gold and gilts utilizing double and single shifting averages.

It is a momentum-based trend-following software in Excel (will work within the previous Excel model as it’s a .xls file however macros are obligatory for each day to month-to-month value conversion).

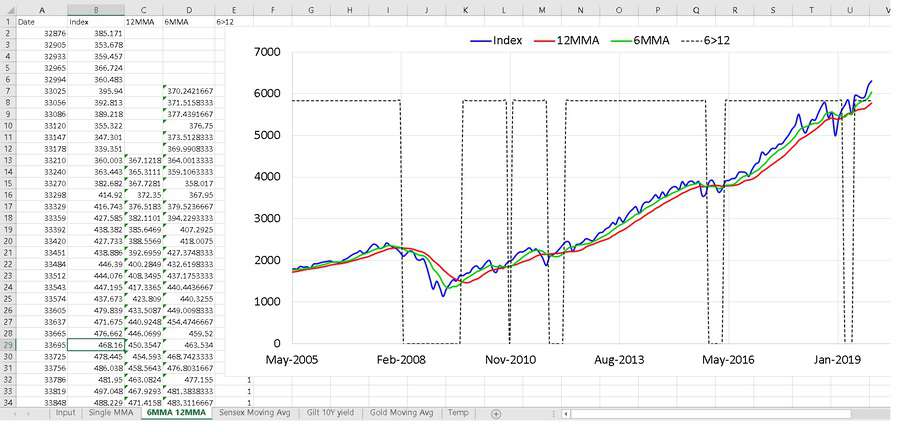

As an illustration, if the six-month shifting common (6MMA) is larger than the twelve-month shifting common (12MMA), it’s a “purchase” sign for fairness or gold. If 6MMA < 12MMA it’s a “promote” sign”. It is a high-risk technique with doubtlessly greater rewards. Please learn the warning and disclaimer part totally and punctiliously.

Warning and disclaimer

Begin of warning and disclaimer: The technique outlined within the above articles and on this software might or might not present a better return whenever you attempt it. Our backtests reveal that this technique has a better danger than systematic investing. It might not all the time present a better reward for the upper danger taken. So customers should admire this earlier than contemplating this technique.

Please recognise outcomes proven in backtests don’t consider future market actions, human feelings, taxation and exit hundreds. All these would influence the end result of market timing (aka tactical asset allocation wrt this software).

Not all asset allocation variations and funding durations have been thought of in our backtests. Previous outcomes and future outcomes will rely upon and differ in line with the asset allocation combine used and funding length thought of. For instance, for fairness, the mannequin works moderately effectively with 50% fairness or decrease fairness (relaxation in mounted revenue) and never so effectively for greater fairness allocations.

Our backtests point out that the mannequin fails for sharp value adjustments (up or down, eg. the March 2020 market crash) and the next sequence of returns.

No single technique would work for all markets and always. After in depth backtesting, we’ve got arrived at this technique as an affordable alternative on the time of unique publication. There isn’t a assure that it might work in future. Future backtesting might reveal flaws on this technique or reveal new or modified methods. We reserve the best to include such findings or modifications on this web page, on this software or anyplace else on our web site.

Anybody who makes use of this software does so at their very own danger. Freefincal or this writer/editor isn’t accountable or chargeable for any good points or losses that will consequence from the usage of this software. Whereas the sheet has been checked for errors and bugs, like some other software, we can’t assure they’re freed from them.

The software is open-source (however not free). This implies all of the formulae and Excel VBA are accessible to the person. So customers are requested to grasp what the software does and double-check for errors and inconsistencies.

The software has a built-in “purchase/promote sign”. This has completely different meanings for a single shifting common, double shifting common, gold and gilts. The customers should learn the above-linked articles and develop their very own tactical technique.

I can’t present some other funding recommendation wrt to future market actions.

Purchase the sheet solely if you’re prepared to be taught, discover, examine and devise your personal, impartial technique. Please word: tactical asset allocation or market timing means exiting one asset class and getting into one other.

That’s, for example, you probably have Rs. 100 invested into fairness and the 6MMA falls under the 12MMA, you promote the fairness holding (totally or partially as per your set plan) and put it into one other asset class.

In case you plan to make use of this software solely to seek out out “what is an effective time to purchase further models or shares”, then as mentioned earlier than the advantages of such an act is prone to both small, restricted or non-existent. So kindly pay attention to these limitations.

Please word that by the discharge of this software, freefincal or this writer is simply providing tactical portfolio administration as a substitute for systematic portfolio administration. No declare is made in regards to the superiority of both technique. It’s as much as the customer to determine on their very own which is appropriate for his or her private circumstances.

This software isn’t a monetary planning software. It is not going to assist with goal-based portfolio administration in any method. Finish of warning and disclaimer.

Proof of idea: backtest outcomes

Listed below are the six months and twelve-month shifting common outcomes proven for fairness (Sensex, small cap funds), gold and gilts. I strongly advocate that you just learn these articles first earlier than utilizing this software. Please word that future outcomes might differ fairly considerably from previous/backtest outcomes.

(1) Is that this a great time to purchase gold? A tactical shopping for technique for gold (2) This “purchase excessive, promote low” market timing technique surprisingly works! (3) Don’t use SIPs for Small Cap Mutual Funds: Do this as an alternative! (4) Can we get higher returns by timing entry & exit from gilt mutual funds?

Options of the shifting common market timer

That is the supply web page for the course on goal-based portfolio administration.

NSE Indices, MF NAV and Inventory value

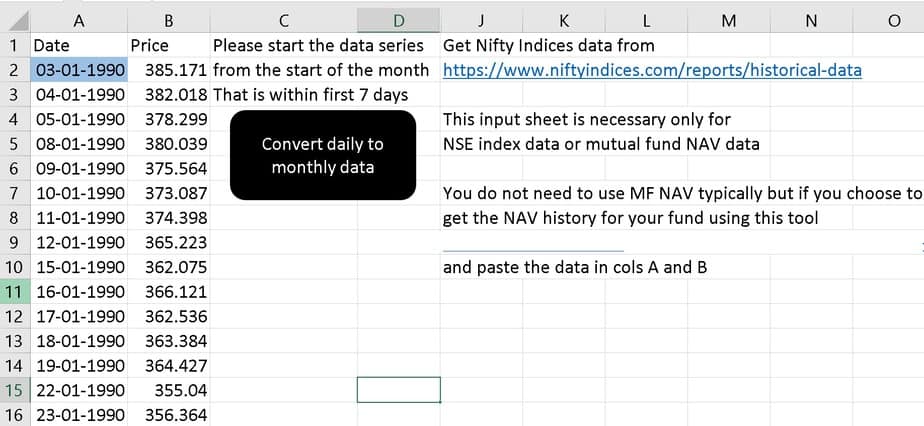

Each day information from NSE (for indices), Mutual Fund NAV (hyperlink to software offered) or shares (hyperlink to software offered) could be taken and pasted in col A and B. Then on clicking the black button the month-to-month averages are computed..

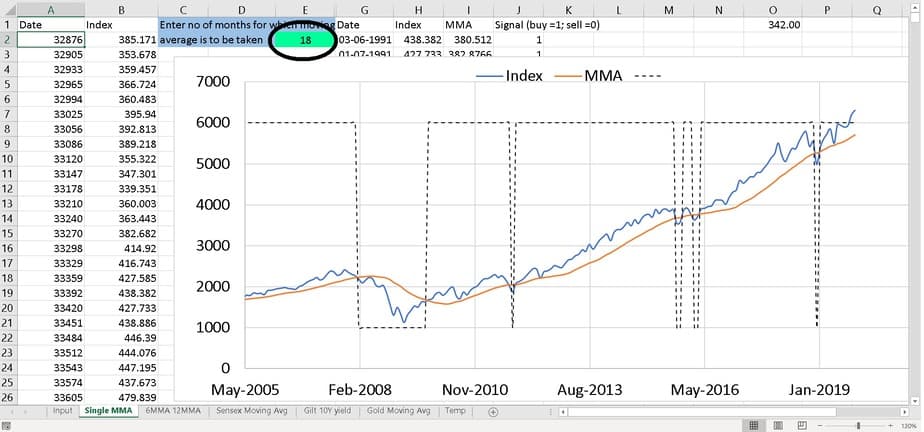

You’ll be able to calculate any month-to-month shifting common on this sheet and generate a corresponding purchase/promote sign.

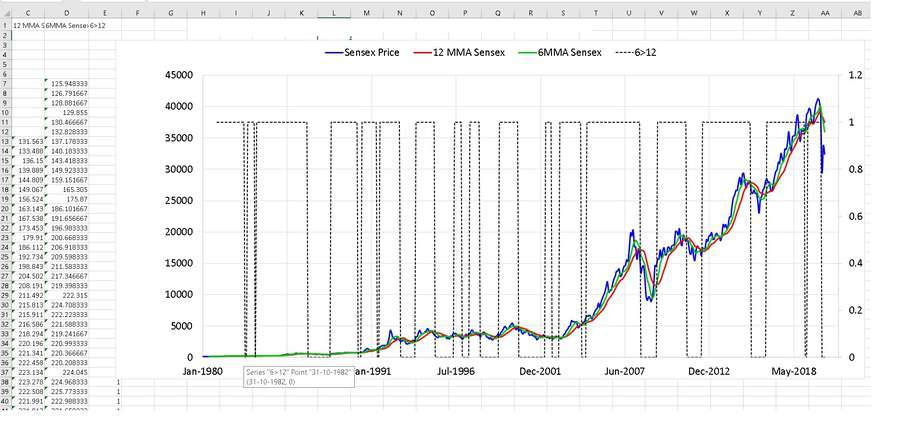

On this sheet 6 and 12-month shifting averages are computed with purchase/promote sign.

Sensex

You may get month-end Sensex information with the hyperlink offered to generate 6,12 MMAs and purchase/promote alerts.

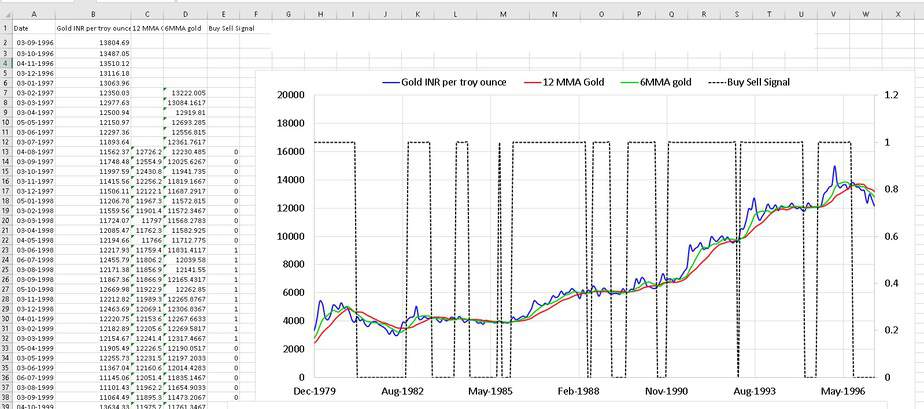

Gold

You may get month-end Gold information with the hyperlink offered to generate 6,12 MMAs and purchase/promote alerts.

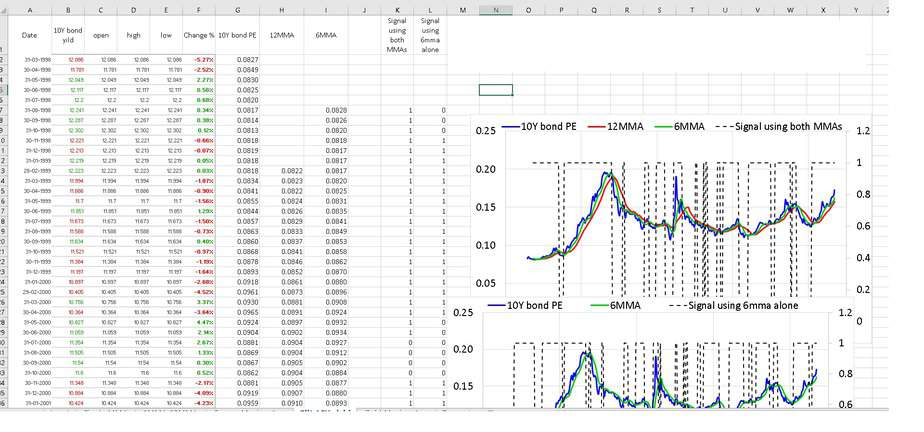

Gilt Yield

You may get month-end 10-year gilt information, calculate bond PE after which generate 6,12 MMAs and purchase/promote alerts. The software tells you when the 10Y bond PE is under each MMAs. You’ll be able to simply change this sign to something that you just want. Please additionally see Can we get higher returns by timing entry & exit from gilt mutual funds?

Demo Video

Buy hyperlink to acquire the software

Do share this text with your mates utilizing the buttons under.