With pension plans on the decline and ongoing questions in regards to the solvency of social safety, increasingly Individuals might want to take motion to save lots of for retirement. The SECURE Act and SECURE 2.0 have been enacted to assist jumpstart these financial savings or get folks again on observe. In addition they present tax incentives for small companies that undertake a brand new retirement plan. However they omit many current plans and plan members who proceed to lag behind.

Happily, autopilot retirement plan options—auto-enrollment, auto-deferral escalation, and auto-reenrollment—cowl lots of the provisions mandated by the acts and supply an efficient means for members to spice up their financial savings. And so they present many benefits to your plan sponsor shoppers as properly.

1. Kick-Begin Financial savings with Auto-Enrollment

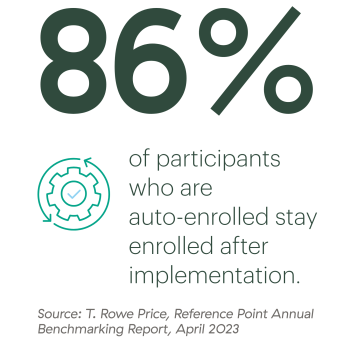

Auto-enrollment is growing in recognition as a result of it permits eligible staff to routinely contribute a selected proportion of pay to a retirement plan. In response to T. Rowe Value’s current benchmarking report, plan adoption of auto-enrollment was at 66 p.c in 2022. Though there’s an opt-out function, solely 10 p.c of staff selected to not enroll.

With 86 p.c of members staying enrolled after implementation—in comparison with simply 37 p.c participation in non-auto-enrollment plans—it’s simple to see the influence of this easy however efficient plan design enchancment.

How does this assist plan sponsors? There are a number of benefits:

-

For companies with 10 or extra staff, SECURE 2.0 requires plans adopted after December 31, 2024, to routinely enroll members as they develop into eligible. It additionally gives an annual tax credit score of as much as $500 within the plan’s first three years for any plan with fewer than 50 staff that undertake auto-enrollment.

-

Elevated participation and better contribution charges might favorably have an effect on a sponsor’s nondiscrimination testing outcomes, permitting house owners and extremely compensated staff to contribute extra to their retirement financial savings plan.

-

By lowering paper-based workflows, employers can onboard new staff extra effectively.

-

Simplified collection of applicable investments, significantly target-date fund investments, typically fulfills certified default funding different (QDIA) aims, offering secure harbor protections for plan fiduciaries.

-

When staff can afford to retire, it advantages them and the enterprise’s monetary assets. Enhanced retirement plan choices are additionally an effective way to entice and retain expertise.

2. Save Extra with Auto-Deferral Escalation

By including auto-deferral escalation to a plan, members can incrementally bump up their contribution charges till they meet a predetermined stage. The minimal beneficial ceiling is 10 p.c. Plan sponsors can set the share by which a participant’s elective deferral will improve annually (1 p.c is commonest) till it reaches a predetermined ceiling.

By implementing an opt-out methodology, extra folks can save extra for retirement. In response to T. Rowe Value, 62 p.c of members introduced with an opt-out methodology for auto-deferral escalation remained enrolled, in comparison with a ten p.c adoption fee for individuals who needed to choose in. Plus, growing deferral percentages allows members to appreciate the complete extent of their employer-matching contribution prospects—no extra leaving free cash on the desk!

3. Hit the Reset Button with Auto-Reenrollment

For members who aren’t assured in selecting investments or lack time to handle them, reenrollment is an effective way to give members a recent begin and be sure that they’re repositioned to fulfill their retirement targets. Contributors are notified that current belongings and future contributions shall be redirected from their current 401(ok) funding decisions to the QDIA (sometimes a target-date fund) on a specified date until they choose out.

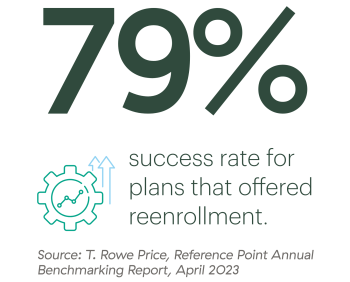

When carried out accurately, reenrollment permits plan sponsors to strengthen their fiduciary standing by gaining favorable QDIA secure harbor protections. Whereas solely 14 p.c of plans supplied reenrollment, the success fee in 2022 was 79 p.c.

Getting Your Plan Sponsor Shoppers on Board

There’s a lot to achieve from shifting to an automated retirement plan design. So, how do you get your plan sponsor shoppers to make the transfer? Listed below are some steps you possibly can comply with:

Evaluation your ebook of enterprise. Establish plans that aren’t arrange with auto options, and decide who might most profit from automated plan design. These with probably the most to achieve embrace:

-

Plans with low or declining participation charges, low or declining financial savings charges (the common participant financial savings fee is 7.3 p.c, in response to Vanguard analysis), or low common account balances (the common stability is $141,542, in response to Vanguard analysis)

-

Plans that not too long ago needed to make corrective distributions as a consequence of nondiscrimination testing failure and required extremely compensated staff to have a portion of their elective deferrals returned

-

Companies with a number of workplace places, which generally have enrollment and engagement challenges

-

Plans that don’t supply QDIA or target-date funds

Current the case. Spotlight the advantages and make sure you notice how a retirement plan profit could be a key issue when making an attempt to draw and retain gifted staff. Additionally, contemplate sharing finest practices for every function.

-

Auto-enrollment. Recommend setting the default auto-enrollment fee at 6 p.c or increased. That is the usual fee for 39 p.c of plans, which represents a rise of almost 100% over 9 years. For shoppers whose plans have already adopted this function at a decrease default fee, counsel bumping it as much as 6 p.c.

-

Auto-deferral escalation. Encourage shoppers to make use of a better annual improve fee (2 p.c moderately than 1 p.c) and to intention increased with the annual improve cap quantity (e.g., 10 p.c–15 p.c) to align with the rise in auto-deferral escalation ceiling charges. Employers who supply annual pay raises also can goal deferral escalations across the identical time of 12 months to scale back worker shock.

-

Reenrollment. Advocate reenrollment as a means to enhance participation within the plan, present skilled administration of belongings, and fulfill their fiduciary obligations. Emphasize the significance of periodically reviewing the plan’s QDIA to make sure that it displays the plan’s targets and aims.

Speak with the service suppliers. Your shoppers’ service suppliers (e.g., recordkeepers and third-party directors) can decide whether or not the options are possible for a specific plan and the way they might have an effect on the employer’s annual nondiscrimination testing and matching contribution budgets. Moreover, examine to see if adopting auto provisions will set off payment reductions from the recordkeeper.

Now’s the Time to Begin the Dialog

The SECURE Act and SECURE 2.0 will profit many Individuals who want to save lots of extra for retirement. You probably have shoppers with current plans, nonetheless, they received’t be required to undertake the auto options. That leaves the door open so that you can persuade them why it’s good for them and their members. Give your shoppers the nudge they want right now!

All for studying how partnering with Commonwealth can assist you evolve your retirement plan enterprise? Contact us right now.

Editor’s notice: This publish was initially printed in January 2021, however we’ve up to date it to convey you extra related and well timed info.