A perennial problem with China’s development mannequin has been overly excessive funding spending relative to GDP and unusually low shopper spending, one thing which China has lengthy struggled to rebalance. As China makes an attempt to maneuver away from credit-intensive, investment-focused development, the economic system’s development must depend on greater shopper spending. Nevertheless, a protracted family borrowing binge, COVID scarring and a deep stoop within the property market in China have broken family stability sheets and eroded shopper sentiment. On this submit, we look at the affect of current shocks on Chinese language family conduct for clues across the outlook for reviving consumption and financial development in China.

Consumption and Family Stability Sheets

China’s lengthy delayed emergence from COVID lockdowns in late 2022 led to hypothesis that there can be a large leap in consumption in 2023. Shopper spending did enhance over the primary half of the yr, however solely modestly, which means China’s “revenge spending” has, up to now, been muted.

Over the ten years previous the beginning of COVID, households binged on debt, primarily fueled by China’s property growth. Unbridled development in family borrowing averaged over 25 p.c yearly from 2009-19. Because of extended strong borrowing, family debt elevated quickly, now accounting for 62 p.c of GDP. This pushed family debt in China to ranges which are fairly excessive by creating nation requirements, elevating considerations round stretched family stability sheets—significantly amongst decrease revenue cohorts.

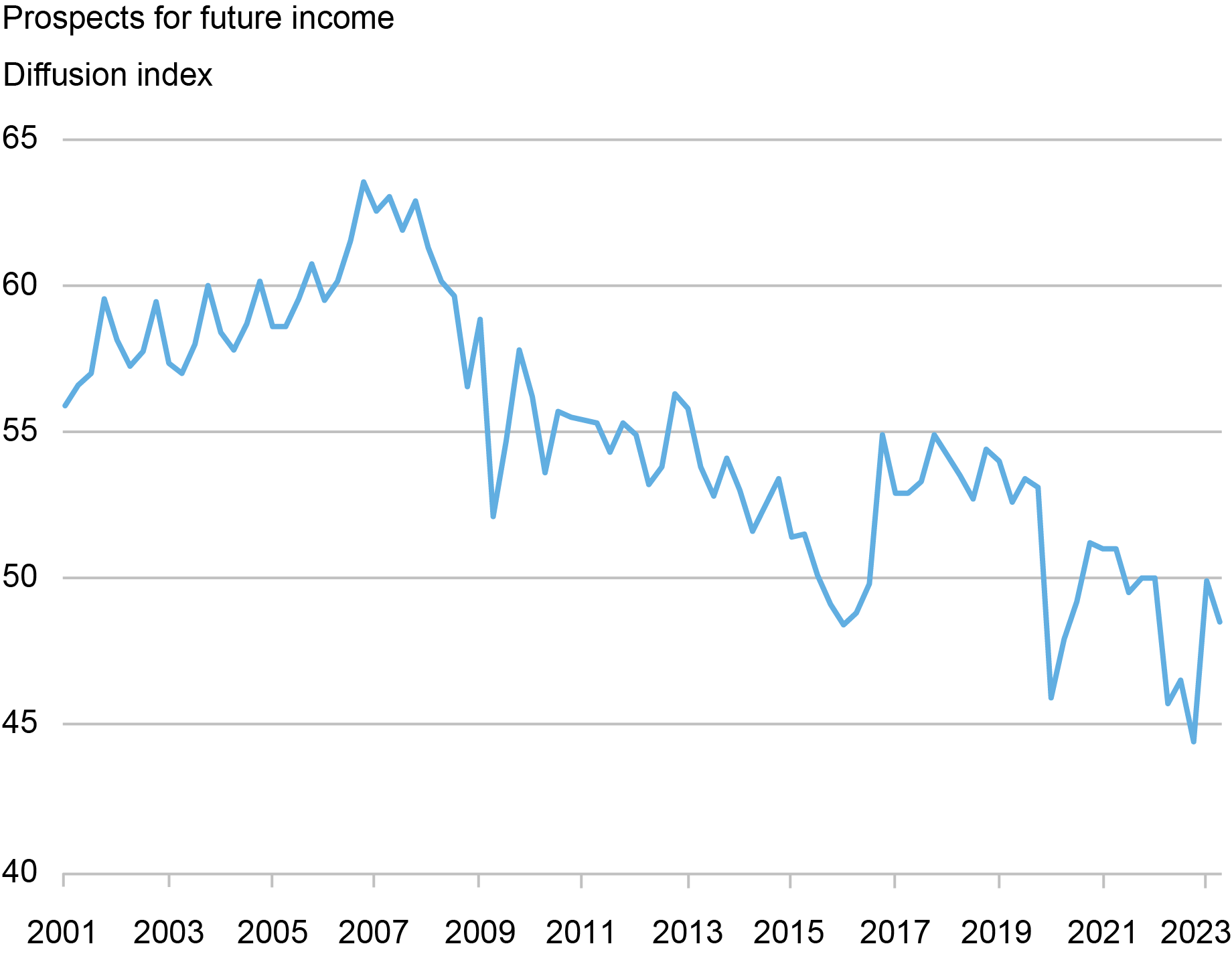

Prolonged pandemic lockdowns in China additional exacerbated stability sheet harm among the many most susceptible households impacted by the collapse in financial exercise, job losses, pay cuts, and a weaker social security web. Whereas households’ pessimism across the future has been declining for a while, current surveys present households’ confidence within the outlook for future revenue positive factors hovering close to the bottom stage on report (see chart beneath). China’s youthful generations, which have historically helped gasoline the nation’s consumption spending, have been significantly onerous hit; youth unemployment rose to a historic excessive of 21.3 p.c in June, earlier than the federal government stopped publishing the info. Authorities restrictions on China’s vibrant personal sector, the place current school graduates sometimes discover jobs, has additionally undermined confidence sooner or later.

Confidence Survey Exhibits Optimism in regards to the Future Has Eroded

Property because the Largest Family Asset

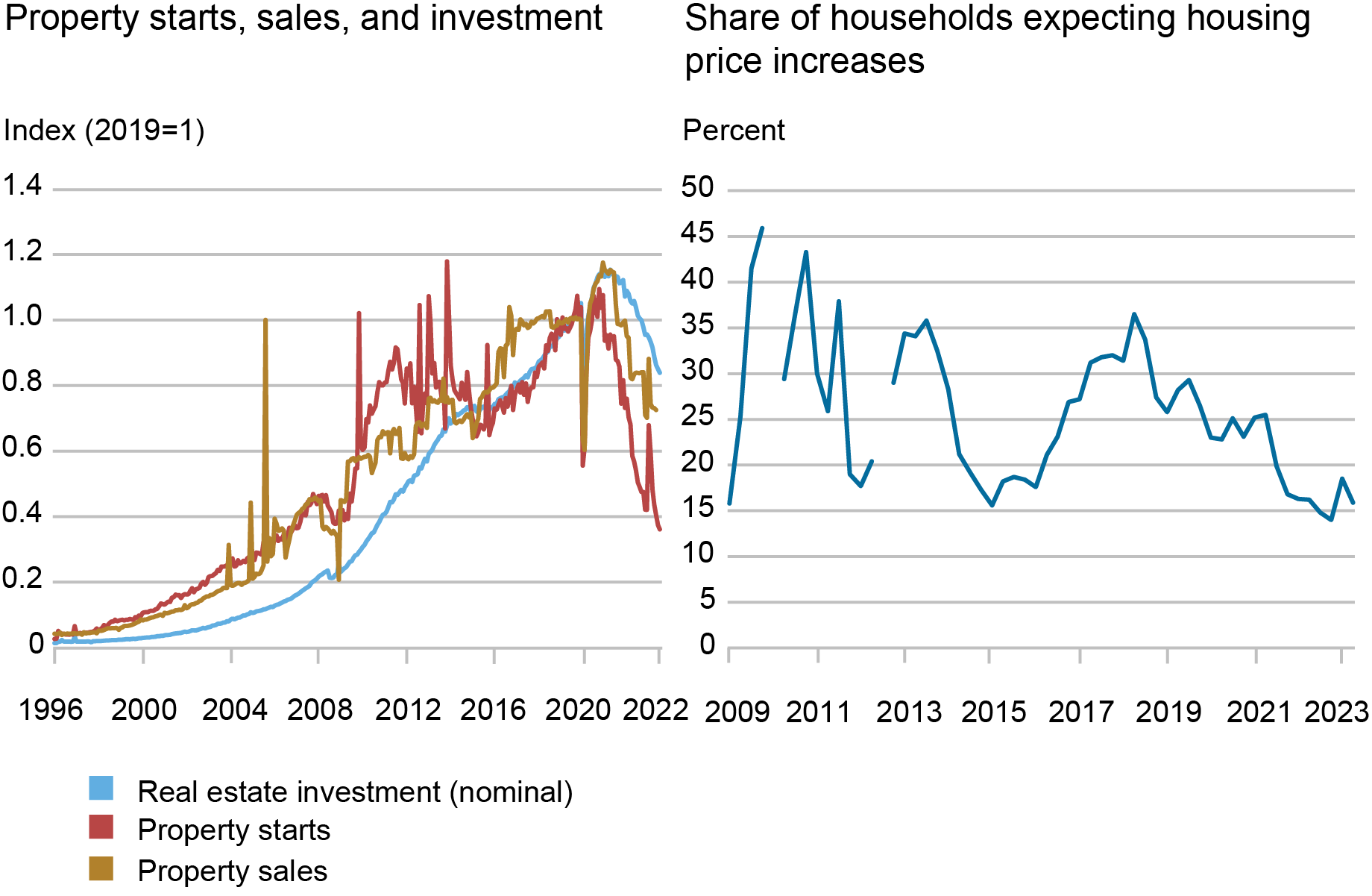

Chinese language households endured the longest pandemic lockdowns on the earth and, in August 2020, the federal government prioritized curbing excesses within the property sector. These elements contributed to the collapse of a serious property developer, and the ensuing property sector disaster a couple of yr later. Indicators of housing exercise have been in digital freefall (as illustrated within the left panel of the following chart), with begins knowledge pointing to a continued decline in residential funding spending within the close to time period. Property is an important retailer of wealth for households in China, accounting for roughly two-thirds of family property. Homeownership can be excessive in China, with over 80 p.c of households proudly owning a house.

China’s Housing Market Has Slowed; Few Households See House Costs Rising

Be aware: Knowledge in left panel are seasonally adjusted.

Skepticism surrounds official property worth statistics, which will be distorted by authorities worth controls. Official knowledge recommend solely a modest fall in nationwide property costs, however there’s vital divergence throughout metropolis tiers and areas, with some estimates noting that costs have fallen by roughly 20 p.c in lower-tier cities. Chinese language sentiment has shifted notably with fewer households assuming costs will proceed to rise. The best panel of the chart above exhibits the newest Individuals’s Financial institution of China quarterly family survey the place family expectations for worth rises are near all-time lows. Property builders’ struggles to finish development of pre-sold properties and associated monetary misery of builders have additionally elevated the dangers round shopping for a brand new residence.

Chinese language authorities’ efforts to revive demand for brand new properties have didn’t tempt homebuyers again to the market. The central financial institution has minimize rates of interest to the bottom stage on report and lowered a spread of macroprudential measures. Nevertheless, in contrast to in previous property cycles, coverage easing has not led to will increase in residence gross sales.

Households Are More and more Threat Averse

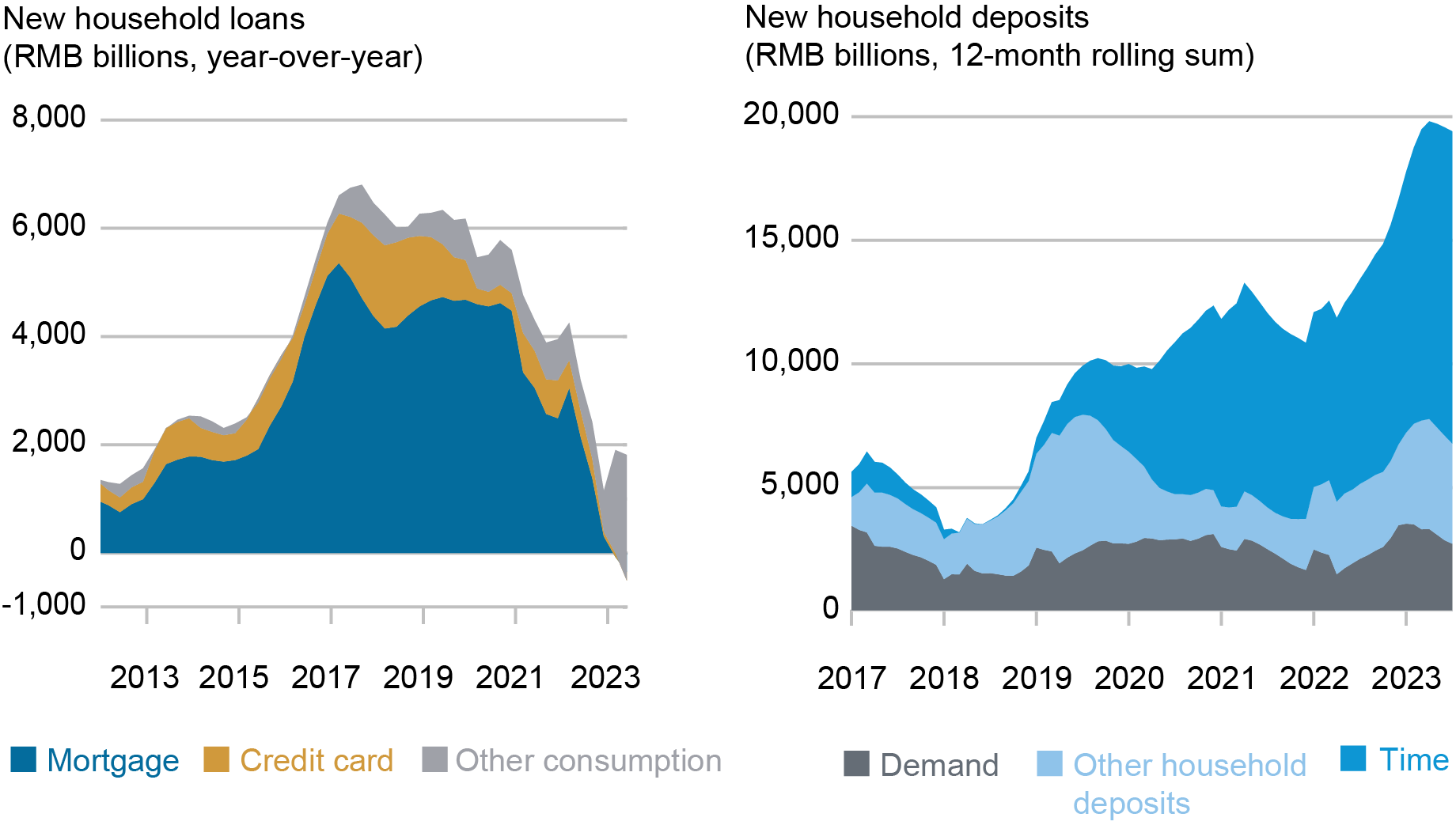

With all this, households have responded by paying down their mortgage debt. As of July 2023, mortgage loans accounted for over 50 p.c of whole family debt ($6 trillion and a 3rd of GDP). Over the previous yr, the quantity of mortgage loans excellent has declined for the primary time ever in China as households have prioritized mortgage repayments. Be aware that different types of shopper credit score have additionally slowed sharply as highlighted within the left panel of the chart beneath.

Households Have Stopped Borrowing, whereas Financial savings Deposits Have Surged

Be aware: Left panel excludes “operational loans,” which China classifies as family debt, however in impact are financial institution loans to sole proprietorships.

Beginning in 2019, there has additionally been sharp rise in new financial institution deposits. The preliminary enhance corresponds with the ultimate implementation of recent guidelines on the asset administration enterprise in China. The lockdown’s affect on shopper spending helped push up deposits within the 2020-21 interval. New deposit development has accelerated notably over the previous yr. One key driver is poor efficiency and disruption in home monetary markets, inflicting a reallocation of some property to financial institution deposits. The opposite is the stoop within the property market, which has led to a serious discount in residential residence purchases and mortgage borrowing, with property gross sales declining over 30 p.c over the previous yr.

This surge in new financial institution deposits suggests shopper pessimism round the true property outlook. Notably, households have opted overwhelmingly to carry longer-term financial savings deposits, as illustrated in the fitting panel of the chart above, whilst rates of interest in China proceed to fall. Latest survey knowledge recommend family preferences are for additional rising holdings of time period deposits sooner or later. Information round failures of other funding merchandise tied to property builders in China will doubtless solely enhance danger aversion amongst households.

Paradox of Thrift?

Some have prompt shopper pessimism in China has already turn out to be entrenched, akin to “financial lengthy COVID.” Consequently, households will be anticipated to borrow much less, pay down their debt, shrink back from shopping for properties, and maintain extra financial savings deposits. With issues within the property sector prone to be protracted and direct help for households not historically a part of Chinese language authorities’ playbook, policymakers face a tall activity of reversing households’ attitudes in regards to the future that can be key to bolstering consumption and reviving financial development momentum.

Jeffrey B. Dawson is a global coverage advisor in Worldwide Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

How one can cite this submit:

Jeff Dawson, “Why Are China’s Households within the Doldrums?,” Federal Reserve Financial institution of New York Liberty Road Economics, September 27, 2023, https://libertystreeteconomics.newyorkfed.org/2023/09/why-are-chinas-households-in-the-doldrums/.

Disclaimer

The views expressed on this submit are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the writer(s).