“Purchase now, pay later” (BNPL) has develop into an more and more in style type of fee amongst People lately. Whereas BNPL supplies customers with the flexibleness to pay for items and companies over time, often with zero curiosity, the Shopper Monetary Safety Bureau (CFPB) has recognized a number of areas of potential shopper hurt related to its rising use, together with inconsistent shopper protections, and the danger of extreme debt accumulation and over-extension. BNPL proponents have argued that the service permits improved credit score entry and better monetary inclusion, with approval being fast and comparatively simple. Extra analysis is required to evaluate the general dangers and advantages of BNPL for customers. As a primary step, we draw on new survey knowledge to look at the background and circumstances of customers who obtain and take up BNPL affords. We discover each the provision and use of BNPL to be pretty widespread however see disproportionate take-up amongst customers with unmet credit score wants, restricted credit score entry, and better monetary fragility. Whereas BNPL expands monetary inclusion, particularly to these with low credit score scores, there’s a danger that these fee plans contribute to extreme debt accumulation and over-extension.

In our evaluation of the provision and use of BNPL loans, we draw on knowledge collected as a part of the June 2023 Survey of Shopper Expectations (SCE) Credit score Entry Survey. The survey is fielded each 4 months as a rotating module of the “core” SCE, which is itself a month-to-month, nationally consultant internet-based survey of a rotating panel of family heads performed by the Federal Reserve Financial institution of New York since June 2013. Right here, we deal with responses by about 1,000 respondents to a particular set of questions added to the June 2023 survey.

Who Is Supplied BNPL?

We first requested survey contributors whether or not they had ever been provided a BNPL possibility. We then requested whether or not prior to now yr they’d bought something utilizing the BNPL possibility, and in that case what fee technique they used to make the installments. Lastly, we requested respondents for the p.c probability that they may buy one thing over the subsequent yr utilizing a BNPL possibility (the precise query textual content is included within the observe under the primary chart under).

We discover that about 64 p.c of respondents within the June 2023 survey have ever been provided a BNPL fee possibility, whereas 19 p.c (29 p.c of offerees) have used it as fee technique prior to now yr. Amongst customers, 77 p.c made installment repayments utilizing a debit card, checking account, or financial institution verify; 10 p.c used a bank card; 6 p.c used a pay as you go card; and eight p.c used a fee service resembling Venmo. We additionally discover from different survey solutions that the overwhelming majority of BNPL mortgage customers are typically banked and often have a credit score rating.

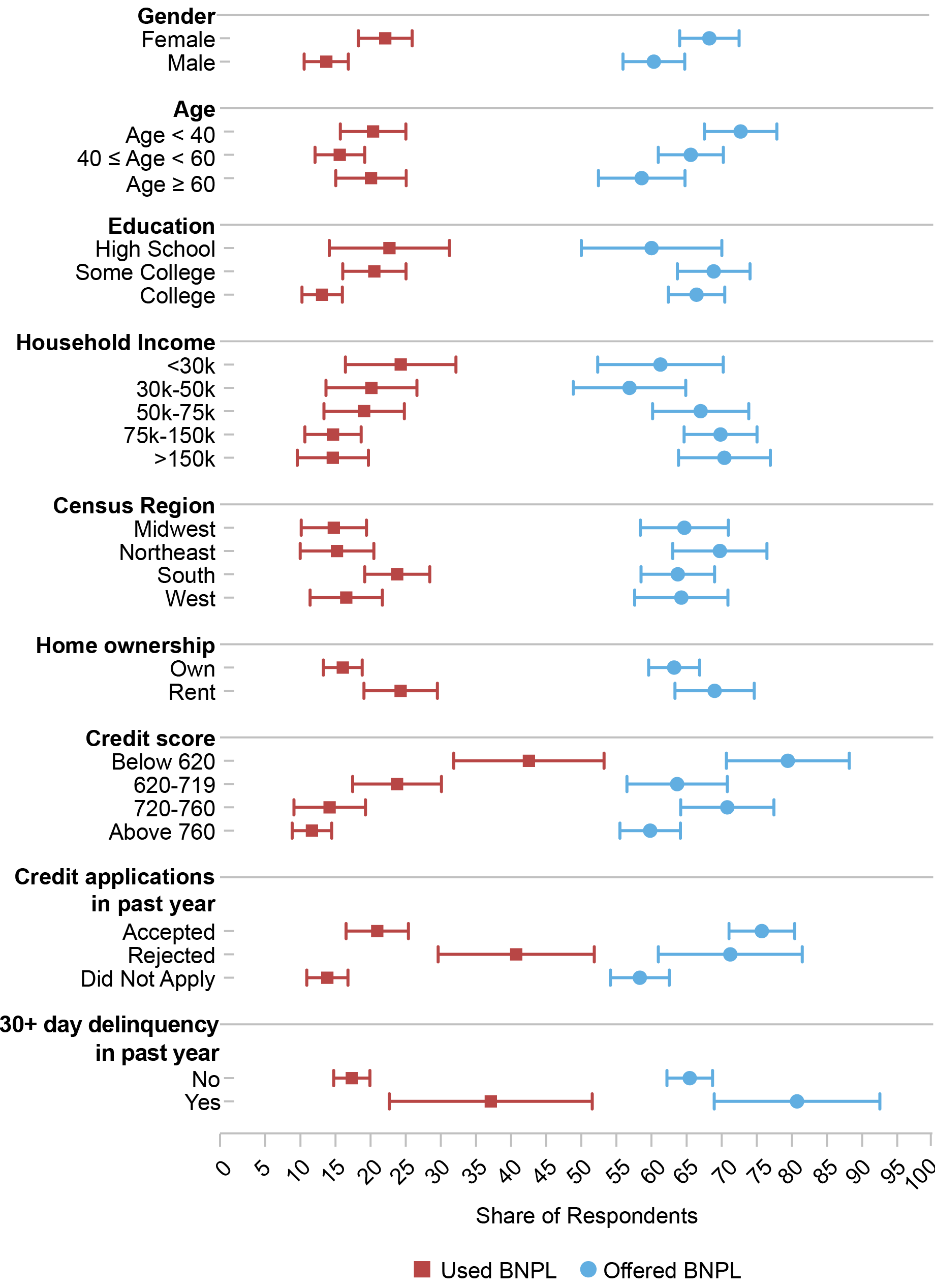

Whereas not all respondents are equally prone to have encountered the BNPL possibility, the expertise is remarkably broad-based, with a majority in all demographic and socioeconomic teams reporting having been provided the fee possibility. The chart under reveals how the “provided” share (blue dots, with confidence intervals) varies with respondent traits. Feminine and youthful respondents and people with greater family revenue usually tend to report encountering the BNPL possibility. 60 p.c of respondents with credit score scores above 760 have obtained a BNPL provide, in comparison with about 80 p.c of these with credit score scores under 620. Apparently, those that had a credit score software rejected or had been delinquent on a mortgage over the previous yr had been additionally extra prone to have been provided the BNPL possibility. These variations are prone to replicate each the provision, and attainable concentrating on, of this fee possibility, mixed with what’s being bought and from the place. As well as, they could to some extent replicate curiosity in and consciousness (and reminiscence) of a BNPL possibility, which may very well be demand-driven.

Survey Outcomes: Engagement with BNPL

Supply: Survey responses from the New York Fed’s Survey of Shopper Expectations (SCE) Credit score Entry Survey.

Notes: The query comparable to “provided BNPL” was: “Some shops provide fee plans with a ‘purchase now, pay later’ possibility, whereby prospects don’t pay for the complete value on the time of buy, however quite pay later in a number of installments. (These fee plans are sometimes provided by firms resembling Affirm, Afterpay, and Klarna.) Have you ever ever been provided such a “purchase now, pay later” possibility?” The query comparable to “used BNPL previous yr” was: “Previously yr, have you ever bought something utilizing a ‘purchase now, pay later’ possibility?”

Who Makes use of BNPL?

There’s better variability throughout teams when contemplating the speed at which BNPL was really used over the previous yr. As proven within the chart above, we discover BNPL use (proven in pink with confidence intervals) to be considerably greater for females, renters, people with no school diploma, and to be monotonically reducing in revenue (these patterns are largely in line with the 2023 CFPB report). Whereas decrease revenue people are much less prone to be provided BNPL they’re extra seemingly to make use of it. Total 19 p.c of people used BNPL, however BNPL utilization is noticeably greater for these with credit score scores under 620 (43 p.c) and those that had been thirty days or extra delinquent sooner or later in the course of the previous yr (37 p.c). Those that utilized for another kind of credit score over the previous yr (an indicator of upper credit score demand), typically had been additionally extra prone to report utilizing BNPL prior to now yr, in comparison with those that didn’t apply for credit score. Amongst those that utilized for credit score, BNPL use was notably excessive for many who reported a credit score software rejection over the previous yr (41 p.c). After all, these varied respondent traits are correlated with one another, suggesting the necessity for a multivariate evaluation: when controlling for all covariates collectively in a multivariate regression, the upper charges for these with low credit score scores or a current credit score software rejection stay extremely statistically important.

Regardless of being pretty broad-based, with important take-up amongst greater educated and better revenue respondents, total we discover that these with decrease credit score scores and better unmet credit score wants make up a disproportionate share of all BNPL customers. Certainly, 32.7 p.c of BNPL customers both held a credit score rating of lower than 620, reported having a credit score software rejected, or had been delinquent on a mortgage over the previous yr; this group, in the meantime, represents simply 16.6 p.c of our full pattern. Moreover, we discover BNPL customers to be total extra financially fragile, as measured by the common chance of with the ability to give you $2,000 within the subsequent month in case of an emergency. That likelihood stands at 66 p.c throughout all respondents and respondents which have ever been provided the BNPL possibility, however solely 52 p.c amongst those that reported utilizing BNPL over the previous yr. BNPL customers are additionally much less prone to depend on financial savings when dealing with a monetary shock. Whereas 68 p.c of all respondents would depend on financial savings to give you the wanted funds, solely 42 p.c of BNPL customers would. As an alternative, they report that they’re extra prone to depend on borrowing (from pals, household, banks, or bank cards). The truth that a disproportionate share of BNPL customers are already financially fragile raises questions concerning the resilience of BNPL lending and its efficiency following an adversarial financial shock.

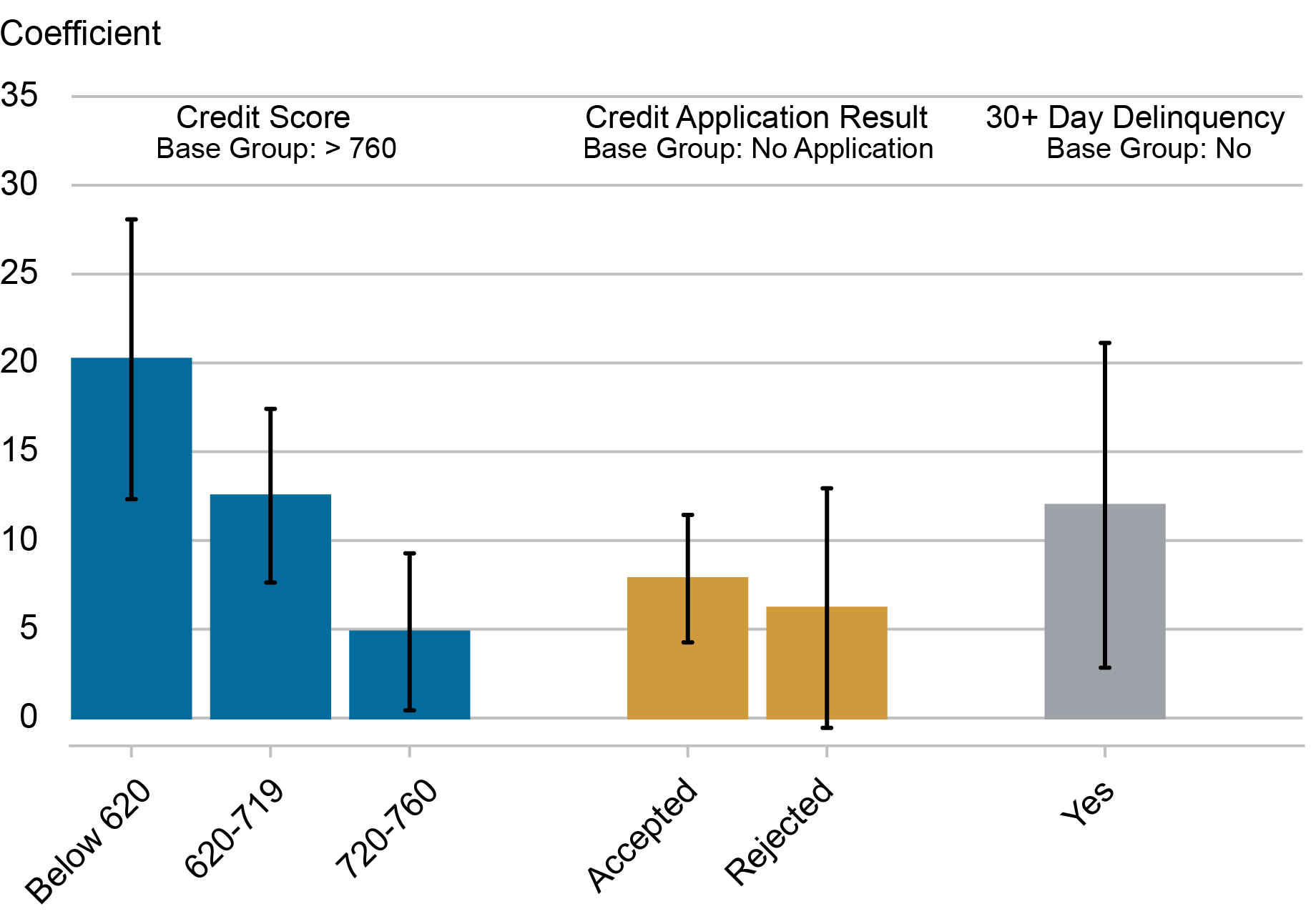

BNPL Will increase Monetary Inclusion, however Not With out Danger

BNPL utilization might replicate demand in addition to provide components. For instance, these with decrease incomes and credit score scores might discover interest-free BNPL financing extra enticing and reasonably priced, or might have better entry to such loans because of the place (at what retailers) BNPL is obtainable. It might additionally seize a decrease credit score rating and mortgage delinquency that had been the results of, quite than cause for, BNPL use (debt over-extension), though most BNPL loans should not reported to credit score bureaus. To additional study the extent to which these patterns replicate demand, quite than “concentrating on,” we associated a respondent’s background and circumstances to their anticipated year-ahead BNPL use. We once more discover a a lot greater reported common likelihood of utilizing BNPL over the subsequent yr amongst these with decrease credit score scores and those that had a credit score software rejected over the previous yr. Controlling for all covariates collectively in a regression doesn’t alter these findings, as proven by the estimated marginal results within the chart under. These outcomes due to this fact recommend that whereas BNPL might not profit unbanked customers or those that are “credit score invisible” or unscorable, BNPL loans seem notably enticing to these with unmet credit score wants and restricted credit score entry. Representing a further enticing supply of credit score to assist debtors easy consumption and handle their debt funds at decrease value, BNPL might thus increase monetary inclusion, particularly to these with low credit score scores.

Marginal Results on Common Likelihood of Utilizing BNPL within the Subsequent 12 months

Word: The reference teams for the estimated results are these with credit score scores above 760, who didn’t apply for credit score prior to now yr and was not late on a debt fee over the previous yr.

On the similar time, our proof substantiates to some extent a priority expressed by some BNPL critics, that BNPL might appeal to customers who have already got monetary difficulties and are struggling to pay their present payments and debt funds. We can not dismiss the potential dangers of overextension, whereby frequent use of BNPL funding results in extreme debt accumulation over time, affecting a shopper’s capacity to satisfy non-BNPL obligations. The truth that many BNPL lenders don’t at present furnish knowledge to the most important credit score reporting companies might contribute to such dangers, as each BNPL lenders and different establishments can be unaware of a borrower’s present liabilities when deciding to originate new loans.

Additionally regarding on this regard is that BNPL is likely to be enabling customers to spend (and borrow) greater than they in any other case would, quite than merely shifting purchases to a brand new fee platform. Berg et al (2023) discover causal proof for this, exhibiting that prospects spend 20 p.c extra when BNPL is accessible, with much less creditworthy prospects being most conscious of BNPL affords.

So whereas our findings point out that BNPL companies take pleasure in broad-based curiosity, seem to fill a niche within the credit score market, and increase credit score entry and monetary inclusion, extra knowledge and evaluation are wanted to research the extent to which BNPL borrowing might contribute to better monetary stress and have an effect on total monetary well-being, particularly over the course of the enterprise cycle.

Felix Aidala is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Daniel Mangrum is a analysis economist in Equitable Progress Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Wilbert van der Klaauw is the financial analysis advisor for Family and Public Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Find out how to cite this publish:

Felix Aidala, Daniel Mangrum, and Wilbert van der Klaauw, “Who Makes use of “Purchase Now, Pay Later?”,” Federal Reserve Financial institution of New York Liberty Road Economics, September 26, 2023, https://libertystreeteconomics.newyorkfed.org/2023/09/who-uses-buy-now-pay-later/.

Disclaimer

The views expressed on this publish are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the writer(s).