Step one in defending purchasers that present indicators of cognitive decline is easy, argues Barbara Archer, managing director and associate of Hightower Wealth Advisors in St. Louis.

“If we see one thing, we have to say one thing,” she says in an interview with ThinkAdvisor.

Particularly, this implies talking with the consumer after which to a trusted contact if the consumer has one.

When advisors spot a crimson flag, additionally they want to guard themselves. This entails taking the above steps plus contacting their agency’s compliance division and the state by which they’re primarily based to find out applicable guidelines, says Archer.

Ought to a consumer with diminishing cognitive capability or different psychological well being points begin to deal with property in another way from a longtime method, “the consumer’s household or their counsel might query the advisor. If there’s a difficulty, there may be legal responsibility,” Archer factors out.

Some behavioral adjustments don’t essentially sign cognitive decline, she notes. They could be non permanent adjustments ensuing from a brand new treatment or an an infection.

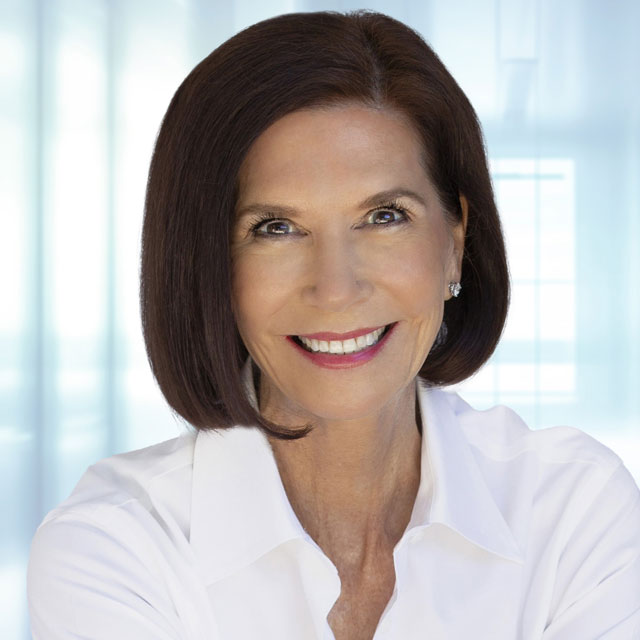

Archer, who heads a follow with two companions and 5 different advisors, supported by six associates — with property beneath administration of greater than $1 billion — based Archer Wealth Administration in 1983 and joined Hightower in 2016, merging her follow with Carol Rogers, a longtime advisor and buddy who retired in 2022.

Archer focuses on house owners of carefully held companies, prime company executives and professionals, like physicians and attorneys.

Within the latest interview with Archer, who was talking from Memphis, Tennessee, the place she was holding a consumer assembly, discusses her course of for serving purchasers with reducing psychological capability and particulars learn how to shield purchasers — aged or younger — from scammers.

“There’s no age restriction on being phished,” Archer says. “It may well occur to anybody.”

Listed below are highlights of our interview:

THINKADVISOR: What ought to monetary advisors do in the event that they word cognitive decline in a consumer?

BARBARA ARCHER: If we see one thing, we have to say one thing.

If we all know how the consumer sometimes acts and unexpectedly one thing begins altering, we have now to step in as an goal observer.

It’s a troublesome dialog to have. However it’s crucial for advisors who care for his or her purchasers to handle the problem completely.

If the consumer has youngsters, we might discover one thing earlier than they do. Or generally the household is in denial. We inform them, “Right here’s what we observed.”

Then we’ll recommend that the kids go to Mother or Dad to see in the event that they observe something totally different.

How can advisors shield themselves and purchasers ought to a consumer turn out to be confused or mentally incapacitated?

First, throughout our common planning conferences, we at all times evaluation the consumer’s authorized paperwork that should be in place: energy of lawyer, designated particular person who would possibly make monetary selections when the consumer not can, a medical directive, dwelling will that states their medical preferences if they’ll’t talk.

Additionally, we be sure the consumer has their will and trusts in place, particularly for distributing property after they die, and that the right beneficiary designations are on their retirement plans and life insurance coverage.

Do you do the rest to guard purchasers?

We provide the choice to present us the identify of a trusted contact. That’s virtually at all times going to be the partner and, then, it’s the kids. In the event that they don’t have youngsters, will probably be one among their highest buddies.

We are able to recommend to the trusted contact to succeed in out to authorized and medical counsel.

By connecting with the trusted contact, we’ve glad our obligation because the monetary fiduciary.

Is the trusted contact possibility supposed only for older purchasers?

No. The consumer might be 30 years outdated. They may fall and bump their head and get confused and overlook issues. There are many methods individuals can have points.

What has to happen so that you can talk with the trusted contact?

We name to allow them to know we observed one thing that isn’t proper within the consumer’s world.

If we have now a relationship with two or three of the generations in a household, there’s extra of a consolation system to assist the consumer that could be teetering on that psychological [cliff] in comparison with what we sometimes see.

We additionally provide household conferences, the place we carry within the youngsters or grandchildren. The consumer can share the technique of how their property will transfer sooner or later.

Some are very comfy sharing the numbers, too.

How do advisors shield themselves when a consumer reveals indicators of cognitive decline?

Notify the trusted contact of any crimson flags. Have common conferences and keep conscious of any adjustments throughout them.

Sustaining detailed notes on all interactions may help shield in opposition to potential disputes.

Contact compliance. Attain out to the state the advisor is in or search for contacts on the North American Securities Directors Affiliation for his or her state contact to be able to perceive necessities.