By Nadia Stovicek and JoAnn Volk

A latest research from the Authorities Accountability Workplace (GAO) sheds new gentle on well being care sharing ministries (HCSMs). The GAO interviewed officers from 5 HCSMs on plan options, enrollment, and advertising. The report contains, for instance, details about HCSM use of paid gross sales representatives, administrative prices (one HCSM directs as much as 40 % of members’ contributions to administrative prices) and membership (one HCSM stated a survey of their members discovered 42 % had revenue beneath 200 % of the poverty stage, which might make them eligible for substantial subsidies for a Market plan). However the report provides solely a snapshot of a handful of HCSMs.

Regardless of a historical past of fraud and unpaid payments, HCSMs are largely a black field for insurance coverage regulators and most people. Trinity, an HCSM administered by the corporate Aliera, lately went bankrupt; at the very least 14 states have taken motion to close down Aliera due to their malfeasance. Members suing Aliera are solely anticipated to recoup one to 5 % of the cash they’re owed, which may quantity to a whole lot of 1000’s of {dollars}. Extra lately, the North Dakota Legal professional Basic settled a lawsuit with HCSM Jericho Share for creating “a misunderstanding that its merchandise are medical health insurance” and utilizing that misunderstanding to promote memberships. Past the info within the GAO report, little is understood concerning the operations or funds of HCSMs. A client contemplating changing into a member of a well being care sharing ministry—with an expectation that their well being care payments can be paid—could wish to know, for instance, if the HCSM has a historical past of steady income or retains in reserve sufficient funds to cowl members’ well being care payments. To higher perceive what data is out there, we reviewed publicly obtainable audits and income stories to the IRS to see what data an bold client might get hold of about an HCSM earlier than enrolling.

What are HCSMs?

HCSMs’ members comply with observe a typical set of non secular or moral beliefs and contribute common funds to assist pay the qualifying medical bills of different members. HCSMs have many options which might be just like these of insurance coverage. For instance, members’ funds are usually required on a month-to-month foundation and should fluctuate relying on age and stage of protection, very similar to a premium. Members should pay some prices out-of-pocket earlier than they will submit payments to the HCSM for fee, akin to a deductible; member pointers for protection usually require members to pay co-insurance and use a community supplier when getting care. Even the advertising depends closely on the similarity to insurance coverage, which may mislead customers into considering they’re getting extra from a membership than an HCSM gives.

Regardless of these similarities, most states don’t think about HCSMs to be medical health insurance issuers, and don’t topic them to the requirements that insurance coverage firms should meet. This may depart members financially weak. HCSMs make no assure that they may cowl any well being care declare, even those who meet pointers for sharing, and so they don’t have to fulfill monetary requirements to make sure they’ve sufficient funds to pay claims. Additionally they should not have to adjust to the buyer protections of the Inexpensive Care Act (ACA). For instance, HCSMs should not have to cowl important well being advantages, which embrace hospitalization, maternity care, psychological well being and substance use dysfunction companies, prescribed drugs, and preventative companies. In reality, HCSMs usually exclude protection for preexisting circumstances, behavioral well being, and maternity care besides in restricted circumstances, and restrict protection for prescribed drugs.

What information is publicly obtainable?

State regulators want information to know how HCSMs function and market memberships to customers, however most states don’t gather such data. Solely Colorado requires information from all HCSMs promoting memberships in-state; Massachusetts collects information from these HCSMs whose members can declare credit score for protection beneath the state’s particular person protection requirement. The federal authorities doesn’t gather or present to the general public actionable information about HCSMs both.

Nonetheless, some states require HCSMs that search an exemption from state insurance coverage necessities to make obtainable an annual audit upon request. The ACA definition of HCSMs whose members are exempt from the person mandate additionally contains that requirement. Based mostly on these annual audit reporting necessities, we contacted seven HCSMs, representing the most important HCSMs working throughout states to request a replica of their annual audit: Altrua, Christian Healthcare Ministries (CHM), Medi-share, Samaritan, Sedera Well being, Solidarity, and Liberty HealthShare.

These audits are usually carried out by an accounting agency and supply an summary of the monetary solvency of a company, together with statements of economic positions, actions, practical bills, and money flows. Of the 7 HCSMs we contacted, solely 3 offered us with an audit when requested. (See Desk 1.) One HCSM, Medi-Share, solely offered a transient doc with extra restricted information than could be required in an official audit.

Desk 1.

| HSCM | Audit offered? |

| Altrua | No |

| Christian Healthcare Ministries | Sure |

| Medi-Share Christian Care Ministry | No |

| Samaritan Ministries | Sure |

| Sedera Well being | No |

| Solidarity HealthShare | No |

| Liberty HealthShare | Sure |

Supply: Authors’ communication with the listed ministries

As a result of we have been unable to acquire an annual audit from all seven HCSMs, we additionally reviewed their publicly obtainable 990 types to investigate monetary information. Non-profit organizations should yearly file a Type 990 with the Inside Income Service (IRS). With this manner, non-profits report required information on the group’s actions, funds, governance, and compensation paid to sure workers and people in management positions. We obtained a number of years of 990 types by way of ProPublica, a information web site, and the IRS web site for all the HCSMs we reviewed besides Sedera. It’s unclear why Sedera, which claims to be a non-profit on its web site, wouldn’t have submitted a 990. As a result of the IRS has not but printed 2021-2022 990s, we couldn’t evaluation the latest information.

What the Knowledge Reveal

Audits, the place obtainable, present better element than a 990. For instance, audits present data on “practical bills,” which embrace spending on public relations, worker advantages and taxes, amongst different bills. Two audits additionally reported loans obtained beneath the Paycheck Safety Program: $3 million to Liberty HealthShare and $2.5 million to Christian Healthcare Ministries, each of which have been forgiven.

However audit information aren’t reported in a constant method. For instance, Samaritan Ministries and Christian Healthcare Ministries checklist members’ items and dues as income; Liberty HealthShare doesn’t depend member contributions as income as a result of they’re held in members’ sharing accounts, which aren’t mirrored within the audit. In one other instance, Samaritan Ministries stories spending on promoting, Christian Healthcare Ministries stories spending on “member growth charges,” which is claimed to replicate spending on promoting, and Liberty HealthShare stories “member growth charges” and “promoting” prices individually, which suggests member growth charges could embrace commissions to brokers. HCSMs that pay dealer commissions usually pay considerably increased commissions than these paid to brokers who enroll folks in ACA protection, which may drive better enrollment.

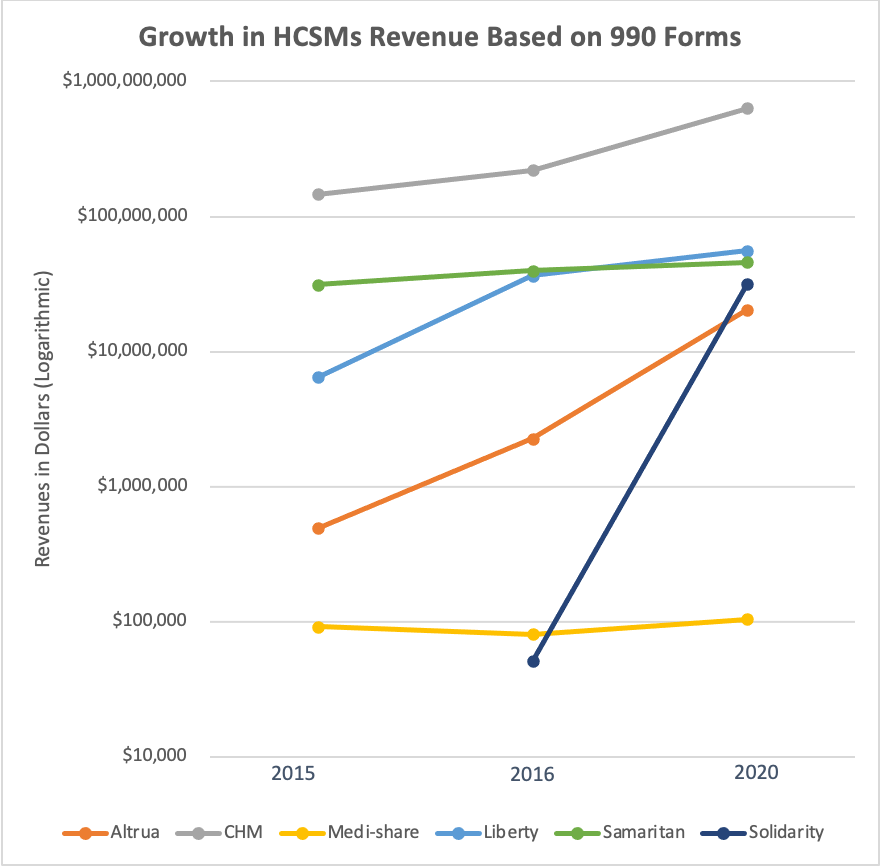

As a result of we have been in a position to get hold of a number of years of 990s, we have been in a position to examine income adjustments over time. HCSMs report whole income on 990s primarily based on contributions, program companies, or each. The 990s lack element however it’s probably the income at the very least roughly displays rising membership. Most HCSMs’ 990s that we reviewed noticed big income development between the years we might evaluation. (See Graph 1). For instance, Solidarity HealthShare’s reported income grew a whopping 62,143% in 4 years, and Altrua grew about 4,010% in 5 years. Medi-Share was a notable exception to this pattern; it reported little or no income and development between 2011 and 2020. It’s not clear why, as Medi-Share is among the oldest and largest HCSMs within the nation.

Graph 1.

Supply: authors’ evaluation of 990 filings

A majority of the HCSM 990 types we reviewed (Solidarity, Samaritan, Christian Healthcare Ministries, Medi-share, and Altrua) indicated spending in extra of revenues in some years and substantial income fluctuations year-to-year. This raises questions concerning the adequacy and stability of funding obtainable to cowl members’ well being care prices. One HCSM, Liberty HealthShare, has come beneath latest scrutiny for his or her historical past of not paying their members’ claims.

One problem with the info obtainable on the 990s is that every HCSM stories its information in another way, making it troublesome to make comparisons between them. In distinction, well being insurers should use a standardized template to report monetary information to state regulators, making it attainable to know and examine insurers primarily based on premium income, obtainable reserves, and bills paid for administrative prices and members’ well being care claims.

Conclusion

The dramatic development in income for almost all of HCSMs we checked out suggests substantial development in enrollment. Nonetheless, the numerous income fluctuations from year-to-year, coupled with some HCSMs displaying bills that exceed revenues, elevate questions on whether or not customers who select an HCSM as a substitute for complete protection can depend on their well being care payments getting paid. Regulators searching for to know the rising function of HCSMs of their markets—and the dangers to customers who’re persuaded, usually by deceptive advertising, to purchase memberships—want extra full information reported frequently. Making certain HCSMs adjust to the requirement to make obtainable an annual audit is a spot to start out in states the place that applies, however even that information is proscribed and all states ought to have an curiosity in acquiring extra full information to higher perceive this rising phase of protection.