The chapter submitting of WeWork Inc. on November 6, 2023 got here with neither a whimper nor a bang, however with a laconic shrug. Though the corporate has been round for 13 years, it has been outlined extra by successive flirtations with demise and unseemly company revelations than by modern concepts for the second half of its life. Few had been stunned when the newest, and probably not the ultimate, chapter arrived.

Whereas some tales are higher advised beginning on the finish, the WeWork story is greatest advised from the start: It began as an organization that rents desks. That’s it. Sure, it has been described as an enterprise offering “versatile co-working areas” with the worth provides of “collaboration” and “group.” Through the years it has variously billed itself as an actual property firm and a high-tech agency. It has dabbled in on-line occasions, run a design company, owned a smartphone authentication startup, acquired an on-line services administration platform, and stretched the We model past recognition (WeLive, WeGrow, Rise by We, and others). On the root of all, although — buried deep beneath a morass of company mysticism, questionable enterprise dealings, and most of all a penchant for squandering cash at a Biblically diluvian charge — is a enterprise of renting desks.

One can simply see how the sharing mannequin employed by Uber, AirBNB, Turo, TaskRabbit, Spinlister, and different such companies would’ve discovered its manner into the industrial actual property enterprise. But subleasing as a enterprise was not pioneered by WeWork. Giant city workplace buildings are regularly not absolutely occupied exterior conventional enterprise hours. And infrequently are there workplace areas sufficiently small to each accommodate and justify the expense of 1 or two people, or for under a day or two per week, or different permutations thereof. And that is the place financial calculation begins: If some sensible individual might work out deal with industrial house like a four-dimensional sport of Tetris, cleverly becoming completely different occupancy wants of areas and occasions collectively in ways in which conventional constructing managers can’t or gained’t, they may not solely serve an unmet want, however eke out a revenue within the course of.

However landlords aren’t terribly desirous about placing wild-eyed intermediaries between themselves and their earnings. So an entrepreneur desirous about providing distinctive, customizable workplace areas has to first hire out house, normally a number of flooring or a whole constructing, solely then dividing it into the weird items for which there could also be a market. Whereas ultimately WeWork did buy and function its personal buildings, its primary enterprise is that of a sublessor: renting house to hire again out at a slight premium with perks to reinforce the marketability of areas. A few of these facilities had been delicate, like dartboards or Ping Pong tables. Others appeared out-of-place in a enterprise context, like beer on faucet and hammocks. A number of, like administrative assist, cellphone techniques, and printers undoubtedly added worth.

Whereas there are various challenges to operating that sort of enterprise, a number of are instantly evident. First, margins are more likely to be small — even earlier than spending on inducements. Additionally, offering most permutability to would-be renters of varied sizes and phrases requires taking long-term leases. And it goes with out saying that so as to make important income and earnings, the enterprise — once more, essentially, renting desks — must be scaled enormously. Extra flooring, in additional buildings, in additional cities, with tireless advertising and marketing, gross sales, and improvement assist.

If, someday in 2019, you’d requested a significant, worldwide sublessor what the foremost threats to their enterprise had been, they’d most likely have mentioned a terror assault or critical recession. However each of these issues have occurred, and whereas they dampened financial development, they weren’t long-lasting. Plus, worldwide diversification gives a hedge, of kinds, to that sort of shock. What few, if any, would have guessed is {that a} pandemic would escape. Far fewer would have guessed that governments all over the world, with few exceptions, would reply to a pandemic by ordering widespread enterprise shutdowns, restrictions on in-person conferences, and different heedlessly harmful insurance policies. And who, even when the phrase COVID turned a part of the 24-hour information cycle all through 2020 and 2021, would have anticipated that the comfort of non-pharmaceutical interventions wouldn’t be met by a surge again into workplace areas, however by a vastly broader acceptance of distant work?

Sooner or later, the numerous idiosyncrasies of founder Adam Neumann are more likely to determine prominently in WeWork retellings. The reason for the chapter that’s more likely to prevail, nonetheless, is that WeWork was felled by COVID precautions. Actually, WeWork was conceived of and established through the Federal Reserve’s post-2008 collapse zero rate of interest coverage (ZIRP), at a time when credit score was low-cost and plentiful. And simply as the corporate was going through calamity, traditionally expansive financial and financial coverage measures gave the long-ailing WeWork a reprieve earlier than it finally succumbed to long-looming monetary vulnerabilities.

Austrian Enterprise Cycle Principle

It generally puzzles observers that scores of sound companies buzzing alongside would instantly collapse in massive bunches as financial situations start to deteriorate. Or relatedly, that companies that are unprofitable can at occasions limp alongside for years on finish. The Austrian Enterprise Cycle Principle (ABCT) presents a proof for these phenomena, by focusing upon the connection between central financial institution insurance policies, rates of interest, and the allocation of sources inside an financial system.

ABCT designates the beginning of booms with a interval of credit score enlargement by a central financial institution, which generally entails decreasing rates of interest and growing the cash provide. This enlargement results in a lower in market rates of interest, making borrowing cheaper and extra engaging to companies and buyers. On account of the decrease rates of interest, companies and buyers enhance their borrowing and funding actions. This results in an financial growth characterised by elevated spending, funding in long-term tasks, and a common sense of optimism within the financial system.

Artificially low rates of interest (charges set by coverage, reasonably than set by market forces in lending markets) ship deceptive alerts to entrepreneurs and buyers. These low charges recommend that sources are extra considerable than they really are, and that the time choice for consumption, versus saving and funding, has modified. Entrepreneurs and companies reply to the distorted rate of interest alerts by making investments in long-term and capital-intensive tasks that will not be economically viable in the long term. They might have interaction in speculative ventures and allocate sources inefficiently. Owing to bountiful credit score at negligible value, enterprise ideas which, in regular intervals at market-determined charges, might by no means have gotten off the bottom are usually not solely established however achieve preliminary traction.

The credit score enlargement can result in the creation of asset bubbles in numerous sectors. These bubbles are unsustainable as a result of they’re pushed by the substitute credit score enlargement reasonably than real financial fundamentals. Finally, the unsustainable nature of the growth turns into evident. The central financial institution might begin to increase rates of interest or cut back financial stimulus, resulting in a contraction in credit score and a shift in market sentiment. This triggers the “bust” part. Malinvestments made through the growth turn out to be obvious. Companies might discover that their long-term tasks are not worthwhile, resulting in bankruptcies, layoffs, and a revaluation of asset costs.

The Federal Reserve started its first spherical of quantitative easing (QE1) in late 2008 in response to the worldwide monetary disaster. It was adopted by QE2, which ran from November 2010 to September 2012 and QE3, which resulted in October 2014. WeWork’s institution in March 2010 locations its company start late throughout the first, most-expansionary part of the post-2008-crisis financial coverage regimes.

When rates of interest are pushed to rock-bottom costs as a matter of coverage, buyers start to hunt higher-risk tasks and automobiles to supply significant returns. This phenomenon is named the “attain for yield,” which has been seen time and time once more all through growth and bust cycles. It might induce particular person buyers getting ready for retirement to desert funding grade bonds and inventory indices in favor of riskier securities. And it could drive enterprise capital companies already within the enterprise of taking up speculative ventures to ratchet up their publicity to unsure and questionable ventures. This has been proven from one speculative bubble to the following.

The WeWork Saga

As talked about beforehand, WeWork has executed one factor constantly since its founding: lose cash. A $15 million funding in 2010 which valued the corporate at $45 million leapt to a $16 billion valuation by 2016. By that point, the agency was already struggling, lacking a number of monetary targets and shedding a considerable variety of its workers. By mid-2017 the agency was valued at $20 billion, boosted by high-profile investments from the Softbank Imaginative and prescient Fund amongst others. All through this era, WeWork embarked upon an acquisition spree, buying high-profile buildings, worldwide areas, opponents, and a number of companies (some notably uncommon). The valuation of the corporate reached roughly $42 billion by the top of 2018, even because it misplaced over $2 billion all year long.

The height of WeWork’s valuation was $47 billion in January 2019. At that time, an preliminary public providing of inventory was thought of, and in August 2019 a Type S-1 was filed with the US Securities and Change Fee (SEC).

(It’s instructive at this level to notice that an preliminary public providing, whereas generally depicted as a magnanimous alternative for retail buyers, is the truth is an exit technique for founders and early-stage buyers. Though most corporations proceed to generate optimistic returns after going public, IPOs are undertaken when the final consensus amongst insiders is that the explosive interval of preliminary development is over, almost so, or that public fairness valuations are excessive sufficient that they need to be taken benefit of.)

The submitting revealed WeWork to be incurring large losses, with questionable governance preparations and doubtful prospects. Of explicit observe was the disclosure that the corporate had incurred $47 billion in future lease obligations with solely $4 billion in lease commitments. A variety of questionable monetary metrics throughout the submitting moreover raised issues concerning the correct depiction of the agency’s monetary well being. The impact of those revelations, in addition to doubts concerning the health of Neumann to function the CEO of a public firm, led to the IPO being withdrawn in September 2019. Inside this time interval, the corporate’s valuation plummeted from almost $50 billion to an estimated $10 billion.

In November, SoftBank Group disclosed a $9.2 billion loss within the worth of its investments in WeWork, which amounted to roughly 90 % of the $10.3 billion that SoftBank had beforehand invested in WeWork over the previous years. Lower than two weeks later, WeWork introduced workforce reductions of roughly 20 % of its world headcount. The agency was already struggling mightily earlier than the pandemic struck.

With the onset of the pandemic got here a number of rounds of massively expansionary financial coverage packages, in addition to fiscal stimuli insurance policies, on a world scale. A inventory market crash in March 2020 — the primary since 1987 — accompanied by a number of rounds of stimulus checks, rock-bottom rates of interest, and collective ennui, drove buyers into markets starting from equities to cryptocurrencies and past. The coordinated quick squeezes of a handful of distressed fairness points was emblematic of the results of the huge credit score growth.

All through 2020, WeWork liquidated a few of its Chinese language property and engaged in a number of extra rounds of layoffs. It additionally renegotiated sure lease agreements and deferments at many areas. Low-cost cash and seemingly insatiable danger appetites all year long led to a surge in Particular Goal Acquisition Firm (SPAC) offers, which:

are additionally generally known as clean examine corporations … [T]hrough a SPAC transaction, a non-public firm can turn out to be a publicly traded firm with extra certainty as to pricing and management over deal phrases as in comparison with conventional preliminary public choices, or IPOs … Not like an working firm that turns into public by means of a conventional IPO, nonetheless, a SPAC is a shell firm when it turns into public. Which means it doesn’t have an underlying working enterprise and doesn’t have property aside from money and restricted investments, together with the proceeds from the IPO.

This was the means by which WeWork finally turned a publicly traded firm on October 21, 2021. It ended its first buying and selling day up 13 % to $11.78 per share, for a valuation of $9 billion.

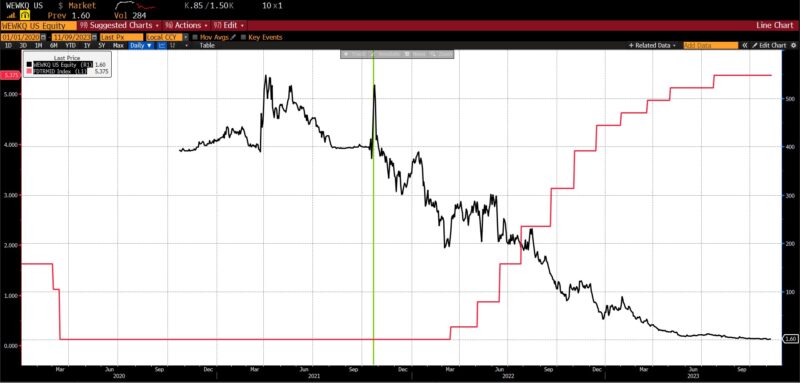

Fed Funds charge (crimson), WeWork inventory worth (black, w/first buying and selling date inexperienced horizontal line)

(Supply: Bloomberg Finance, LP)

Lower than six months later, in March 2022, the Federal Reserve started its most-aggressive contractionary coverage marketing campaign in 4 many years to arrest the surge of inflation in the US. With increased rates of interest and the contraction of the stability sheet, the scale of the US cash inventory started contracting for the primary time in many years. Because the move of credit score slowed and have become costlier, the prospects of many SPACs dimmed, with their inventory costs following.

After going public, WeWork’s inventory worth and valuation declined steadily. By August 2023 the share worth hit $0.14 cents, down 99 % in 22 months. WeWork bonds traded at a deeply distressed 10 cents to the greenback. As soon as valued at $47 billion, the corporate’s valuation had fallen to $300 million. To keep up the minimal $1 bid worth required to stay listed on the New York Inventory Change, the corporate undertook a 1:40 reverse break up. And regardless of a debt restructuring, shedding superfluous property, and the renegotiation of just about all of its remaining world leases, WeWork filed for chapter on Monday, November sixth, with $15 billion in property, $18 billion in debt, and at a reverse break up inventory worth of 84 cents valued at $60 million. Softbank’s complete losses in WeWork are calculated at over $14 billion.

Since 2008, some eleven years have seen coverage charges set at one % or much less. In that point interval, the year-over-year enlargement of various financial aggregates has assorted tremendously. From March 2020 to July 2022, the M2 cash provide elevated by virtually $6 trillion, and has since been contracting on the quickest charge in many years.

Corporations based in straightforward cash intervals will are usually probably the most weak. Many companies will survive the credit score crunch, however few will emerge unscathed. WeWork is simply among the many most outstanding of numerous companies which had been carried aloft by expansionary insurance policies, now feeling the results of the extreme contractionary reversal (see additionally Peloton, Past Meat, Zoom, Didi World, and others).

Inventory costs of Peloton (blue), Past Meat (inexperienced), Zoom (purple), and Didi World ADR (crimson), M1 Cash Provide Index (black sprint), and M2 Cash Provide M2 Index (black dots), 2020 – current

(Supply: Bloomberg Finance, LP)

The liquidation of malinvestment is painful and takes time. There shall be extra layoffs, extra breached contracts, and extra hearth gross sales. There’s a probability that, tremendously scaled down and extremely centered, WeWork can emerge from chapter and discover some measure of business success. Or its property could also be acquired by different entrepreneurs and put to work profitably. One can not and shouldn’t fault enterprise visionaries for trying to scale a distinct segment, low-margin enterprise into a world empire…even when that enterprise is renting desks. Nor are they to be blamed for profiting from investor curiosity, expansive credit score presents, or unconventional sources of financing. The trigger finally lies not with them, and far much less with a virus, however with the financial interventionism that made each the try and the following wreckage attainable.