Keep knowledgeable with free updates

Merely signal as much as the Rising markets myFT Digest — delivered on to your inbox.

Many smaller rising markets are confronting a “silent debt disaster” as they battle with the influence of excessive US rates of interest on their already-fragile funds, the World Financial institution has warned.

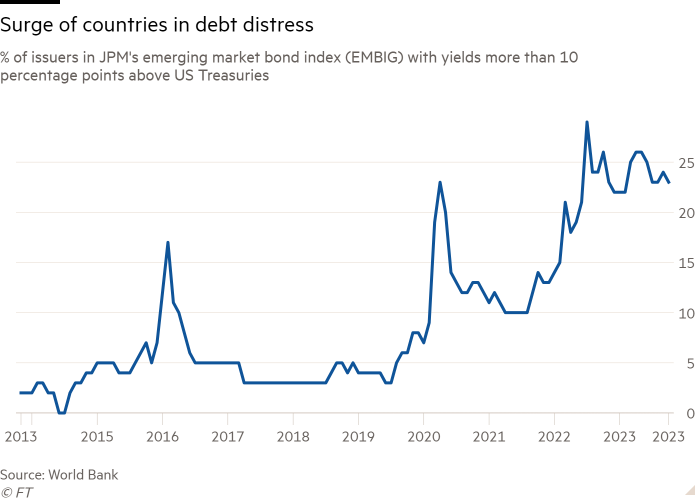

After a pointy sell-off final 12 months triggered by a fast rise in world rates of interest and a sturdy greenback, international forex rising market debt has struggled to recuperate as buyers wager that borrowing prices must keep greater for longer.

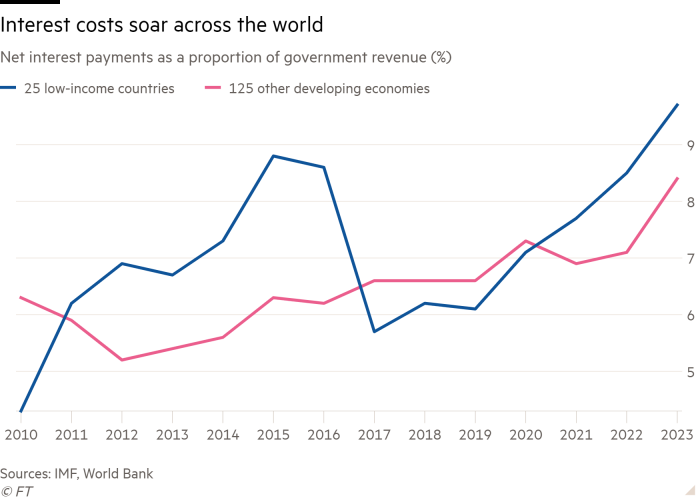

That has left the proportion of rising and creating nations whose borrowing prices are greater than 10 share factors above these of the US at 23 per cent. That compares with lower than 5 per cent in 2019, the World Financial institution calculates, in a sign of the stress these economies are actually below.

In consequence, debt curiosity funds as a share of presidency revenues have been at their highest degree since a minimum of 2010, based on the financial institution.

The financial coverage tightening cycle had been a “nightmare” for lower-income nations with excessive ranges of debt, mentioned Ayhan Kose, deputy chief economist of the World Financial institution Group in an interview. “Given the well-defined challenges these economies are dealing with with respect to rolling over debt obligations . . . we’re saying there’s a silent debt disaster that has been going down.”

The ache from greater borrowing prices is predicted to be significantly acute for lower-income nations, provided that a lot of them ran up massive debt piles through the Covid-19 pandemic.

Increased yields imply bigger curiosity funds on freshly issued debt, which might power up debt-to-gross home product ratios if governments borrow extra to fund these funds. Bond yields transfer inversely to costs.

Rising market and middle-income nations’ common gross authorities debt burden is heading above 78 per cent of GDP by 2028, based on IMF forecasts, in contrast with simply over 53 per cent a decade earlier.

Whereas lots of the greatest rising economies have weathered greater borrowing prices comparatively nicely, smaller economies with extra fragile funds have struggled.

The rise in yields has additionally shut off many low-income nations from worldwide financing, pushing the likes of Ghana and Sri Lanka into default and leaving many others on the brink.

A subset of weaker rising and creating nations “have been simply priced out of the greenback bond market”, mentioned Brad Setser, a senior fellow on the Council on International Relations. “It’s an atmosphere the place solely the stronger rising markets can afford to borrow in {dollars}.”

If charges keep greater for an prolonged interval, borrowing prices are prone to bear down on financial progress, say analysts, making it tougher for economies to develop out of their debt stresses. That’s significantly worrying for nations corresponding to Egypt and Kenya, which every have bonds maturing subsequent 12 months and face the tough prospect of attempting to refinance at greater yields.

“Increased prices to finance will over time weaken fiscal deficits, so nations might want to tighten their belts to keep away from having their debt ratios rise,” mentioned Lucas Martin, fixed-income sovereign strategist at Financial institution of America, noting that this could possibly be sophisticated in nations the place there may be fatigue over austerity measures.

Increased US rates of interest additionally cut back the power of rising economies to chop their very own charges even when home inflation has fallen, as this might weaken their currencies, resulting in inflation by way of greater import costs.

A number of rising economies have been a lot quicker to react than western central banks to the specter of inflation in 2021 and have already began reducing charges. However nations together with Hungary and Chile have slowed the tempo at which they’re reducing in current months, partly to assist their currencies within the face of upper US charges.

The amount of international forex debt issued in rising markets has slumped dramatically over the previous two years as the price of borrowing has soared. Rising markets have issued about $360bn of international forex debt this 12 months, based on Dealogic, following complete issuance of $380bn in 2022. That follows issuance of between $700bn-$800bn in every of the earlier three years.

Issuance has been hit by a scarcity of demand, as buyers favoured issuers with excessive credit score scores, and waning provide as many sovereigns with low credit score scores misplaced market entry through the fast enhance in US charges of the previous 18 months.

“It’s a textbook atmosphere for buyers to hunker down and transfer capital towards the US and de-risk in EM and different asset courses,” mentioned Paul Greer, rising market debt fund supervisor at Constancy. “Increased yields means costlier issuance, until you really want to borrow you could be a bit tactical and await decrease yields to difficulty.”