All employers are answerable for reporting worker wage and tax data to the IRS. Many employers use Kind 941 to report this data every quarter. However, some eligible small enterprise house owners use Kind 944 to report wages and taxes yearly as an alternative. Are you considered one of them? If that’s the case, you must learn to fill out Kind 944.

What’s Kind 944?

Kind 944, Employer’s Annual Federal Tax Return, reviews federal earnings and FICA (Social Safety and Medicare) tax on worker wages.

Employers who use Kind 944 solely file and pay withheld taxes yearly. The 944 kind is a substitute for the quarterly Kind 941. However, solely qualifying small employers can use Kind 944.

Chances are you’ll qualify to make use of Kind 944 as an alternative of Kind 941 in case your annual legal responsibility for federal earnings, Social Safety, and Medicare taxes is $1,000 or much less yearly. Solely use Kind 944 if the IRS sends you a written discover.

Tips on how to fill out Kind 944 for 2023

Did the IRS notify you that you would be able to fill out the 944 kind? Check out the next steps to learn to fill out IRS Kind 944 to report wages paid in 2023.

1. Collect Kind 944 data

Except you utilize payroll software program, you’ll have to fill out Kind 944 by hand. To try this, collect some primary details about your enterprise, worker wages, and payroll taxes.

Earlier than studying the ins and outs of the way to fill out a 944 kind, get the next data prepared:

- Details about your enterprise (e.g., title, deal with, and Employer Identification Quantity)

- Whole wages you paid staff in the course of the yr

- Suggestions staff reported to you

- Federal earnings tax you withheld from worker wages

- Employer and worker shares of Social Safety and Medicare taxes

- Further Medicare tax withheld from worker wages

- Sure credit and changes

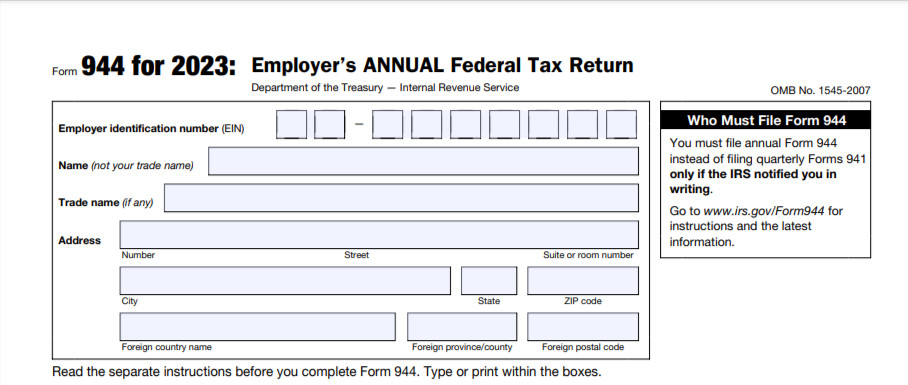

2. Fill out enterprise data

The highest portion of Kind 944 is reserved for enterprise data, together with your:

3. Fill within the sections of Kind 944

There are 5 components of Kind 944. Should you’d prefer to observe alongside, you’ll find the newest model of the 944 on the IRS web site.

Remember that there may be additionally a cost voucher kind (Kind 944-V, Fee Voucher) on the finish of Kind 944. However, you solely have to deal with Kind 944-V in case you pay with a test or cash order.

Right here’s the way to fill out a 944 kind by half, full with screenshots.

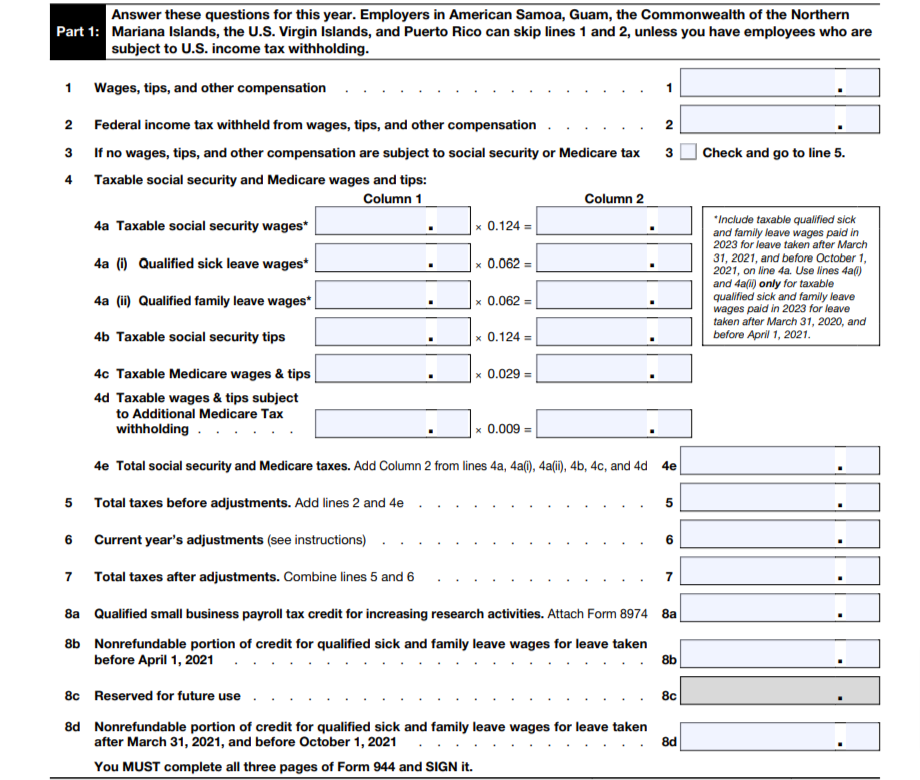

Half 1: Questions for the yr

Half 1 of Kind 944 has 12 traces. Some traces have a number of components (e.g., 4a, 4b, and so forth.). Half 1 begins on Web page 1 of the 944 and continues onto Web page 2. Whenever you get to Web page 2, you should add your title and EIN to the highest of the web page.

Right here’s an in depth have a look at every line and the data you must present.

Line 1

Enter the full wages, ideas, and different compensation you paid staff in the course of the yr, together with sick pay. This contains the quantities you additionally embrace in field 1 in your staff’ Varieties W-2.

Don’t embrace certified sick or household depart wages right here.

Line 2

On line 2, enter the quantity of federal earnings tax you withheld from wages, ideas, and different compensation.

Embrace federal earnings tax you withheld from:

- Certified sick depart wages paid in 2023 (for depart taken after March 31, 2020 and earlier than October 1, 2021)

- Certified household depart wages paid in 2023 (for depart taken after March 31, 2020 and earlier than October 1, 2021)

- Suggestions

- Taxable fringe advantages

- Supplemental unemployment compensation advantages

Don’t embrace earnings tax withheld by a third-party sick payer, if relevant, or certified well being plan bills.

Line 3

Verify the field on line 3 if no wages, ideas, and different compensation are topic to Social Safety or Medicare tax. Then, you possibly can skip traces 4a-4e and go to line 5.

Depart this field clean if wages, ideas, and different compensation are topic to Social Safety or Medicare tax. Then, fill out traces 4a-4e.

Strains 4a-4e

Line 4 reviews taxable Social Safety and Medicare wages and ideas. Fill out traces 4a-4e if wages, ideas, and different compensation you paid staff are topic to Social Safety or Medicare tax.

Remember that wages above the Social Safety wage base are usually not topic to the Social Safety tax, so don’t embrace them. The 2023 Social Safety wage base is $160,200. Medicare doesn’t have a wage base. As a substitute, there’s a further Medicare tax fee of 0.9% you should withhold when an worker earns $200,000 or extra.

4a

Enter taxable Social Safety wages on line 4a below column 1. Multiply this quantity by 0.124 (aka 12.4%, the full tax fee shared between employers and staff). Then, enter the full in column 2.

4a(i)

Enter certified sick depart wages on line 4a(i) that you just paid in 2023 for depart taken after March 31, 2020 and earlier than April 1, 2021. Then, multiply by 0.062 (aka 6.2%, the worker portion of Social Safety tax). Lastly, enter the full in column 2. These wages are usually not topic to the employer portion of Social Safety tax.

4a(ii)

Enter certified household depart wages on line 4a(ii) that you just paid in 2023 for depart taken after March 31, 2020 and earlier than April 1, 2021. Then, multiply by 0.062. Once more, enter the full in column 2. These wages are usually not topic to the employer portion of Social Safety tax.

4b

Enter taxable Social Safety recommendations on line 4b below column 1. Multiply this quantity by 0.124. Then, enter the full in column 2.

4c

Now, you possibly can transfer on to Medicare. Enter your staff’ whole taxable Medicare wages and recommendations on line 4c below column 1. Multiply this quantity by 0.029 (aka 2.9%, the full tax fee shared between employers and staff). Enter the full in column 2.

4d

If any of your worker wages and ideas have been topic to further Medicare tax withholding, enter the quantity on line 4d below column 1. Multiply the quantity by 0.009 (aka 0.09%) and enter the full in column 2.

4e

And final however not least, add all your column 2 totals up from traces 4a-4d. Enter the full quantity in line 4e. That is the full Social Safety and Medicare taxes.

Line 5

Enter your whole taxes earlier than changes on line 5. To do that, add collectively traces 2 (federal earnings tax withheld) and 4e (whole Social Safety and Medicare taxes).

Line 6

Greater than doubtless, you’ll have to do some changes to account for:

- Fractions of cents (attributable to rounding regarding Social Safety and Medicare taxes withheld)

- Sick pay (third-party sick payer)

- Suggestions and group-term life insurance coverage

Changes for fractions of cents might be both optimistic or adverse. Enter a adverse quantity for ideas and group-term life insurance coverage changes.

Line 7

Add collectively the quantities on traces 5 and 6. Enter the quantity on line 7.

Strains 8a-8g

Strains 8a-8g take care of nonrefundable credit.

8a

Line 8a is for a payroll tax credit score for rising analysis actions. Enter the quantity of credit score from Kind 8974, line 12 if this credit score applies to you. And, connect Kind 8974, Certified Small Enterprise Payroll Tax Credit score for Growing Analysis Actions.

Depart 8a clean if this credit score doesn’t apply to your enterprise.

8b

Did you pay certified sick depart or household depart wages in 2023 for depart taken after March 31, 2020 and earlier than April 1, 2021? If that’s the case, enter the nonrefundable portion of credit score for certified sick and household depart wages on line 8b.

Yow will discover the nonrefundable portion of the credit score for certified sick and household depart wages from Worksheet 1, step 2, line 2j.

8c

Line 8c is presently “Reserved for future use.” Depart this clean.

8d

Did you pay certified sick depart or household depart wages in 2023 for depart taken after March 31, 2021 and earlier than October 1, 2021? If that’s the case, enter the nonrefundable portion of credit score for certified sick and household depart wages on line 8d.

Yow will discover the nonrefundable portion of the credit score for certified sick and household depart wages from Worksheet 2, step 2, line 2p.

8e

Line 8e is presently “Reserved for future use.” Depart this clean.

8f

Line 8f is presently “Reserved for future use.” Depart this clean.

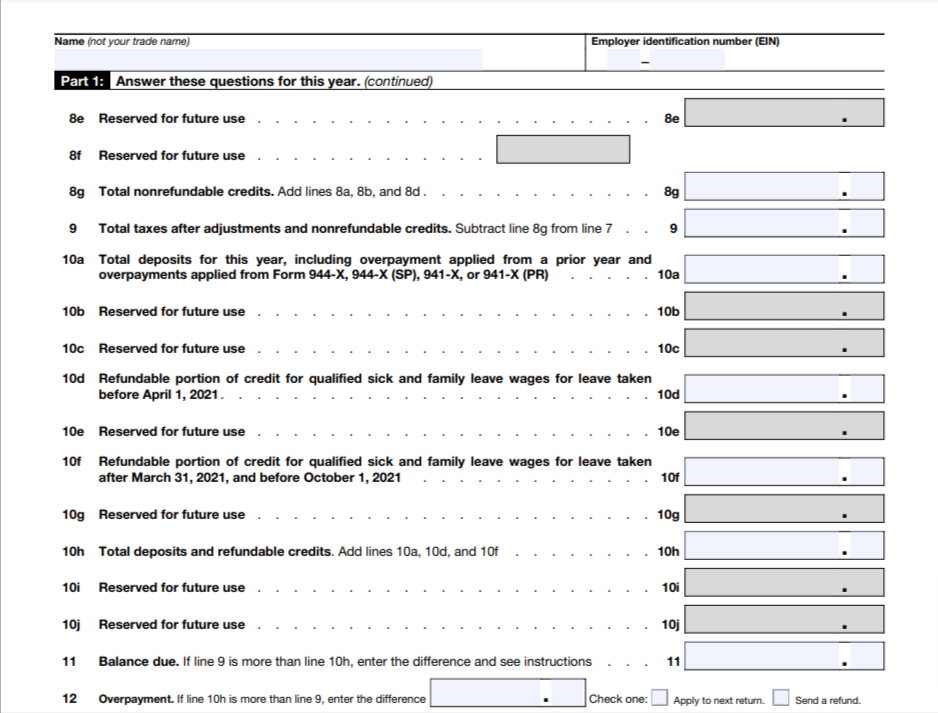

8g

Add collectively traces 8a, 8b, and 8d, and enter the full right here.

Line 9

Enter your whole taxes after changes and nonrefundable credit. Yow will discover this quantity by subtracting line 8g from line 7. You can’t enter an quantity lower than zero.

If line 9 is lower than $2,500, you possibly can pay the quantity with Kind 944 utilizing Kind 944-V or depositing the quantity.

If line 9 is $2,500 or extra, deposit your tax liabilities with an digital funds switch (EFT). However, you possibly can pay taxes with Kind 944 in case you deposited taxes accrued within the first three quarters of the yr and your fourth quarter legal responsibility is lower than $2,500.

Strains 10a-10j

Not all traces are presently in use. There are a number of traces you should depart clean as a result of they are saying “Reserved for future use:”

10a

Line 10a reviews your whole deposits for the yr. This contains overpayments utilized from a earlier yr and overpayments utilized from Kind 944-X, 944-X (SP), or 941-X (PR).

10d

Did you pay certified sick depart wages, certified household depart wages, or each in 2023 for depart taken after March 31, 2020 and earlier than April 1, 2021? If that’s the case, enter the quantity right here.

That is the refundable portion of credit score for certified sick and household depart wages for this era. Yow will discover this data from Worksheet 1, step 2, line 2k.

10f

Did you pay certified sick depart wages, certified household depart wages, or each in 2023 for depart taken after March 31, 2021 and earlier than October 1, 2021? If that’s the case, enter the quantity right here.

That is the refundable portion of credit score for certified sick and household depart wages for this era. Yow will discover this data from Worksheet 2, step 2, line 2q.

10h

Report the full deposits and refundable credit by including collectively traces 10a, 10d, and 10f.

Line 11

Should you underpaid (aka line 9 is larger than line 10h), enter your steadiness due. Your steadiness due is the distinction between traces 9 and 10h.

Should you didn’t underpay, depart this line clean and transfer on to line 12.

Line 12

Should you overpaid (aka line 10h is larger than line 9), enter the quantity right here. Your overpayment is the distinction between traces 10h and 9.

Should you didn’t overpay, depart this line clean and return to line 11.

Additionally, determine in order for you the IRS to:

- Apply your overpayment to your subsequent return

- Ship a refund

Verify the suitable field.

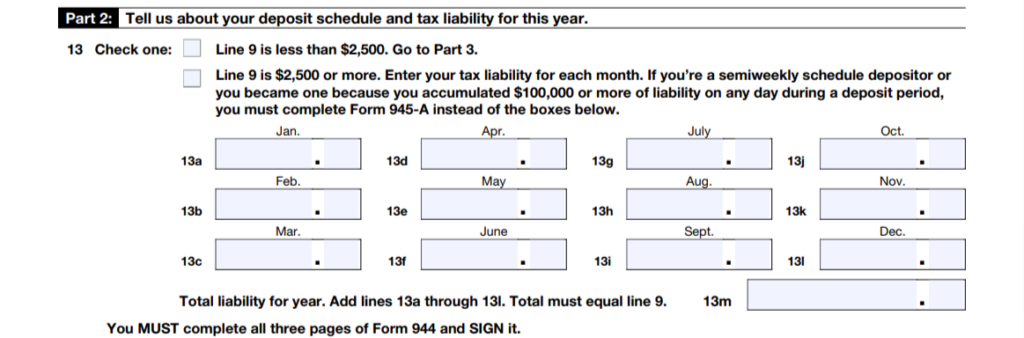

Half 2: Deposit schedule and tax legal responsibility for the yr

In comparison with Half 1, Half 2 is comparatively quick. Actually, there’s just one line—line 13. Right here, you must enter details about your deposit schedule and tax legal responsibility.

Line 13

There are two containers to select from on line 13. The field you test relies on the quantity you enter on line 9.

If line 9 is lower than $2,500, mark an “X” subsequent to the primary field. Then, you possibly can transfer on to Half 3.

If line 9 is $2,500 or extra, mark an “X” subsequent to the second field and do one of many following, relying in your deposit schedule:

- Month-to-month tax depositor: Fill out traces 13a-13l. In traces 13a-13l, enter your month-to-month tax liabilities. Add up traces 13a-13l and enter the full in line 13m. Line 13m should equal line 9.

- Semiweekly tax depositor: Full Kind 945-A and file it together with your 944.

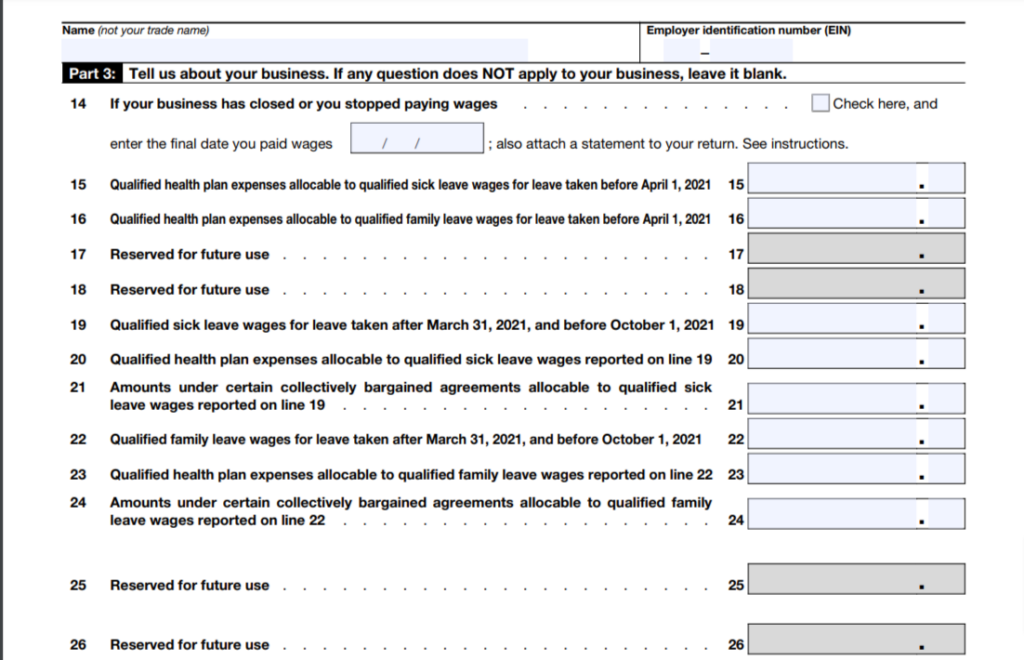

Half 3: About your enterprise

Half 3 begins on web page 3 of Kind 944. So, keep in mind so as to add your title and EIN on the prime of the web page.

Strains 14-26 make up Half 3 and ask questions on your enterprise. There are a number of traces on probably the most present Kind 944 that say “Reserved for future use.” Depart these clean. If some other questions don’t apply to your enterprise, depart them clean, too.

Line 14

Line 14 asks if your enterprise has closed or in case you stopped paying wages. If this line applies to you, test the field (aka enter an X) and enter the ultimate date you paid wages. You’ll additionally want to connect an announcement while you file Kind 944.

If this line doesn’t apply to you, depart it clean.

Line 15

On the present 944, enter any certified well being plan bills allocable to certified sick depart wages for depart taken after March 31, 2020 and earlier than April 1, 2021.

The quantity you enter on line 15 can be what you enter on Worksheet 1, step 2, line 2b.

Line 16

The present 944 asks you to enter any certified well being plan bills allocable to certified household depart wages for depart taken after March 31, 2020 and earlier than April 1, 2021.

The quantity you enter on line 16 can be what you enter on Worksheet 1, step 2, line 2f.

Line 17

The 944 for 2022 doesn’t use line 17. It’s “Reserved for future use.”

Line 18

The 944 for 2022 doesn’t use line 18. It’s “Reserved for future use.”

Line 19

Did you pay certified sick depart wages to staff in 2023 for depart taken after March 31, 2021 and earlier than October 1, 2021? If that’s the case, enter the quantity right here.

The quantity you enter on line 19 can be what you enter on Worksheet 2, step 2, line 2a.

Line 20

Enter any certified well being plan bills allocable to the certified sick depart wages you report on line 19.

The quantity you enter on line 20 can be what you enter on Worksheet 2, step 2, line 2b.

Line 21

Line 21 asks you to enter quantities below sure collectively bargained agreements which can be allocable to certified sick depart wages you report on line 19.

The quantity you enter on line 21 can be what you enter on Worksheet 2, step 2, line 2c.

Line 22

Did you pay certified household depart wages to staff in 2023 for depart taken after March 31, 2021 and earlier than October 1, 2021? If that’s the case, enter the quantity right here.

The quantity you enter on line 22 can be what you enter on Worksheet 2, step 2, line 2g.

Line 23

Enter any certified well being plan bills allocable to the certified household depart wages you report on line 22.

The quantity you enter on line 20 can be what you enter on Worksheet 2, step 2, line 2h.

Line 24

Enter quantities below sure collectively bargained agreements which can be allocable to certified household depart wages you report on line 22.

The quantity you enter on line 24 can be what you enter on Worksheet 2, Step 2, line 2i.

Line 25

The 944 for 2023 doesn’t use line 25. It’s “Reserved for future use.”

Line 26

The 944 for 2023 doesn’t use line 26. It’s “Reserved for future use.”

Half 4: Third-party designee

Would you like an worker, paid tax preparer, or one other individual to speak about your Kind 944 with the IRS? If that’s the case, Half 4 of Kind 944 is the place to checklist your third-party designee and their telephone quantity.

Including a third-party designee offers them the power to present lacking 944 data to the IRS, name the IRS to seek out out about processing Kind 944, and reply to IRS notices about math errors.

Verify “Sure” so as to add a third-party designee or “No” in case you don’t need anybody else to debate the return with the IRS.

Half 5: Signature

And at last, we’ve come to the final a part of studying the way to fill out Kind 944—the signature. Remember that solely sure individuals can signal Kind 944.

The next individuals can signal Kind 944 for every enterprise construction:

- Sole proprietorship: Proprietor

- Company: President, vp, or one other principal officer

- Partnership: Accountable and duly licensed associate, member, or one other officer

- Disregarded entity: Proprietor or a principal officer

- Belief or property: Fiduciary

Licensed signers should signal within the field subsequent to “Signal your title right here,” print their title and title, add a date, and embrace a telephone quantity.

Should you rent a paid preparer to fill out Kind 944, they need to fill out the “Paid Preparer Use Solely” part and embrace data like their title, deal with, and EIN.

4. Submit Kind 944 by the 2024 deadline

Kind 944 is due by January 31 every year. Nonetheless, the IRS could provide you with till February 12, 2024 in case you made on-time tax deposits.

The IRS encourages companies to file Kind 944 electronically. However, you possibly can select to mail a paper return as an alternative. The place you ship Kind 944 relies on your state and whether or not you’re making a deposit together with your kind. You’ll be able to view mailing addresses on the IRS web site.

Take a look at the IRS Kind 944 Directions for extra data on finishing and submitting the employer return.

Tips on how to fill out 944 kind precisely: Suggestions

The IRS supplies a number of ideas to assist employers make correct entries on Kind 944:

- Use 12-point Courier font if typing

- Don’t enter greenback indicators and decimal factors

- Enter {dollars} to the left of preprinted decimal factors and cents to the appropriate of them

- Don’t spherical entries to entire {dollars}

- Depart containers clean if they’ve a price of zero (besides line 9)

- Enter adverse quantities with a minus signal

- Add your title and EIN on every web page

- If submitting paper kinds, staple sheets within the higher left nook

- Full all three pages of Kind 944

How Patriot Software program handles Kind 944

Patriot Software program affords each Fundamental and Full Service Payroll to streamline payroll.

Patriot’s Fundamental Payroll software program prospects will be capable of fill out kind 944 with data present in payroll reviews within the software program.

Full Service Payroll prospects could have Kind 944 that Patriot will file with the IRS on the client’s behalf. Full Service Payroll prospects can view Kind 944 of their firm tax packets.

This text has been up to date from its authentic publication date of March 15, 2023.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.