Keep knowledgeable with free updates

Merely signal as much as the Conflict in Ukraine myFT Digest — delivered on to your inbox.

Inside days of Vladimir Putin’s full-scale assault on Ukraine, western capitals acted with outstanding dedication in blocking Russia’s entry to greater than $300bn of international change reserves. Within the 20 months since, nonetheless, the western sanctions coalition has received itself into ever extra contortions attempting to keep away from the morally apparent subsequent steps: seizing the reserves and deploying them for Ukraine’s profit.

The ostensible justification is authorized obstacles. But when these have been actually the rationale for such timidity, western governments would have been doing all they may to beat them: pursuing compensation claims below current regulation, pushing legislative modifications (as Canada, uniquely, has achieved), and endorsing outstanding attorneys’ arguments that Moscow has no authorized recourse towards asset seizures after its violations of worldwide regulation.

That this isn’t taking place reveals the authorized qualms as vicarious arguments for extra self-interested objections to seizure. Crucial is the worry that confiscating Russia’s property will make different non-western nations pull their very own reserves out of the west, in case someday the identical therapy may very well be meted out to them.

The priority is that this might destabilise the worldwide monetary system and specifically diminish the greenback’s and the euro’s captive buyers amongst central financial institution reserve managers. The European Central Financial institution has issued a powerful warning to European policymakers towards even taxing EU firms making windfall earnings on blocked Russian property — which appears probably the most that the sanctions coalition is at the moment prepared to ponder.

The argument appears to be like superficially sound. But it surely unravels upon a better take a look at the information. If non-western governments have been to react to seizure by pulling out their reserves, that horse would have already bolted on at the least two events: the blocking order itself, and the G7 announcement that accounts won’t be unblocked till Russia compensates Ukraine for its destruction.

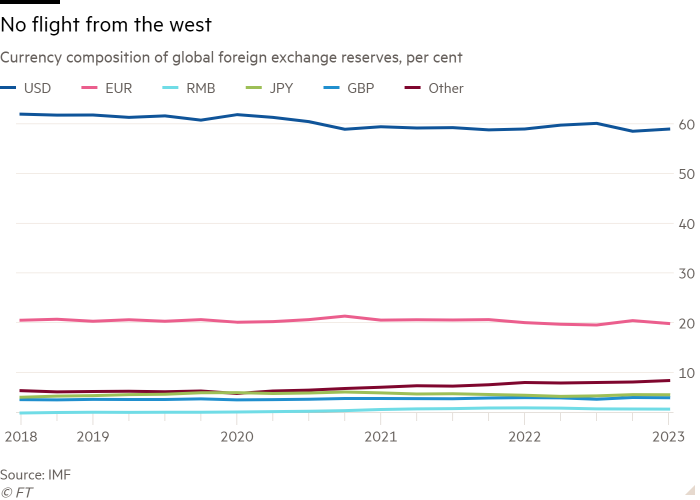

But IMF information reveals no subsequent shift of reserves out of the western fold. The place would they go? The biggest reserves belong to Beijing, and replicate gathered Chinese language commerce surpluses with western business companions. Claims on the west will stay denominated in western currencies and ruled by its legal guidelines. If Beijing wished to promote out of western property altogether, it will wrestle to seek out options. The remainder of the world is simply too small to deal with the dimensions of claims China desires to rack up.

Different giant reserve holders do at the least have an alternative choice to the west, specifically to position their official financial savings in China. That may come at an financial price: a non-convertible foreign money isn’t any selection for prudent reserve administration. Nor wouldn’t it make a lot sense politically. Nevertheless hypocritical or self-serving rising nations might discover the west, certainly nobody believes Xi Jinping is much less tempted to weaponise monetary dependence.

The one life like prospect is that non-western economies determine to not accumulate such giant reserves within the first place, and marginally diversify these they keep. There may be some signal of the previous. In 2022, world reserves fell by 8 per cent in greenback phrases earlier than recovering considerably. Extreme surpluses being a supply of worldwide instability, this isn’t one thing to worry. And sluggish diversification is certain to occur anyway as the worldwide financial system modifications.

The supposed price of seizing Russia’s reserves, then, is proscribed. It should in any case be held towards the financial beneficial properties. They embrace giving Ukraine the monetary means to win, get well and turn out to be match to affix the EU. It might additionally set a salutary precedent, suggesting {that a} nation that flagrantly assaults the worldwide order can not count on to take pleasure in its protections.

Different financial arguments are harboured in personal. One goes: Europe is aware of from its historical past that exacting funds from a defeated wartime foe could make issues lots worse. 100 years in the past, battle reparations imposed on Germany have been so giant that trying to pay them destabilised the German financial system.

However the switch downside doesn’t apply at present. Russia’s reserves are gathered surpluses from the previous. Taking them wouldn’t require the Russian financial system to supply unimaginable surpluses sooner or later. Name it the Weimar fallacy: there isn’t any parallel right here to the Versailles treaty’s errors.

That such ideas flow into is an indication of the west’s unreliable intentions. Nevertheless the battle ends, calls to deal with Russia “moderately” will all of a sudden multiply. All of the extra purpose to grab its reserves now.