Employed your first worker? Verify. Set a begin date? Verify. Able to course of payroll? Not fairly but. Earlier than you can begin paying your workers, there are a couple of steps you could know and a few phrases to be taught. This useful payroll 101 information explains the best way to arrange payroll the precise method so you may breathe simpler and get again to enterprise.

Earlier than you run payroll

Earlier than working your first payroll, you might have some preparation to do. Fortunately, a lot of the duties are ones you solely need to do as soon as.

Gathering payroll info

It’s essential collect some payroll info and register for accounts earlier than working payroll. Every of those accounts is required to run payroll and pay taxes. Listed here are some issues you could register for:

- Employer Identification Quantity (EIN)

- Digital Federal Tax Fee System (EFTPS) account

- State tax accounts (e.g., state unemployment insurance coverage)

- New rent reporting account from the state

- Employees’ compensation protection

This isn’t an all-inclusive listing. Your state might require you to register for extra payroll-related accounts. Contact your state for extra info.

After you collect all of your employer info, you additionally must get paperwork and particulars out of your worker to run payroll.

Every worker should fill out Type W-4, Worker’s Withholding Certificates. On the shape, the worker enters info that impacts how a lot federal earnings tax you withhold from their wages. Relying on the place what you are promoting is positioned, your worker may also must fill out a state withholding kind.

In the event you supply small enterprise worker advantages, you want the advantages election info for every worker. It’s essential understand how a lot you should withhold for the advantages and whether or not the deductions are pre-tax vs. post-tax.

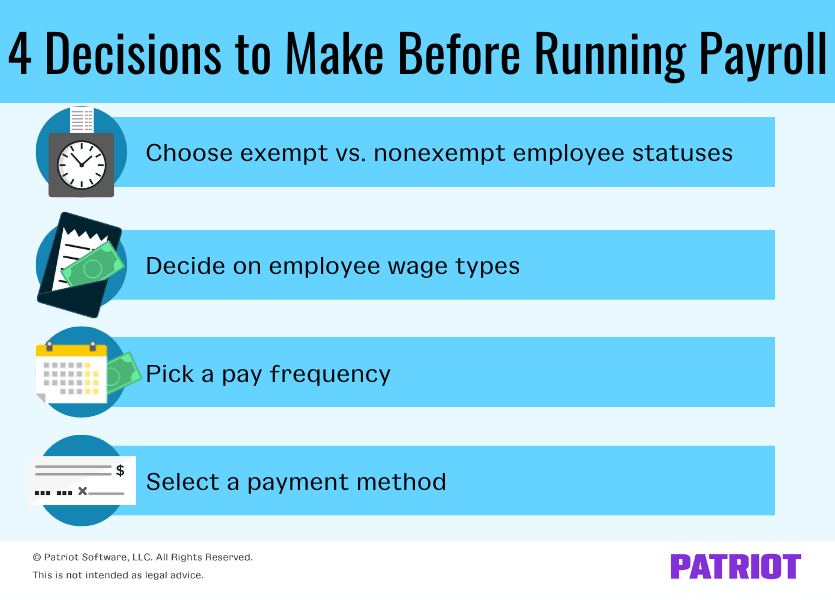

Making payroll choices

Have your whole employer and worker info sorted out? Good. Now that you recognize your employer accounts and worker withholding particulars, it’s time to make a couple of different payroll choices.

Exempt vs. nonexempt

First, decide if an worker is exempt vs. nonexempt from additional time wages. To be exempt below federal tips, an worker should fall below one of many following exemptions:

- Govt, administrative, or skilled exemption

- Laptop exemption

- Outdoors gross sales exemption

- Extremely compensated worker exemption

If the worker doesn’t meet one of many above exemption varieties, the worker is usually nonexempt, and you should pay the worker additional time wages for additional time hours labored. Some states require stricter standards than the federal authorities. Verify along with your state for extra info.

Worker wages

After figuring out if an worker is exempt or nonexempt, determine if you’ll pay an worker a wage vs. hourly wages. In case your worker is exempt, you should pay the worker a wage. But when your worker is nonexempt, you may select whether or not you pay a wage or an hourly wage.

Additionally, determine in case your worker will earn different wages, reminiscent of ideas or commissions.

Pay frequency

Decide a pay frequency. The pay frequency determines how usually you pay your worker. Frequent frequencies embrace weekly, biweekly, semimonthly, and month-to-month.

Once more, your state might have extra details about how usually you should pay workers. Be taught the pay frequency by state guidelines or test along with your state straight.

Fee technique

Are you aware how you’ll pay your workers and the way usually? Now it’s time to pick how you’ll give the worker their paychecks.

You possibly can pay your worker with a written or printed test, direct deposit, money, or payroll card. In the event you use direct deposit, you will have additional info to finish your payroll, reminiscent of what you are promoting’s checking account quantity and routing quantity. In the event you determine to make use of direct deposit to pay your workers, acquire their banking info, too.

Organising a payroll system for small enterprise

When you get all the mandatory info and make your payroll choices, it’s time to start out organising payroll. When organising payroll for small enterprise, you may both rent an worker or accountant, do payroll by hand, or use on-line payroll software program. Payroll software program is inexpensive than hiring somebody and fewer time exhaustive than doing payroll by hand.

Add all of your payroll info (e.g., worker withholding and cost information) to no matter system you utilize. That method, you’re ready the primary time you could run payroll.

After finishing the best way to arrange payroll for small enterprise, you’re able to run payroll.

Operating payroll 101

If you attain the top of a pay interval, it’s time to run payroll. The way you run payroll is determined by what payroll technique you utilize. Regardless of the variations, there are usually three steps of working payroll.

1. Gathering info, getting into hours, and making calculations

First, collect and calculate worker hours and wages. It’s essential know what number of hours your worker labored throughout the pay interval. Think about using time and attendance software program for small enterprise to assist with worker attendance administration.

You additionally must know your worker’s hourly wage or pay interval wage. Utilizing that info, calculate the worker’s earnings. Make sure you embrace additional time wages and every other earnings (e.g., fee).

After calculating the worker’s gross wages earned, subtract taxes and different deductions ( we’ll get to that later).

In the event you use payroll software program, the software program will robotically calculate your worker’s wages and withholdings.

2. Approving payroll

When the calculations are performed, double-check the outcomes for accuracy. This step is straightforward to skip over, however you shouldn’t.

In the event you do guide payroll calculations, ensure you did the mathematics appropriately. In the event you use payroll software program, test to ensure you entered the numbers appropriately (e.g., 40 hours as a substitute of 400).

If you find yourself approving payroll, look over the paycheck totals. The web pay and the withholdings must be the identical or just like earlier paychecks.

Verify to make sure that all withholdings are deducted from the worker’s paycheck earlier than approving payroll.

3. Paying your worker

After you approve payroll, you could get the wages to your worker. Use the cost technique you selected earlier to distribute the wages (e.g., direct deposit).

Payroll taxes

As an employer, you should withhold and contribute to employment taxes. The principle taxes you could learn about embrace:

- Social Safety and Medicare taxes

- Federal, state, and native earnings taxes

- Federal and state unemployment taxes

Every tax has its personal fee and guidelines. Verify them out within the chart beneath:

| Tax | Tax Charge | Wage Cap | Who Pays? |

|---|---|---|---|

| Social Safety Tax | 6.2% (Worker) 6.2% (Employer) |

$168,600 (2024) | Worker Employer |

| Medicare Tax | 1.45% (Worker) 0.9% (Further Medicare tax, worker solely) 1.45% (Employer) |

No wage cap

Further Medicare tax begins at: |

Worker Employer (Solely the worker owes further Medicare tax) |

| Federal Revenue Tax | Varies primarily based on worker’s earnings and withholding changes | No wage cap | Worker |

| State and Native Revenue Tax | Varies by state and locality (Doesn’t apply to all states and localities) | No wage cap | Worker |

| Federal Unemployment Tax (FUTA tax) | 6% (0.6% with tax credit score) | $7,000 | Employer |

| State Unemployment Tax/Insurance coverage (SUTA tax) | Varies by state | Varies | Employer

In some states, each worker and employer |

After you withhold the taxes, it’s a must to deposit them regularly. There are additionally kinds you could fill out as an employer. Here’s what you could learn about depositing and submitting payroll taxes:

| Tax | Deposit Frequency | The way to Deposit | Type to File | Submitting deadline |

|---|---|---|---|---|

| Social Safety, Medicare, and Federal Revenue Tax | Month-to-month or semiweekly (Will depend on a lookback interval) | Digital funds switch utilizing EFTPS, a tax skilled, or a payroll tax submitting service | Type 941 (Quarterly)

OR Type 944 (Annual), if relevant |

Quarterly: April 30 July 31 October 31 January 31 Yearly: January 31 |

| State and Native Revenue Tax | Varies | Varies | Varies | Varies |

| Federal Unemployment Tax (FUTA tax) | Quarterly, due on: April 30 July 31 October 31 January 31 |

EFTPS, a tax skilled, or a payroll service | Type 940 | January 31 |

| State Unemployment Tax/Insurance coverage (SUTA tax) | Varies | Varies | Varies | Varies |

Verify the IRS web site and your state tax web site for extra details about employment taxes.

Type W-2

On the finish of yearly, you should ship Type W-2, Wage and Tax Assertion, to your workers and the federal and state governments. Type W-2 summarizes what you paid your worker throughout the yr. The shape additionally lists how a lot you withheld for every tax.

You should ship Type W-2 to the worker, the Social Safety Administration (SSA), and your state authorities (if required) by January 31 every year. Additionally, ship Type W-3, Transmittal of Wage and Tax Assertion, with the copy of Type W-2 you ship to the SSA.

This text has been up to date from its authentic publication date of March 13, 2017.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.