This submit is a part of a collection sponsored by Insurance coverage Quantified.

“I Know, You Don’t Have Time to Learn This. You’re Drowning in Submissions.”

I’ve had the chance to spend a part of my profession serving to insurance coverage carriers and their underwriting groups to extend their submission circulation within the face of failing premiums and a seemingly bottomless pit of capability. At the moment, with premiums and thus commissions on the decrease aspect, it made loads of sense for carriers to give attention to consumer acquisitions. It was a pure alternative to essentially give attention to constructing out distribution networks and deepening relationships.

At this time, the market dynamics have modified for a number of markets, doubtless as a result of present exhausting market, and I as a substitute hear frequently from underwriting groups which can be drowning in submissions.

These situations of submission overload appear to be commonest in these merchandise and industries hit hardest by the firming market, particularly in Extra & Surplus (E&S), the place the market has grown by 20%. I’ve heard tales of shared submission e-mail inboxes which can be overflowing with submissions that haven’t been touched or responded to, to not point out these sitting in underwriters’ private inboxes. At first blush, this will sound like a pleasant drawback to have, however is it actually?

Success within the insurance coverage trade is rooted in relationships, notably for underwriters, who spend their careers cultivating partnerships. Underwriting groups have to be responsive with the intention to preserve their relationships and develop their distribution networks. If submissions are falling by way of the cracks, some savvy brokers will take steps to get your consideration in order that their purchasers can get quotes, however others will simply write you off.

The enterprise advantages of responding to all submissions transcend cementing a status for being well timed and responsive. It additionally unlocks the chance to cite extra enterprise and thus write extra premium, as improvements like simpler entry to knowledge and smoother workflows facilitate a extra scalable underwriting course of total.

The Enterprise Case for Systematic Prioritization

Once I speak with underwriting groups, I usually ask them what their submission-to-quote ratio is. Some can reply that query, however those that are actually drowning in submissions normally do not know. How may they, after they don’t totally perceive the scope of their submission influx? Nonetheless, what nearly each underwriting group does know is their quote-to-bind ratio, which is a key consider discussing why underwriting groups must regain management of the overflowing submission inbox.

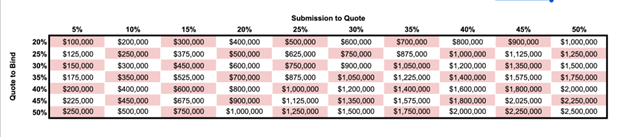

To assist illustrate this, I’ve offered a desk that appears on the financial impression of adjustments in a service’s quote price. This primary instance seems at a median coverage dimension of $10,000 with 1,000 submissions per 30 days.

Let’s look at the quote-to-bind ratio of 20%. With each 5% improve in submission-to-quote, this agency realizes an extra $100,000 in premium a month or $1.2 million a 12 months. But when the quote-to-bind ratio will increase to 50%, a 5% enchancment in submission-to-quote yields $250,000 a month in premium or $3 million a 12 months. The 5% improve is a primary benchmark determine, however this grows with the power to cite extra enterprise, assuming the quote-to-bind ratio stays constant as the amount will increase.

One of many counterarguments to this might be that not all of these submissions would fall into your urge for food, so how may you quote them? That is definitely true, however it’s additionally the case that figuring out extra about all these submissions that you’re presently lacking allows you to higher work along with your distribution companions to know your urge for food and maybe create new product choices higher aligned along with your distribution.

By now, hopefully you agree that it makes good financial sense to discover a approach to tackle all these untouched submissions in your inbox. In any case, this enterprise cycle will ultimately transfer on and cut back these volumes, so now’s the time to benefit from them and never squander vital relationships. The important thing query: how will you all of a sudden discover the time to handle all these submissions?

Key Tech Capabilities for Underwriting Prioritization

Happily, there’s expertise for that. Discovering the proper answer comes all the way down to assembling the proper set of capabilities to satisfy your small business necessities. On this specific use case, firms which can be inundated with submissions can profit tremendously from discovering an answer that won’t solely full the consumption course of in a well timed, correct method, however may also apply guidelines that assist prioritize and in the end floor the most effective alternatives for underwriters to give attention to. As you might be evaluating expertise options, listed below are some core capabilities to search for:

#1: Turning the mass of submissions into actionable knowledge for underwriting

One of many key ache factors we hear is round getting knowledge out of the inbox and right into a usable format for underwriting. Surprisingly, that is nonetheless a extremely handbook course of, with individuals usually compelled to enter knowledge a number of occasions, which takes time and will increase potential for human error. Ingestion expertise leverages AI and machine studying methodologies to extract the important thing knowledge wanted to judge submissions and convert them right into a constant, usable format.

#2: Validating and enhancing the ingested knowledge by way of verified, third-party sources

Extracting info is vital, however even properly formatted knowledge continuously has gaps and wishes verifying earlier than you may name it full and prepared for an underwriter. That is the place enrichment as a functionality is available in. By layering third-party knowledge sources on prime of your ingested knowledge, you may fill info gaps, decreasing back-and-forth along with your dealer whereas additionally constructing in checks and balances to validate the standard of the knowledge and cut back potential threat to your small business.

#3: Taking the newly acquired knowledge asset and overlaying your small business necessities

With this newly full knowledge asset at your fingertips, the final step within the course of is making use of some kind of logic to assist rapidly floor the most effective alternatives. There are workflow instruments that allow you to set guidelines particularly for your small business necessities which can be then mechanically utilized to all accomplished submissions. The tip result’s a complete software rating utilized to your complete submission pipeline that you should use to simply prioritize areas of focus and make knowledgeable, environment friendly choices.

Subjects

Business Traces

Enterprise Insurance coverage

Underwriting