As a company chief, that attaining your organization’s objectives is determined by the collective efforts of your government group, staff, and different stakeholders. The identical goes to your company giving initiatives. As philanthropy turns into an increasing precedence for corporations and customers all over the world, it’s extra vital than ever to rally everybody in your organization to make a mixed distinction in the neighborhood.

Whereas company giving packages are interesting to many socially acutely aware staff, a lot of them could not take part just because they aren’t conscious of the alternatives. That’s why creating a company charitable giving coverage is significant to the long-term success of your program.

If your organization wants a company giving coverage, we’ve bought you lined. We’ll stroll by all of the fundamentals and greatest practices within the following sections:

Greater than 26 million people work for corporations with matching reward packages, however over 78% of them are unaware that their firm presents this program or know any program specifics. Crafting a complete company charitable donations coverage is a straightforward and needed resolution to this lack of information.

What’s a Company Charitable Giving Coverage?

Company giving is one facet of an organization’s company social accountability (CSR), or its position in selling social good inside the neighborhood. By contributing funds, companies, and different sources to charitable causes, corporations can exhibit that they’re excited about extra than simply making a revenue, but in addition enhancing society as a complete.

A company charitable giving coverage outlines your organization’s method, tips, and processes for company giving. It serves as a supply of reality for directors and contributors alike, spelling out important particulars similar to eligibility standards and deadlines.

Solely 19% of corporations embody greater than a single paragraph on matching reward packages in accessible worker handbook supplies or their web site. Reasonably than leaving your staff in the dead of night, encourage them to embrace your company giving efforts by enlightening them about your packages. The extra info you present upfront, the simpler it is going to be for workers to become involved.

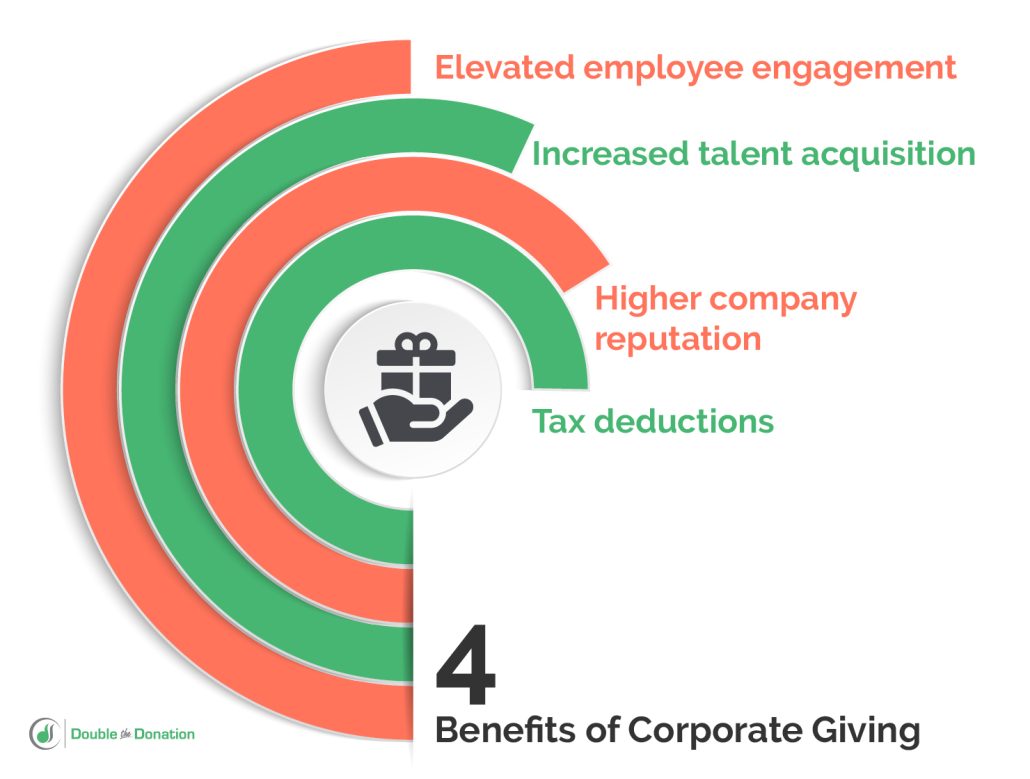

Advantages of Company Giving

An official company charitable donations coverage permits your organization to faucet into the total advantages of company giving. By demonstrating a extra critical funding in philanthropy, you’ll be capable to:

- Elevate worker engagement. Constructing a piece surroundings with engaged staff is vital to boosting their productiveness, encouraging innovation, and sustaining their dedication to your organization. A well-defined company giving program can produce a way of satisfaction amongst staff, serving to them really feel fulfilled and purposeful of their roles.

- Improve expertise acquisition. Current analysis reveals that 54% of U.S. staff are keen to take a pay reduce to work at an organization with higher values, and 56% wouldn’t even take into account working for an organization with values they disagree with. Subsequently, having a transparent company charitable giving coverage can appeal to extra socially acutely aware prime expertise to your firm.

- Increase firm status. The priorities of contemporary customers are altering. In keeping with Accenture, 46% of progressive customers would pay extra to assist a retail model that takes motion to enhance society. An in depth, public-facing company giving coverage can go a great distance towards demonstrating your organization’s social priorities and drawing in additional clients.

- Qualify for tax deductions. By participating in company giving, your organization can qualify for tax deductions. This implies you possibly can retain extra general earnings whereas retaining staff and producing a significant influence in your neighborhood.

To entry these advantages, you’ll have to arrange an efficient company giving program that staff are enthusiastic to become involved in.

On the similar time, company giving impacts extra than simply your organization. Thanks to those initiatives, nonprofits can increase extra funds, discover extra volunteers, and purchase extra sources for his or her causes. Mutually useful nonprofit-corporate partnerships permit each events to broaden their audiences and obtain extra.

Principal Varieties of Company Giving Packages

In your organization’s company giving coverage, you’ll specify the entire varied company giving alternatives that you simply supply. Whereas these will differ from firm to firm, let’s discover a number of the predominant varieties you would possibly embody in your coverage:

Matching Presents

A matching reward program permits staff to double the influence of their donations to nonprofits. After they make a present to a trigger they care about, they’ll submit an identical reward request to their employer. So long as they meet all the factors, the corporate will sometimes match that reward quantity and make a contribution of its personal to the nonprofit.

Whether or not or not your organization already has an identical reward program, staying up-to-date on well-liked program tips ensures that you simply design a rewarding expertise to your staff. Take into account these widespread matching reward tips and tendencies to tell your company charitable giving coverage:

- 93% of corporations have a minimal match requirement of lower than or equal to $50.

- 91% of corporations match donations at a 1:1 ratio.

- Greater matching reward caps yield larger worker engagement, with maximums above $10,000 seeing an engagement charge of as much as 40%.

If your organization is seeking to improve participation in its matching reward program, take into consideration reducing your minimal match requirement and rising your match ratio. This fashion, you’ll encourage staff to make a distinction by giving nevertheless a lot they’re comfy with.

Volunteer Grants

Company volunteer grants are one other well-liked kind of philanthropy much like matching items. Nonetheless, as an alternative of matching donation quantities, corporations award financial grants to nonprofits after their staff volunteer a sure variety of hours there.

In your company charitable donations coverage, you’ll clarify parameters similar to eligibility standards, restrictions, minimal volunteer hours required, and deadlines. Moreover, you’ll want to incorporate how a lot funding you’ll award for each hour volunteered.

Past volunteer grants, there are just a few different methods your organization can encourage volunteerism amongst staff. For instance, you possibly can present volunteer day without work (VTO) to empower extra staff to become involved of their neighborhood or manage company volunteer occasions to advertise team-building.

Neighborhood Grants

By neighborhood grants, corporations dispense monetary assist on to nonprofits, normally to deal with an area want or precedence inside their communities. To acquire this funding, nonprofits should meet the {qualifications} for the grant and full an software course of, which entails explaining what they’ll use the cash for.

A neighborhood grant will sometimes align together with your firm’s general mission and values. As an illustration, a healthcare firm could supply grants for nonprofit packages associated to enhancing the well being of neighborhood members. You may as well have interaction staff by asking for his or her enter in the neighborhood grants you present, similar to by giving them the chance to appoint nonprofits or vote on causes to assist.

Sponsorships

With sponsorships, corporations can assemble mutually useful partnerships with nonprofits as a part of their company philanthropy technique. You’ll fund a nonprofit’s occasion or challenge, and as thanks to your assist, the nonprofit will acknowledge your organization in its promotional supplies. This results in a win-win for each events, because the nonprofit receives important funds to conduct its actions and your organization advantages from additional advertising.

In-Variety Donations

Your organization can provide nonprofits with extra than simply financial sources by in-kind donations. These items embody varied items or companies that may energy a nonprofit’s mission. For instance, chances are you’ll contribute workplace gear, reward baskets for an upcoming public sale, or venue area for an occasion. Moreover, you could possibly contain extra staff by having them volunteer to offer free companies to a nonprofit, similar to graphic design or authorized consulting.

Scholarships

Many corporations select to put money into next-generation expertise by beginning company scholarship packages. Highschool and faculty college students can apply for these alternatives and safe vital funds to cowl bills similar to tuition, instructional supplies, and different school-related wants. You may even focus your scholarships on areas related to your organization’s sector to domesticate a expertise pool of promising candidates sooner or later.

What to Embrace in a Company Charitable Donations Coverage

Whatever the company giving alternatives your organization presents, the important thing to a profitable program lies in speaking them successfully to your staff, nonprofits, and different stakeholders. A company charitable giving coverage needs to be detailed but concise, so readers can simply entry all the knowledge they want.

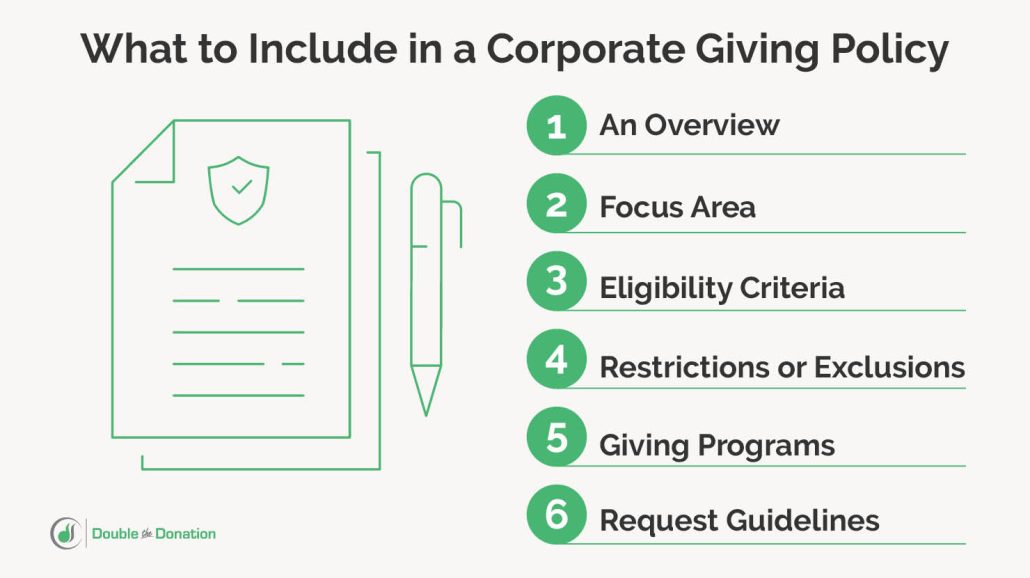

These are the principle parts it’s best to embody in your company giving coverage:

Overview

In the beginning, embody a quick overview explaining the aim of your company giving program. Join these objectives to your organization’s bigger mission and values. This can be certain that staff perceive how their participation contributes to the general success of your organization and encourage them to become involved. Moreover, embody some extent of contact that staff can attain out to with questions.

Focus Space

In case your company giving program facilities on particular causes or areas of focus, specify these in your worker charitable giving coverage. This fashion, your staff will know which varieties of nonprofits you prioritize supporting. For instance, an training software program firm could primarily direct its company philanthropy efforts towards nonprofits with education-related causes.

Eligibility

Define the necessities that organizations should meet to be eligible to your assist. One widespread situation amongst U.S. corporations is that solely 501(c)(3) entities can profit from their philanthropic initiatives.

Additionally, make clear which staff are eligible to take part in your program. Some corporations restrict engagement of their packages to full-time staff, whereas others permit part-time and even retired staff to become involved.

Restrictions

Listing any restrictions or exclusions in your company giving program. As an illustration, your organization might need geographical limitations on the nonprofits you assist. Or, you would possibly choose to not embody political or spiritual organizations, even when they’ve 501(c)(3) standing.

Nonetheless, it’s vital to notice that the share of Russell 1000 corporations providing “unrestricted matching items” grew over 48% over the previous three years. Which means that extra companies are shifting their packages to broaden their assist and create a extra vital influence of their communities.

Giving Packages

Embrace your whole firm’s company giving alternatives on this part, from matching items to scholarships. Be particular about particulars similar to:

- Match ratio

- Minimal and most match quantities

- Deadline to submit a request

Within the case of volunteer grants, make sure you point out if there’s a minimal variety of hours an worker should volunteer earlier than they’re eligible to submit a request.

Request Pointers

On this part of your company charitable giving coverage, stroll by the precise steps an worker ought to take to submit an identical reward or volunteer grant request. The better the method, the extra possible staff will truly take part in your program.

As an illustration, 96% of staff desire that their employer matches donations they make on to a nonprofit, fairly than solely these made on the corporate’s company giving platform. Having versatile giving choices and eligibility standards permits you to higher accommodate various worker preferences and pursuits.

5 Steps to Create a Company Charitable Giving Coverage

Able to put collectively your organization’s charitable giving coverage and begin powering change inside your neighborhood? Use these primary steps as a jumping-off level:

- Make clear your company giving objectives. Start by solidifying your company giving objectives, together with the sort of influence you’d wish to have on society. Formulate your coverage together with your general mission, values, and enterprise technique in thoughts. This ensures that your whole efforts contribute to a sustainable, cohesive, and fascinating company giving program.

- Set your charitable giving price range. Take the time to find out the quantity of funds your organization will allocate to its company giving program. This price range will information you as you’re employed out particular standards and different particulars of your giving alternatives, similar to minimal and most match quantities.

- Gather suggestions. Ship out a survey to staff and different stakeholders to get a greater understanding of their priorities, pursuits, and preferences with regards to company giving. Determine widespread insights and take them into consideration as you conceive and finalize the specifics of your organization’s program.

- Outline particular standards and focus areas. Based mostly on the company giving alternatives you’re planning to supply, map out the factors for participation and fund allocation. This consists of focus areas, the varieties of staff eligible to become involved, and any restrictions you might have on which organizations can obtain your organization’s assist.

- Confirm authorized compliance. After you’ve drafted your company charitable donations coverage, keep away from any potential fines, penalties, or losses by verifying that every little thing complies with native, state, and federal legal guidelines. Some factors to keep in mind embody tax deductions and reporting necessities. As an illustration, it’s vital to know and talk that contributions made to organizations with out 501(c)(3) should not tax deductible.

Take into account creating a number of variations of your company giving coverage. In doing so, you possibly can share an exterior, public-facing doc that focuses on showcasing your organization’s values, devotion to philanthropy, desired influence, and dedication to transparency. Then, you possibly can flow into an inside, employee-facing coverage that features extra particular particulars on eligibility and participation.

Moreover, when you’ve ready your company charitable giving coverage, ensure your organization is provided with all of the instruments to hold out its program.

For instance, office giving software program that integrates with matching reward instruments like auto-submission simplifies the method for workers by mechanically submitting requests on their behalf after they donate. This may considerably elevate your company giving program’s participation charges and assist your organization generate extra of an influence.

4 Stellar Examples of Company Charitable Giving Insurance policies

To set your organization’s company giving coverage and program up for achievement, it’s greatest to remain knowledgeable concerning the newest philanthropy tendencies and greatest practices. Let’s check out well-designed insurance policies produced by different charitable corporations.

IBM

As a multinational expertise firm, IBM considers itself a frontrunner in CSR, detailing quite a few charitable giving initiatives in its Advantages Abstract. In a devoted part for CSR, it lists the next alternatives for workers to become involved in, similar to:

- IBM Service Corps. By IBM Service Corps, staff can take part in varied pro-bono neighborhood tasks to enhance their management expertise, contribute to social good, and follow problem-solving. Since its inception, practically 4,000 IBM staff have accomplished over 1,300 tasks all over the world.

- P-TECH and SkillsBuild Mentoring. These two packages permit IBM staff to turn into mentors, serving to college students and job seekers by project-based studying.

- IBM Volunteer Grants. Each present and retired IBM staff can safe volunteer grants for the nonprofits they volunteer with, incomes $10 per hour after reaching a minimal of 10 hours served.

- IBM Matching Grants Program. IBM gives unrestricted matching grants to eligible nonprofit organizations, contributing as much as a complete of $10,000 per worker every calendar yr.

IBM’s coverage stands out as a result of number of engagement choices the corporate gives to staff. This encourages extra staff to take part based on their preferences and pursuits.

Verizon

On Verizon’s company philanthropy web page, the corporate shares two separate company giving insurance policies for matching items and volunteer grants. This enables them to enter extra element about every alternative.

The matching items program coverage delves into eligibility standards, request deadlines, and exclusions. It even consists of administrative notes, together with when to anticipate matching funds and the place to go for extra questions on this system.

Equally, the volunteer grants program coverage covers eligibility standards and different specifics similar to the utmost quantity that Verizon will contribute to a nonprofit per worker every year.

Basic Electrical

The GE Basis presents a complete matching reward coverage for workers, that includes Basic Electrical’s emblem on each web page and even reviews when it was final up to date.

The corporate lists every little thing in clear sections, together with:

- Overview

- GE participant eligibility

- Charitable group eligibility

- Present eligibility

- Present matching course of

Below every part, Basic Electrical goes into specifics about which varieties of organizations are ineligible, similar to spiritual organizations, and the way the inspiration confirms items made to nonprofits.

Enhancing Philanthropy with a Company Giving Coverage

A company charitable giving coverage units your whole firm’s philanthropy efforts in stone. Nonetheless, this doesn’t imply that every little thing is everlasting. After you’ve shared the coverage with staff and different stakeholders, make sure you acquire suggestions on each your giving program and the coverage itself. Doing so lets you determine areas to enhance, particulars to make clear, and methods to have interaction extra staff in company giving in the long run.

In case you’re searching for ideas and greatest practices for embracing company philanthropy and constructing a greater office at your organization, take a look at these extra sources: