Monetary and technological innovation and modifications within the macroeconomic setting have led to the expansion of nonbank monetary establishments (NBFIs), and to the potential displacement of banks within the provision of conventional monetary intermediation providers (deposit taking, mortgage making, and facilitation of funds). On this submit, we take a look at the joint evolution of banks—known as depository establishments from right here on—and nonbanks contained in the organizational construction of financial institution holding firms (BHCs). Utilizing a distinctive database of the organizational construction of all BHCs ever in existence for the reason that Seventies, we doc the evolution of NBFI actions inside BHCs. Our proof means that there exist necessary conglomeration synergies to having each banks and NBFIs below the identical organizational umbrella.

The Evolution of Banks and Nonbanks: Different Views

The standard view of economic intermediation is that banks and nonbanks evolve independently. Banks are essentially depository establishment that make loans and facilitate funds, and their evolution stays anchored on these “core” actions. NBFIs, then again, are seen as a heterogenous bunch—insurers, specialty lenders, funding funds, et cetera, with every section working below distinct enterprise fashions, governing constructions, and even rules. One commonality of NBFIs, nonetheless, is that they will substitute for banks as monetary intermediaries.

Another view is that banks evolve and adapt their enterprise mannequin to the prevalent mode of economic intermediation. Beneath this view, the evolution of banks and nonbanks is very intertwined. For instance, monetary innovation and regulatory modifications within the Nineteen Nineties enhanced asset securitization, shifting the prevalent mode of economic intermediation from a bank-centric mannequin of taking deposits and issuing loans (and holding them to maturity) to a brand new mannequin the place loans had been packaged into securities and offered to buyers. With this shift, a number of nonbank actions involving the supply of specialised providers in assist of the securitization course of (similar to specialty lending, making markets, managing property, and insurance coverage) grew in significance. Slightly than remaining passive observers of those developments, banks tailored their enterprise fashions and more and more integrated these new actions below their organizational umbrellas to benefit from synergistic advantages. This different view implies that banks and NBFI actions could also be complementary to 1 one other and never substitutes.

On this submit, we offer ample assist for that different view. Our distinctive database of the organizational construction of all BHCs permits us to trace every subsidiary within the banking trade over the past fifty years, map the subsidiary to its direct mother or father and to its final mother or father, and monitor the exercise that the subsidiary is engaged in. Utilizing this knowledge, we describe the joint evolution of banks and nonbanks over the previous thirty years.

The Co-Evolution of Banks and Nonbanks

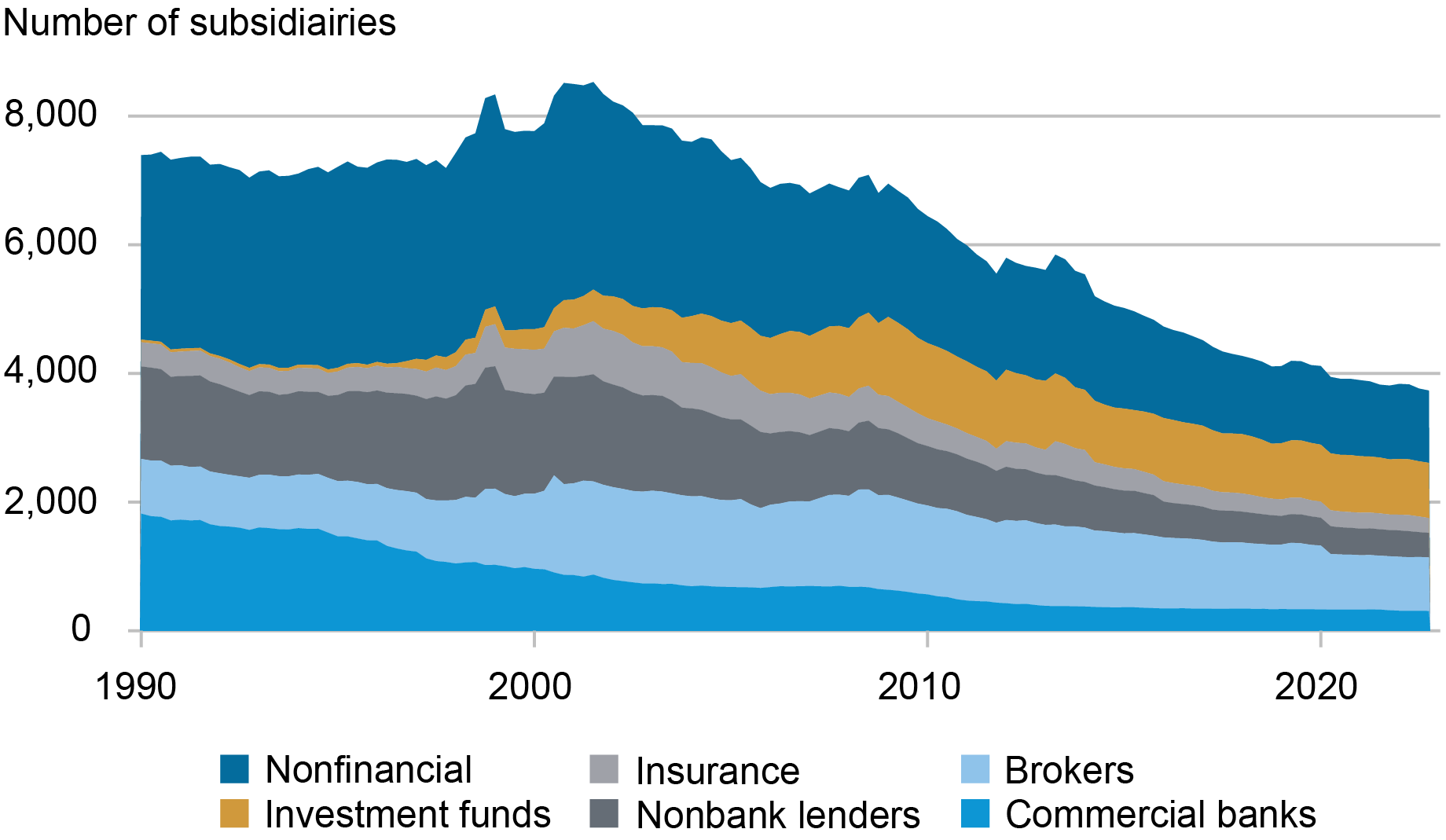

BHCs have traditionally had a considerable nonbank footprint. Within the chart beneath, we decompose the actions of BHCs’ subsidiaries. For every quarter from 1990 to 2022, we choose the highest 200 BHCs by property (collectively holding roughly 90 % of trade property), excluding Goldman Sachs, Morgan Stanley, and different BHCs that solely entered the trade later within the pattern interval. We discover that BHCs have hundreds of subsidiaries, the overwhelming majority of that are nonbanks. Through the years, BHCs have added entities similar to nonbank lenders, broker-dealers, asset administration establishments (funds), and insurers, amongst others. As of 2022:This fall, solely about 8 % of BHC subsidiaries had been categorised as business banks (depository establishments).

Composition of BHC Subsidiaries by Exercise

Sources: FR Y-10; authors’ calculations.

Observe: We exclude the next BHCs: Goldman Sachs, Morgan Stanley, American Categorical, CIT Group, Ally Monetary, Uncover, M&T Financial institution, MetLife.

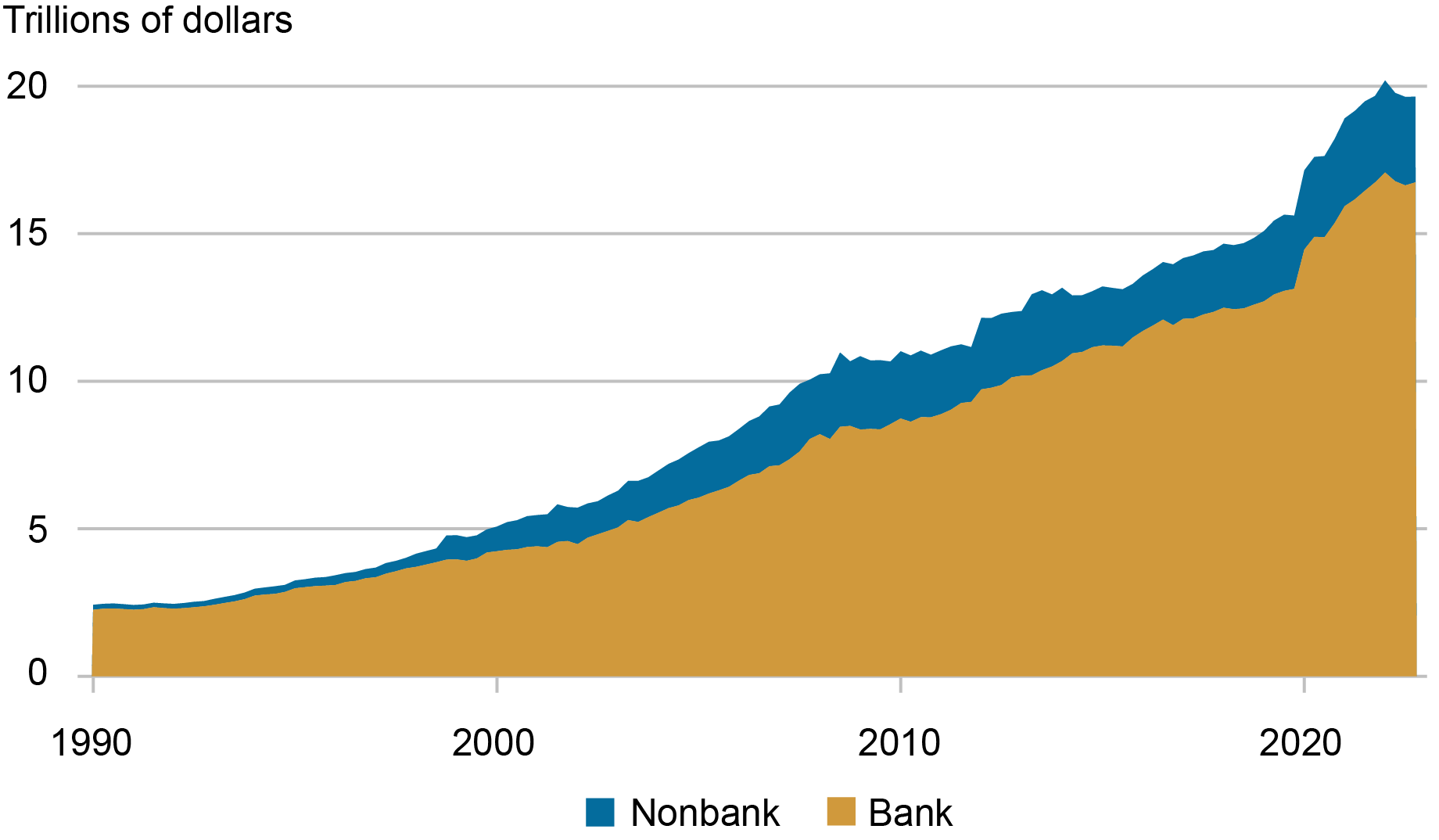

A view of nonbank actions centered on subsidiary counts could also be deceptive as a result of these entities may simply be empty shells created for authorized causes, or they could possibly be incidental to the enterprise, just like the nonfinancial subsidiaries we observe within the chart above, however not essentially reflecting actions the BHCs interact in. As an alternative, we discover that nonbank subsidiaries are significant contributors to the enterprise mannequin of BHCs, as measured by the composition of their property and earnings. Within the chart beneath, we decompose the property of the highest 200 BHCs by subsidiary kind: financial institution or nonbank. To take action, we benefit from a lesser utilized reporting kind, the FR Y-9LP, which captures the unconsolidated steadiness sheet of BHCs’ mother or father firms (or intermediate holding firms). Because the chart reveals, NBFIs account for a steadily rising share of complete BHC property—about 15 %, or greater than $2.9 trillion, as of 2022:This fall.

Composition of BHC Property

Sources: FR Y9-LP; FR Y9-C; FR Y-10; creator’s calculations.

Observe: We exclude the next BHCs: Goldman Sachs, Morgan Stanley, American Categorical, CIT Group, Ally Monetary, Uncover, M&T Financial institution, MetLife.

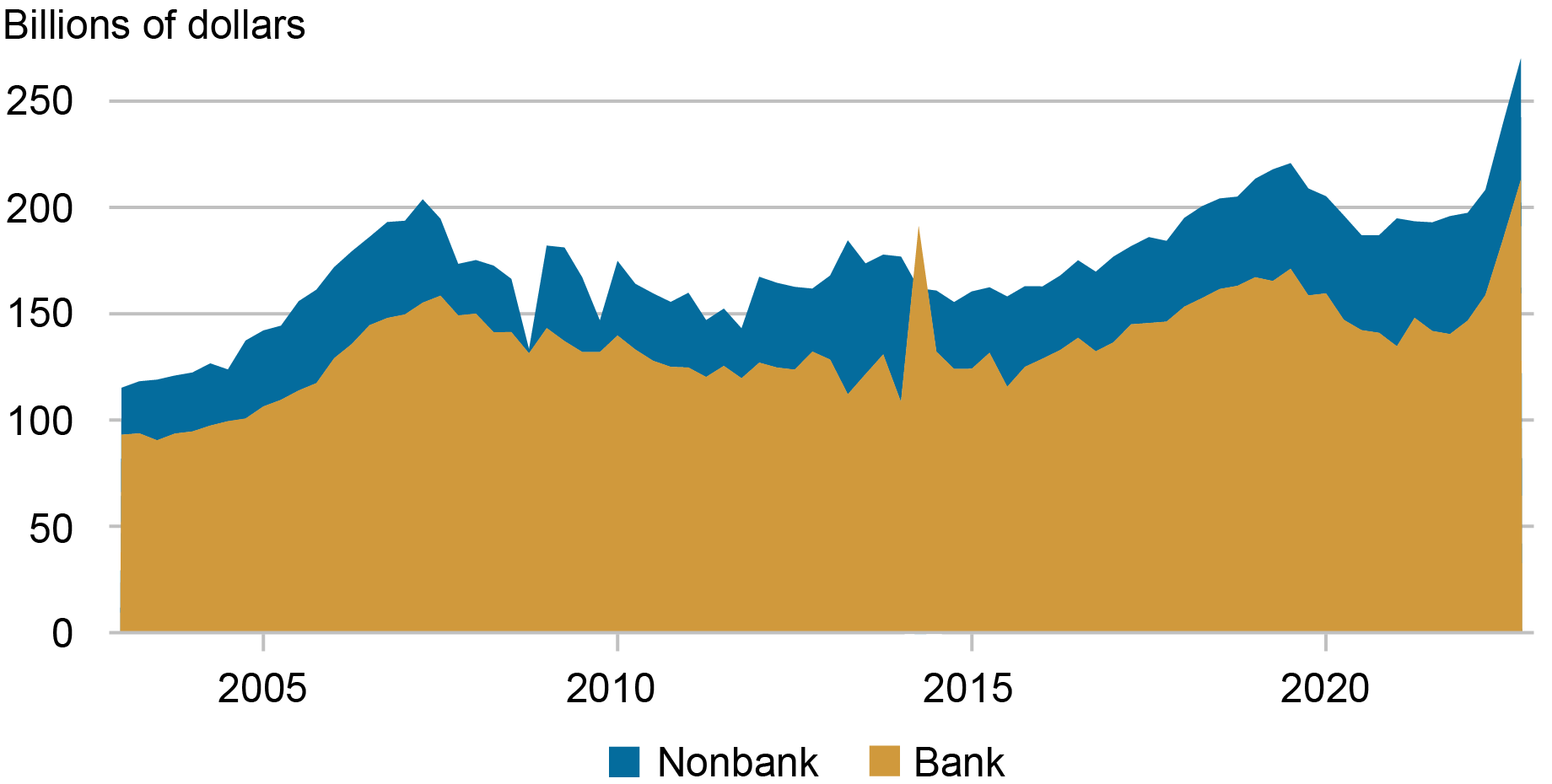

An identical image seems when wanting on the prime 200 BHCs by working revenues, outlined as curiosity earnings plus noninterest earnings. Within the subsequent chart, we decompose BHC working revenues, utilizing nonbank working income from the FR Y-9LP and complete BHC working income from the FR Y-9C (the consolidated steadiness sheet of BHCs). NBFIs’ share of complete working income has additionally been rising over time, representing roughly 21 % of BHCs’ complete working income in 2022:This fall.

Composition of BHC Working Income

Sources: FR Y9-LP; FR Y9-C; FR Y-10; authors’ calculations.

Observe: We exclude the next BHCs: Goldman Sachs, Morgan Stanley, American Categorical, CIT Group, Ally Monetary, Uncover, M&T Financial institution, MetLife.

Whereas the proof reveals that NBFIs have had a major function inside BHCs over time, what’s the relationship between NBFIs and “core” depository establishments? Did banking corporations merely pursue a method of organizational diversification, or did they acknowledge the potential existence of conglomeration advantages between banks and NBFIs? Within the latter case, possession or controlling pursuits in each forms of establishments might enable the exploitation of synergies, thus creating advantages for the group as a complete.

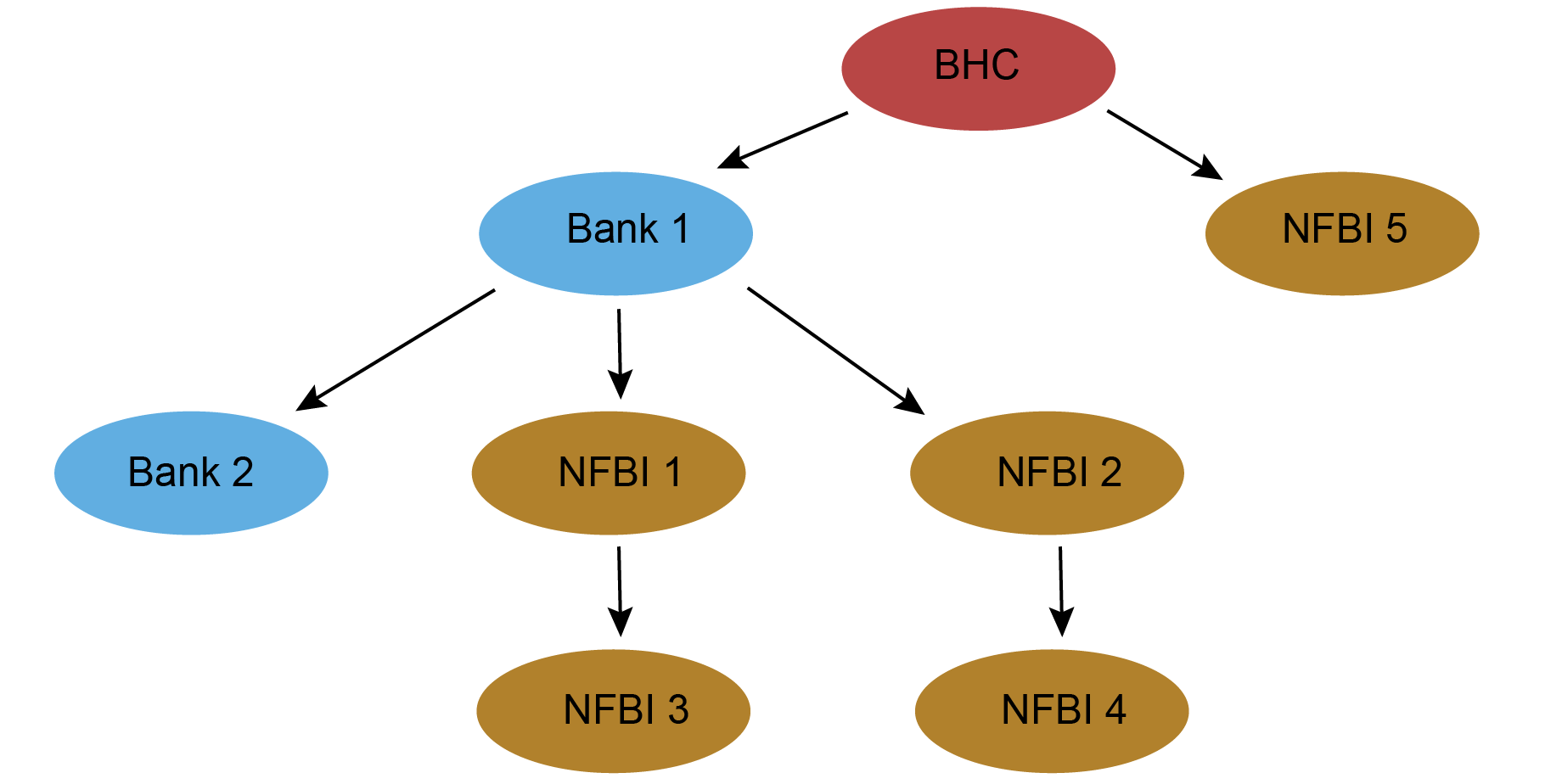

To discover this subject, we take into account the tiering construction inside every BHC in our database, which permits us to determine each the final word mother or father of a given subsidiary in addition to the intermediate entities holding the subsidiary earlier than the mother or father. Within the diagram beneath, we present a stylized instance of an organizational construction. The diagram establishes that “NBFI 1” is in the end a subsidiary of the mother or father BHC and is immediately owned by the depository establishment “Financial institution 1,” which in flip is immediately owned by the mother or father BHC.

Instance of BHC Organizational Construction

We argue that the choice to nest subsidiaries inside inner management chains might replicate the capability of these linked subsidiaries to generate conglomeration advantages. Particularly, the extent to which depository establishment subsidiaries of BHCs immediately management NBFI subsidiaries (as “Financial institution 1” controls NBFIs 1-4) captures the extent to which the “core” parts of a banking agency—the depository establishments—are intently linked to the nonbank facet.

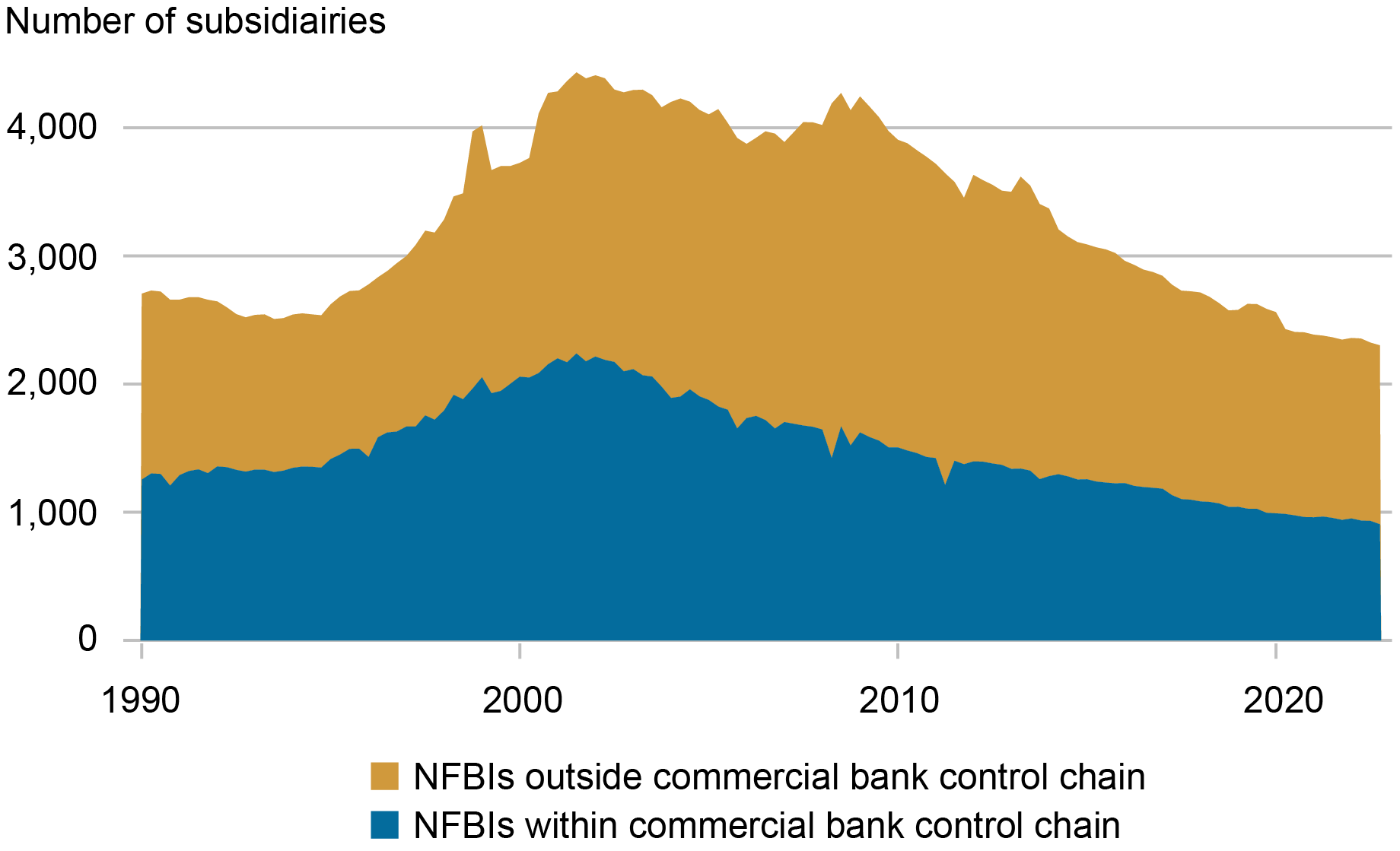

Within the chart beneath, we present how the variety of NBFI subsidiaries inside the prime 200 BHCs which might be managed by depository establishments, by each direct and oblique possession, has advanced relative to the entire variety of NBFI subsidiaries below a BHC umbrella. We discover that the variety of nonbank subsidiaries nested below a depository establishment, and thus a part of a depository establishment’s direct management chain inside a BHC, has been fairly substantial over time. Nonbanks have forged an extended shadow over core banking actions for a very long time.

Composition of BHC Nonbank Subsidiaries by Management Chain

Sources: FR Y-10; authors’ calculations.

Observe: We exclude the next BHCs: Goldman Sachs, Morgan Stanley, American Categorical, CIT Group, Ally Monetary, Uncover, M&T Financial institution, MetLife.

Nonbank Evolution and Residing Wills

The identical chart reveals that, after the GFC, the depend of NBFI subsidiaries decreases fairly considerably. Curiously, this pattern reversal coincides with the biggest BHCs changing into topic to decision plans, or “dwelling wills,” below the Dodd-Frank Act. Residing wills pressured banks to create a blueprint for a way they could possibly be resolved in chapter with out undue spillovers to the remainder of the system. Particularly, dwelling wills are thought to have pressured banks to create extra organizational separation between depository establishments and nonbank actions. For instance, Goldman Sachs in its 2015 dwelling will submission writes: “We’ve got established quite a lot of standards for a much less complicated and extra rational authorized entity construction with the aim of… defending our insured depository establishment from losses incurred by non-bank associates” (see web page 15). Nonetheless, given the historical past of banking corporations adapting and evolving round regulatory boundaries, there’s a likelihood that the bank-NBFI nexus we’ve recognized might not have disappeared, however merely shifted to a special kind. In a forthcoming paper, we examine these questions at better size, and we are going to report on our findings in subsequent posts.

Nicola Cetorelli is the top of Non-Financial institution Monetary Establishment Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Saketh Prazad is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

cite this submit:

Nicola Cetorelli and Saketh Prazad, “The Nonbank Shadow of Banks,” Federal Reserve Financial institution of New York Liberty Avenue Economics, November 27, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/the-nonbank-shadow-of-banks/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).