Editor’s be aware: We have now up to date the “date of forecast” row within the forecast comparability desk to show the right yr (2023, not 2024). (September 25, 2023, 5:01 p.m.)

This submit presents an replace of the financial forecasts generated by the Federal Reserve Financial institution of New York’s dynamic stochastic normal equilibrium (DSGE) mannequin. We describe very briefly our forecast and its change since June 2023. As ordinary, we want to remind our readers that the DSGE mannequin forecast will not be an official New York Fed forecast, however solely an enter to the Analysis employees’s total forecasting course of. For extra details about the mannequin and variables mentioned right here, see our DSGE mannequin Q & A.

The New York Fed mannequin forecasts use knowledge launched by means of 2023:Q2, augmented for 2023:Q3 with the median forecasts for actual GDP development and core PCE inflation from the Survey of Skilled Forecasters (SPF), in addition to the yields on ten-year Treasury securities and Baa-rated company bonds based mostly on 2023:Q3 averages as much as August 30. Furthermore, beginning in 2021:This fall, the anticipated federal funds charge between one and 6 quarters into the longer term is restricted to equal the corresponding median level forecast from the newest obtainable Survey of Major Sellers (SPD) within the corresponding quarter. The present projection may be discovered right here.

The change within the forecast relative to June displays the truth that the financial system stays resilient regardless of the more and more restrictive stance of financial coverage. Output development is projected to be nearly 1 proportion level greater in 2023 than forecasted in June (1.9 versus 1.0 p.c) and considerably greater than June for the remainder of the forecast horizon (1.1, 0.7, and 1.2 p.c in 2024, 2025, and 2026, versus 0.7, 0.4, and 0.9 in June, respectively). The likelihood of a not-so-soft recession, as outlined by four-quarter GDP development dipping under -1 p.c by the top of 2023, has change into negligible at 4.6 p.c, down from 26 p.c in June. In response to the mannequin, a lot of the resilience within the financial system up to now stems from the stunning power within the monetary sector, which counteracts the consequences of the tightening in financial coverage. Inflation projections are near what they have been in June: 3.7 p.c for 2023 (unchanged from the earlier forecast), 2.2 p.c for 2024 (down from 2.5 p.c), and a couple of.0 p.c for each 2025 and 2026 (down from 2.2 and a couple of.1 p.c, respectively). The mannequin nonetheless sees inflation returning near the FOMC’s longer-run purpose by the top of subsequent yr.

The output hole is projected to be considerably greater over the forecast horizon than it was in June, per the truth that the stunning power of the financial system is especially pushed by demand elements corresponding to monetary shocks, versus provide elements. As within the June forecast, the hole progressively declines from its present optimistic worth to a barely detrimental worth by 2025. The true pure charge of curiosity is estimated at 2.5 p.c for 2023 (up from 2.2 p.c in June), declining to 2.2 p.c in 2024, 1.9 p.c in 2025, and 1.6 p.c in 2026.

Forecast Comparability

| Forecast Interval | 2023 | 2024 | 2025 | 2026 | ||||

|---|---|---|---|---|---|---|---|---|

| Date of Forecast | Sep 23 | Jun 23 | Sep 23 | Jun 23 | Sep 23 | Jun 23 | Sep 23 | Jun 23 |

| GDP development (This fall/This fall) |

1.9 (0.2, 3.6) |

1.0 (-1.9, 4.0) |

1.1 (-4.0, 6.3) |

0.7 (-4.2, 5.7) |

0.7 (-4.4, 5.8) |

0.4 (-4.7, 5.5) |

1.2 (-4.2, 6.6) |

0.9 (-4.5, 6.3) |

| Core PCE inflation (This fall/This fall) |

3.7 (3.4, 3.9) |

3.7 (3.3, 4.2) |

2.2 (1.5, 3.0) |

2.5 (1.6, 3.3) |

2.0 (1.1, 2.9) |

2.2 (1.2, 3.1) |

2.0 (1.0, 3.0) |

2.1 (1.1, 3.2) |

| Actual pure charge of curiosity (This fall) |

2.5 (1.3, 3.7) |

2.2 (1.0, 3.5) |

2.2 (0.8, 3.7) |

1.8 (0.3, 3.2) |

1.9 (0.3, 3.4) |

1.5 (-0.1, 3.0) |

1.6 (-0.0, 3.3) |

1.3 (-0.4, 3.0) |

Notes: This desk lists the forecasts of output development, core PCE inflation, and the actual pure charge of curiosity from the September 2023 and June 2023 forecasts. The numbers exterior parentheses are the imply forecasts, and the numbers in parentheses are the 68 p.c bands.

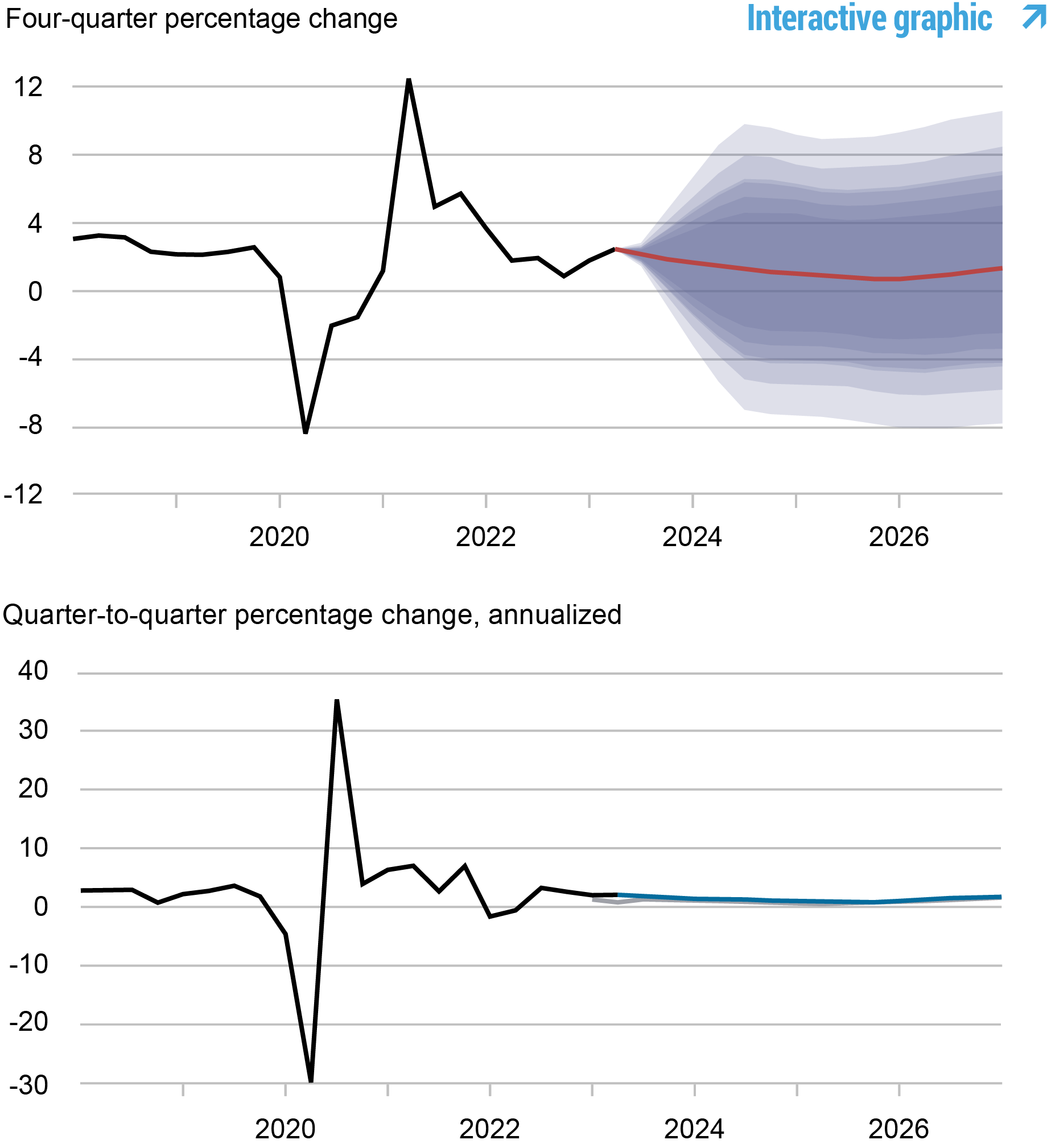

Forecasts of Output Progress

Supply: Authors’ calculations.

Notes: These two panels depict output development. Within the prime panel, the black line signifies precise knowledge and the pink line reveals the mannequin forecasts. The shaded areas mark the uncertainty related to our forecasts at 50, 60, 70, 80, and 90 p.c likelihood intervals. Within the backside panel, the blue line reveals the present forecast (quarter-to-quarter, annualized), and the grey line reveals the June 2023 forecast.

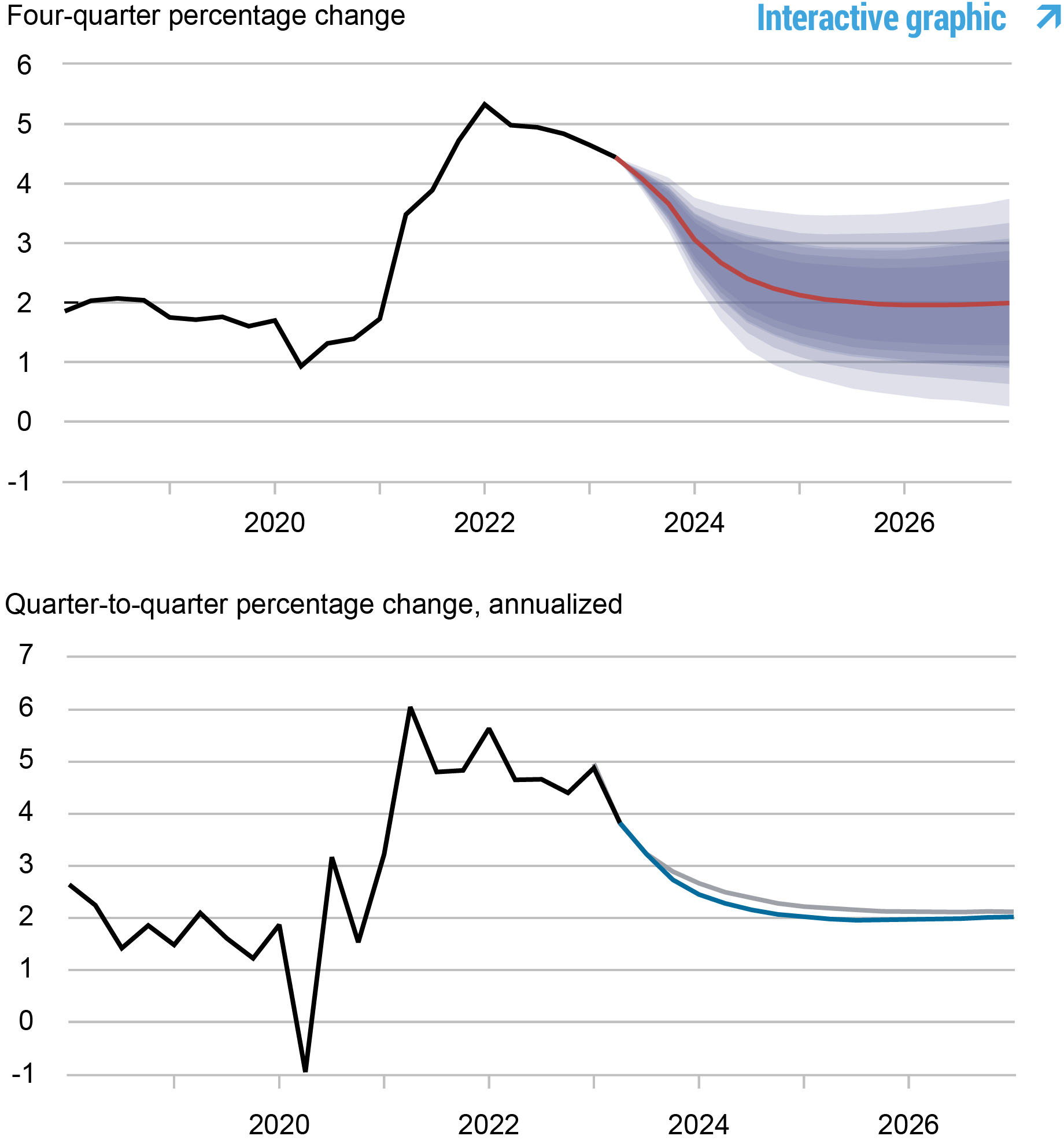

Forecasts of Inflation

Supply: Authors’ calculations.

Notes: These two panels depict core private consumption expenditures (PCE) inflation. Within the prime panel, the black line signifies precise knowledge and the pink line reveals the mannequin forecasts. The shaded areas mark the uncertainty related to our forecasts at 50, 60, 70, 80, and 90 p.c likelihood intervals. Within the backside panel, the blue line reveals the present forecast (quarter-to-quarter, annualized), and the grey line reveals the June 2023 forecast.

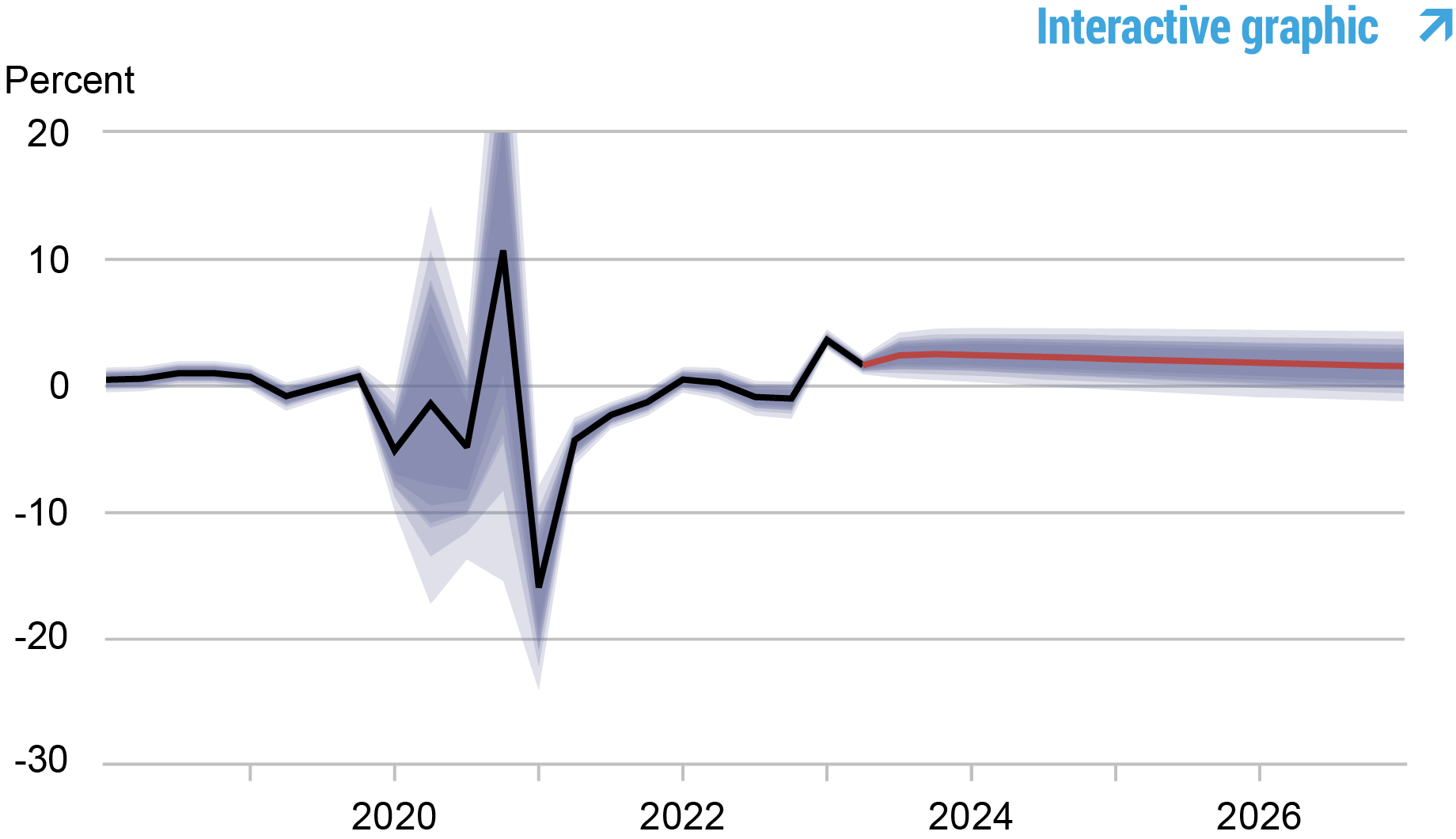

Actual Pure Charge of Curiosity

Supply: Authors’ calculations.

Notes: The black line reveals the mannequin’s imply estimate of the actual pure charge of curiosity; the pink line reveals the mannequin forecast of the actual pure charge. The shaded space marks the uncertainty related to the forecasts at 50, 60, 70, 80, and 90 p.c likelihood intervals.

Marco Del Negro is an financial analysis advisor in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Pranay Gundam is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Donggyu Lee is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Ramya Nallamotu is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Brian Pacula is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Easy methods to cite this submit:

Marco Del Negro, Pranay Gundam, Donggyu Lee, Ramya Nallamotu, and Brian Pacula, “The New York Fed DSGE Mannequin Forecast— September 2023,” Federal Reserve Financial institution of New York Liberty Avenue Economics, September 22, 2023, https://libertystreeteconomics.newyorkfed.org/2023/09/the-new-york-fed-dsge-model-forecast-september-2023/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).