(This publish is an interlude between historical past and VARs)

Jesper Rangvid has a nice weblog publish in the present day on completely different inflation measures.

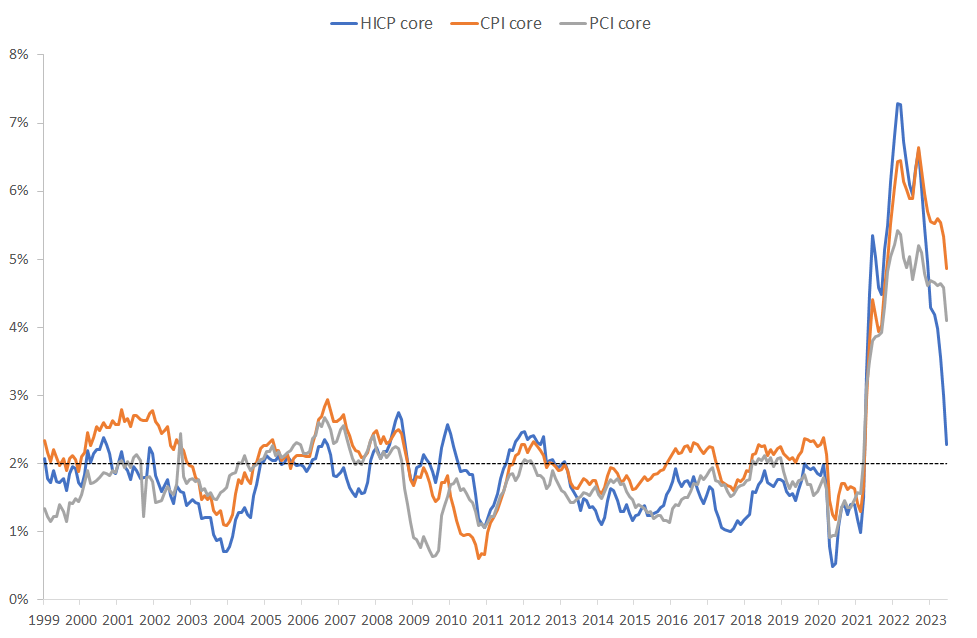

CPI and PCE core inflation (orange and grey) are how the US calculates inflation much less meals and power, however together with housing. We do an economically subtle measure that tries to measure the “value of housing” by rents for many who hire, plus how a lot a house owner pays by “renting” the home to him or herself. You may rapidly give you the plus and minus of that method, particularly for taking a look at month to month traits in inflation. Europe within the “HICP core” line would not even attempt to leaves proprietor occupied housing out altogether.

Jesper’s level: when you measure inflation Europe’s approach, US inflation is already again to 2%. The Fed can hang around a “mission completed” banner. (Or, in my opinion, a “it went away earlier than we actually needed to do something critical about it” banner.) And, since he writes to a European viewers, Europe has an extended method to go.

Just a few deeper (and barely grumpier) factors:

Discover simply right here how completely different measures of inflation broadly correlated, however are 1-2% completely different from one another. Nicely, inflation is imprecisely measured. Get used to that and cease worrying an excessive amount of about something previous the decimal level.

All this enterprise about core vs. headline, hosing vs nonhousing, PCE vs. CPI, inflation is ok all besides for 3 classes, and so forth is a bit complicated. Ultimately, inflation is inflation, and all items matter. You pay for meals, power, and housing. So why ignore these? Why not use probably the most complete measure at all times? The perfect quantity we have now for the general rise of the price of residing within the US is the total PCE, together with all households, and meals, power, and housing. Inflation is just not over and the mission not completed till it’s over, and that features meals power and housing. Why is it not simply sophistry to say “properly, inflation is again to 2% aside from meals power and housing, so the struggle is over?” “Each ship however your 4 quickest” is just not “each ship.”

The standard (implicit) argument is that core inflation is a greater predictor of general inflation a 12 months from now than is in the present day’s full inflation. Meals and power costs have upward and downward spikes that predictably reverse themselves. The argument have to be comparable for leaving out imputed rents. There are predictable housing worth dynamics in how home costs and rents feed into one another, and the way rents on new leases propagate to rents of outdated ones after they roll over. That one may need some behavioral argument that households being each landlord and tenant do not feel the ache and do not modify conduct as rapidly in response to alternative prices as renters do to out of pocket prices. However that needs to be mirrored in what you do with the quantity relatively than leaving it out of the info.

Extra typically, why do individuals indulge on this economist nerd pastime of slicing and dicing inflation to what went up and what went down and the way may it’s completely different if we left this or that out? Determining what it means for general inflation sooner or later is the one purpose I can see for it. (Maybe determining whose inflation went up or down greater than another person’s can also be a purpose to do it.)

However this should be much more rigorous. If the purpose is, we take a look at core in the present day as a result of core is a greater forecast of inflation a 12 months from now than inflation in the present day, let’s examine the regression proof. Is it true that

All items and providers inflation a 12 months from now = a + b x Core inflation in the present day + error

produces a greater forecast than

All items and providers inflation a 12 months from now = a + b x All items and providers inflation in the present day + error?

That’s not the precise regression you’d run, in fact. I’d begin with

PCE (t+1) = a + b x PCE(t) + c x (Core(t)-PCE(t)) + error.

And we wish to embrace different variables actually. If the sport is to forecast PCE a 12 months from now, then you definitely need an acceptable kitchen sink on the correct hand aspect, as much as overfitting. Simply how necessary is core vs. pce in that kitchen sink? How a lot does taking a look at all the assorted parts of inflation assist to forecast inflation? Let’s put these expiring lease dynamics in to forecast housing inflation, explicitly.

I think the reply is that each one of this doesn’t assist a lot. My reminiscence of Jim Inventory and Mark Watson’s work on forecasting inflation with a lot of proper hand variables is that it is actually laborious to forecast inflation. However that was 20 years in the past.

So I will depart this as a query for commenters. How can we greatest forecast inflation? How does taking a look at varied parts of inflation allow you to to forecast the general amount? This have to be a query with a properly established reply, no? Ship your favourite papers within the feedback. (If you cannot get blogger’s horrible remark system to work ship electronic mail.)

If not, it is in the present day’s suggestion for low hanging fruit paper subject! How taking a look at parts does or doesn’t assist to forecast general inflation is a extremely necessary query.

A final remark: Folks take a look at all the assorted parts of inflation, however do not ever (that I’ve seen) cite forecasting general inflation as the specific query. They very often say that the element view suggests inflation is or is not going to rise sooner or later, so I am imputing this because the query. If not, what’s the query? Why are we taking a look at parts? In so many areas, it is fascinating that folks so seldom state the query to which they proffer solutions.

Replace:

Why be lazy? I understand how to run regressions. Pattern 1960:1-2023:6, month-to-month knowledge, forecasting one-year inflation from lagged one-year inflation, overlapping knowledge with Newey-West corrected t statistics, 24 lags. I embrace a relentless in every regression, omitted within the desk. Fred collection fedfunds, cpilfesl, cpiaucsl.

| CPI | Core | Core-CPI | Core-CPI degree | R2 |

|---|---|---|---|---|

| 0.74 | 0.55 | |||

| (7.19) | ||||

| 0.77 | 0.47 | |||

| (5.55) | ||||

| 0.76 | -0.02 | 0.55 | ||

| (2.42) | (-0.05) | |||

| 0.74 | -0.02 | 0.55 | ||

| (6.09) | (-0.05) | |||

| 0.77 | 0.04 | 0.55 | ||

| (8.11) | (0.79) |

Row 1, inflation is forecastable by lagged inflation with an 0.74 AR(1) coefficient. That Fed dot plots at all times appear to be an AR(1) with an 0.74 coefficient is fairly wise. Row 2, core inflation additionally forecasts inflation. However the R2 is decrease. Inflation forecasts itself higher than core. Row 3, in a a number of regression, core does nothing to assist to forecast inflation. Row 4, the distinction between core and inflation does nothing to forecast inflation. Row 5, to seize long run traits and transitory inflation, you may suppose that the distinction between the core and headline CPI ranges helps to forecast CPI inflation. Nope.

That is approach worse than I assumed. I assumed Core would assist a bit. I believed that meals and power would have momentary variation which core would inform us to disregard. Maybe the usual “provide shock” story has some advantage. Meals or power goes up due to a provide shock. The Fed or fiscal coverage then accommodates the provision shock with extra demand, in order that wages and different costs meet up with the headline relatively than making headline return down once more.

Replace:

A great weblog publish making the case that core is healthier. Two necessary variations: 1) Pattern restricted to after 1983, so not evaluating its use in the course of the one large inflation and disinflation 2) Pure quantity, no regression. I.e. how does measure x forecast inflation, not a + b x measure x.

Additionally a very good Jason Furman tweet