I used to be requested not too long ago what I considered T. Rowe Value Capital Appreciation (PRWCX) in comparison with T. Rowe Value Capital Appreciation Fairness ETF (TCAF), which has gained $235 million in property beneath administration since its June 2023 launch. TCAF is considered one of two new T Rowe Value choices that play off the unparalleled success of the PRWCX, which is closed to new buyers. The opposite new entrant, the T. Rowe Value Capital Appreciation and Earnings Fund, has not but debuted.

Probably the most hanging similarities are the identify and the truth that they’re each managed by David R. Giroux, who has an impressive file. From right here, the similarity fades. PRWCX is a reasonable to growth-oriented mixed-asset fund, whereas TCAF is a predominantly home fairness fund. There are variations in how the fairness sleeve of PRWCX compares to TCAF, that are explored on this article.

Let’s begin with a assessment of PRWCX earlier than diving into the toddler TCAF.

BEST MIXED-ASSET TARGET ALLOCATION GROWTH FUNDS

T Rowe Value Capital Appreciation (PRWCX) is classed by Lipper within the Combined-Asset “Development” Class and Morningstar as a “Reasonable” class. Its present allocation is about 62% equities, however the fund has a number of flexibility to regulate to market situations.

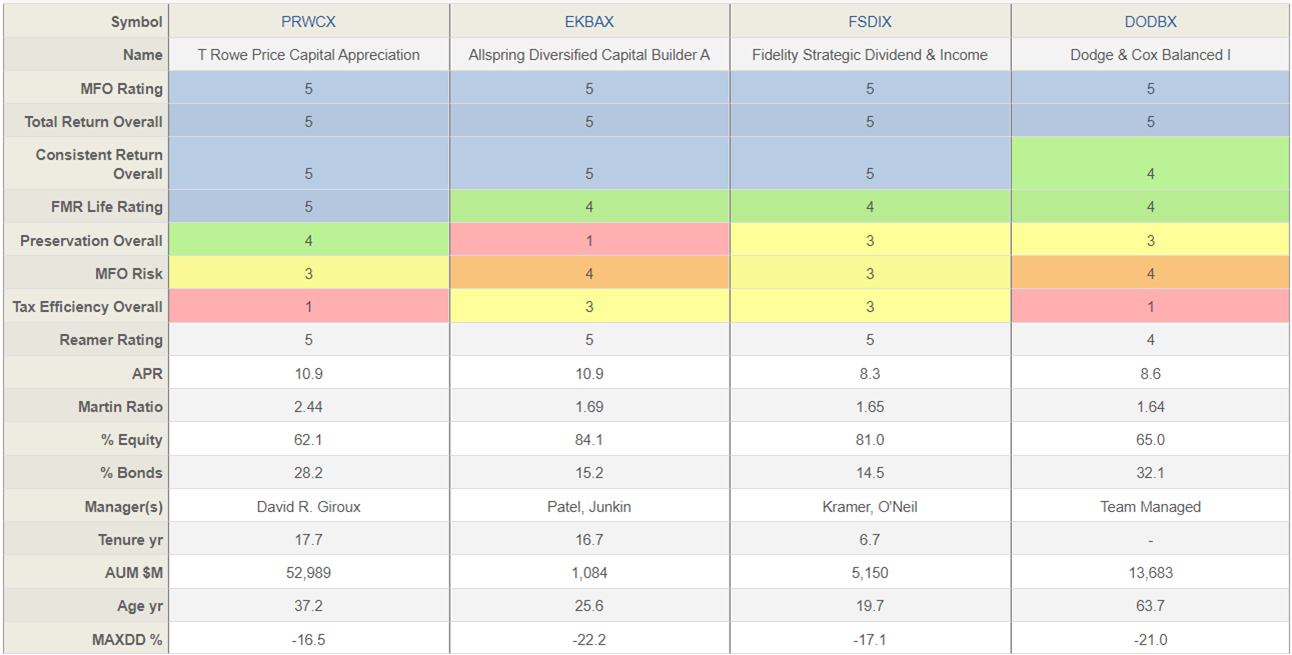

The checklist of best-performing mixed-asset goal allocation progress funds over the previous ten years is small. To pick the 5 funds in Desk #1, I used the High Quintile of the MFO Ranking for 3, 5, and 10 years for funds out there at Constancy. Dodge & Cox Balanced (DODBX) has a transaction payment, and PRWCX has been closed to new buyers since 2014.

T Rowe Value Capital Appreciation (PRWCX) is the standout performer. It’s the class’s solely Nice Owl, which implies it’s the solely progress allocation fund to generate persistently top-tier risk-adjusted returns over all trailing intervals. To be clear, it’s The One out of 250 such funds. It has been in existence for 37 years and has been managed by David R. Giroux for the previous eighteen years. Because of its efficiency, it has grown to $53 billion in property beneath administration. For the previous ten years, Allspring Diversified Capital Builder (EKBAX) has had comparable excessive total efficiency however with extra danger. I like that PRWCX has a inventory allocation of 62%, which is reasonable in comparison with EKBAX, with 84%.

Desk #1: Greatest Performing Combined-Asset Development Funds – Ten Years

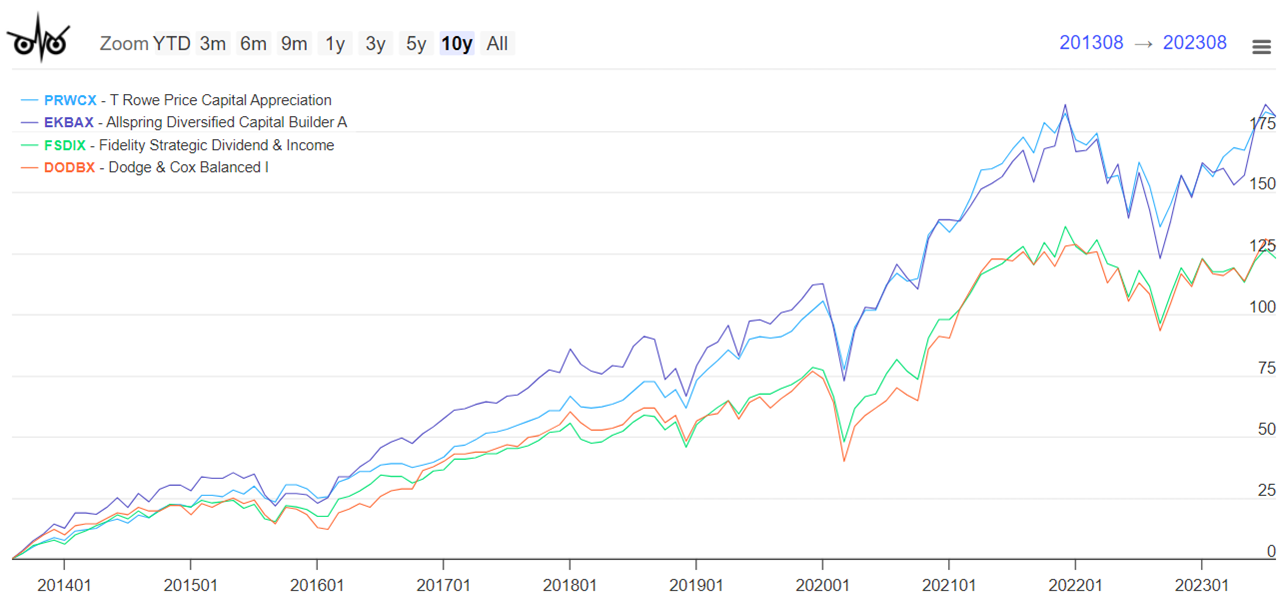

Determine #1: Greatest Performing Combined-Asset Development Funds

My colleague David Snowball provided a complementary evaluation of the fund in his August 2023 article on the upcoming launch of T. Rowe Value Capital Appreciation and Earnings. His take: “You care [about the new fund] as a result of T. Rowe Value Capital Appreciation is (a) totally unmatched and (b) closed tight.”

T. ROWE PRICE CAPITAL APPRECIATION (PRWCX)

The technique of the T. Rowe Value Capital Appreciation Fund (PRWCX) is

The fund usually invests a minimum of 50% of its whole property in shares and the remaining property are usually invested in company and authorities debt (together with mortgage- and asset-backed securities), convertible securities, and financial institution loans (which signify an curiosity in quantities owed by a borrower to a syndicate of lenders) in line with the fund’s goal. The fund can also make investments as much as 25% of its whole property in international securities.

The fund’s investments in shares usually fall into considered one of two classes: the bigger class contains long-term core holdings whose costs when bought are thought of low when it comes to firm property, earnings, or different components; the smaller class contains opportunistic investments whose costs we count on to rise within the brief time period however not essentially over the long run. There aren’t any limits available on the market capitalization of the issuers of the shares by which the fund invests. Since we try to stop losses in addition to obtain beneficial properties, we usually use a worth strategy in choosing investments. Our in-house analysis crew seeks to establish corporations that appear undervalued by numerous measures, comparable to worth/e book worth, and could also be briefly out of favor however have good prospects for capital appreciation. We could set up comparatively massive positions in corporations we discover significantly enticing.

We work as exhausting to scale back danger as to maximise beneficial properties and will search to comprehend beneficial properties somewhat than lose them in market declines. As well as, we seek for enticing danger/reward values amongst all forms of securities. The portion of the fund’s funding in a specific kind of safety, comparable to frequent shares, outcomes largely from case-by-case funding selections, and the scale of the fund’s money reserves could mirror the portfolio supervisor’s potential to search out corporations that meet valuation standards somewhat than his market outlook.

The fund could buy bonds, convertible securities, and financial institution loans for his or her earnings or different options or to achieve further publicity to an organization. Maturity and high quality usually are not essentially main concerns and there aren’t any limits on the maturities or credit score scores of the debt devices by which the fund invests. The fund could make investments as much as 30% of its whole property in under investment-grade company bonds (also referred to as “junk bonds”) and different debt devices which are rated under funding grade…

PRWCX fairness is presently 95% home. It’s obese Expertise and Healthcare. Thirty % of its mounted earnings is in Financial institution Loans.

Morningstar offers PRWCX a 5 Star Ranking with a Gold Analyst Ranking. The Portfolio Supervisor is David R. Giroux (CFA), and Ira Carnahan (CFA) is a Portfolio Specialist engaged on the Capital Appreciation Fund.

In keeping with Morningstar:

David Giroux rose to the administration ranks on this technique in mid-2006 after becoming a member of T. Rowe Value in 1998 as an analyst overlaying the industrials sector. Initially a comanager, he rapidly took a lead function on the portfolio by early 2007 and have become the only supervisor in June of that yr…

Giroux delivers a high-conviction basket of roughly 40-50 shares that vary between 56% and 72% of the fund’s property. He’ll shift the exposures meaningfully when he identifies mispricing, like scaling fairness publicity when drawdowns deliver valuations to a extra enticing stage.

From T. Rowe Value:

David Giroux is a portfolio supervisor for the Capital Appreciation Technique, together with the Capital Appreciation Fund and Capital Appreciation Fairness ETF, at T. Rowe Value Funding Administration. He is also head of Funding Technique and chief funding officer for T. Rowe Value Funding Administration. David is the president, chairman, and a member of the Capital Appreciation Funding Advisory Committee and a member of the Capital Appreciation Fairness ETF Funding Advisory Committee. He’s a member of the T. Rowe Value Funding Administration ESG Committee and the T. Rowe Value Funding Administration Funding Steering Committee.

The Reality Sheet for PRWCX is accessible right here, and the Prospectus is right here.

T. ROWE PRICE CAPITAL APPRECIATION EQUITY ETF (TCAF)

T. Rowe Value Capital Appreciation Fairness ETF (TCAF) has an inception date of June 2023; Morningstar doesn’t give it a Star Ranking however offers it an Analyst Ranking of Gold. It has attracted $235 million in property up to now. Like PRWCX, TCAF is obese in Expertise and Healthcare.

The Reality Sheet for TCAF is accessible right here, and the Prospectus is right here. The Principal Funding Methods of TFAC differ considerably from PRWXC:

The fund usually invests a minimum of 80% of its internet property (together with any borrowings for funding functions) in fairness securities. The fund takes a core strategy to inventory choice, which implies each progress and worth types of investing are utilized. The fund could buy the shares of corporations of any dimension, however usually focuses on massive U.S. corporations. The portfolio is often constructed in a “backside up” method, an strategy that focuses extra on evaluations of particular person shares than on evaluation of total financial traits and market cycles.

In choosing shares, the adviser usually seeks out corporations with a number of of the next traits:

- skilled and succesful administration;

- robust risk-adjusted return potential;

- main or bettering market place or proprietary benefits; and/or

- enticing valuation relative to an organization’s friends or its personal historic norm.

The fund seeks to keep up roughly 100 securities within the portfolio.

Sector allocations are largely the results of the fund’s deal with inventory choice. The fund could at instances, make investments considerably in sure sectors, together with the knowledge expertise and healthcare sectors.

The fund is “nondiversified,” that means it could make investments a higher portion of its property in a single issuer and personal extra of the issuer’s voting securities than is permissible for a “diversified” fund.

This Morningstar video, 3 New ETFs That Stand Out From the Pack, describes how TFAC differs from the fairness portion of PRWCX, together with longer holding intervals and decrease dividend yields to reinforce tax effectivity. As well as, TFAC will maintain personal roughly 100 shares that the Group believes will ship greater risk-adjusted returns.

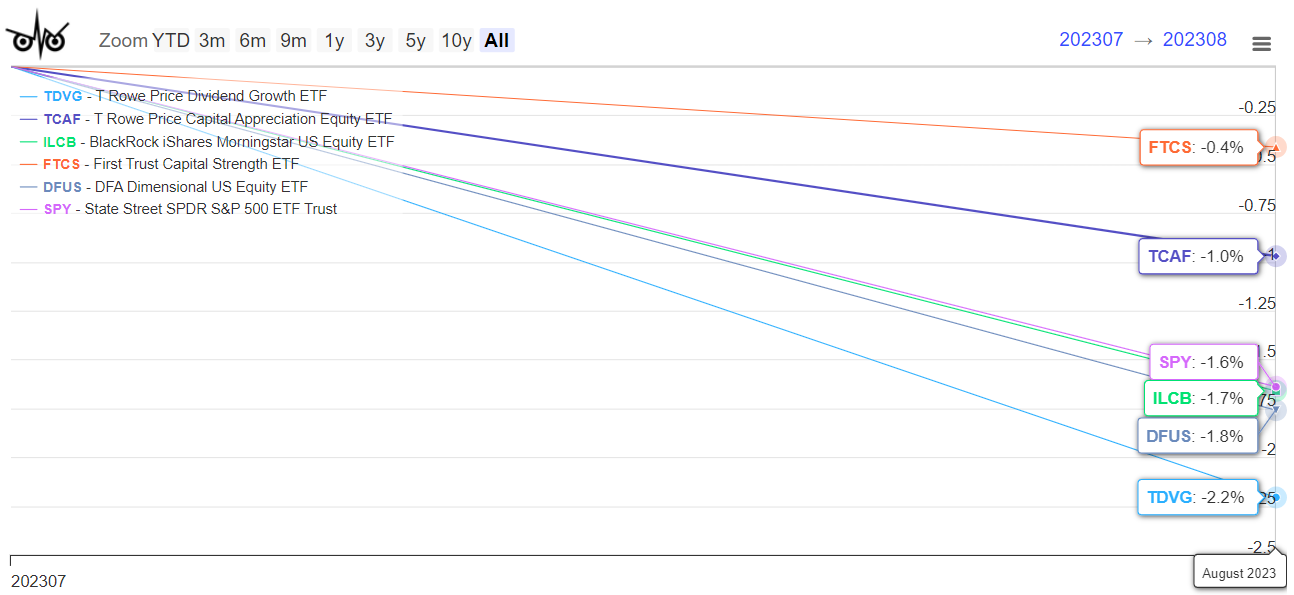

Determine #2: Comparability Chosen Actively Managed Massive Cap Core ETFs – Two Months

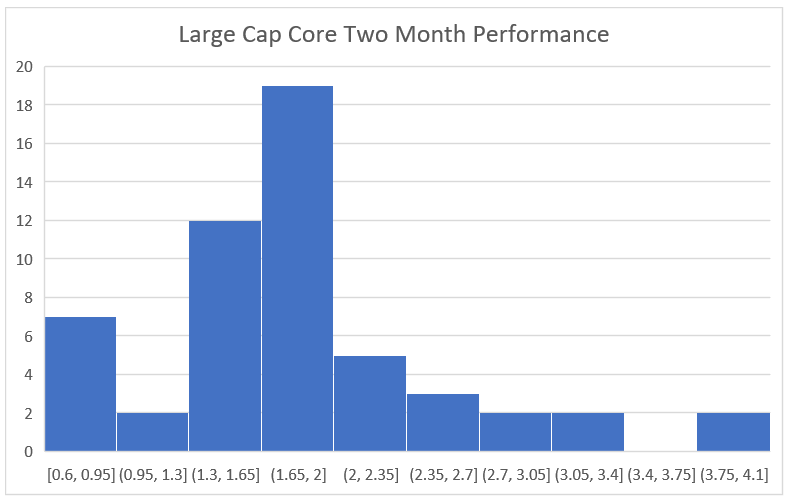

The histogram in Determine #3 reveals the efficiency of all actively managed fairness ETFs with a minimum of $100 million in property beneath administration. TCAF resides within the largest bin with two month returns of 1.65% to 2.0%.

Determine #3: Histogram of Actively Managed Massive Cap Core ETFs

Closing Ideas

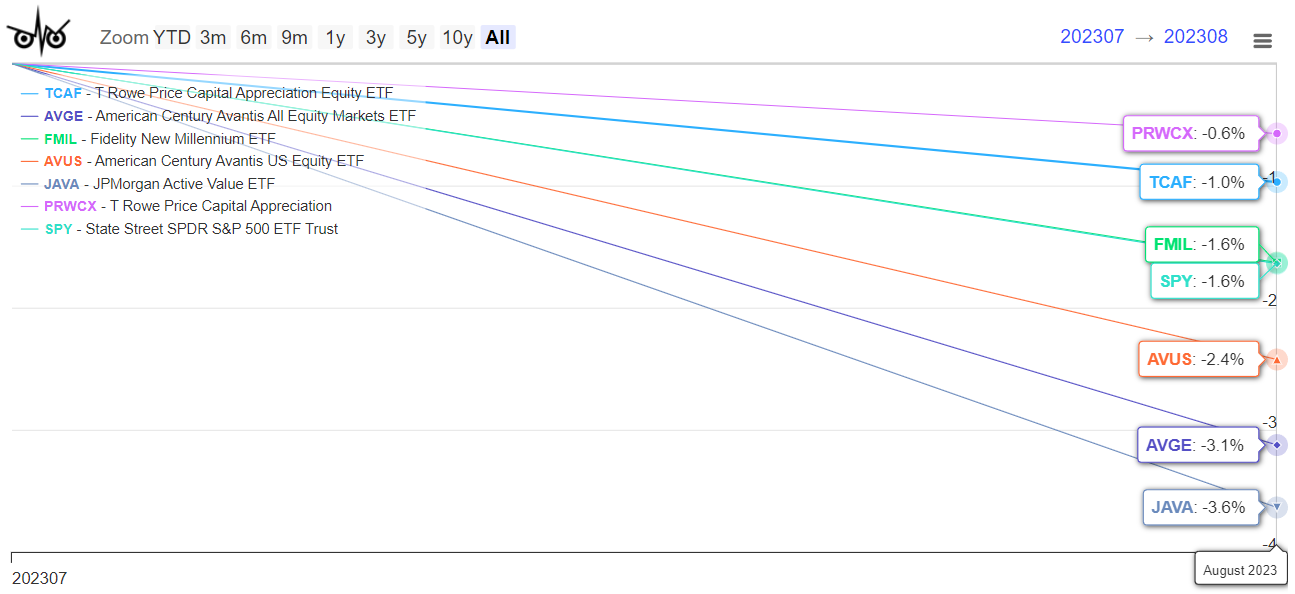

With the mix of financial slowdown, excessive mounted earnings yields, strikes by the United Auto Employees, authorities shutdown, and seasonal fluctuations, I proceed to be conservative. I’ve dry powder for alternatives which will come up. I like actively managed ETFs. Beneath are the 5 that I monitor plus S&P 500 (SPY) and PRWCX over the previous two months, that are too brief to get significant efficiency comparisons however could mirror relative volatility.

Determine #4: Creator’s Brief Listing of Actively Managed Fairness ETFs (Plus SPY & PRWCX)

I wrote Certainly one of a Sort: American Century Avantis All Fairness Markets ETF (AVGE) and Constancy Actively Managed New Millennium ETF (FMIL) describing why I like these funds. I personal a small starter place in AVGE. Because of writing this text, I’m additionally fascinated by shopping for TCAF throughout dips.