The inventory market positive appears bullish in November given the large bounce from backside. However the massive cap bias of the S&P 500 (SPY) continues to cover a few of the weak spot present in smaller shares. This essential matter must be reviewed to understand the well being and longevity of this bull run. That matter is on the middle of Steve Reitmeister’s most up-to-date commentary that features a preview of his prime 11 picks for at present’s market. Learn on for extra….

Probably the most bullish occasion this yr passed off on Tuesday November 14th. That’s when the small caps within the Russell 2000 almost tripled the S&P 500’s (SPY) return at +5.44%.

Since then massive caps proceed to rise and small caps are lagging as soon as once more. This makes me marvel simply how bullish this market really is???

Let’s dig in additional on this very important matter in at present’s commentary.

Market Commentary

November has been bullish altogether. No denying that as bond charges have dropped offering an awesome catalyst for inventory value advances.

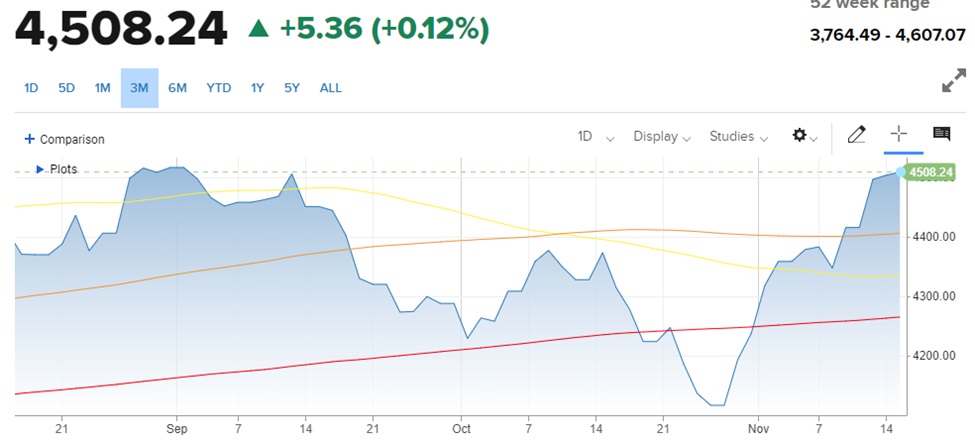

As you may see within the chart under, we have now rapidly reclaimed bullish territory above the three key shifting averages for the S&P 500:

Transferring Averages: 50 Day (yellow), 100 Day (orange), 200 Day (crimson)

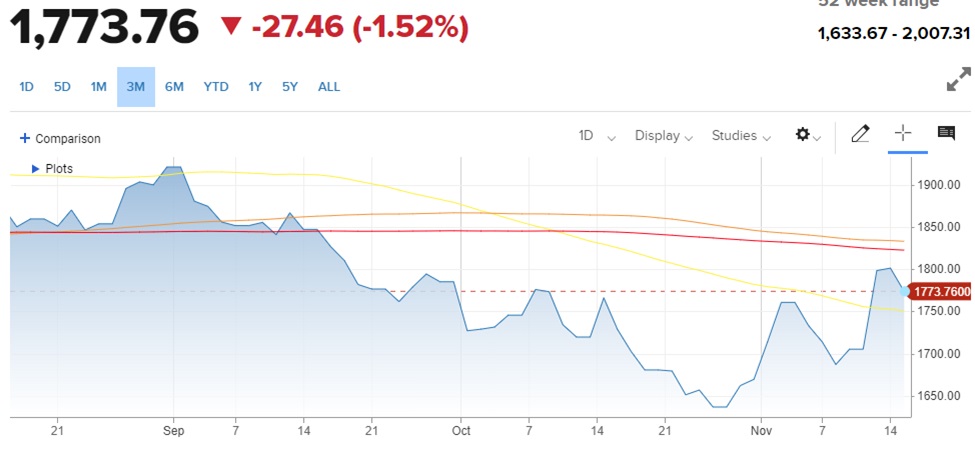

But as we ponder the view from small caps…it isn’t as rosy. Right here is identical 3 month chart with key development strains for the Russell 2000:

Transferring Averages: 50 Day (yellow), 100 Day (orange), 200 Day (crimson)

The aforementioned +5.44% achieve for this key index on Tuesday was very promising. That is as a result of there is no such thing as a option to really feel really bullish when all of the beneficial properties are simply accruing to the standard mega cap suspects previously often known as FAANG and now being referred to as the Magnificent 7.

The mark of a really bullish market is that there’s extra danger urge for food main traders to smaller, growthier corporations. This additionally exhibits up in the long run benefit for small caps vs. massive caps that actually hasn’t been true in additional than 3 years.

So sure, there are good indicators for traders. That inflation and bond charges are happening which will increase the percentages that the Fed is on the finish of their hawkish cycle. However till extra of the beneficial properties present up in small caps, then we’re proper to be considerably skeptical of the upside potential of this market.

Talking of inflation, it was certainly the higher than anticipated studying for CPI on Tuesday that was behind the spectacular inventory beneficial properties. That idea acquired an exclamation mark on Wednesday because the extra ahead wanting PPI report confirmed a -0.5% decline for inflation month over month. Sure, a detrimental PPI studying which bodes properly for future CPI and PCE readings that are what the Fed focuses on.

This explains the continued drop in Treasury charges charges…and mortgages…and auto loans…and company borrowing prices, which all factors to a more healthy economic system forward. It additionally factors to the Fed most definitely ending its hawkish charge hike regime within the not too distant future.

The truth is, the extensively adopted FedWatch software from the CME exhibits just about NO CHANCE of one other Fed charge hike given this current information. Now the guessing sport focuses on when the Fed will begin reducing charges.

The percentages level to a 4% likelihood of that occurring on the late January 2024 assembly. That will increase to a 33% likelihood for March 20, 2024 assembly. And 42% for Might 1, 2024.

Sure, the Fed is information dependent and “may” increase charges once more. However they’ve been clear that their coverage is already restrictive and has long run lagged results.

So the market in all probability has this one proper. That the Fed is finished with charge hikes and someday within the spring of 2024 they’ll begin reducing charges which is useful to financial progress…earnings progress…and share value progress.

This says it pays to remain bullish. And it SHOULD level to the eventual outperformance within the small cap house.

Certainly, that would be the finest indicator of true market well being. Thus, we’ll keep watch over the Russell 2000 within the hopes that it breaks above…and stays above it is 200 day shifting common that’s solely 3% increased than present ranges.

What To Do Subsequent?

Uncover my present portfolio of seven shares packed to the brim with the outperforming advantages present in our POWR Rankings mannequin. Sure, the identical mannequin that has crushed the market by greater than 4X since 1999.

Plus I’ve added 4 ETFs which can be all in sectors properly positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and every little thing between.

In case you are curious to be taught extra, and need to see these 11 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares fell $0.14 (-0.03%) in after-hours buying and selling Friday. 12 months-to-date, SPY has gained 19.18%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish Small Downside Might Loom Massive for Bull Market appeared first on StockNews.com