This text is an on-site model of our Disrupted Occasions publication. Join right here to get the publication despatched straight to your inbox 3 times every week

In the present day’s prime tales

-

US secretary of state Antony Blinken met Israeli prime minister Benjamin Netanyahu in Tel Aviv to push for a “pause” within the preventing in Gaza as issues mounted that the conflict might escalate right into a regional battle. Israel-Hamas conflict: full protection

-

FTX founder Sam Bankman-Fried was convicted of fraud and cash laundering in a landmark felony verdict that’s prone to condemn the ex-crypto tycoon to many years in jail and bolster US authorities’ makes an attempt to carry an unruly monetary sector to heel. Right here’s our profile of the fallen “king of crypto”.

-

Transport big Maersk is chopping not less than 10,000 jobs as demand plunges from pandemic highs. The business in the meantime is stepping up efforts to construct metal containers outdoors China, which is chargeable for 95 per cent of the world’s provide of the metallic bins, because it tries to guard a key a part of international commerce from provide chain and geopolitical pressures.

For up-to-the-minute information updates, go to our reside weblog

Good night.

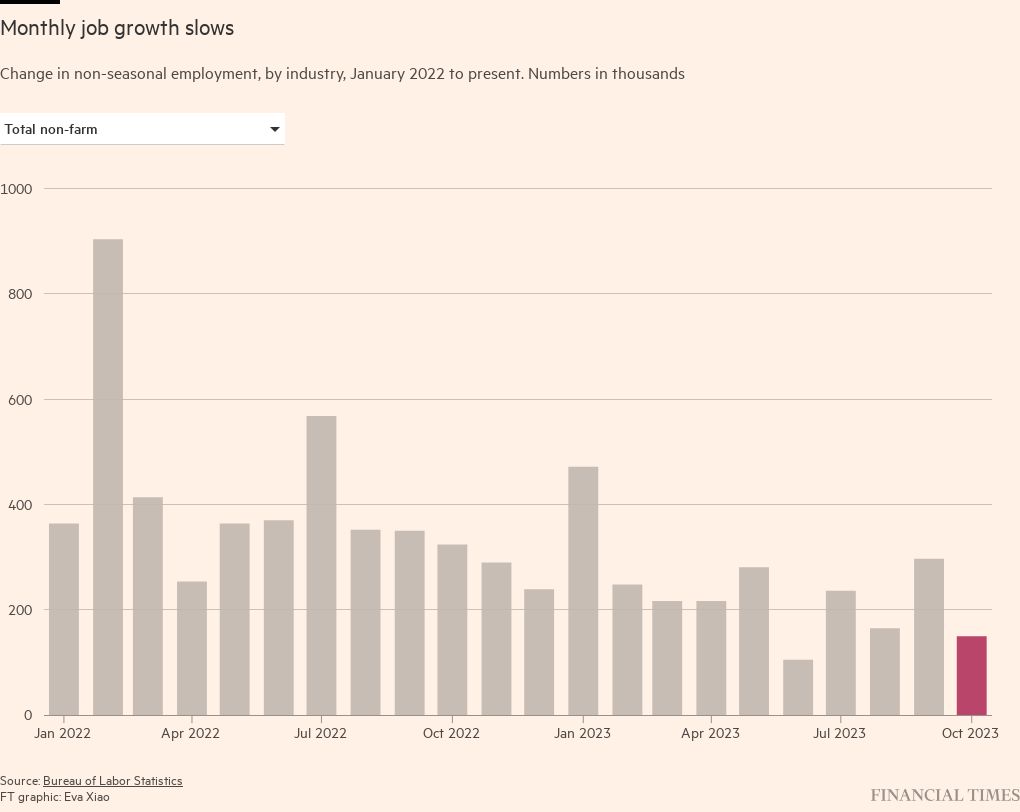

US jobs progress slowed sharply in October, fuelling traders’ bets that the Federal Reserve wouldn’t increase rates of interest additional in coming months.

The world’s largest economic system added a fewer than anticipated 150,000 new posts final month, whereas the unemployment charge rose from 3.8 per cent to three.9 per cent.

“This jobs report is . . . serving to persuade non-believers that that is very a lot the top of the speed hike cycle,” stated one strategist. “We’re very a lot in a disinflationary pattern, the economic system is cooling and the Fed doesn’t need to hike charges once more.” Individually, companies sector information additionally out at the moment bolstered the view that progress within the US economic system is slowing down.

The yield on the two-year US Treasury be aware, which strikes inversely to cost and tracks rate of interest expectations, fell to a two-month low of 4.86 per cent. US shares rose.

Earlier than at the moment’s information, the Fed, which saved charges at a 22-year excessive this week, had indicated that current stronger stats may need left it with extra work to do to fulfill its inflation goal.

As our new Huge Learn particulars, though traders are optimistic that inflation is below management and the period of rising charges is over, central bankers really feel that additional will increase stay on the desk.

Some market members, equivalent to BlackRock, the world’s largest asset supervisor, imagine traders nonetheless have to think about a lot increased long-term borrowing prices due to ageing populations, fractious geopolitics and prices related to the power transition. In any case, as commentator Soumaya Keynes writes, forecasting the place rates of interest are going can be a little bit of a mug’s recreation.

As Seth Carpenter, an ex-employee of the Treasury and the Fed places it, policymakers are removed from hanging up the “mission achieved” banner.

“The previous two and a half years have proven simply how tough forecasting could be,” he stated. “And I do assume there’s a ample dose of applicable humility throughout central bankers about how onerous it’s to know for positive the place issues are going.”

Must know: UK and Europe economic system

The Financial institution of England held rates of interest at 5.25 per cent and warned that its restrictive coverage must stay for an “prolonged interval”. BoE governor Andrew Bailey stated there was an extended strategy to go earlier than policymakers might chill out about inflation.

“We had been going to be nice.” Right here’s our wrap of the swearathon that was every week within the UK Covid inquiry, detailing the authorities’s response to the pandemic.

UK housebuilding was at its weakest for the reason that begin of pandemic within the three months to September, in keeping with surveyors, with new information suggesting a pointy drop in building exercise as rates of interest elevated.

Eurozone unemployment unexpectedly rose from its document low to hit 6.5 per cent in September as excessive rates of interest and a stagnating economic system took their toll on the labour market. As with the Fed, the European Central Financial institution is watching the job market carefully for indicators it should weaken and sluggish wage will increase, a key driver of inflation.

Ukraine is bracing for assaults on its power grid as Russia switches targets from seaports and grain-exporting infrastructure.

Must know: World economic system

The UK AI summit was a worthy affair, writes innovation editor John Thornhill, however in the end it’s the US, because the world’s technological hegemon, that may write the principles of the sport. The gathering ended with X boss Elon Musk telling prime minister Rishi Sunak that AI would render all jobs out of date.

Creating nations want as much as $387bn a yr to adapt to local weather change, in keeping with the UN Surroundings Programme.

Japan’s prime minister Fumio Kishida is staking his future on a $113bn stimulus plan of tax cuts and money handouts, as he fights excessive inflation and record-low approval rankings. Right here’s an explainer on what the top of the nation’s “yield curve management” experiment means for markets.

China’s anti-corruption drive continued with a ban on celebration officers investing in personal fairness. A Huge Learn particulars how the nation’s dream of “frequent prosperity” is starting to fade.

Must know: enterprise

US regulator FTC alleged that Amazon earned $1bn in further revenue from a secret algorithm that managed pricing, recognized internally as “Challenge Nessie”.

Shell earnings hit $6.2bn within the third quarter and the corporate elevated share buybacks because of excessive oil costs and refining margins.

There was extra proof of the bounceback in air journey, as German service Lufthansa reported the “highest income and revenue ever achieved in a single summer season”. There was additionally a surge in demand for first-class tickets, regardless of spiralling costs.

Official information confirmed the profitability of UK personal non-financial corporations fell within the second quarter and was under its pre-pandemic common, suggesting that increased margins weren’t a key driver of inflation, tallying with Financial institution of England findings downplaying the phenomenon of “greedflation”.

Science spherical up

New analysis highlighted the rising menace posed by zoonotic infections. Environmental and inhabitants adjustments over the previous many years are driving rising numbers of animal-to-human “spillover occasions”.

One other emissions drawback is beginning to achieve traction, this time regarding tyres, which launch many extra polluting particles than an exhaust pipe however hardly ever come below scrutiny. Meals chains are additionally in danger: a current examine confirmed a chemical from tyres had made its manner right into a lettuce plant.

The pioneering UK Biobank genetics database has gained donations of $10mn every from former Google chief government Eric Schmidt and billionaire investor Ken Griffin, highlighting the joy about its potential for breakthroughs in combating ailments.

An FT Huge Learn appears to be like on the proof exhibiting incidences of dementia slowing, regardless of the growing prevalence of longer life. Higher cardiovascular well being is prone to be a major issue, in addition to “cognitive reserve” — the place individuals whose brains stay nimble and energetic appear higher in a position to tolerate the deterioration of dementia with none apparent lack of colleges.

Commentator Anjana Ahuja discusses the nonetheless poorly understood scientific causes for menopause, a life change seemingly in battle with the evolutionary crucial to breed.

Some excellent news

New analysis exhibiting rats have humanlike powers of creativeness might increase improvement in neuroprosthesis, using mind capabilities to manage units equivalent to synthetic limbs, robotic arms or listening to implants.

One thing for the weekend

Attempt your hand on the vary of FT Weekend and day by day cryptic crosswords.

Interactive crosswords on the FT app

Subscribers can now remedy the FT’s Every day Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Really helpful newsletters

Working it — Uncover the large concepts shaping at the moment’s workplaces with a weekly publication from work & careers editor Isabel Berwick. Join right here

The Local weather Graphic: Defined — Understanding a very powerful local weather information of the week. Join right here

Thanks for studying Disrupted Occasions. If this text has been forwarded to you, please enroll right here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thanks