The leaves are turning crimson and gold in Central Park. On the Higher West Facet, surrounding the American Museum of Pure Historical past, are oak bushes. They line the pedestrian walkway and are swinging to the rhythm of a lightweight chill wind, marking the start of fall in New York. Acorns and dry leaves crunch below our ft. There’s a farmer’s market which begins on 81st and Columbus Avenue, continues right down to 77th Road, after which wraps across the museum to Central Park West. Various sizzling canines, kababs, and low carts line the trail the place the farmer’s market ends. It’s not your customary Broadway avenue truthful with trinkets; it’s a correct market the place locals get their meat and vegetable purchasing accomplished for the week. The primary stand on Columbus is Kernan Farms.

walkway and are swinging to the rhythm of a lightweight chill wind, marking the start of fall in New York. Acorns and dry leaves crunch below our ft. There’s a farmer’s market which begins on 81st and Columbus Avenue, continues right down to 77th Road, after which wraps across the museum to Central Park West. Various sizzling canines, kababs, and low carts line the trail the place the farmer’s market ends. It’s not your customary Broadway avenue truthful with trinkets; it’s a correct market the place locals get their meat and vegetable purchasing accomplished for the week. The primary stand on Columbus is Kernan Farms.

“I grew up close to this farm in New Jersey,” says David Sherman, founder, and portfolio supervisor of CrossingBridge funds, one of the crucial constant short-term and high-yield bond fund homes, and no stranger to the Mutual Fund Observer readers. The candy potatoes look actually good. He picks some up for his spouse. However no tomatoes; they’re out of season, he says.

I assumed the whole lot was in season all twelve months in Manhattan, and am pleased to be taught one thing new. I’ve been betrayed by Complete Meals.

We stroll the museum loop. At a espresso stand throughout from the place as soon as stood the statue of Teddy Roosevelt, and now a void, David orders a sizzling chocolate and a espresso and proceeds to combine it.

We’ve simply had a two-hour brunch at our neighborhood Italian Tarallucci e Vino, the place he obtained an omelet, and I had a farro salad. David quizzed me about fifty issues in investing within the first ten minutes. I can deal with the questions. However it’s his solutions I’m right here for.

I’d love to do a repeat of what we did for the June MFO article. I’d love to listen to his tackle the varied asset courses and funding traits. However the dialog veers off, and we now have a distinct bouquet of concepts this time. We should float.

David’s been investing professionally for over 40 years. He has been investing his personal cash by way of the many years, is a wide-ranging and unique thinker, and teaches an investing class at NYU the place he invitations a variety of profitable cash managers to talk. He’s beneficiant along with his time to MFO readers, and we’re grateful for that.

On MFO

David: Are you aware who you might be?

Devesh (to himself): I’ve been born numerous occasions to seek out the reply to that query, however I’m certain he isn’t speaking about that. Silence.

David: You – MFO – are a content material supplier. And I’m the content material!

On India

David: INDIA: I just lately invested in an India fairness fund. It’s a public markets hedge fund. I met the man, and he looks like he and his companions have good concepts and appear sincere. I didn’t wish to spend money on Personal Fairness as a result of liquidity, the power to get out, is essential to me. I didn’t wish to spend money on a public ETF. I believe this fund has been profitable in sourcing smaller corporations and investing in them. I’ll give them a couple of years, and if they’re down 20% in whole return compounded, I’d determine then, however I do know I’ve an exit. With Personal Fairness, I don’t have an exit. I was in Indian shares (ed be aware – for his mom) beginning in 1999 and exited. It is a new India place for me.

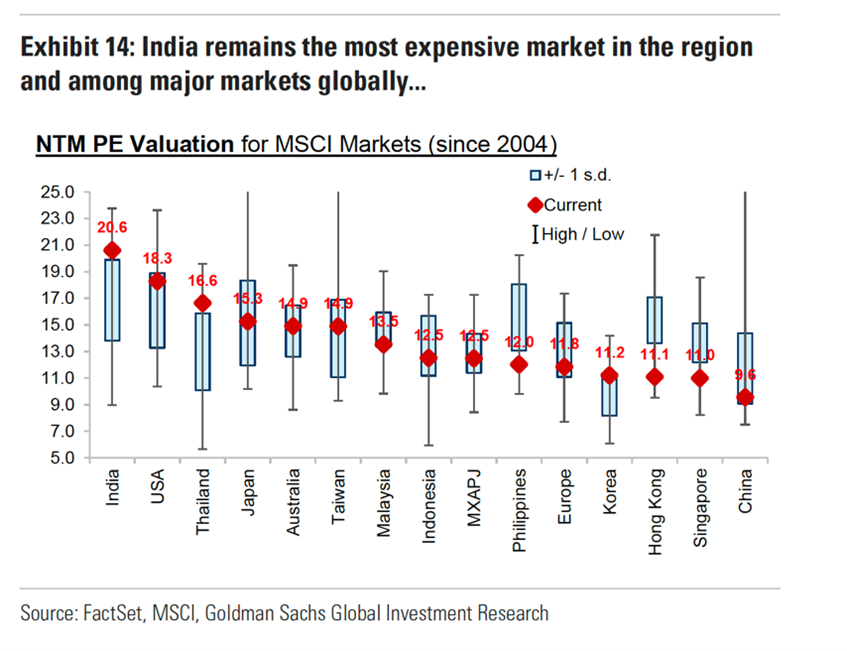

Devesh: I do know he’s preferred India up to now and is bullish in regards to the Lollapalooza impact. All the things is coming collectively for Mom India to have sustainable development for many years forward. One in all my mates who runs one other Indian hedge fund, Nischay Goel of Duro Capital out of Singapore, calls the funding alternative in India over the subsequent ten years Ridonculous!! The success of the South Pole moon touchdown, the G20, the dominance of Narendra Modi’s political social gathering, and the widespread man lastly being stuffed with pleasure and seeing the advantages accrue from progress is a sight to behold. Infrastructure is bettering all through the nation, and there’s going to be a truckload of billionaires being minted in India over the subsequent ten years. $39 billion {dollars} of home cash flows into shares every year as home wealth era and liquidity occasions unbound, and most traders can not take their cash overseas. The flip facet: Indian shares are costly, on the highest valuation in Rising Markets.

On Japan

David: JAPAN: I purchased right into a Japan Passive-Energetic fund recently. In Japan, it’s nonetheless troublesome to get board seats and alter the corporate’s course. However you might be allowed to tender for shares. And if you accumulate sufficient inventory place, you possibly can then associate with a bigger participant and purchase out the corporate. The fund I’ve invested in does that. It’s lively within the sense that it buys substantial portions of shares of public corporations. However it’s passive in that it’s going to roll up its fairness stake into the privatization of corporations to make them extra worthwhile. Japanese markets have gone up decently over the previous few years, however I nonetheless like them.

Devesh: Readers ought to be aware that these investments are for Certified Buyers. There’s info in each the car and the belongings he has picked. He’s lengthy Equities in Japan and India. However he isn’t shopping for a passive ETF. He’s deciding on a fund that’s acceptable for his wants. Particular person traders ought to learn that these are the place VERY LONG-TERM alternatives should exist. When to purchase and what to purchase is as much as every investor. I ask him to refresh his ideas for the readers on home US belongings, recalling he feels US shares are costly.

On enterprise capital and his private investments

David: Two years in the past, I offered virtually all of my US shares. When Enterprise Capital was preventing with one another to throw cash at any startup, it felt like a low-quality funding alternative to be invested in US shares. I offered the whole lot. (Sips his sizzling espresso/chocolate concoction).

David: I additionally didn’t have to take a mortgage, however they had been letting me borrow cash at 2.5%, so I took one! Think about a world the place there have been trillions of negative-yielding devices. Why would somebody purchase them? Solely as a result of they might suppose they might lose much less cash in these bonds than they might in different belongings. One thing needs to be massively mistaken with the world for a very long time. We’ve seen what’s occurred to inflation and rates of interest for the reason that period of unfavourable charges. And when the price of rates of interest goes up for the US Authorities, it goes up for everybody. Some shares seemed okay when the 10-year Rates of interest had been at 2.5% however not nearly as good at 5% rates of interest.

Warren, Berkshire, and Sherman

Devesh: I requested him his ideas on Berkshire Hathaway. He had preferred Buffett’s strikes in Japan and elsewhere once we final met.

David: After I offered within the US, my intent wasn’t to carry on to at least one inventory. I offered virtually the whole lot. Berkshire is a good personal fairness + mutual fund supervisor. It’s very nicely managed. Munger and Buffett’s ages should be considered. What’s the P/E of Berkshire?

Devesh: It’s buying and selling at 1.35x e-book worth, and it additionally has $147 Billion in Money with the Optionality worth to do one thing with it. Let’s put the quantity at about 20 occasions working earnings.

David: At 20x earnings, you might be mainly shopping for an funding with an Earnings Yield of 5% (1 divided by 20).

Devesh: He leaves the conclusion to me. I ask him in regards to the fiscal debt, the deficit, the potential cash printing, and better inflation, the necessity for corporations with actual belongings, corporations which have giant floor prints, and corporations with the power to reset costs.

Inflation, the greenback as world forex, and your future

David: We don’t know what inflation sooner or later goes to appear like. We simply don’t. And inflation is explicit to you and to me. After getting life-style creep, I’ve information for you: your bills will not be taking place. And we haven’t found out what to do when and if the US Greenback is not the reserve forex of the world. What are you going to do then?! If you’re excited about inflation, it is best to take into consideration the reserve forex standing as nicely.

Devesh: The dialog is unsettling. Most particular person traders don’t do a lot aside from allocating throughout some funds, shares, and bonds. If David makes no cash in his investments, he’s tremendous with it, so long as he doesn’t lose in investments he doesn’t like. Being invested for the sake of being invested is anathema to David.

On benchmarking your investments

In the meantime, as a standalone investor, long-term investing and incomes threat premium throughout asset courses is all I’ve. After I ask him which benchmark an investor should observe to be snug not being invested in US shares (the way in which he’s), I get a pointy poke within the eye.

David: What’s YOUR FASCINATION with BENCHMARKS!!

Devesh: If you happen to take a look at what a majority of establishments do world wide, they observe benchmarks. Trillions upon trillions of {dollars} observe indexing, benchmarks, diversification, passive or lively, and deploy their funds accordingly. And not using a benchmark, how have you learnt if you’re doing nicely and if the fund you invested in is doing nicely in its asset class? A benchmark is what brings self-discipline to the common investor.

David: What you might be suggesting is that if a benchmark tells you to purchase a lemon, you should purchase a lemon!

Devesh: If David doesn’t suppose an asset class, let’s say, US or Worldwide Developed or Rising Markets equities as an asset class, is attention-grabbing, he isn’t going to waste his time discovering a fund supervisor in these locations. He’s OUT. Benchmark is irrelevant. The Bogle three-fund or four-fund resolution or 60/40 or no matter is immaterial if the asset on provide is a lemon.

Tips on how to spend your time

David: Most individuals pay ample consideration to their careers. One will get suggestions, one appears at opinions, and one tries to enhance their ability set to allow them to receives a commission nicely for the quantity of stress they’re prepared to take.

Each investor equally must spend time on their funding portfolio.

- Begin with figuring out how a lot you want in years 1, 2, 3, 5, 10, and longer durations.

- Keep away from leverage in investments and buying and selling. It’s one factor that kills most traders.

- If you happen to actually wish to be levered, borrow cash towards your own home for 30 years and let that price of mortgage funding be your leverage. In case your mortgage price is 8% and you may’t discover an funding to beat that, possibly there isn’t a lot that leverage can do for you.

- In observe, you don’t want a couple of inventory supervisor and one bond supervisor. Spend time with a wealth advisor to choose the precise supervisor on your wants.

- Perceive that the very best traders undergo durations of mediocre efficiency. Buffett sucked wind for a big a part of the final decade. So did Ron Baron just lately. However in the long run, traders who keep on with the actually good high quality managers are okay.

- Nearly all of traders who get entangled in long-short methods, choices, and different complicated methods try to keep away from volatility. However why are they managing the volatility of their portfolio? It’s as a result of they haven’t totally considered their portfolio.

- In case your bases and desires are lined, what do you care what the market “benchmark” does? It’s irrelevant. Since inception, RSIIX has barely underperformed the Morningstar US HY BD TR USD by much less round a cumulative 100 bp or lower than 10 bp per 12 months. There have been durations of serious outperformance (notably just lately) and durations of serious underperformance. However volatility and consistency have been far superior. Does it matter? Return of capital issues greater than return on capital. The standard/threat of our portfolio is significantly better than the passive index.

- You need your supervisor to observe the 2 guidelines. Rule 1: don’t lose cash. Rule 2: don’t overlook rule 1.

Devesh: That is good, superb. It helps me perceive how David Sherman thinks in regards to the threat, rewards, and ease of investing. It additionally reconciles his personal funding positions for his private belongings with tutorial idea as we perceive it. I elaborate on my ideas later within the article.

On the Center East

I requested David for his ideas on the state of affairs within the Center East. As he describes his observations and evaluation of the choices out there for peace and struggle, I can see he feels the state of affairs viscerally.

The state of affairs within the Center East is tragic for everybody! There aren’t any good outcomes.

“On a really private foundation, you must perceive that antisemitism continues to be current. And what begins as antisemitism can simply finish in generalized bigotry.”

We proceed strolling. The River Ranch farm stand makes paneer and mango lassi. The Caucasian farmer hung out in India, labored with a Punjabi worker, and now’s our go-to man for milk merchandise each weekend. All the workers for Kernan Farms are Nepalese. That all of us perceive and embrace this multi-cultural melting pot as ours is a present. That we additionally perceive that peace is tough to attain and hold and that the Center East goes to see numerous deaths, and that the majority of us might be unable to vary a factor can be a curse for us to just accept and dwell with.

I thank David Sherman for a thought-provoking and insightful meal. He has given our readers so much to course of. Till subsequent time, David.

Be aware and afterthoughts

All funding returns for all market individuals mixed can come from simply three totally different buckets:

- Asset Allocation (which belongings – inventory/bond/actual property + personal/public)

- Safety Choice (which fund, which inventory, or bond notably)

- Market Timing (deciding when to be in or out)

David’s asset legal responsibility equation might not be yours or mine. His alternative of being detached to the benchmarks, and avoiding asset allocation if there’s a lemon, is extremely considerate, for him.

I do know individuals of their 80s who maintain 60 to 80% of their positions in US equities for causes many readers will acknowledge:

- Their liabilities (bills) are lined.

- These investments are for his or her youngsters and grandchildren, who, in flip, have a for much longer investing window.

- American corporations do a 3rd of their enterprise overseas. Previously, they noticed causes to carry overseas shares, however they don’t anymore as a result of enterprise has modified. They’re okay with their asset allocation being principally American shares.

- Previously, selecting particular person shares labored as a result of US equities had been under-owned, and since there weren’t as many hedge funds as right now with their computer systems. Now, it doesn’t. Safety choice for the common investor gives questionable worth.

- What about market timing?

There’s a current article by Howard Marks, Additional Ideas on Sea Change (5/30/2023). Right here, Marks particularly needs to shake the established order. I paraphrase him right here: Look, you don’t have to personal equities proper now and all of the volatility that equities will convey as a result of you possibly can earn 9% in excessive yield.

Marks is aware of we’re not going to liquidate shares, however he’s nonetheless saying we should always contemplate it as a result of the world of rates of interest has modified fully in comparison with the final forty years.

David Sherman’s option to be out of US equities and Howard Marks’ article are infinitely smart and possibly prescient as a result of these traders are forward of the sport. They’ve thought by way of the danger rewards, and when the world adjustments sooner or later, they may rethink them rapidly once more and act on it.

In the meantime, the common investor has additionally learnt. It’s a troublesome factor to outsmart the market. The one factor an investor can do is allocate throughout belongings, take the volatility, and hope, that, in the long term, they earn the danger premium embedded in numerous asset courses. Because of this many select to keep away from market timing.

There’s an in-between place, although. None of this precludes traders from decreasing threat in a single place and including in one other. We don’t should be in or out. We will cut back and improve allocations. That’s in our fingers.

Lastly, allow us to additionally settle for that none of us is aware of the long run.