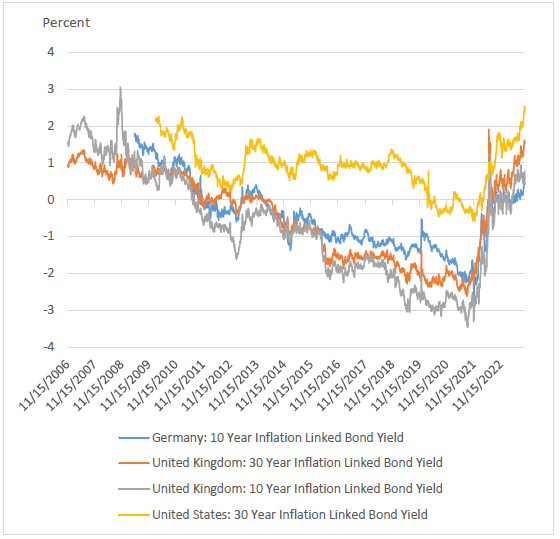

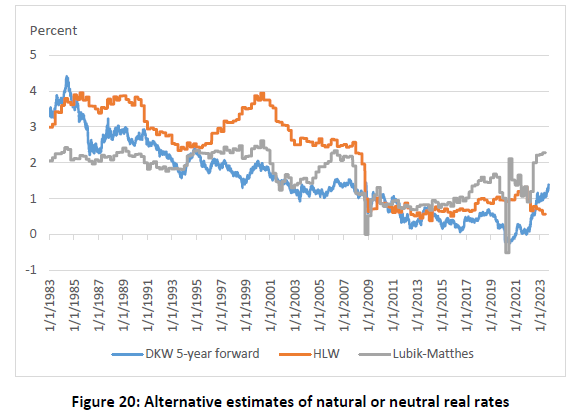

…properly, actual curiosity not less than. Whereas within the years for the reason that COVID-19 pandemic have seen nominal rates of interest rising, in the long term actual (i.e., inflation adjusted) rates of interest are falling. A NBER working paper by Obstfeld (2023) supplies compelling proof of this development. Present actual rates of interest are doubtless someplace within the 1%-2% vary. Causes for this development embrace “demographic shifts, decrease productiveness progress, company market energy, and protected asset demand relative to provide.” Some graphics displaying this development are beneath.

One motive why this may matter to well being economics is that many price effectiveness analyses embrace a reduction fee that reductions future well being positive aspects and prices relative to well being positive aspects and price that accrue within the current. Oftentimes, that low cost fee is linked to the true rate of interest within the economic system. If the true rate of interest is falling, ought to the low cost fee used for cost-effectiveness fashions and worth evaluation on the whole additionally fall? One would suppose so

You’ll be able to learn the total paper right here.