The motor insurance coverage sector has been grappling with a surge in car theft – an issue most prevalent within the high-value car market.

In 2022, car thefts noticed an alarming 25% year-on-year enhance, in accordance with ONS knowledge – a pattern attributed, partly, to the cost-of-living disaster and the escalating worth of used automobiles.

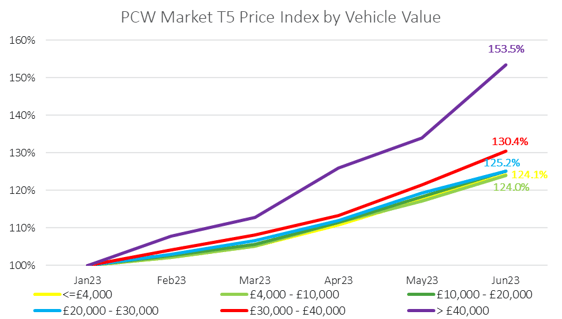

The shortage of obtainable used automobiles is inserting them in increased demand, making them engaging targets for thieves and driving up the potential resale worth for stolen automobiles. In consequence, insurers are pricing in opposition to this, bumping up premiums extra for drivers with increased worth automobiles in comparison with the remainder of the market.

However the acceleration in thefts isn’t the one factor pushing up premiums for high-value automobiles. The impact of claims inflation is amplified for these automobiles, because of increased price of substitute elements (corresponding to semiconductor chips and sensors), in addition to provide chain points with newer fashions.

The repercussions of those tendencies are evident. Autos valued over £40,000 have skilled a staggering 50% enhance in insurance coverage premiums because the starting of the 12 months, and this notable surge has pushed corporations to undertake proactive measures. In Might this 12 months, Aviva took the step to subject warnings to their purchasers in regards to the sharp rise in thefts of SUVs and luxurious automobiles. This highlights the concentrate on limiting publicity to claims for high-value property.

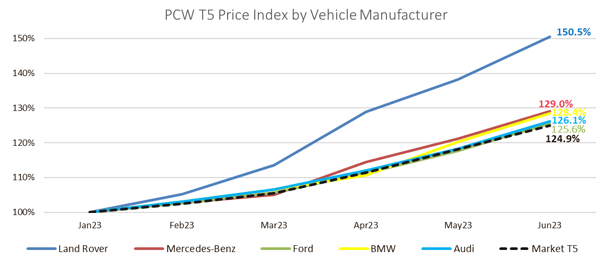

DVLA knowledge exhibits that sure automobile manufacturers are at the next threat of theft. Land Rover has emerged as probably the most steadily stolen automobile model by a big margin. Notably, six of their fashions have secured positions within the Prime 10 most stolen automobile fashions within the UK, as recorded within the 12 months ending March 2023. The Vary Rover Velar R-Dyn was discovered to be probably the most focused. This pattern is compounded by reviews suggesting vulnerabilities in Land Rover’s safety, together with points with keyless expertise.

Jaguar Land Rover CEO Adrian Marshall admitted final month that the quantity of Vary Rover and Vary Rover Sport thefts, significantly in massive cities, has turn out to be an issue. The issue is so acute in London that Vary Rover homeowners at the moment are being denied insurance coverage or supplied unaffordable premiums, as reported in Autocar earlier this 12 months.

Sadly, the automobile theft pattern isn’t set to decelerate anytime quickly. Document low automobile provide sits in opposition to a backdrop of excessive demand, driving up the worth of second-hand automobiles and elements, making automobile theft a profitable and interesting enterprise, particularly to these hit hardest by the deepening cost-of-living disaster.

Regardless of this inevitability, there’s a slither of hope on this escalating nightmare. This month, the Authorities introduced plans to ban keyless automobile hacking tools, underneath plans presently being thought-about by ministers and police chiefs. Nonetheless, their efforts might be futile with out assist throughout the motor business. It’s time for all sides to return collectively – Authorities, producers and insurers – to determine a united manner ahead to securing higher client outcomes.

Perceive and optimise your aggressive place.

Market View is an insurance coverage market benchmarking resolution that gives a uniquely complete understanding of market dynamics, competitor behaviour and model positioning inside the basic insurance coverage business.