The Authorities of India rolled out the Nationwide Pension Scheme (NPS) for all of the residents of India method again on Could 1, 2009 and for company sector from December, 2011. Since then, NPS has turn out to be probably the most well-liked funding and tax saving choices in India.

The numbers communicate for themselves – The Whole property beneath administration (AUM) with NPS is now at Rs. 8.82 Lakh crore with Y-o-Y progress of 23.45%. The variety of subscribers beneath numerous schemes beneath the Nationwide Pension System (NPS) rose to 624.81 lakh as at March 4th 2023 from 508.47 Lakh in March 2022 displaying a year- on- 12 months (Y-o-Y) improve of twenty-two.88%.

Most of my weblog readers have chosen NPS for 2 fundamental causes – i) for tax saving goal & ii) No different selection however to speculate, as contribution to NPS has been made necessary for a lot of the Govt workers.

If you’re investing in NPS Scheme or planning to put money into NPS, you want to pay attention to all the newest NPS Revenue Tax advantages which can be presently obtainable beneath outdated Tax Regime and New Tax Regime (w.e.f FY 2020-21).

On this put up, lets focus on – What are the NPS Revenue Tax advantages for FY 2023-24 or AY 2024-25? Are you able to declare Revenue Tax Deduction on NPS contribution beneath New Tax Regime? Are there any tax deductions beneath NPS Tier-2 account? Beneath what sections of the IT act NPS investments could be claimed as tax deductions? What’s the funding proof to avail the tax profit beneath NPS for FY 2023-24?

Newest NPS Revenue Tax Advantages FY 2023-24 / AY 2024-25 beneath Outdated & New Tax Regimes

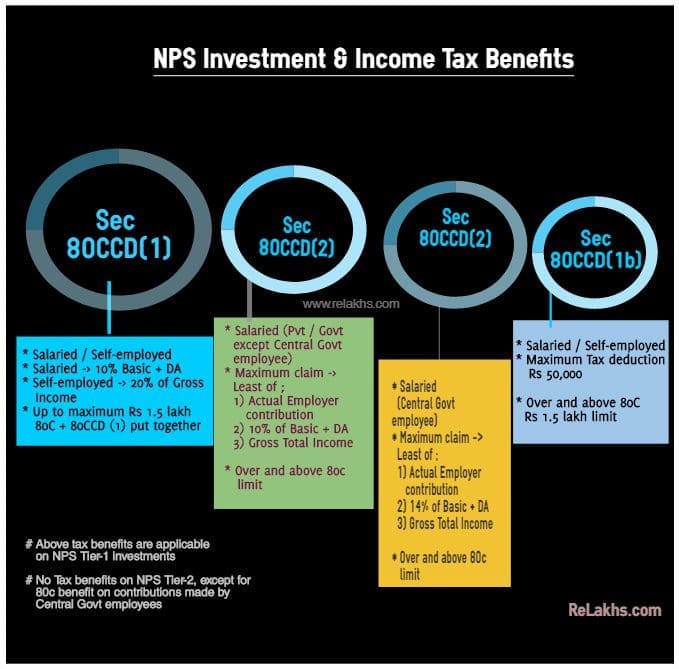

Under are the varied Revenue Tax Sections beneath which an NPS investor can declare Revenue Tax Deductions for FY 2023-24 / AY 2024-25 .

- Part 80C

- Part 80CCD (1)

- U/S 80CCD (1b)

- Part 80CCD (2)

“Beneath the brand new tax regime, the primary three deductions will not be obtainable, however the fourth one continues to be obtainable”

Revenue Tax Advantages beneath NPS Tier-1 Account for AY 2024-25

Tax Deduction beneath 80CCD(1) on NPS funding by Salaried particular person (besides Central Govt workers) :

- An Worker can contribute to Authorities notified Pension Schemes (like Nationwide Pension Scheme – NPS). The contributions could be upto 10% of the wage (salaried people).

- The utmost quantity that may be claimed as tax deduction is Rs 1.5 lakh u/s 80 CCD(1).

Outdated Tax Regime : If you’re opting outdated tax regime then you possibly can proceed claiming earnings tax deduction as listed within the above two factors.

New Tax Regime : If you’re going forward with New Tax Regime then you can’t declare earnings tax advantages u/s 80 CCD(1).

Tax Deduction beneath 80CCD(1) on NPS funding by Self-employed particular person :

- The self-employed (particular person apart from the salaried class) can contribute as much as 20% of their gross earnings and the identical could be deducted from the taxable earnings beneath Part 80CCD (1) of the Revenue Tax Act, 1961.

- The utmost quantity that may be claimed as tax deduction is Rs 1.5 lakh u/s 80CCD(1).

Beneath Outdated Tax Regime : If you’re opting outdated tax regime then you possibly can proceed claiming earnings tax deduction as listed within the above two factors.

New Tax Regime : If you’re going forward with New Tax Regime you then can’t declare earnings tax advantages u/s 80CCD(1).

Revenue Tax Deduction beneath 80CCD(2) on NPS funding for Non-Central Govt Staff :

- An employer can even contributes to NPS scheme.

- The contribution quantity made by the employer could be claimed as tax deduction u/s 80CCD(2), topic to the edge restrict of, least of the under; Quantity contributed by an employer

- 10% of Fundamental wage + DA (or)

- Gross Whole earnings

- That is an extra deduction which is not going to kind a part of Sec.80C restrict.

- Self-employed people will not be eligible to assert the NPS tax deduction u/s 80CCD(2).

Beneath outdated & New Tax Regime : If you’re choosing New Tax Regime in your Revenue Tax Return then there may be now a threshold restrict u/s 80CCD(2), with efficient from FY 2020-21. Your employer can contribute to your NPS account as talked about within the above factors. Nonetheless, in case your employer’s contributions beneath Sec 80CCD(2) are greater than Rs 7,50,000 a 12 months (together with EPF and Superannuation), then such exceeding contributions are taxable earnings within the fingers of the worker. The curiosity earned on over and above Rs 7.5 lakh stability can be taxable.

Revenue Tax Deduction beneath 80CCD(2) on NPS funding for Central Govt Staff :

- The contribution quantity made by the employer (Central Govt on this case) could be claimed as tax deduction u/s 80CCD(2), topic to the edge restrict of, least of the under;Quantity contributed by an employer

- 14% of Fundamental wage + DA (or)

- Gross Whole earnings

- The Centre will now contribute 14% of fundamental wage to Govt workers’ pension corpus, up from 10%. That is w.e.f April 2019.

- That is an extra deduction which is not going to kind a part of Sec.80C restrict.

Beneath outdated & New Tax Regime : If you’re choosing New Tax Regime in your Revenue Tax Return then there may be now a threshold restrict u/s 80CCD(2), with efficient from FY 2020-21. Your employer can contribute to your NPS account as talked about within the above factors. Nonetheless, in case your employer’s contributions beneath Sec 80CCD(2) are greater than Rs 7,50,000 a 12 months (together with EPF and Superannuation), then such exceeding contributions are taxable earnings within the fingers of the worker. The curiosity earned on over and above Rs 7.5 lakh stability can be taxable.

NPS Extra Tax Deduction u.s 80CCD(1b)

An extra tax advantage of Rs 50,000 could be claimed u/s 80CCD (1b) by the salaried or self-employed people.

Kindly word that the Whole Deduction beneath part 80C, 80CCC and 80CCD(1) collectively can’t exceed Rs 1,50,000 for the monetary 12 months 2020-21. The extra tax deduction of Rs 50,000 u/s 80CCD (1b) is over and above this Rs 1.5 Lakh restrict.

Beneath Outdated Tax Regime : If you’re opting outdated tax regime then you possibly can proceed claiming earnings tax deduction of Rs 50,000 u/s 80CCD(1b).

New Tax Regime : If you’re going forward with New Tax Regime you then can’t declare further earnings tax deduction of Rs 50,000 u/s 80CCD(1b).

Revenue Tax Advantages beneath NPS Tier-2 Account for FY 2023-24

The Tier II Nationwide Pension Scheme account is rather like a financial savings account and subscribers are free to withdraw the cash as and every time they require.

Tax Deduction beneath 80c for NPS Tier-2 funding

The contributions by the federal government workers (solely) beneath Tier-II of NPS will likely be coated beneath Part 80C for deduction as much as Rs 1.5 lakh for the aim of earnings tax, with a three-year lock-in interval. That is w.e.f April, 2019.

For different NPS subscribers, there aren’t any tax advantages obtainable on NPS investments in Tier-2 accounts.

Beneath Outdated Tax Regime : If you’re opting outdated tax regime then you possibly can proceed claiming earnings tax deduction u/s 80C.

New Tax Regime : If you’re going forward with New Tax Regime you then can’t declare these contributions u/s 80c.

NPS Maturity Proceeds & Withdrawal Guidelines FY 2023-24

Under are the frequent guidelines which can be relevant beneath outdated and new tax regimes relating to NPS Maturity proceeds and withdrawals;

NPS Tier-1 Maturity proceeds on Retirement is Tax-exempt

- After attaining 60 years of age, you’re allowed to withdraw 60% of the full Corpus quantity and a minimum of 40% of the amassed wealth within the NPS account must be utilized for buy of annuity/pension plan.

- With efficient from 1st April, 2019, the 60% NPS withdrawal is absolutely tax-exempt.

- In case the full corpus within the account is lower than Rs. 2 Lakhs as on the Date of Retirement (Authorities sector)/attaining the age of 60 (Non-Authorities sector), the subscriber (apart from Swavalamban subscribers) can avail the choice of full withdrawal. Nonetheless 60% of this withdrawal will likely be tax-exempt and 40% is taxable.

NPS Tier-1 Account & Partial withdrawals

The Tier 1 account is non-withdrawable until the individual reaches the age of 60. Nonetheless, partial withdrawal earlier than that’s allowed in particular circumstances.

- Within the newest rule change (Price range 2017), PFRDA (Pension Fund Regulatory And Growth Authority) has relaxed the withdrawal norms to the impact that now the subscribers can withdraw as much as 25% of contributions ranging from the third 12 months of opening of NPS.

- Kindly word that such partial withdrawals are tax-exempt. (The NPS partial withdrawals made earlier than 1.04.2017 are taxable.)

The withdrawals from NPS Tier 2 account don’t include any earnings tax profit. The tax assessee is answerable for taxation on any positive aspects arising out of investments in NPS Tier-II account and such positive aspects are taxable as per the relevant earnings tax slab charges.

Can NRIs declare Tax deductions on NPS AY 2024-25?

Whether or not you’re eligible to assert tax advantages is determined by the tax regime you go for for FY 2023-24.

Non-resident Indians (NRIs) are eligible to put money into the NPS scheme similar to resident Indians. The Rs 50,000 further tax profit on NPS can be obtainable to NRIs. These tax deductions can be found beneath outdated tax regime.

The switch of funds ought to be routed by way of a non-resident exterior account (NRE) or non-resident odd account (NRO). The one distinction is that the previous is a repatriable resident account whereas the latter is non-repatriable one.

What’s the funding proof to avail the tax profit beneath NPS?

The Subscriber can submit the Transaction Assertion as an funding proof. Alternatively, Subscriber from “All Residents of India” can even obtain the receipt of voluntary contribution made in Tier I account for the required monetary 12 months from NPS account NSDL log-in. It may be downloaded from the sub menu “Assertion of Voluntary Contribution beneath Nationwide Pension System (NPS)” obtainable beneath fundamental menu “View” in NPS account log-in.

Kindly word that this text is not a suggestion to put money into NPS Scheme. It’s only meant to offer info on NPS Revenue tax advantages FY 2023-24.

Proceed studying:

(Publish first revealed on : 23-Sep-2023)