Expensive associates,

Completely happy New 12 months! And oíche Shamhna shona duit!

November 1st is Samhain (pronounced “sow-in” in case you’re curious), the standard starting of the brand new yr in Gaelic tradition. It’s proceeded not solely by Samhain Eve but additionally by … properly, three days of consuming. After which adopted by three days of regretting it, a minimum of a bit of.

Samhain marked the top of the harvest season and the onset of “the darker half” of the yr, a time of accelerating isolation and lowering meals shares. It made all of the sense on the planet to do what folks do within the face of adversity: throw an enormous communal gathering, feast, and costume up in scary costumes, and inform the brokers of darkness to go elsewhere.

The Christian church, all the time looking out for a pagan vacation that they might cadge, imported it. Within the eighth century, Pope Gregory III designated November 1 as a time to honor all saints. All Saints Day, or “All Hallows Day” in an older iteration, included a number of the traditions of Samhain in its All Hallows Eve festivities.

And so, I assume, a season of modifications and a reminder that we finest face adversity once we are shoulder-to-shoulder with our neighbors, hopeful and beneficiant in spirit. (And spirits.)

On this month’s Mutual Fund Observer

My colleague Devesh Shah shares one other considerate report of a protracted luncheon dialog with Cohanzick’s David Sherman. Their speak is wide-ranging, relating topics from investing in India and MFO’s future to the foolishness of funding benchmarks. A part of the criticism there may be pushed by Mr. Sherman’s studying of a provocative essay by Howard Marks.

Howard Marks is the legendary co-founder and co-CEO of Oaktree Capital Administration. I exploit “legendary” in recognition of two information: (1) reportedly, his funds have returned 19% yearly since inception, and (2) just about each grown-up within the trade takes Mr. Marks’ essays severely. Oaktree invests $183 billion in “alternate options,” about two-thirds of which is invested in credit score (typically known as “excessive yield”) methods. Their company philosophy facilities on danger management, consistency of efficiency, and accountability to stakeholders and to society. It’s, on the entire, an admirable bunch.

Howard Marks’ essay to which Devesh and David Sherman refer, “Additional Ideas on Sea Change” (10/13/2023), makes two provocative arguments:

If the declining and/or ultra-low rates of interest of the easy-money interval aren’t going to be the rule within the years forward … after a protracted interval when the whole lot was unusually simple on the planet of investing, one thing nearer to normalcy is more likely to set in.

And …

Due to the modifications over the past yr and a half, buyers at the moment can get equity-like returns from investments in credit score.

The Commonplace & Poor’s 500 Index has returned simply over 10% per yr for nearly a century, and everybody’s very comfortable (10% a yr for 100 years turns $1 into nearly $14,000). These days, the ICE BofA U.S. Excessive Yield Constrained Index gives a yield of over 8.5%, the CS Leveraged Mortgage Index gives roughly 10.0%, and personal loans supply significantly extra. In different phrases, anticipated pre-tax yields from non-investment grade debt investments now method or exceed the historic returns from fairness.

And, importantly, these are contractual returns.

By “contractual returns,” Mr. Marks signifies that absent a company default, for those who maintain one among these bonds to maturity, you will get your 10% per yr. With shares, contrarily, the perfect we are able to say is “if we maintain shares for a minimum of 20 years, it’s fairly durn possible that the years of fifty% declines and 70% beneficial properties will common out to round 10%. Most likely.”

Mr. Marks, half facetiously, suggested a non-profit on whose board he sits to “Unload the massive shares, the small shares, the worth shares, the expansion shares, the U.S. shares, and the international shares. Promote the personal fairness together with the general public fairness, the actual property, the hedge funds, and the enterprise capital.” The flip aspect is the superbly critical statement that “if the developments I describe actually represent a sea change as I imagine – elementary, vital, and doubtlessly long-lasting – credit score devices ought to most likely signify a considerable portion of portfolios . . . maybe the bulk.” (The MFO dialogue of the essay does flag the ugly dangers inherent in proudly owning high-yield if a recession strikes, fyi.)

I take Mr. Marks (and Mr. Sherman and Mr. Shah) severely in “Investing Past The Nice Distortion.” In that essay, I attempt to present each the empirical results of The Nice Distortion – the interval of extraordinary occasions that Mr. Marks decries – and to focus on 4 funds that may make a fabric contribution to your portfolio out there past it.

Lynn Bolin displays on his variations of his personal portfolio to a number of the identical forces in “Quick Time period Market Momentum.” Like others, Lynn is considering long-dated bonds as a possible supply of capital appreciation relatively than simply revenue.

We additionally profile First Basis Whole Return, a fund almost left for lifeless some years in the past. Working as Highland Whole Return below a special adviser and burdened by a minimum of two units of dangerous inherited fixed-income holdings, the fund was staggering towards demise when First Basis adopted it and revived it with nice success. We share a little bit of the story.

Lastly, The Shadow does what The Shadow does, and shares three dozen modifications – together with three items of uncommon excellent news – within the trade. His Briefly Famous is properly price your time.

MFO neither engages in, nor significantly endorses, market-timing conduct. It’s an excellent strategy to lose relatively some huge cash. That mentioned, the “sea change” argument superior by Mr. Marks and others suggests an everlasting, near-permanent change within the guidelines may be within the offing. We needed to pair your consideration of that big-picture strategic risk with a simultaneous change within the tactical scenario. For that, we depend on the great of us at The Leuthold Group.

Leuthold: the lights have all turned purple, time to loosen up on shares

The Leuthold Group was initially a analysis supplier to institutional and high-net-worth buyers. The success of their analysis enterprise led them to start managing cash for wealthy folks as a aspect enterprise, after which to managing cash for shiny particular person buyers. Since investing is only a thoughts recreation (a inventory is price what folks imagine it’s price, a market rises when folks imagine it’ll rise … and act accordingly), they’ve recognized and repeatedly tracked an enormous number of cues which have kind of better predictive reliability relating to the economic system and markets.

The Leuthold Group was initially a analysis supplier to institutional and high-net-worth buyers. The success of their analysis enterprise led them to start managing cash for wealthy folks as a aspect enterprise, after which to managing cash for shiny particular person buyers. Since investing is only a thoughts recreation (a inventory is price what folks imagine it’s price, a market rises when folks imagine it’ll rise … and act accordingly), they’ve recognized and repeatedly tracked an enormous number of cues which have kind of better predictive reliability relating to the economic system and markets.

The snapshot is their Main Development Index, which seems at modifications in 4 broad aggregates: sentiment, valuations, technicals (e.g., trendlines or market breadth), and cyclicals (the conduct of belongings that rise and fall with the rhythms of the economic system and market). They are saying: “Main Development Index is a weekly e mail replace on the standing of our 130+ issue evaluation of inventory market danger.”

In early October, it went broadly unfavourable. By the third week of October, it grew to become redder nonetheless because the Main Development Index went “into the dumpster.” That decline prompted Leuthold to “additional cut back fairness weightings in our tactical portfolios. Within the Leuthold Core Fund, Core personal accounts, and Leuthold World Fund, fairness hedges had been adjusted to lower web fairness publicity to 44%.” (“MTI: Turned Unfavourable, Trimming Equities Additional,” 10/10/2023)

They’re fairly good at what they do. Their core product is Leuthold Core Funding, which is a five-star, Gold-rated tactical allocation fund. Neither allocation is 60/40, however they will drop shares as little as 40%. Since its inception in 1995, they’ve made 7.8% APR; in each trailing interval, they submit increased returns than their friends (0.7-3.5% APR) with noticeably decrease volatility. Their portfolio selections are pushed by the output of their quant fashions, not by their managers’ intestine. On the entire, I’d describe them as institutionally cautious.

Within the final three months of decline, LCORX has misplaced 50% of what its friends have; over the previous three years, it has made 250% of what they’ve (per Morningstar).

Right here’s the LCORX homepage, which is reasonably fascinating.

The Season of Adjustments

Adjustments come, sought or not. We caught up with three folks we vastly respect this month to turn out to be apprised of the modifications of their lives.

Dan Wiener

Dan Wiener (celebrated by one among my senior colleagues as “Dan, Dan, the Vanguard Man”) started publishing The Unbiased Adviser for Vanguard Traders in 1991. It’s the most generally learn, cited, and revered of the publications specializing in the $8 trillion funding behemoth. Alongside that, he crafted a $15 billion funding advisory.

Dan Wiener (celebrated by one among my senior colleagues as “Dan, Dan, the Vanguard Man”) started publishing The Unbiased Adviser for Vanguard Traders in 1991. It’s the most generally learn, cited, and revered of the publications specializing in the $8 trillion funding behemoth. Alongside that, he crafted a $15 billion funding advisory.

Lots to cowl for one man … so he introduced in another. Then, sensibly sufficient, stepped again. We caught up with Dan on October 17th and poked him, only a bit, about his plans and his classes from a long time within the enterprise.

On the following chapter:

We will see what the following chapter brings. Proper now I’m getting extra concerned with a number of the personal investments I’ve made (you would name them alternate options) in the whole lot from vitality to environmental security to know-how, plus a couple of meals service companies which have finished amazingly properly, opposite to well-liked perception. I even have plans to go snowboarding in Japan in February and take my son helicopter snowboarding in March. Plus, spend extra time with my three grandkids.

On his recommendation for the readers we fear about most, the younger of us simply beginning out and all the parents who’re feeling strapped and unsure:

My recommendation on investing for the younger and uninitiated is the Nike recommendation, “Simply do it!” However right here’s the factor, it doesn’t matter what anybody says about diversification or bonds, don’t hear. You need to go all in on shares. Interval. I’ve been investing because the 80s and even throughout the largest bond bull market in historical past, you’d have been a chump to have taken any cash from shares and put it into bonds. From December 1979 via December 2021, the Agg’s complete return was 1,813%. The S&P 500 returned 13,162%. The Russell 2000 did 8,023%. The EAFE did 3,212%. So, even for those who went all in on international shares you continue to about doubled the return on bonds throughout a 4 decade bond bull market.

Anyway, a child ought to do two issues: 1, get within the behavior of saving, and a couple of, purchase shares. I’ll go away it to you and your genius to inform them easy methods to purchase shares. Me, I put my children’ cash into funds run by the PRIMECAP staff and so they did very, very properly, thanks very a lot.

We rejoice the truth that Dan’s perspective on the place finest to take a position is a bit at odds with the suggestions of other people, who you’ll encounter beneath. That range of views is important to your potential to type via your personal tolerance for danger and wish for returns, so as to make the perfect determination for you and your loved ones.

What are you aware now that you simply want you’d have recognized then?

As for what I want I’d recognized 30 years in the past, nothing instantly involves thoughts. However two issues do stand out. One is that luck and timing can assist loads. I used to be fortunate to have come of age (professionally) when mutual funds had been democratizing the markets. And as a journalist I had a front-row seat.

The one factor I’d inform any teenager below your tutelage is that no matter they’re into or no matter profession they search to pursue, to learn, learn, learn. Immerse themselves within the trade, within the enterprise, within the knowledge of no matter they’re doing. Turn into the professional. Cease taking part in video video games and studying science fiction. Learn commerce journals. Learn the WSJ. Learn the whole lot you’ll be able to and speak to consultants within the discipline. I believe that’s one place the place I used to be fortunate as a journalist in that I had entry to scores of publications and knowledge and consultants. (I by no means left the workplace with out a briefcase filled with stuff to learn on my subway rides to and from dwelling.)

Zeke Ashton

Zeke Ashton, founder, managing associate, and a portfolio supervisor of Centaur Capital Companions L.P., managed Centaur Whole Return Fund from its inception. On November 1, 2018, the fund’s Board of Trustees introduced an epochal change: Zeke, the final of its 4 founding managers, had notified the Board that he meant to resign after a run of 13.5 years. Earlier than founding Centaur in 2002, he spent three years working for The Motley Idiot, the place he developed and produced investing seminars, subscription investing newsletters, and inventory analysis studies, along with writing on-line investing articles. He graduated from Austin School, a superb liberal arts faculty, in 1995 with levels in Economics and German and subsequently has served on the school’s Board of Trustees.

Centaur was a remarkably good little fund. All-weather, nice returns over time, absolute worth orientation. Zeke needed to have a completely invested fairness portfolio however has saved 40-60% in money because the market grew to become richly valued. It’s made 12% yearly over the last decade as a result of his inventory picks carry out very well; In 2017, he had a 13.5% return sitting on 50% money, which suggests his shares returned about 27%. We profiled it a number of instances.

Zeke defined the choice to liquidate each the fund and its companion hedge fund as a call about stability and which means in life. “Being knowledgeable investor takes a lot effort, working weekends and nights. We’ve had no trip in six years. We’ve been married for 14 years, working the technique for 14 years. Enterprise has come to dominate our relationship.” After chatting about household and well being challenges, Zeke concluded, “This all made me notice, that the inventory market is all the time going to be there, however the folks you’re keen on received’t all the time be.”

This week, Zeke introduced the choice to launch a hedge fund, Ashton Capital. (All the great names, he laments, had been taken). Fairness lengthy/brief, benchmark-free, and its historic complete return emphasis. He guarantees “no loopy ARKK-like dangers” however permits that he’s “too younger to take no dangers. We’ve been specializing in pleasure via this all, and I believe that investing has introduced the enjoyment again.”

There is no such thing as a plan to launch a mutual fund (too many complications, an excessive amount of competitors), however RIAs and different certified buyers would possibly comply with his launch, and contemplate speaking to the person himself.

Pierre Py

A brief notice on Pierre Py, one of many two founding managers of FPA Worldwide Worth, which finally (a) transitioned to a brand new advisor and a brand new identify – Phaeacian World Worth and Phaeacian Accent Worldwide Worth – and (b) famously crashed in a bitter enterprise dispute between Mr. Py and his staff on the one hand and the adviser, Polar Capital, on the opposite.

A brief notice on Pierre Py, one of many two founding managers of FPA Worldwide Worth, which finally (a) transitioned to a brand new advisor and a brand new identify – Phaeacian World Worth and Phaeacian Accent Worldwide Worth – and (b) famously crashed in a bitter enterprise dispute between Mr. Py and his staff on the one hand and the adviser, Polar Capital, on the opposite.

The dispute initially concerned Polar Capital and FPA, however that piece has now been resolved.

The Polar/Py dispute has not but reached a decision, however he’s hopeful that the competition is far nearer to its finish than to its starting.

Within the interim, he and his long-time co-manager proceed investing. For the second, they proceed managing the technique via individually managed accounts. Whereas the AUM is small, they’ve continued so as to add substantial alpha in 2022-23.

As we talked concerning the future, Pierre expressed a passionate need to serve “the little man.” He’s fairly overtly important of the course that the funding trade has taken, producing “commoditized items” pushed by the calls for of the advertising and marketing and distribution groups. The skilled buyers – the producers, so to talk – have been devalued by years of relentlessly rising markets that appear to have satisfied many who neither talent nor an appreciation of danger has any enduring worth. “The funding trade gutted itself in favor of relying on rising markets; in a better inflation and better rate of interest setting, that’s going to be actually onerous, and almost unattainable with a 200 identify portfolio.”

We may, he notes, “have labored for a hedge fund or very wealthy people, however that’s not the place our ardour lies. I’m very eager to return to engaged on behalf of retail buyers.”

We are going to preserve a watch out and fingers crossed, each for Mr. Py’s sake and for yours.

JP Morgan: do your self a favor, don’t overthink this one

An essay within the Monetary Instances argues in favor of radically simplifying one’s strategic asset allocation. It argues, at base, that uncommon belongings produce uncommon returns solely till they’re found by the hoi polloi and the trade arbitrages away the distinctive achieve. Consequently, the actual cash is made by first movers, and the actual prices are borne by these of us who attempt to get in later.

Right here’s the core:

On common, analysis exhibits round 100 per cent of their complete returns could be ascribed to their alternative of coverage benchmark [i.e., their strategic asset allocation], together with round 90 per cent of their return volatility. The outcomes of these judgments are sometimes advanced.

Jan Loeys, JPMorgan’s veteran asset allocation guru, says in a latest shopper notice that this complexity is each pointless and counterproductive. Pointless, as a result of buyers want solely two belongings: a worldwide fairness one and an area bond one, with the relative quantities pushed by their potential to face up to short-term drawdowns and return wants. (Much less is extra relating to strategic asset allocation,” FT.com, 10/17/2023)

There’s a extremely wholesome dialogue on the MFO dialogue board that thinks via the implications of Mr. Loeys’ radical simplification. You would possibly get pleasure from it.

Exhausting issues finished properly

In 1983, John Osterweis based Osterweis Capital Administration to handle belongings for people, households, endowments, and establishments. The agency, headquartered in San Francisco, manages $6.5 billion in belongings and advises the Osterweis funds.

Generally, Osterweis is distinguished in various methods. First, it detests the prospect of dropping its shareholders’ cash, particularly needlessly. Second, it pursues methods that don’t mesh properly with Morningstar’s style-box-driven view of the world. Third, it’s very critical about doing good work for its shareholders. The fund is primarily employee-owned, and its administration groups are typically secure and constant.

Generally, Osterweis is distinguished in various methods. First, it detests the prospect of dropping its shareholders’ cash, particularly needlessly. Second, it pursues methods that don’t mesh properly with Morningstar’s style-box-driven view of the world. Third, it’s very critical about doing good work for its shareholders. The fund is primarily employee-owned, and its administration groups are typically secure and constant.

That makes it putting that the agency selected to liquidate three mutual funds in brief order. The primary two had been the previous Zeo funds. In October, they introduced that Osterweis Whole Return was following them to the graveyard. Curious, I reached out and was happy by the chance to talk instantly with Carl Kaufman, the #2 man at Osterweis behind founder John Osterweis.

Right here’s the brief model of Carl’s clarification:

Most Osterweis fixed-income investing focuses on credit score alternatives, not funding grade. That higher credit score gives a richer alternative set, and the destiny of a credit-driven portfolio is within the palms of the buyers. An funding grade portfolio is topic to rate of interest danger; for example, Vanguard’s passive Lengthy Time period Bond ETF is down 44.5% since its peak in July 2020, at that’s via no fault of its personal. Rates of interest tick up, and lengthy bonds die a bloody demise. Generally, that’s not a combat buyers can win, and it’s not one which Osterweis – usually – desires any a part of.

Whole Return was the exception. Osterweis believed that they might assemble an funding portfolio that might climate the market’s storms greater than a portfolio with lower-rated bonds would possibly. They discovered a superb staff, allotted sources to the fund, and stepped again and watched it for the previous seven years. It began with two actually stable years, then two okay years, after which the turbulence hit.

What they noticed was disappointing. Mr. Kaufman somberly studies, “The fund was merely not serving its buyers’ wants; it alleged to do a lot higher in down markets than the standard bond combination fund. Heck, we thought it had a reasonably good probability to go up final yr. 2022 (when the fund misplaced 6.5%, a purely mediocre relative efficiency) was eye-opening. It had the promise, not the efficiency. It was time to react to actuality. Actually nice staff, however it’s what it’s.”

Mr. Kaufman recommended to me a ebook that he’s been studying, Stop: The Energy of Figuring out When to Stroll Away (2022). The creator is, amongst different issues, knowledgeable poker participant and has studied cognitive psychology with funding from the Nationwide Science Basis. As a tradition, we worship persistence, from adages like “winners by no means stop, quitters by no means win” to celebrations of men who pushed on via all of the purple lights to summit Mt. Everest (the place they heroically, properly, died).

Mr. Kaufman recommended to me a ebook that he’s been studying, Stop: The Energy of Figuring out When to Stroll Away (2022). The creator is, amongst different issues, knowledgeable poker participant and has studied cognitive psychology with funding from the Nationwide Science Basis. As a tradition, we worship persistence, from adages like “winners by no means stop, quitters by no means win” to celebrations of men who pushed on via all of the purple lights to summit Mt. Everest (the place they heroically, properly, died).

Ms. Duke argues that successful typically requires quitting:

Quitting, when finished proper, means that you can obtain your objectives extra shortly. That is counterintuitive, as a result of we consider quitting as stopping our progress. However that’s not true when the factor you began isn’t worthwhile. In case you stop, that frees up all of these sources to change to one thing that may truly assist.

I recommend creating what I name “kill standards” prematurely. Don’t belief your self to do it within the second. Ask your self: what are the alerts I may see sooner or later that might inform me that it’s time to stop?

Mr. Kaufman notes that Osterweis, successfully, has “kill standards” for every of their methods. They’ve expectations, standards, and benchmarks for every technique. They’ve received persistence. They usually’ve received a willpower to finish methods that aren’t as much as their requirements. They closed their hedge funds in 2012 due to it, and so they made the identical painful determination with their three funds this fall.

Their determination strikes me as each rational and principled. And the dialog satisfied me to choose up a duplicate of Stop from my native Barnes and Noble. (Amazon has confirmed to be so constantly predatory of its staff, suppliers, companions, and neighborhood that I’ve been attempting to keep away from them every time potential.)

I’ll let you realize what I be taught.

Towle Deep Worth Fund: what a distinction 10 days could make

Towle Deep Worth Fund is a deep worth / small cap fund. It’s concerning the purest deep worth mess around, which is engaging as a result of the educational analysis says that the “worth impact” is most obvious in actually deep worth, simply because the small-cap impact is most seen in actually small caps.

Good folks doing onerous stuff.

They’re at the moment a one-star fund in Morningstar’s system. Charles’s score of them since inception (2011) is comparable: 1 (lowest 20% within the peer group primarily based on risk-adjusted returns). This made their quarterly report pop, as they famous that their SMA composite for his or her technique returned simply over 19% yearly for the previous three years. Morningstar’s three-year numbers, which by default on the final 36 months from at the moment, are far decrease. Curious, I checked.

What a distinction 10 days makes: the fund loses one-third of its trailing three-year returns while you shift from 9/30/23 as your finish date to 10/13/2023. That’s about 10 buying and selling days. However the reverse impact is seen within the five-year returns, which enhance by 50%.

Three yr returns (per Morningstar)

As of 9/30/23: 19.18%

As of 10/13/23: 12.74% – a 33% decline

5 yr returns

As of 9/30/23: 2.47%

As of 10/13/23: 3.76% – a 50% rise

Ten yr returns

As of 9/30/23: 6.43%

As of 10/13/23: 5.86% – a ten% decline

One purpose that MFO historically pushed “full market cycles” because the metric relatively than arbitrary home windows (what’s the significance of “three years”?) is that it’s essential to discover a strategy to keep away from being misled by efficiency studies that may replicate one efficiency bubble rolling off simply as a drawdown rolls on.

Which is to say: look lengthy and onerous ( you, Ms. Woods) earlier than concluding, “these numbers are candy! Right here’s my cash!”

Morningstar’s persevering with weirdness

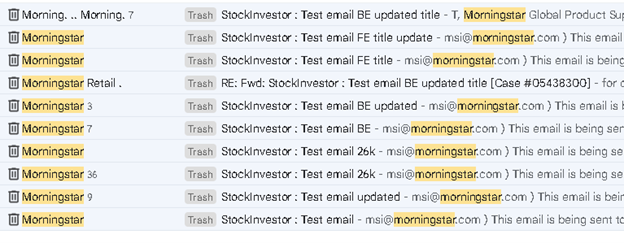

I obtained over 60 check emails from Morningstar “as a part of my StockInvestor subscription,” over the course of two weeks. Nothing I did – together with writing to media relations and retail assist – stemmed the tide.

(I don’t even subscribe to StockInvestor.) Within the face of all of that, the eventual response was nearly laughable.

Hey David,

We hope you might be doing properly.

We wish to inform you that the staff responded to us that they weren’t sending any emails however they are going to be cautious for any future reference.

Finest regards,

_________________________________

Morningstar World Product Assist

“They aren’t sending any emails”? Ummm … sure, they had been.

In case you’re in search of a extremely good purpose to assist a substitute for Morningstar, fairly aside from the abandonment of retail fund buyers, dominance of AI-written textual content, and senseless fund screener, that may be it.

Thanks

To The Devoted Few, whose month-to-month contributions preserve spirits up and the lights on: S & F Funding Advisers, Wilson, Brian, Gregory, Doug, David, William, and William. In case you’d love to do your half to maintain MFO up and working, please click on on the “Assist Us” hyperlink above or be a part of the MFO Premium of us who, for simply $120/yr, get entry to maestro Charles and a number of the most superior search instruments out there (or, a minimum of, “out there for lower than the $16,000 that some others cost”).

Cheers!