The newest IRDA Declare Settlement Ratio 2024 was launched on twenty eighth Dec 2023. In keeping with this, which is the very best Life Insurance coverage Firm in 2024?

The vast majority of Life Insurance coverage Corporations these days lure patrons primarily based on the IRDA Life Insurance coverage Declare Settlement Ratio. Nevertheless, is it the correct knowledge to look into?

What’s the that means of the Declare Settlement Ratio?

Declare Settlement Ratio is the indicator of what number of dying claims Life Insurance coverage Firm settled in any monetary yr. It’s calculated as the full quantity of claims acquired in opposition to the full variety of claims settled. Allow us to say, the Life Insurance coverage Firm acquired 100 claims and amongst these, it settled 98, then the declare settlement ratio is alleged to be 98%. The remaining 2% of claims the Life Insurance coverage Firm rejected.

Primarily based on this, we are able to simply assume how customer-friendly they’re in coping with dying claims. Nevertheless, I warn you that this declare settlement ratio is uncooked knowledge.

It is not going to offer you a transparent image of what varieties of merchandise they settled. They could be Endowment plans, ULIPs, or Time period Insurance coverage Plans. Therefore, this isn’t the only real criterion in judging the efficiency of a life insurance coverage firm.

Greater than that we don’t know for what causes the insurance coverage firm rejected the claims.

Some attention-grabbing info from IRDA Annual Report 2023

# As per the Swiss Re Sigma Report, the insurance coverage penetration of the Life Insurance coverage sector in India is decreased from 3.2% in 2021-22 to three% in 2022-23 and the identical for the Non-Life Insurance coverage sector remained at 1% in each these years. As such, India’s general insurance coverage penetration decreased to 4% in 2022-23 from the extent of 4.2% in 2021-22.

# For brand new enterprise, conventional merchandise contributed Rs.6.77 lakh crore, constituting 86.59% of the full premium and the share of ULIPs stood at 13.41%. The enterprise from conventional merchandise grew by 14.40% and the identical for ULIPs is 4.61%. This implies persons are nonetheless investing in conventional life insurance coverage and ULIPs. Share of Time period Life Insurance coverage premium appears miniscule.

# Participation of ladies in shopping for life insurance coverage – 30.13% in non-public insurers and 35.81% in public sector insurers.

# Out of the 24 life insurers in operation throughout 2022-23, 17 firms reported earnings.

# IRDAI (Bills of Administration of Insurers transacting life insurance coverage enterprise) Rules, 2016 prescribe the allowable limits of bills of administration making an allowance for, inter alia the kind and nature of the product, premium paying time period, and period of insurance coverage enterprise. Throughout the yr 2022-23, out of 24 life insurers, 18 have been compliant with the aforementioned laws. Six life insurers had exceeded the bounds of bills on an general foundation or segmental foundation and their request for forbearance is beneath examination.

# Throughout 2022-23, life insurers paid a complete quantity of 42,322 crore as fee. The fee bills ratio (fee bills expressed as a proportion of premium) barely elevated to five.41% in 2022-23 from 5.18% in 2021-22. Nevertheless, complete fee outgo elevated by 17.93% (complete premium development 12.98%) throughout 2022-23 as in comparison with the earlier yr.

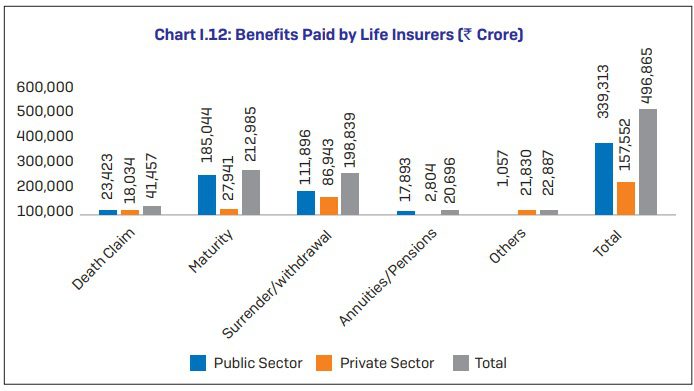

# Advantages paid by life insurers are as beneath.

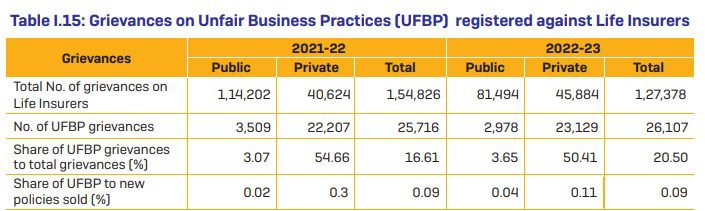

# Grievances on Unfair Enterprise Practices (UFBP ) registered in opposition to Life Insurers. You seen that there’s a lower in complaints. Nevertheless, not an awesome achievement.

# Within the case of a supply of enterprise for all times insurance coverage, banks carry round 53% of enterprise and people carry 23% of enterprise for personal sector insurers. For the general public sector, 96% are from people and round 3% from banks. BEWARE!!

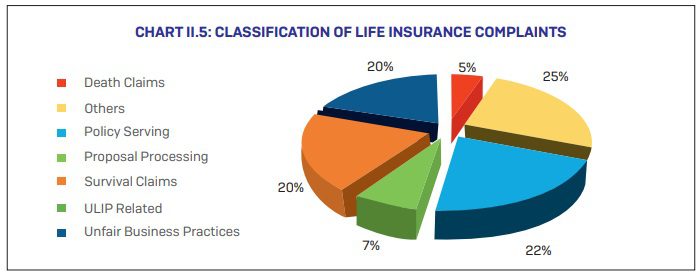

# Classification of Life Insurance coverage Complaints are as beneath.

Seen that the key chunk is said to coverage serving and adopted by unfair enterprise practices. Demise claim-related complaints are simply round 5%.

Newest IRDA Declare Settlement Ratio 2024

Surprisingly, this yr in its annual report, IRDA didn’t publish the person life insurance coverage firms’ declare settlement ratio. As a substitute, IRDA simply revealed this beneath report. Therefore, I’m additionally pressured to share the identical. Nevertheless, I simply seen that they’re importing the declare settlement ratio of life insurers in a unique Excel sheet. However earlier years knowledge is on the market however the newest knowledge is lacking.

Therefore, as of now, I’m sharing regardless of the IRDA shared as a consolidated business declare settlement ratio. As and after I get the person firms’ knowledge, I share the identical right here.

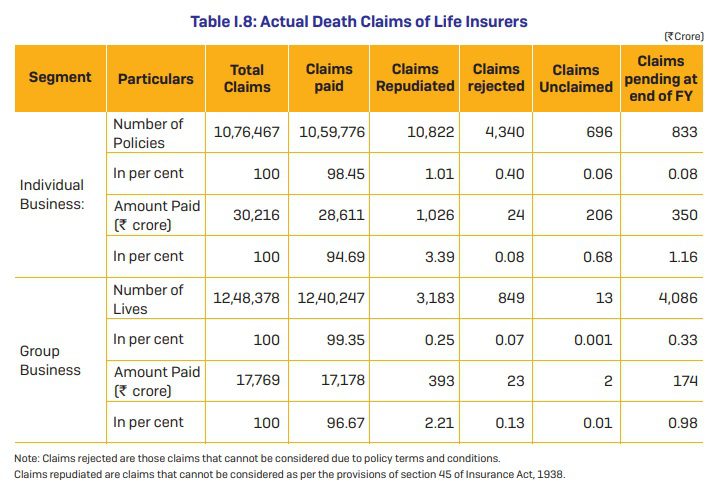

Within the case of particular person life insurance coverage enterprise, through the yr 2022-23, out of the ten.76 lakh complete dying claims, the life insurance coverage firms paid 10.60 lakh dying claims, with a complete profit quantity of 28,611 crore. The variety of claims repudiated was 10,822 for an quantity of Rs.1,026 crore and the variety of claims rejected was Rs.4,340 for an quantity of Rs.24 crore. The claims pending on the finish of the yr have been Rs.833 for Rs.350 crore. The declare settlement ratio of the general public sector insurer was 98.52% at

March 31, 2023, in comparison with 98.74 % as of March 31, 2022. The declare settlement ratio of personal insurers was 98.02% throughout 2022-23 in comparison with 98.11% through the earlier yr. The business’s settlement ratio decreased to 98.45% in 2022-23 from 98.64% in 2021-22.

Primarily based on the above info, it’s laborious to evaluate particular person firms efficiency. Regardless that the declare settlement ratio just isn’t a significant criterion for selecting an insurance coverage firm or product, I feel by not offering the main points like earlier annual experiences, I felt it’s laborious to evaluate even the effectivity of the corporate within the settlement of claims. As a result of earlier annual experiences have been even used to categorise the time taken to settle the claims.

For me, greater than declare settlement, how a lot time every insurer took to settle the declare was important (regardless that causes for delay could also be unknown to us).

Allow us to see if IRDA publishes this lacking knowledge individually. I’ll share that info as soon as I get it.