Authorities of India is providing the longest bond of fifty years “New Authorities Safety 2073”. This Authorities of India Bond 2073 is out there at a 7.52% yield. Who can make investments?

The bond particulars as per RBI Retail Direct are as beneath.

Safety Identify – NI GOVT. STOCK 2073

Maturity Date – sixth November 2073

Indicative Yield (as of 1st October 2023) – 7.52%

ISIN Quantity – IN0020230127

You should purchase this bond in RBI Retail Direct Platform with none value concerned. (“RBI Retail Direct – Make investments In Authorities Bonds On-line).

As of now, the longest bond providing by the Authorities Of India is 40 years. First-time authorities is providing a 50-year maturing bond. Two extra auctions of 50-year tenure bonds can even be introduced at later dates for the second half of FY2024.

New Authorities Of India Bond 2073 – Who can make investments?

Simply because it’s provided by the Authorities Of India and default or downgrade threat is nearly NIL doesn’t imply it’s SAFE. You’ll be able to keep away from the default or credit score downgrade threat as it’s issued by the Authorities. Nevertheless, you may’t run away from rate of interest threat.

Therefore, allow us to attempt to perceive the professionals and cons of investing within the New Authorities Of India 2073 Bond.

# Curiosity or Coupon Revenue

Curiosity will likely be payable on half yearly foundation. It isn’t like your Financial institution FD the place you accrue the accrued curiosity and get again maturity. Therefore, if you’re in want of such frequent revenue, then you may go for it. In case you are within the accumulation section of your life and making an attempt this bond only for diversification or as a debt half, then it’s of no use for you.

Many might argue that they will reinvest the identical. Nevertheless, be aware that this curiosity revenue is taxable for you. Therefore, post-tax you must make investments, and reinvestment threat is at all times in your head. While you purchase a debt mutual fund, the fund supervisor additionally receives the coupon. Nevertheless, he reinvests which won’t alter your taxation. However in the event you want to do the identical, then you must pay the tax after which reinvest.

# Taxation

As I discussed above, the curiosity or coupon you obtain is taxable as per your taxable. Therefore, take a look at post-tax returns than the pre-tax returns.

Together with this, in the event you promote the bonds within the secondary market earlier than maturity, then you must pay the tax on capital features.

When you promote bonds inside a 12 months of buying them, the features will likely be handled as short-term capital features and will likely be taxed at your revenue tax slab fee. Nevertheless, in the event you promote your bonds after a 12 months of holding them, the features will likely be handled as long-term capital features and will likely be taxed at a decrease fee of 10% (with out indexation profit).

# Curiosity Charge Threat

I wrote an in depth submit on this “Half 3 – Debt Mutual Funds Fundamentals” or I pasted the identical right here on your reference.

Assume that Mr.A is holding a 10-year bond that gives him 8% curiosity with a face worth of Rs.100. Mr.B is holding a 10-year bond that gives him 6% curiosity with a face worth of Rs.100. Assume that the Financial institution FD fee is at 7%.

Allow us to assume that for numerous causes Mr.A and Mr.B are keen to promote their bonds within the secondary market.

Because the Financial institution FD fee is at the moment at 7%, many will attempt to purchase Mr.A’s bond relatively than Mr.B’s bond. Even few could also be able to pay greater than what Mr.A invested (assuming he invested Rs.100). Primarily as a result of the financial institution is providing 7% and Mr.A’s bond is providing greater than this (8%).

Due to this, Mr.A might promote at a premium worth than he truly invested. Say for Rs.106. Now, the customer of the bond from Mr.A will suppose otherwise. As Rs.100 face valued bond is out there at Rs.106, which provides 8% curiosity for the following 10 years, and at maturity, the customer of the bond will get again Rs.100 again, then he begins to calculate the RETURN ON INVESTMENT. For the customer, his funding is Rs.106, he’ll obtain 8% curiosity on Rs.100 face worth and after 10 years he’ll obtain Rs.100 face worth. His return on funding is 7.14%. That is clearly slightly bit greater than the Financial institution FD fee. Therefore, he might purchase it instantly.

Suppose the identical purchaser needs to purchase Mr.B’s bond, to make it enticing to the customer, Mr.B has to promote his bond at Rs.92 (with a lack of Rs.8). Rs.92 priced bond, 6% curiosity, face worth of Rs.100 and tenure 10 years will fetch the identical 7.14% returns for a purchaser.

You seen that the figuring out think about each transactions is the Financial institution FD fee of seven%. Therefore, the rate of interest coverage of RBI is a very powerful issue for the bond market. Bond costs change each day based mostly on such rate of interest motion.

This threat is relevant to all classes of bonds (together with Central Authorities or State Authorities Bonds).

In easy, at any time when there’s an rate of interest hike from RBI, the bond worth will fall and vice versa. From the above instance, not directly you realized two ideas. One is rate of interest threat and the second is YTM (Yield To Maturity). YTM is nothing however the return on funding for a brand new purchaser of the bond from the secondary market. Within the above instance, the customer’s return on funding is nothing however a YTM. As the value of the bond adjustments each day, this YTM additionally adjustments each day.

# Yield To Maturity (YTM)

For this additionally, I wrote an in depth submit “Half 4 – Debt Mutual Funds Fundamentals“. Nevertheless, I’ll clarify the identical intimately.

For a brand new bond investor, yield to maturity in a easy manner say is the return on funding if he holds the bond until maturity. that once you purchase a bond, then you’ll get curiosity at a sure interval (within the majority of bonds) and at maturity, you’ll get again the face worth of the bond.

Allow us to assume {that a} 10-year bond is at the moment buying and selling at Rs.105, the time horizon is 10 years and the coupon (rate of interest) is 8%, then the customer has to calculate the return on funding. The customer can pay Rs.105 (for Rs.100 face worth bond), he’ll obtain 8% (on Rs.100 face worth however not on Rs.105) yearly, and at maturity after 10 years, he’ll obtain Rs.100 (face worth however not the invested quantity of Rs.105).

The YTM calculation is slightly bit sophisticated to grasp for a lot of buyers. As a substitute, there are on-line readymade calculators out there to grasp the YTM. If we go by the above instance, then the yield to maturity for a purchaser or return on funding for a purchaser is 7.8% IF HE HOLD THE BOND UP TO MATURITY.

Clearly, patrons by calculating the YTM evaluate with the present prevailing rate of interest. If YTM is healthier then he’ll purchase in any other case he’ll negotiate the value with the vendor to make it extra worthwhile for him.

Now within the above instance, you seen that fee of curiosity on the bond is 8% however YTM is 7.8%. It’s primarily as a result of if a purchaser is shopping for at face worth, then for him the YTM will likely be 8%. Nevertheless, within the above instance, as he’s shopping for at a better than the face worth, his return on funding is proportionately decreased.

Therefore, at any time when somebody buys a bond, it’s YTM issues much more than the coupon fee. Nevertheless, if somebody is shopping for the bond at issuing worth, then YTM equals to the coupon fee. To grasp this idea in a greater manner, allow us to take into accounts the present YTM of the assorted maturing bonds.

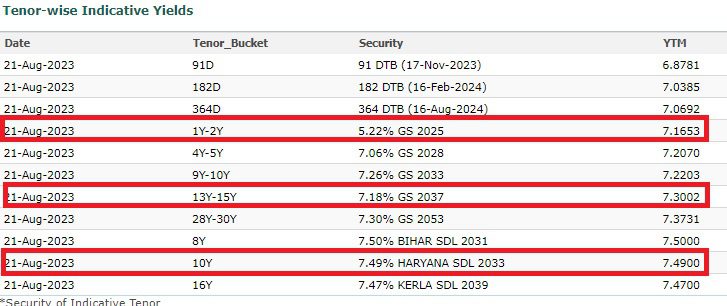

The above listing contains the newest YTM of varied maturing bonds. Simply think about the bonds that I’ve highlighted.

The 2025 maturing bond YTM is now at 7.16%. However the coupon fee is 5.22%. It clearly signifies that the bond is out there at a decrease than the face worth. If we calculate the value, then the bond is out there at round Rs.97 (the face worth is Rs.100).

Similar manner, if look into the 15-year maturing bond, you discover that the YTM is 7.3% however the rate of interest is 7.18%. this once more exhibits that the bond is out there at a reduced worth.

Nevertheless, in the event you take a look at the 10-year Haryana state authorities bond (which is often referred to as SDL), the YTM is the same as the rate of interest. It means the bond is out there at face worth.

Now, your debt mutual fund is holding a bunch of bonds, proper? Then how the fund will arrive on the YTM of the fund? The fund supervisor will calculate the weighted common of bonds is calculated. It implies that based mostly on the weightage of the actual bond in a fund’s portfolio, the YTM is taken into account proportionately to reach on the whole YTM of the fund.

Essential Factors About YTM

- YTM is a return a bond investor can anticipate IF he’s holding the bond until maturity. Nevertheless, if he’s promoting it earlier than maturity, then his YTM will differ based mostly on the prevailing worth of the bond (do do not forget that bond worth adjustments each day and therefore the YTM too) on the time of promoting.

- YTM won’t take into accounts the taxation half.

- Additionally, YTM won’t take into the shopping for and promoting prices.

- Few argue that greater YTM means dangerous and decrease YTM means non-risky. I don’t consider on this plain judgment. As a substitute, we have now to search for the credit score high quality of the bond and the time horizon left to mature. In fact, the decrease YTM bond could also be much less unstable. Nevertheless, what issues is the standard of the bond and the time horizon for maturity.

# Volatility

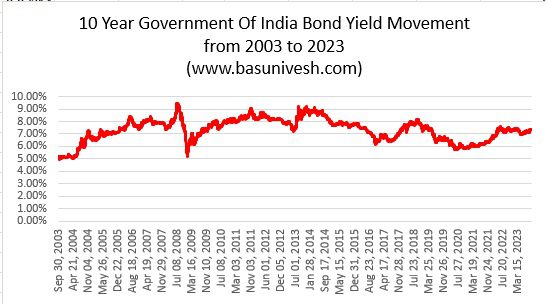

The most important concern particularly once you put money into bonds is volatility. As I discussed above, if the bond tenure is long-term, then volatility will improve drastically. Simply to offer you an instance, I’ve taken the final 20 years’ bond yield motion of the 10-year authorities of India bond (often it’s a benchmark that’s thought of in lots of fields of the funding world).

The beneath chart exhibits the yield motion of the identical of final 20 years.

You seen that the yield was round 5% throughout 2003 and it went as much as greater than 9% throughout 2008 and once more got here down.

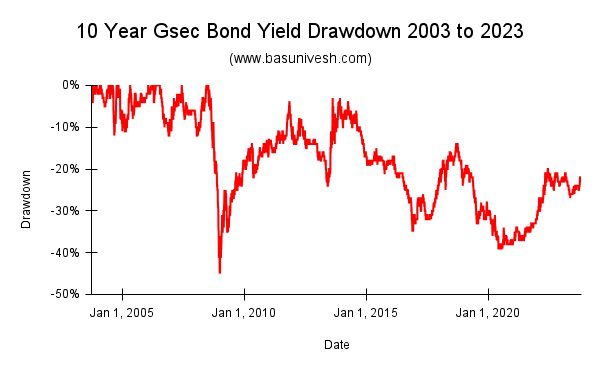

Nevertheless, you could not visualize the volatility so simply. Therefore, as an alternative of the above chart, I created a drawdown chart of the yield of the final 20 years. Drawdown means how a lot % it has fallen from its earlier peak.

Discover the sharp fall in yield of virtually 40% through the 2008-2009 interval and the following huge fall is through the 2020 interval.

Think about the volatility of the New Authorities Of India Bond 2073 as its 50-year maturing bond. I considered exhibiting the present 40 years of Authorities Bond volatility. Nevertheless, because the 40-year maturing bond was first time launched in 2015, I believed that won’t present a transparent image as knowledge factors are usually not a lot. Therefore, in contrast with 10 years bond.

# Liquidity

Liquidity is the most important concern for such long-term bonds. Therefore, with the present enticing yield in the event you make investments and in the event you want the cash earlier than maturity, then you must wrestle so much to promote the bonds within the secondary market. Additionally, as I discussed above, based mostly on the rate of interest cycle, you could achieve or lose.

Conclusion – By no means make investments on this bond simply because the yield is enticing and with worry of lacking this present yield sooner or later. Attempt to first take a look at your necessities, taxation, threat, volatility, and liquidity. Then take a name. Such long-term bonds are usually meant for Staff Provident Fund Organisation (EPFO), insurance coverage corporations, pension funds and even charitable trusts.

Nevertheless, if you’re SURE to carry this bond for the following 50 years, then consider getting into into this bond as threat is minimal in such a scenario. Are you SURE?? If reply is YES, then go forward.