Private finance was my old flame within the cash world.

I used to be a saver earlier than I ever knew what investing even was. But my relationship with private finance has developed as I’ve aged and adjusted my habits.

Most of the private finance guidelines written in stone will at all times apply.

Stay beneath your means. Pay your self first. Keep out of bank card debt. Save for emergencies.

Nonetheless, there are different private finance commandments I don’t utterly agree with anymore.

You don’t should agree with me both however listed here are some private finance concepts I’ve modified my thoughts about through the years:

Paying off a mortgage early is a nasty thought. I see the attraction of paying off your home free and clear.

Extra flexibility. Freed up money move. Freedom from mortgage debt.

I get it from a psychological perspective. Cash is extra about feelings than spreadsheets, blah, blah blah.

It nonetheless is not sensible to me, particularly if you happen to locked in a 3% mortgage.

After refinancing the mortgage on our first home I made double funds for a variety of years. After promoting the home I noticed that cash was simply sitting there in my illiquid home doing nothing.

It was pointless. A concentrated alternative value over my head.

I took out a bunch of debt when charges have been at 3%. I want I might have taken out extra.

I do know some folks can’t deal with debt responsibly. However tax-advantaged debt on the perfect inflation hedge accessible seems like a beautiful deal to me.

So long as it’s paid off by the point I retire that’s adequate for me.1

Frugality is overrated. I subscribe to residing beneath your means. How else are you going to construct wealth if you happen to don’t spend lower than you earn and save the distinction?

However most private finance specialists take this to the intense.

They make you’re feeling unhealthy for spending cash. They need you to dwell a pitiful existence now to save cash to your future self. Besides when you change into your future self you may’t drive your self to truly spend the cash so that you save for the sake of saving.

I’m over that line of pondering.

Sure, it’s essential to delay some stage of gratification to get forward in life. However I don’t see the purpose in delaying all gratification to dwell like a cheapskate.

Being frugal can solely take you thus far in life.

True private finance specialists understand incomes extra money is the way you really get forward along with your funds, not obsessing over each little buy.

The next revenue can take you additional than frugality on the subject of supercharging your funds.

Shopping for stuff is OK. There are many private finance books about getting out of debt, saving cash and investing.

Nobody ever talks about find out how to spend cash. Spending is at all times frowned upon.

I used to stick to this line of pondering.

I don’t anymore.

Don’t get me incorrect — I’m nonetheless not a fan of losing cash. There are particular issues I refuse to spend some huge cash on — fancy eating places, luxurious clothes, high-end furnishings, costly watches…stuff like that.2

However there may be stuff I take pleasure in spending cash on. Experiences nonetheless have an even bigger bang for the buck however there are materials possessions that deliver me pleasure.

I like shopping for new garments and jackets and footwear. Sprucing up the home too. I obtained a brand new TV lately and it *gasp* made me happier! I really like watching TV reveals, sports activities and flicks on a huge HD display screen.

Spending cash isn’t going to fill some gap in your life however you shouldn’t really feel unhealthy about spending cash on belongings you take pleasure in.

The entire level of incomes cash is to spend it sometime. You simply should prioritize the issues that matter to you.

Nobody is aware of what their sufficient is and that’s OK. The individuals who say they’ve sufficient are most likely mendacity to you.

The ever-elusive steadiness between now & then is a pipe dream. Nobody ever utterly figures it out.

That’s why even retirees who amass a wholesome nest egg have bother spending their cash in retirement.

Nobody is ever pleased with their station in life both.

The Wall Avenue Journal lately shared analysis on how a lot cash folks have to make to be pleased:

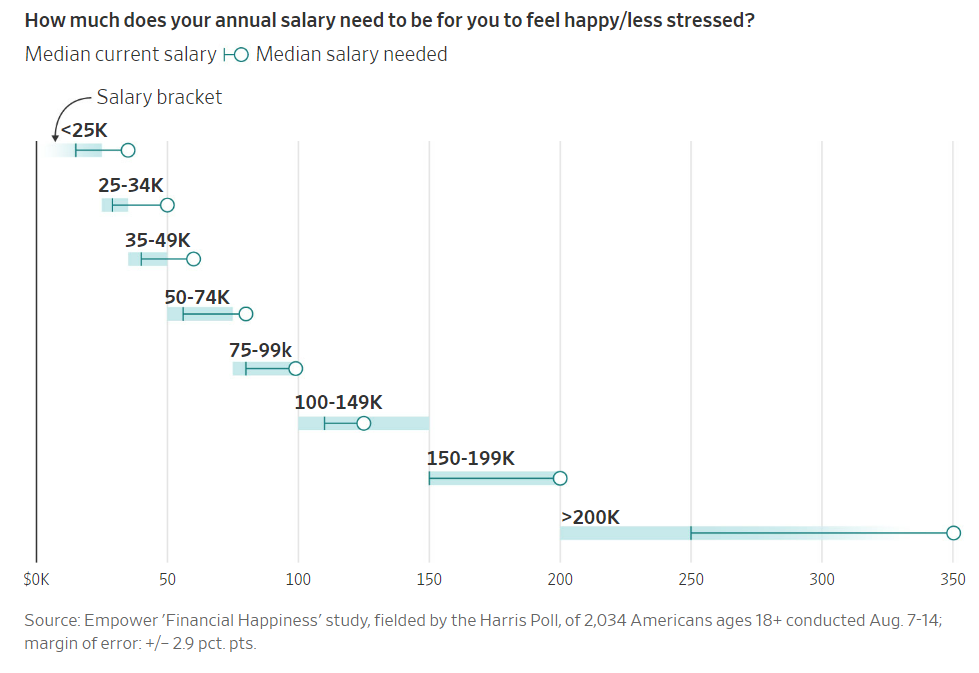

Within the survey, most individuals stated it might take a fairly vital pay bump to ship contentment. The respondents, who had a median wage of $65,000 a 12 months, stated a median of $95,000 would make them pleased and fewer confused. The best earners, with a median revenue of $250,000, gave a median response of $350,000.

This chart is equal elements tragic and bullish:

It’s tragic as a result of it reveals contentment is principally unattainable to seek out. No matter how a lot you make, you’ll at all times need extra. The goalposts simply maintain transferring.

Whereas it’s tragic on a person stage it makes me bullish on us as a species.

Nobody is ever pleased so we maintain striving. We maintain innovating, making progress, producing earnings, spending extra and doing our damnedest to earn extra.

The truth that nobody is ever snug with their stage of revenue or wealth is long-term bullish for humanity.

Michael and I talked about paying off debt, shopping for stuff and why nobody is ever pleased with how a lot they’re making on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

You Most likely Want Much less Cash in Retirement Than You Assume

Now right here’s what I’ve been studying these days:

Books:

1And it’s attainable I’ll resolve even that doesn’t make sense if charges are low sufficient sooner or later.

2I’m not judging these spending classes both. So long as you’re saving cash, spend on the stuff you need.