Yves right here. Wolf Richter gives some essential sightings confirming that there’s loads of liquidity within the monetary system, which is at odds with what the Fed has been attempting to attain with its fast rate of interest will increase and its intention to not again off till it sees outcomes. We mentioned from the get-go that the Fed was unlikely to have the ability to whip inflation by way of rates of interest will increase, wanting killing the financial system stone chilly lifeless, since lots of forces driving this inflation had been the results of provide components that rates of interest can’t tackle.

However Wolf’s factoids counsel that the Fed tightening is failing even in its personal phrases, of attempting to dry up credit score to dampen down enterprise exercise and above all, wages. Why would possibly that be?

Taking a look at cash provide is a poor metric. Monetarist experiments within the US and UK within the early Nineteen Eighties established that altering cash provide ranges correlated with no important macroeconomic variable, even on a lagged foundation. A giant motive, if you happen to imagine in that framework, is that costs are supposedly a perform of financial velocity in addition to provide. What may be rising financial velocity? Varied types of shadow banking, starting from the rise of personal credit score funds, versus banks, as suppliers of funds. One other is using derivatives to extend leverage, witness the Fed-approved financial institution use of artificial threat transfers, which permit banks to blunt the impact of tighter capital necessities.

Within the runup to the 2008 disaster, some analysts and reporters (together with yours really) took observe of and tried to grasp the so-called “wall of liquidity” which resulted in pervasive underpricing of credit score threat. That’s finance-speak had been “lenders not demanding excessive sufficient rates of interest to compensate for the dangers they had been taking.” The wrongdoer then was constructions and methods that created leverage on leverage, significantly asset-backed CDOs and credit score default swaps. One leverage on leverage technique working now’s personal fairness subscription credit score strains, the place personal fairness companies borrow in opposition to unused restricted associate capital commitments fairly than merely use that supply of funding. However it’s effectively nigh not possible to get good information on the use and influence of this method.

Readers who’ve intel on subscription credit score strains and different leverage on leverage methods are very a lot inspired to talk up in feedback.

By Wolf Richter, editor of Wolf Avenue. Initially revealed at Wolf Avenue

One of many large surprises this 12 months is that the Fed’s 5.5% coverage charges and $1.1 trillion in QT have neither meaningfully tightened monetary circumstances nor slowed the financial system.

The Fed has been “tightening” since early 2022 with the intention to “tighten” the monetary circumstances, and these tighter monetary circumstances are then purported to make it tougher and costlier to borrow which is meant to sluggish financial development and take away the gasoline that drives inflation. “Monetary circumstances,” that are tracked by numerous indices, acquired rather less free, after which they re-loosened over again. It’s nearly humorous.

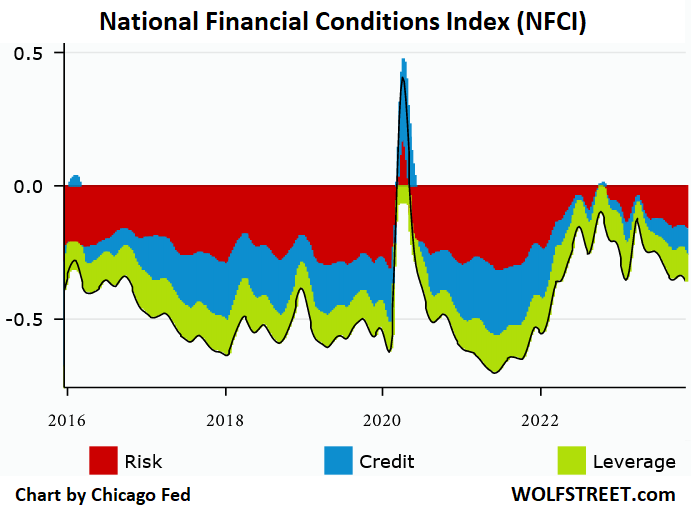

The Chicago Fed’s Nationwide Monetary Situations Index (NFCI) loosened additional, dipping to -0.36 within the newest reporting week, the loosest since Might 2022, when the Fed simply began its tightening cycle. The index is constructed to have a median worth of zero going again to 1971. Unfavourable values present that monetary circumstances are looser than common, and so they have been loosening since April 2023, after a quick tightening episode in the course of the financial institution panic (chart by way of Chicago Fed):

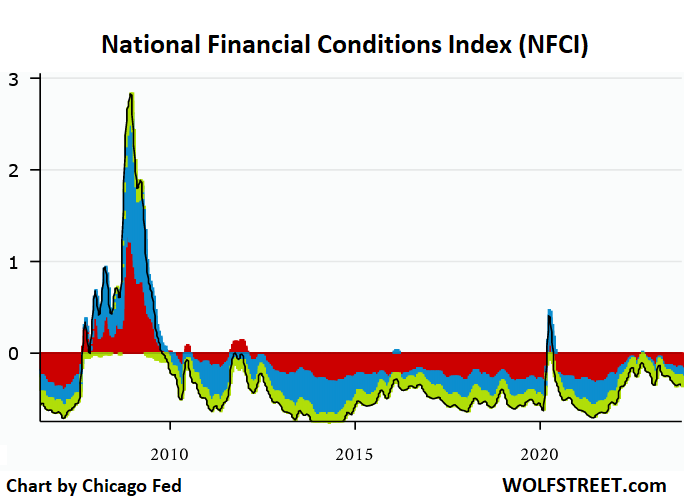

You possibly can see within the chart above how monetary circumstances tightened in March 2020, however not for lengthy – by Might 2020, because the Fed was dousing the land with trillions in QE, they had been already free once more.

So, regardless of the speed hikes and QT by the Fed, monetary circumstances are as free as they had been when the Fed had simply began tightening in Might 2022, and they’re far looser than the long-term common, although they’ve turn into considerably much less loosey-goosey than in the course of the free-money period beginning in mid-2020 by early 2022.

The long-term chart beneath of the NFCI reveals what occurs when monetary circumstances tighten a lot that they strangle the financial system, as they did in the course of the Monetary Disaster. The March-2020 spike barely registers as compared.

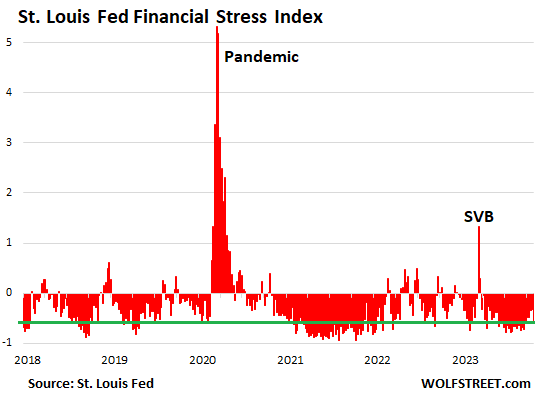

The St. Louis Fed’s Monetary Stress Index takes the same method and measures monetary stress within the credit score markets. The zero line denotes common monetary stress. Unfavourable values denote lower than common monetary stress. Within the present week, it dropped to -0.56. The inexperienced line reveals this present worth throughout time and denotes that credit score markets are nonetheless in la-la-land.

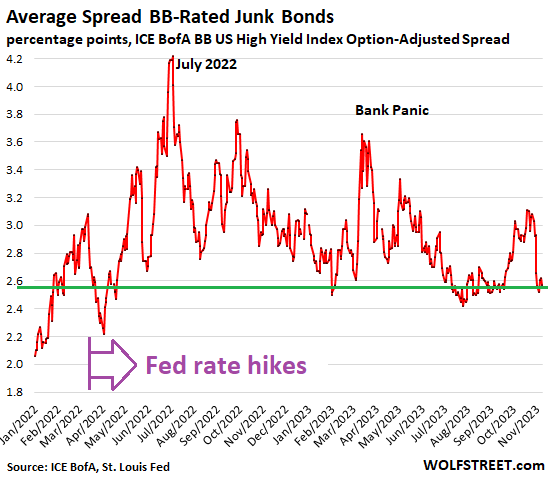

The BB-rated junk-bond spreads are one other measure of economic circumstances. Company bond yields ought to rise or fall with Treasury yields. However a wider unfold between these company bond yields and Treasury yields signifies tighter monetary circumstances; a narrower unfold signifies looser monetary circumstances.

The typical unfold of BB-rated bonds, the much less dangerous finish of high-yield (my cheat sheet for company bond ranking scales) narrowed additional yesterday to 2.57 proportion factors. So that is going within the unsuitable route, by way of what the Fed needs to perform.

Positive, some sectors are burdened and monetary circumstances tightened in these sectors, such because the workplace sector of business actual property, however the troubles within the workplace sector have structural causes, together with working from house and the company realization that they don’t want all this vacant workplace area that they’ve been hogging for years, and can by no means develop into.

And house gross sales have plunged as a result of potential sellers don’t wish to quit the 40% to 60% worth spike they acquired over the interval of pandemic QE; and patrons simply snigger at these costs and go blow their down-payment on all types of stuff and companies, together with travels and vehicles – new car gross sales surged 20% year-over-year in Q3 – contributing to shopper spending.

And positive, the foremost inventory indices are down from their highs a few years in the past. Sharply greater yields (decrease bond costs) have put stress on financial institution stability sheets, and a number of, run by goofballs that didn’t handle this correctly, have collapsed.

However shoppers are working in document numbers and are making document quantities of cash, after receiving the most important pay will increase in 40 years that in 2023 are lastly outrunning inflation, and so they’re spending enormous quantities of cash and are nonetheless ready to avoid wasting. We’ve been lovingly and facetiously calling them our Drunken Sailors right here since at the least March.

And corporations, flush with money from promoting a tsunami of bonds at low charges in the course of the Fed’s 0% period, are investing, together with in a enormous building growth of factories. They usually’ve raised their costs, as a result of, you realize, that is inflation, and so they acquired away with it.

And the true Drunken Sailors, the parents in Congress, are throwing trillions of {dollars} a 12 months in nonetheless simply borrowed cash on the financial system to gasoline development and inflation.

So the Fed’s coverage charges that went from 0.25% to five.5%, and its $1.1 trillion in QT up to now have didn’t broadly tighten monetary circumstances and decelerate this prepare.

May it’s... that a lot central financial institution liquidity was created throughout and earlier than the pandemic that monetary circumstances can’t meaningfully tighten, regardless of the Fed’s tightening, till this liquidity will get burned up?

The Fed alone, not counting different central banks, created $4.8 trillion inside two years of giga-money-printing, as Musk would say; it has now eliminated $1.1 trillion of it by way of QT.

May it’s, with a lot liquidity nonetheless on the market, that it would take much more and lots longer to tighten monetary circumstances sufficient to the place they’ve even an opportunity of eradicating the gasoline from inflation?

And that’s type of humorous as a result of if monetary circumstances don’t tighten sufficient to sluggish the financial system and take away inflationary gasoline, and if it then seems that this dip in year-over-year inflation charges was only a “head faux,” to then resurge once more, as Powell mentioned he suspects it would, the Fed will go at it with extra price hikes. Powell made that clear. With credit score markets nonetheless blowing off the Fed, are they attempting to guarantee that “greater for longer” will get entrenched? That might be humorous.