With paid sick go away applications on the rise, an increasing number of states are establishing new legal guidelines for employers. One state that has taken its regulation to the following degree is Maine. The Maine paid go away regulation takes issues a step additional: paid go away for any purpose.

Learn on to be taught all concerning the Maine paid go away regulation, together with which staff are eligible and the way a lot go away staff can earn and use.

Temporary recap of paid sick go away

Paid sick go away is paid break day an worker can take in the event that they or a member of the family are sick. At present, there isn’t any federal sick go away regulation. Nonetheless, a number of states have adopted their very own paid sick go away legal guidelines. Some states with paid sick go away embody Arizona, California, and Colorado.

As talked about, with Maine’s regulation, “An Act Authorizing Earned Worker Go away,” staff can take paid go away for causes apart from sick time.

If you happen to dwell in a state with paid sick go away or paid go away for any purpose, you have to know your state’s necessities. Paid go away legal guidelines by state specify info like accrued break day charges, accrual limits, and which employers should comply with the regulation.

Maine paid go away regulation

So, what units Maine other than states with paid sick go away?

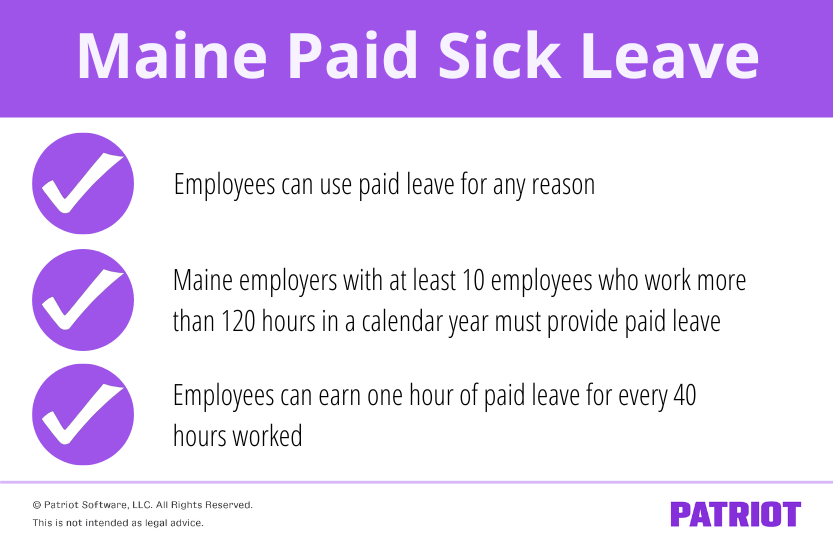

Maine’s Earned Paid Go away regulation permits staff to make use of mandated paid go away for any purpose. This consists of go away for private, household, or medical causes. Nevada and Illinois are different states that enable paid go away for any purpose.

Maine’s regulation was signed on Could 28, 2019. If you happen to’re a Maine employer, you have to know the whos, whats, whens, wheres, and whys of the regulation. Check out some questions and solutions under to start out studying extra about Maine’s paid go away regulation.

When did the regulation go into impact?

Maine’s regulation started on January 1, 2021.

Who should take part?

Maine employers with greater than 10 staff who work greater than 120 hours in a calendar yr should present paid go away.

Seasonal staff should not eligible for Maine paid sick go away. The regulation additionally doesn’t apply to staff with collective bargaining agreements.

Who’s exempt?

Small companies with fewer than 10 staff shouldn’t have to offer paid go away to staff. Once more, seasonal employers are additionally not required to take part.

How a lot paid go away can an worker accrue?

Workers can earn one hour of paid go away for each 40 hours labored. An worker can earn as much as 40 hours of paid go away yearly.

Employers have the liberty to offer extra beneficiant advantages than these mandated by state regulation.

When can staff start accruing paid go away?

Workers start accruing paid go away in the beginning of employment. Employers can implement a 120-day ready interval earlier than letting staff use accrued paid go away.

Workers are required to offer “cheap discover” of their intent to take go away (besides within the case of emergencies or unpredicted occasions or diseases). The regulation doesn’t but outline what is taken into account an inexpensive discover. Nonetheless, the regulation states, “use of go away should be scheduled to stop undue hardship on the employer.”

How a lot can an worker obtain throughout go away?

Employers should pay staff their common wages throughout paid go away.

Employers should additionally keep staff’ advantages (e.g., medical insurance) for workers on go away. Workers can’t lose accrued worker advantages in the event that they take paid go away.

Can staff carry over accrued time?

Workers can carry over as much as 40 hours to the following yr.

What are the penalties for not being compliant?

Employers who violate the regulation can be topic to penalties of as much as $1,000 per violation.

You’ll be able to contact the state for extra info.

The place can I discover extra info?

You’ll be able to be taught extra about Maine’s Earned Paid Go away by trying out the Division of Labor’s FAQs.

Need assistance recording your staff’ accrued paid sick go away? Patriot’s on-line time and attendance software program is a good add-on to our on-line payroll software program. Begin your self-guided demo at this time!

This text has been up to date from its authentic publication date of September 11, 2019.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.