Jimmy and Rosalynn Carter – Habitat For Humanity. Supply: Encyclopædia Britannica

In November, I started volunteering on the Loveland Habitat For Humanity, serving to to construct homes for many who may not have the ability to afford them and not using a hand up. Former President Jimmy Carter and First Girl Rosalynn have volunteered or labored with Habitat For Humanity because the Eighties. Housing costs have roughly doubled up to now ten years placing residence possession out of the attain of many potential patrons. I additionally volunteer at Neighbor To Neighbor, which helps these on the perimeter of homelessness keep sheltered. Pandemic-era financial savings are anticipated to be depleted in the course of the first half of 2024, however for a lot of, shedding work, even quickly, can imply eviction, shedding utilities, and going hungry. This places a human perspective on monetary metrics.

My goal allocation to inventory is 50% inside a variety of 35% to 65% based mostly on my funding mannequin, which loosely follows the rules of Warren Buffet’s mentor, Benjamin Graham. Warren Buffet is often sitting on a pile of money previous to recessions as a result of he tends to cut back his publicity to shares when valuations are excessive. The Motley Idiot reported that Warren Buffet was a web vendor of shares in the course of the third quarter, and “Buffett added $29 billion to his place in short-term U.S. Treasury payments final quarter, bringing his complete funding to greater than $126 billion.” With the latest run up in shares and my Roth Conversion, my fairness allocation has crept as much as 40%. I stay obese in short-term Treasuries and Certificates of Deposit. I’ve no plans to make any adjustments till subsequent 12 months when ladders of bonds and certificates of deposit mature.

On this article, I have a look at the financial system, the labor market, and two metrics that spotlight inflection factors to search for early indicators of adjustments within the markets. I take advantage of the Mutual Fund Observer MultiSearch software to establish funds which are trending now. I’m considering international bond funds and long-duration bond funds as potential additions over the following six months. US equities have performed significantly better than worldwide equities over the previous decade partially attributable to a rise in valuations, stronger greenback, and excessive financial stimulus (Quantitative Easing). I search for this to normalize over the approaching decade. One fund that caught my consideration this month is the rising markets mixed-asset Constancy Whole Rising Markets Fund (FTEMX), which is roughly 40% in bonds.

This text is split into the next sections:

Financial system And Recession Watch

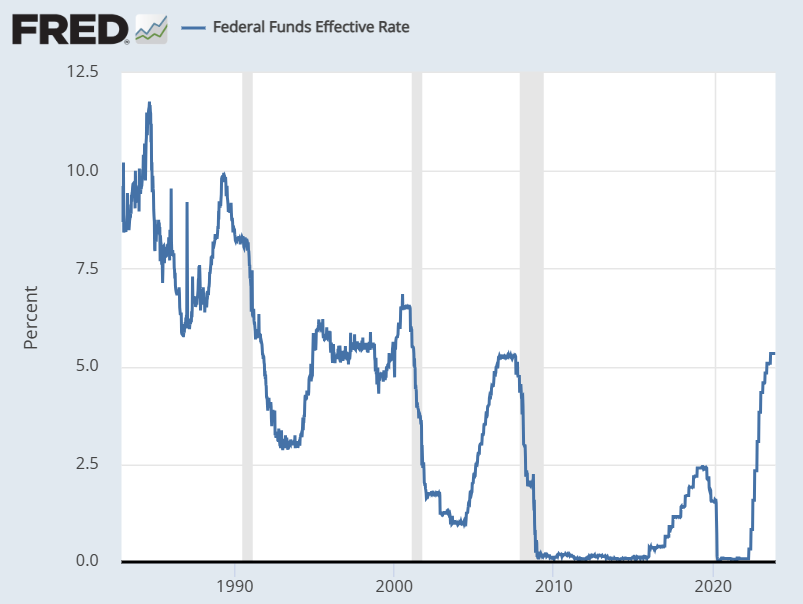

Credit score retains the financial system going as companies borrow to increase and shoppers borrow to maintain spending. The Federal Reserve raises the rate of interest that banks cost one another to borrow or lend extra reserves in a single day, generally known as the Federal Funds charge, with the intention to make borrowing costlier, thereby slowing down the financial system and lowering inflationary pressures. Determine #1 exhibits that by the point the Federal Reserve begins to decrease the Federal Funds charge, a recession typically follows.

Determine #1: Federal Funds Fee with Recession Shading

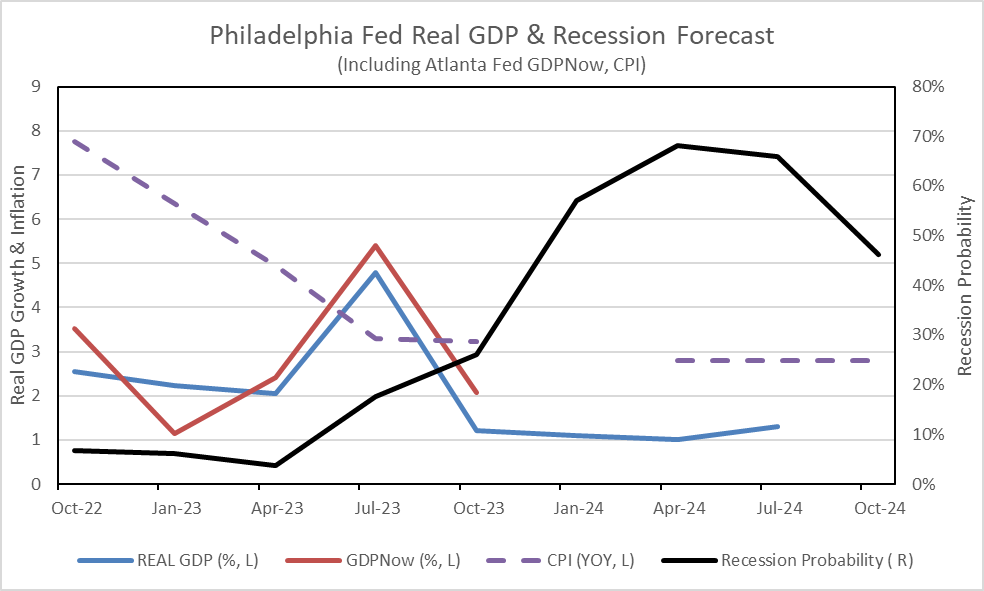

Determine #2 accommodates the Philadelphia Federal Reserve Survey of Skilled Forecasters estimates for actual gross home product development (strong blue line) to be round 0.8% to 1.5% within the first half of subsequent 12 months, and the Reserve Financial institution of New York estimates for the chance of a recession (strong black line) to be 57% to 68%. The Client Value Index (dashed purple line) is at present 3.2%, and the one-year anticipated inflation charge is 2.8%. Inflation is anticipated to be “sticky,” and charges will stay “larger for longer.” The chart exhibits that financial development will likely be low and the chance of a recession comparatively excessive. It ought to be clear by the top of the second quarter of 2024 whether or not there will likely be a recession or a “gentle touchdown.”

Determine #2: Actual GDP Development Forecast and Recession Chances

Supply: Writer Utilizing Philadelphia Fed, Reserve Financial institution of New York, Client Value Index

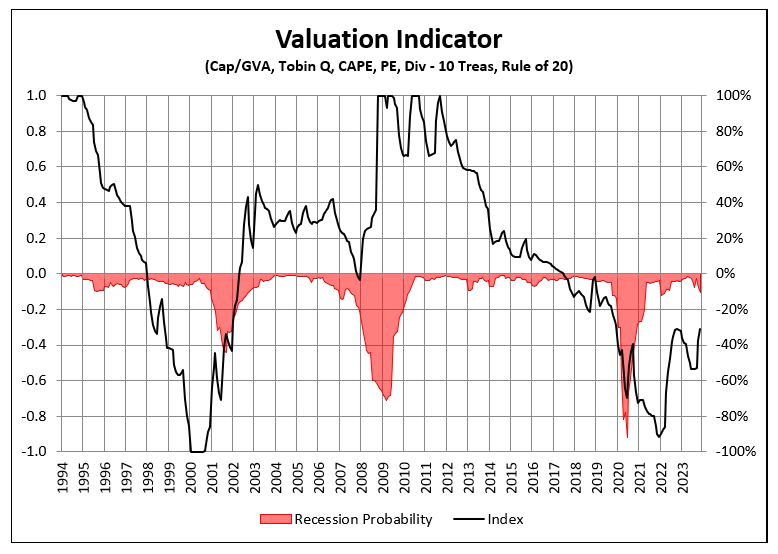

Determine #3 is my composite of six valuation strategies, with +1 being favorable (low valuations) and -1 being unfavorable (excessive valuations). In my perspective, present excessive valuations are usually not justified in a sluggish development atmosphere with excessive bond yields and with the Federal Reserve more likely to decrease the Federal Funds charge within the second or third quarter of subsequent 12 months.

Determine #3: Writer’s Valuation Indicator

Publish Pandemic Shoppers

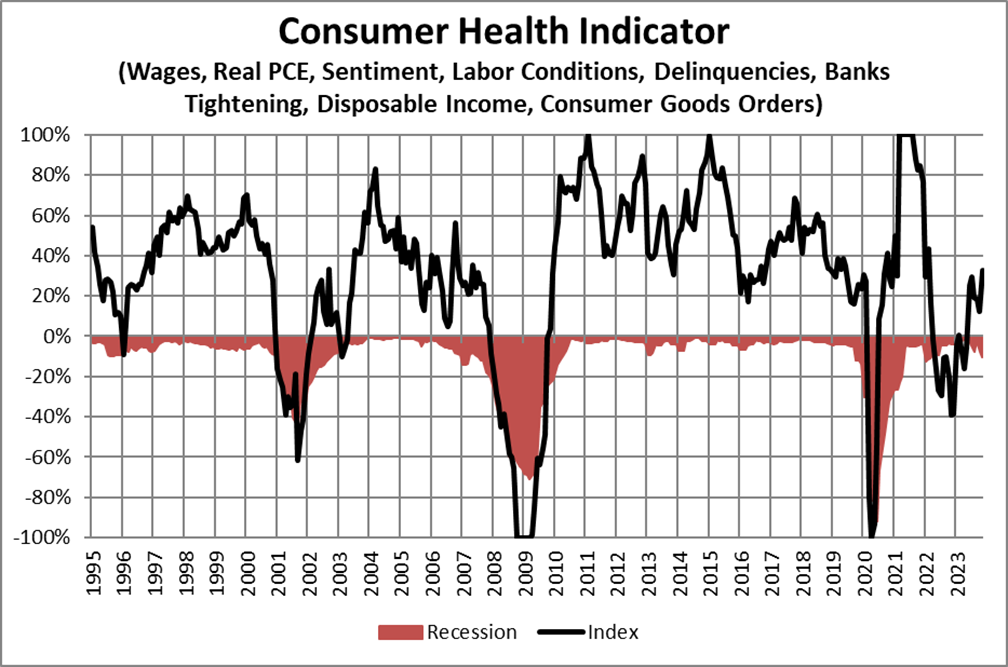

The Federal Reserve Financial institution of San Francisco, utilizing the Bureau of Financial Evaluation, estimates that pandemic-era financial savings have declined from a excessive of $2.1T in August 2021 to $430B in September 2023. Nevertheless, evaluation suggests that the underside 80% of households by revenue have depleted their pandemic-era financial savings. Determine #4 is my Client Well being Indicator which is a composite of ten indicators that counsel how nicely shoppers might be able to proceed their present spending habits. The energy of the buyer will not be excessive however has been bettering since mid-year.

Determine #4: Writer’s Client Well being Indicator

Paxtyn Merten listed an in depth description of industries shedding workers in “The 19 Industries Laying Off the Most Employees Proper Now” for Stacker. The next industries laid off greater than 100,000 workers every in August: 1) Skilled and enterprise companies, 2) Lodging and meals companies, 3) Retail Commerce, 4) Well being care and social help, and 5) Development, and 6) Transportation, warehousing, and utilities. Based on Enterprise Insider, here’s a checklist of a number of the firms lowering workers this 12 months: Amazon, Charles Schwab, Roku, Farmers Insurance coverage, T-Cellular, CVS, Binance, Robinhood, Ford, JP Morgan, Morgan Stanley, Spotify, Hole, Jenny Craig, 3M, Lyft, Deloitte, Complete Meals, Ernst & Younger, McKinsey, Digital Arts, Walmart, Sirius, Accenture, Citigroup, Common Motors, Yahoo, Twitter, Disney, Zoom, Docusign, eBay, Dell, Rivian, Intel, FedEx, PayPal, IBM, Google, Capital One, Microsoft, Blackrock, Goldman Sachs, BNY Mellon, and Direct TV.

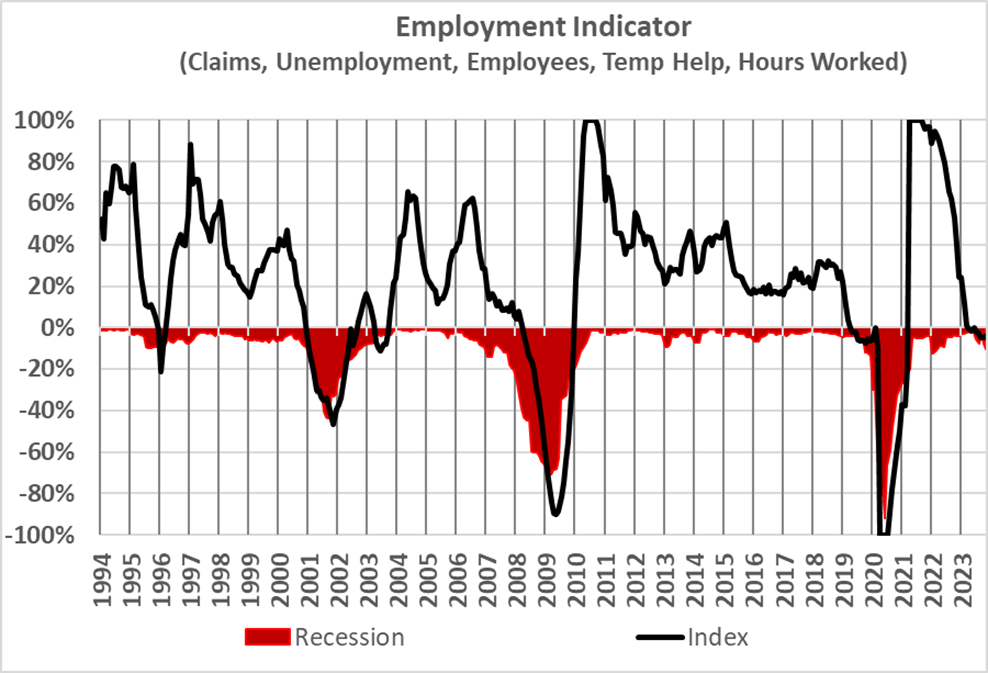

Determine #5 is my composite employment indicator that factors to clouds on the horizon for labor. Companies often cut back Short-term Assist Providers and Hours Labored earlier than shedding full-time workers, and these are falling. Development in individuals employed has slowed.

Determine #5: Writer’s Employment Indicator

Inflection Factors

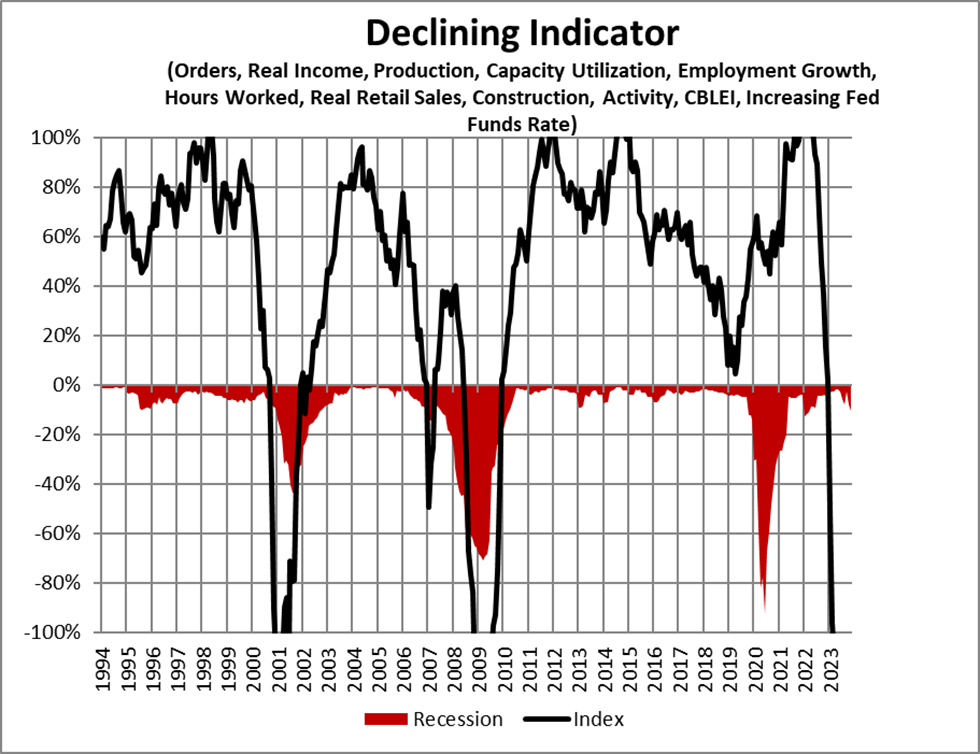

I constructed the Declining Indicator (Determine #6) to measure the p.c of months that indicators are unfavourable. It’s extremely unfavourable, displaying that key indicators are both declining or have peaked.

Determine #6: Writer’s Declining Indicator

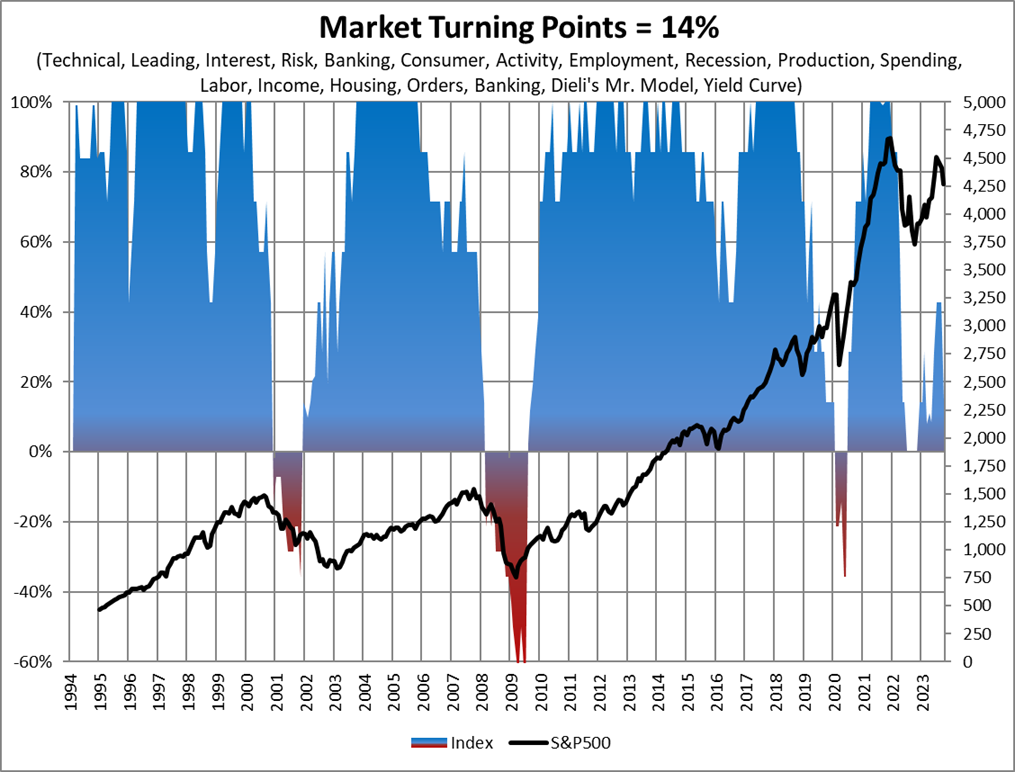

Determine #7 is my Market Turning Factors indicator which composites the values of main and coincident indicators to provide an estimate of main inflection factors. Whereas the extent is low, it’s not unfavourable, suggesting that situations for a market downturn are usually not but totally developed.

Determine #7: Writer’s Market Turning Factors Indicator

Overview Of Writer’s Funds

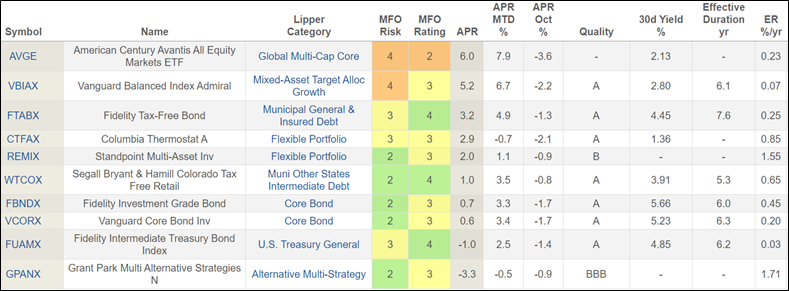

The funds in Desk #1 are those who I at present personal in Bucket #1 (Residing Bills) and Bucket #2 (Anticipated Withdrawal in 3 to 10 years held in a number of accounts), together with mounted revenue ladders. Vanguard Balanced Index Fund (VBIAX) is included as a baseline. My technique has been to lock in larger yields in longer-duration bond funds because the Federal Reserve pauses charge hikes. What I wish to add in the course of the subsequent six months is International/Worldwide bond funds and longer-duration bond funds, however the time will not be proper. I take advantage of administration companies at Constancy and Vanguard for Bucket #3 (longer-term) funds.

Desk #1: Overview of Writer’s Funds – Metrics for One 12 months

Grant Park Multi Different Methods (GPANX) has not carried out nicely this 12 months, however it’s a good fund with a long-term efficiency report, so I’ll hold it. Upon dips, I’ll add to American Century Avantis All Fairness Markets ETF (AVGE), and Columbia Thermostat (COTZX/CTFAX) will enhance its allocation to equities.

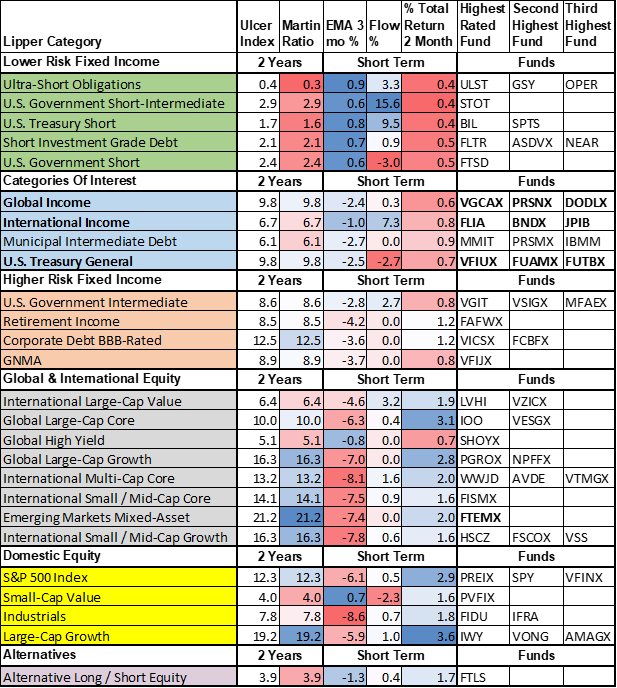

Trending Lipper Classes

Desk #2 accommodates the top-performing Lipper Classes for the 635 funds that I at present monitor. The primary group of funds is short-term, high quality mounted revenue. The Ulcer Index measures the depth and period of drawdowns over the previous two years, whereas the Martin Ratio measures the risk-adjusted efficiency over the previous two years. The subsequent group of classes (Worldwide bond funds and long-duration Treasuries) are usually not trending favorably, however I embody them to fill gaps in my portfolio. Subsequent are intermediate authorities and company bond funds which have larger period or high quality danger than the primary class. International and worldwide equities have lately tended to carry out higher than home equities.

Desk #2: Trending Lipper Classes – Ulcer & Martin Stats – Two Years

Constancy Whole Rising Markets Fund (FTEMX)

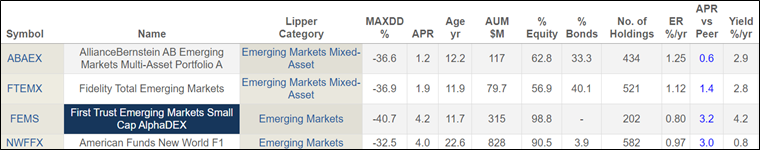

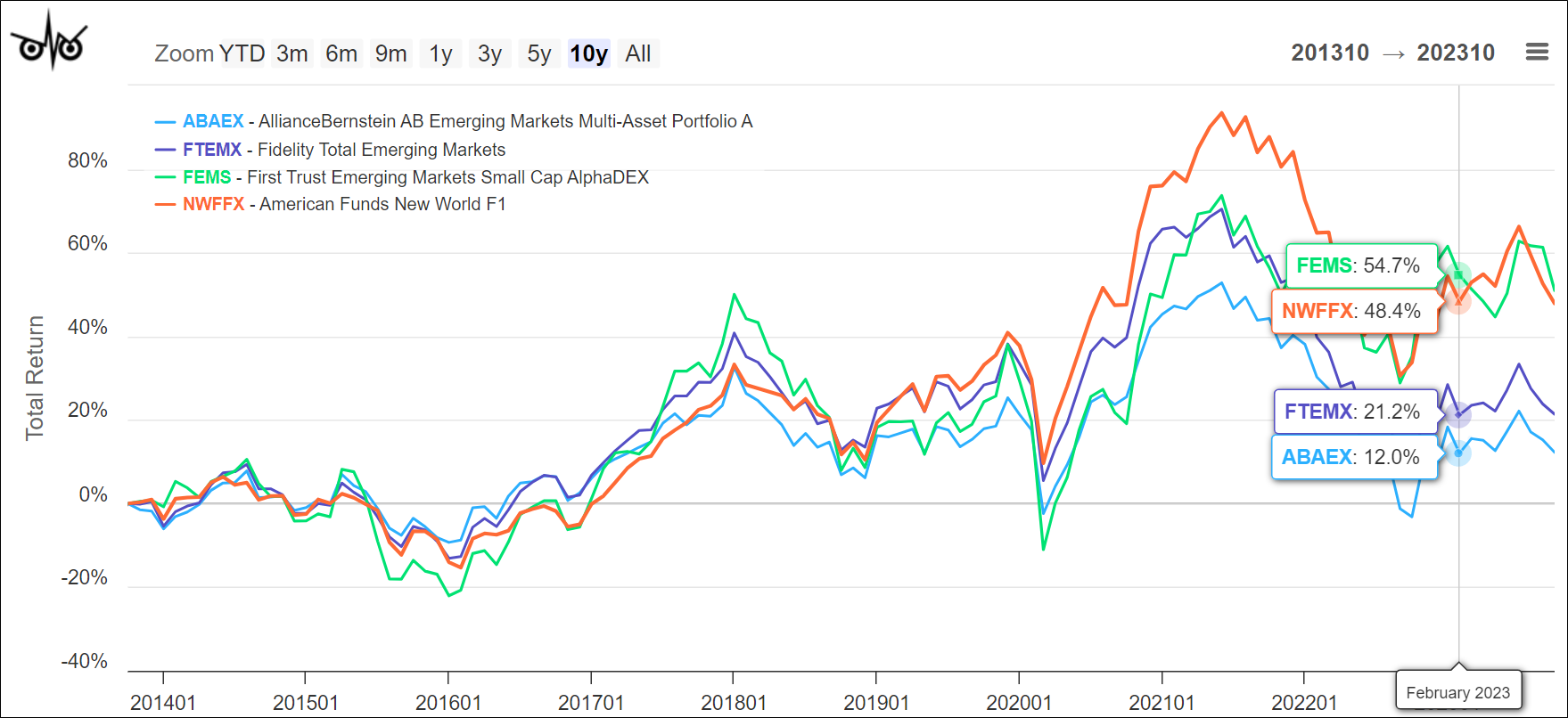

Solely a handful of rising market mixed-asset funds can be found to particular person buyers. One among my standards for choosing an rising market fund is to have low publicity to China. Constancy Whole Rising Markets Fund (FTEMX) has 14% allotted to China, which is beneath the 22% that almost all EM funds have. In Desk #3, I present two rising market mixed-asset funds in comparison with two rising market fairness funds for the previous ten years. I’m not involved in regards to the low annualized returns as a result of I count on rising markets to outperform over the approaching decade.

Desk #3: Rising Market Combined Asset Funds and Chosen Fairness Funds (10 Years)

Determine #8 is a graphical illustration of the above funds. Rising market mixed-asset funds have carried out nicely over the previous decade till rates of interest went up. I’ll monitor FTEMX with curiosity however don’t have any plans to buy it within the close to time period.

Determine #8: Rising Market Combined Asset Funds and Chosen Fairness Funds

Closing Ideas

I just like the prospects for bonds relative to shares within the intermediate time horizon. In November, I bought Allianz PIMCO TRENDS Managed Futures Technique (PQTAX) and purchased Constancy Funding Grade (FBNDX), which is an intermediate period fund with 39% Treasuries and 31% company bonds. Over the following six months, I count on so as to add International/Worldwide bond funds and/or a high quality long-term bond fund.

I created a long-term monetary plan that features Roth Conversions and accelerated withdrawals to reduce long-term taxes and enhance the tax effectivity of property plans. In July, I arrange an appointment to do a Roth Conversion on October 27th, anticipating the markets to go down. I used to be lucky that the S&P 500 fell roughly ten p.c, permitting me to transform extra shares for a similar conversion quantity. The market then recovered. I plan to do one other Roth Conversion in mid-2024 if the market dips as I count on.

Hiring Constancy and Vanguard to handle my long-term funding bucket(s) freed up my time to pursue different pursuits. I take pleasure in volunteering and giving again to the neighborhood. I’m studying rather a lot and assembly lots of fascinating volunteers.